A very important closing hour is ahead for both sides. Bulls seem exhausted after a late morning bounce.. whilst bears are showing renewed strength, with a VIX that is battling to challenge the opening high of 17.08.

VIX'daily3

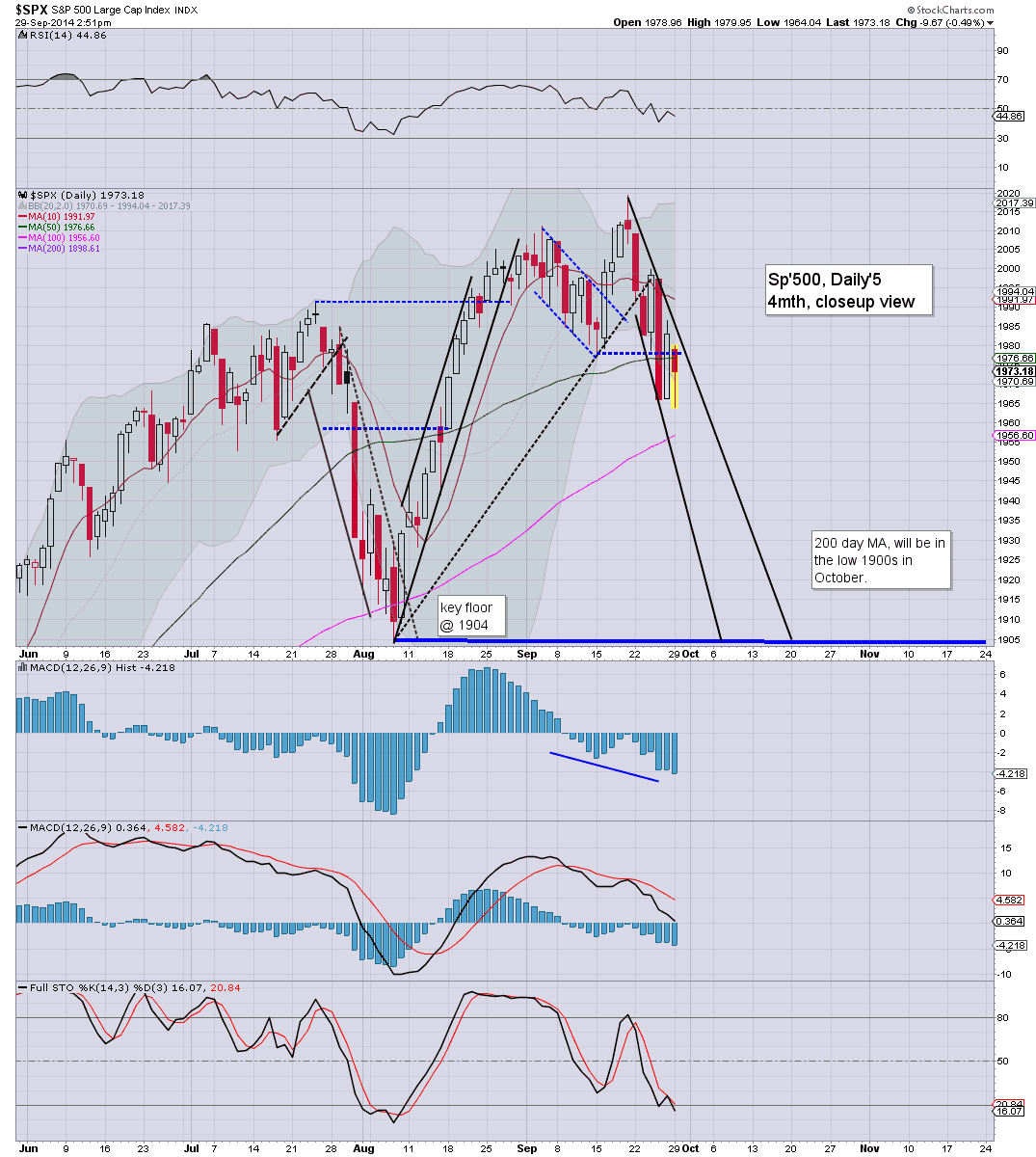

sp'daily5

Summary

... this closing hour could really help shape the next few days.. which in themselves..could determine what happens in Q4.

Indeed, Q3 ends tomorrow... are we going to see a little wash out to the 1940s, with VIX 18/19s?

--

*I will likely hold short into tomorrow, unless VIX breaks into the 18s, with sp'1955/50... but that doesn't seem at all viable until tomorrow.

-

3.19pm... VIX cooling, now just +7%... and bears are failing. I suppose a moderate VIX net daily gain is better than red, but still...its just not enough.

Disappointing... and if we don't break into the sp'1950s tomorrow... then this down wave looks complete.

3.36pm... Major fail for the bears. Daily index candle... spike-floor.. reversal candle.

Yes the VIX is still net higher, but really, that sort of candle is usually bullish for the next day. Any 1990s tomorrow.. and it'll be back to the lunacy for new highs in October.

3.41am... frankly, its a wonder all the bears won't be on suicide watch this evening. Promising opening declines.. only to be whipsawed by a baseless rally (if helped by $2bn of QE fuel)

As ever...its rarely easy for the equity bears... but more on that later...

back at the close