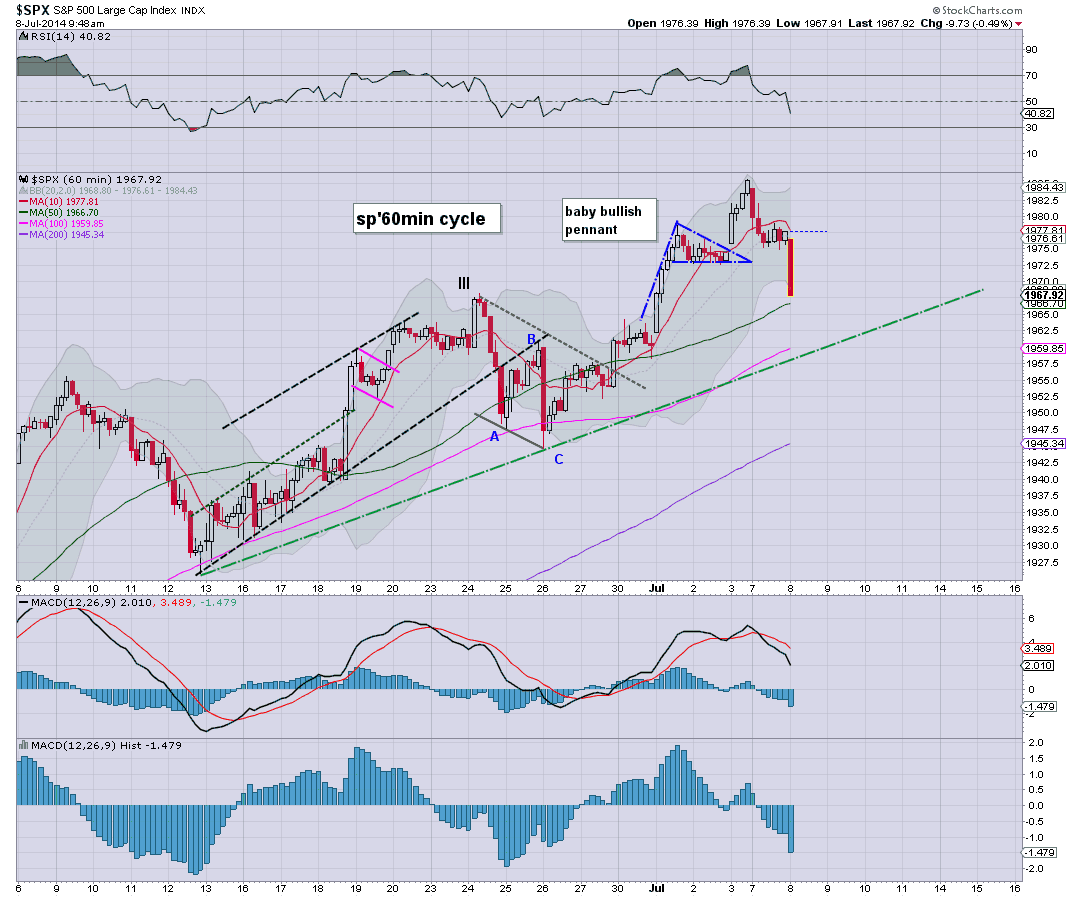

US indexes open moderately weak, but there are multiple aspects of support (across different cycles) in the low sp'1960s. It would seem highly unlikely that the bears can push below 1960 this week.. or indeed, any time soon.

sp'60min

Summary

*VIX is 6% higher, back in the low 12s, but the teens look somewhat unlikely. I suppose 13s are viable if sp'1962/60 today.

--

So... a second morning of declines, but the declines are not significant, and we'll surely hold the 1960s.. before resuming higher.

--

Notable weakness in the airlines.. UAL, DAL, AA

UAL, daily

UAL is close to key support, I'd not be surprised if this floors here.. syncing up with the sp'1960s.

-

I think I should shop... I want some extra things for tonight's big game!

10-.09am.. sp'1965... probably no more than 3-5pts to go.. and then level out.

Equity bears should arguably be tightening stops now.. but I realise some will be seeking much lower levels. Price action does not support such a view though.

Notable weakness: TWTR, -4.5%, back below the $40 threshold, but I still think that nonsense is headed for $50... but more probably on earnings.