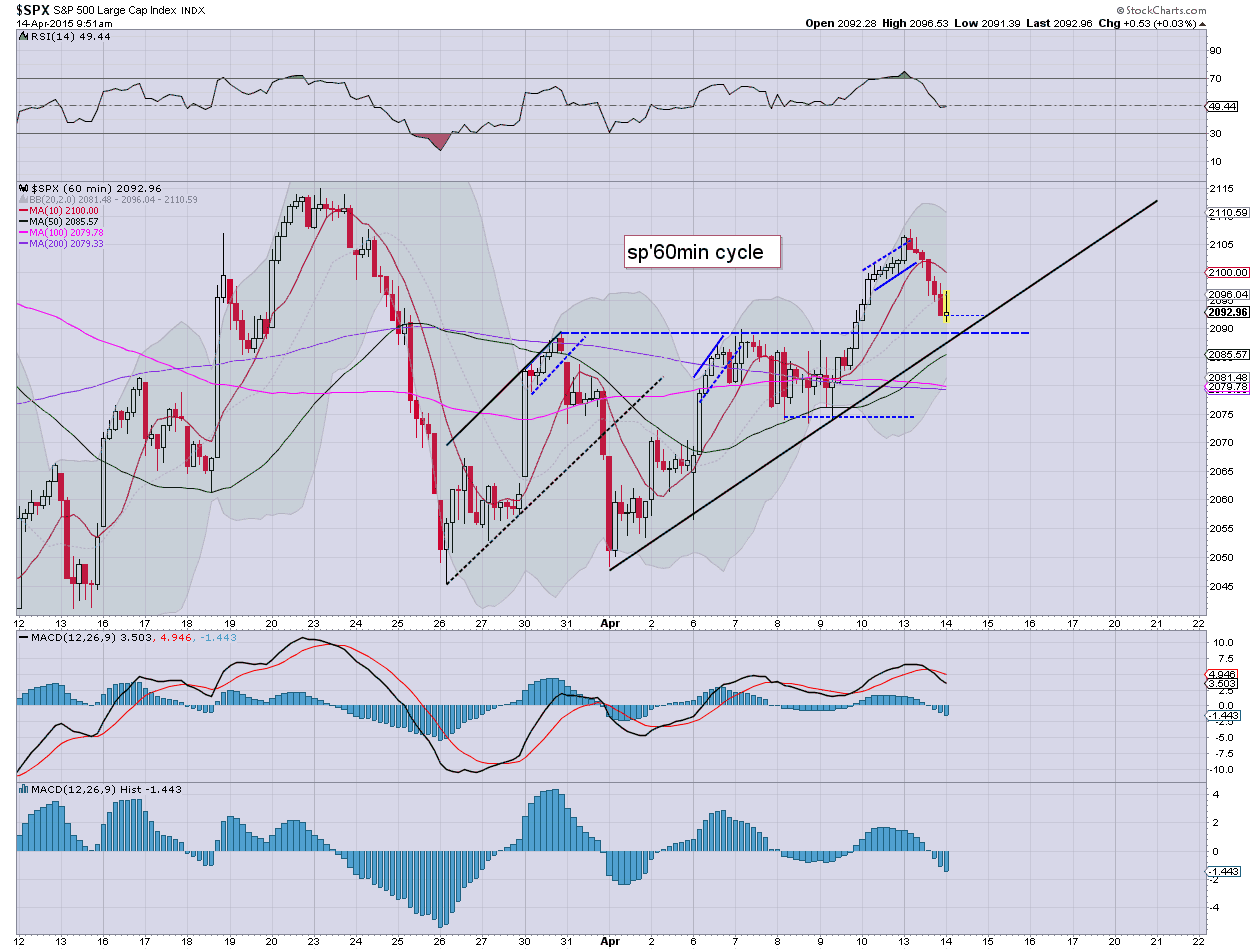

US equities are seeing some minor chop to start the day. The hourly cycle is offering sustained upside later today. VIX is higher, but looks set to cool from the mid 14s. Metals are weak, Gold -$7. Oil is +1.2%... but will be vulnerable into the next set of inventory reports.

sp'60min

VIX'60min

Summary

*notable opening black-fail candle on the VIX, although I recognise that didn't work out yesterday... but they usually do!

--

Despite what some were recently proclaiming, earnings are coming in at least 'reasonable'.

Price action remains broadly strong, and new historic highs look due for the sp/Dow in the near term.

-

notable strength: oil/gas drillers, RIG/SDRL, both higher by around 3.5%

weakness: TSLA -1.2%

10.06am... moderate weakness... sp'2084.... next support... 50dma @ 2081. A daily close under there would be a problem...

Overall price action though is pretty subdued... a latter day recovery looks probable.

10.25am... looks like we have a morning floor of sp'2083.... just 2pts above the 50dma.

A daily close in the 2100s is just about viable.

In any case... price action does not support the equity bears.