The main indexes appear to be beginning a retracement. The two indexes that lead the way up -Transports and Rus'2000, are appropriately the ones leading the way lower. A multi-day fall of 3-4% would seem very reasonable, with a primary target of sp'1460/50 by end of next week, with VIX'17/18

IWM, daily

SP'daily5

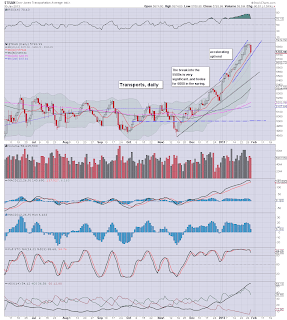

Trans

Summary

Its been two months since we've seen the transports decline by >1.5% - we have to go way back to the post US election November lows. With the Rus'2000 (see IWM chart) similarly falling by 1.2%, I feel confident enough to say that today's close in the two leaders is a good warning that the main indexes will see similar big falls within the next few days.

Transports could fall to 5500 without doing any damage to the primary uptrend, and that equates to sp'1460/50.

So, I think its fair to assume a moderate 3-4% decline in a near term retracement. That is not too bold a call, and as noted, it does nothing to damage in what remain VERY strong up trends - as seen on the weekly/monthly charts.

A little more later