With no EU comments to spook the market, its a much quieter day. There is no reason to think bears have any chance today, or indeed the rest of the week. USD is a touch higher, whilst Oil is the star of the day, +1.5%. Metals remain weak, but again look exhausted on the sell side.

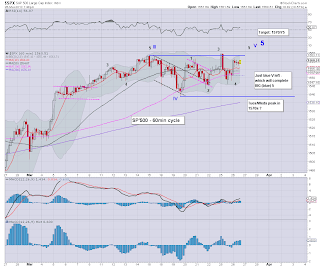

sp'60min

USO, daily2

GLD'60min

Summary

Sp' hourly chart is offering a baby bull flag, that is opening the door to the 1570s Wed/Thursday.

--

We could melt higher into the close, and the HFT bots have a real chance to cause a short-stop cascade to the upside.

No point shorting here.

--

*The GLD chart is extremely child-like simple, but the point is clear. MACD cycle looks very low..and we're due to cycle up.

Price action looks like a bullish wedge/pennant. A break back into the 155s would open up a move that might help to challenge the key resistance around 158

-

USO/Oil sure is tempting re-short here..but whilst equities are still due to go higher, can't be shorting the Oil.