The bulls have seen a rather significant bounce from sp'1560 to the recent high of 1626. The big issue to end this short trading week, will be whether the jobs data is interpreted by Mr Market as 'good data is good data', 'bad data is good data', or 'bad data is bad data'.

sp'weekly7 - bearish count

sp'monthly'3 - rainbow

Summary

In terms of key price levels for tomorrow, arguably bulls should be looking for a weekly close >sp'1628 for a break higher, and bears <sp'1600 for downside.

VIX is back down to what is an unquestionably very low level. The market remains in an almost completely fearless state, but then...the 'supportive' Fed is still out there of course.

--

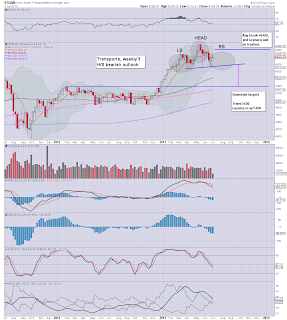

Something I am keeping in mind for Aug/September is the following. It will apply as much to the other indexes, as it does for the Transports..

Transports, weekly'3 - H/S scenario

The scenario is pretty clear, and we'll know whether to trash it, or consider it, depending on whether 6400 or 6000 is hit first. As many recognise, there is some potentially very serious EU turmoil viable this Aug/September. The recent surge in Portuguese rates, and the Euro/$ back <1.30, could just be pre-cursors to something very major indeed.

Looking ahead

Market consensus is for 161k net job gains, with the headline rate falling from 7.6 to 7.5%. Those are not exactly bold targets for those bullish the US economy. Anything <125k should give everyone serious concern for Q3.

However, even if I knew the numbers ahead of tomorrow, I can't fathom to guess how the market will decide to interpret the data. As has been the case for the last few years, it is the interpretation of the data that matters, not the data itself.

*There is no QE tomorrow, and only 'minor' on Monday. Next sig' QE is Tuesday

--

I am still short from over a week ago (from sp'1601), and seeking an exit in the 1570s. How we close tomorrow, will - as ever, be infinitely more important than the pre-market/futures. All things considered, so long as we don't break/close >sp'1628, I will hold to my weekly7 outlook.

Goodnight from London