For the first time since last October, equity bears are seeing two days of sig' downside in a row. How we close today will be critical. Metals are higher, with Gold breaking back above old support for first time since mid November. VIX is +12% in the mid 15s.

sp'60min

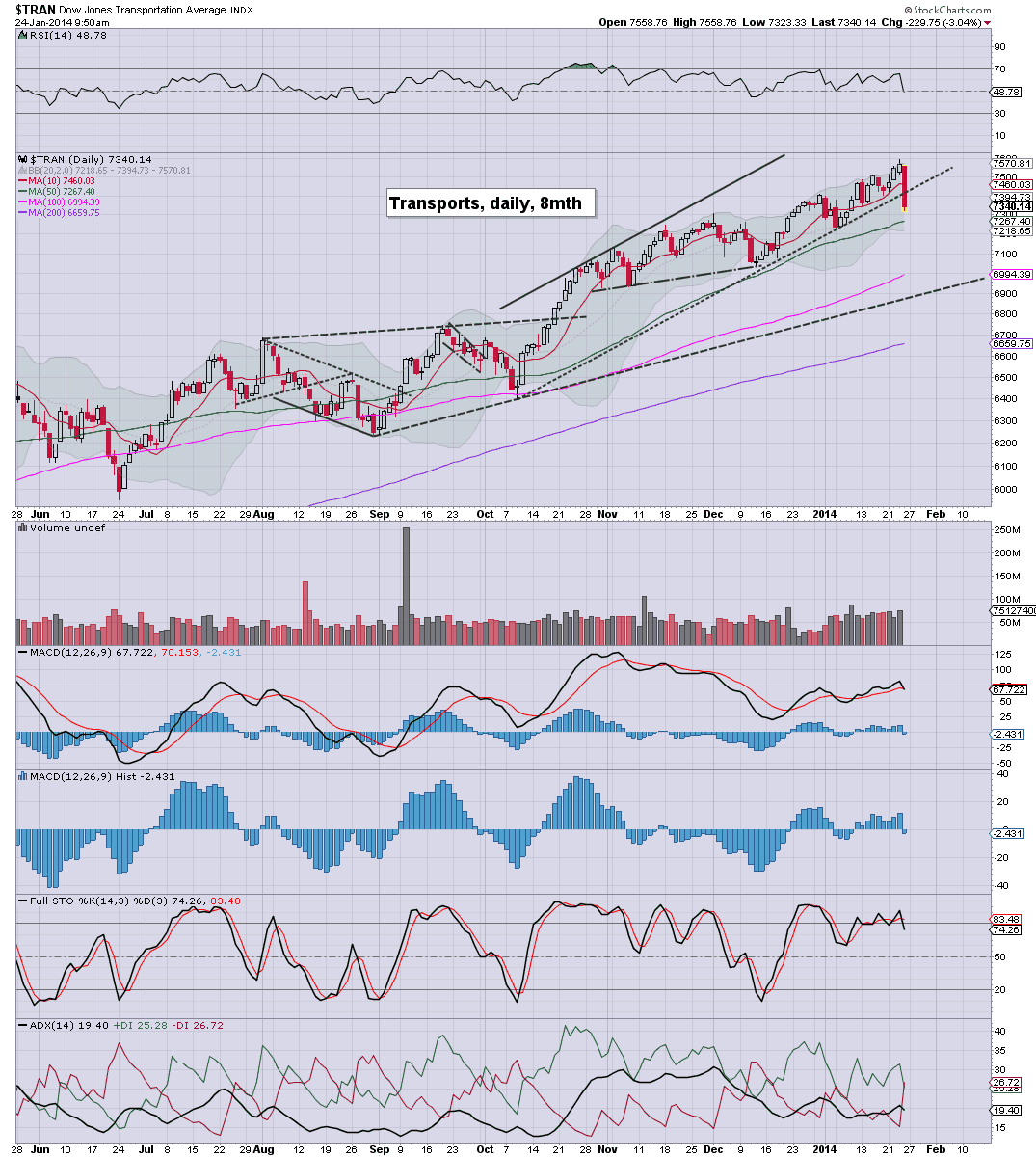

Trans'daily

Summary

*there is a lot to cover, but I think the above two charts cover the bigger issues right now.

--

Clearly, the break <1815 confirms the dow break <16174...bulls are in trouble.

The old leader - Trans, which even managed to close yesterday higher, is getting smashed this morning, biggest fall since last August.

-

*I should note, there is sig' QE of $2-3bn this hour...bears should at least be tightening short-stops right now.

-

To the doomer bears out there...

All those still looking for a mid size collapse wave, should be clawing for a end Jan close <1767 - the FOMC low. If that 'miracle' occurred, it'd break the weekly up trend..and make things real interesting for March/April.

As it is, I don't expect that, but then..I didn't expect this morning's follow through either.

-

10.11am.. minor bounce underway, but really...bulls need to clear 1830 before out of the problem zone.

Hey, at least its not a boring end to the week, right?

10.20am..battling it out at the 50 day of sp'1813/12. Although yes...the Dow is already well below.

The real issue here is how big a bounce will the bulls get.

10.36am Consider this....

It taken the bears FOUR weeks to knock the market down from 1850 to 1809....

2.5% over FOUR weeks. That is truly lousy