The US market saw significant declines, with the sp -26pts @ 1630. The two leaders - Trans/R2K, saw rather severe falls of 2.6% and 2.4% respectively. Near term trend looks very weak, with a bigger downside target of sp'1570/60s viable within the coming days...along with VIX in the low 20s.

sp'daily5

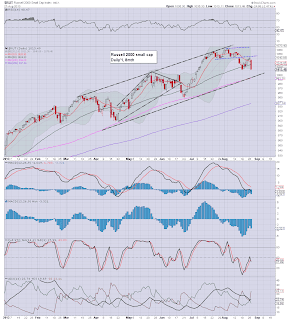

R2K

Trans

Summary

The market opened around sp' 17pts lower, and despite some hours of trying, the bulls simply weren't able to form a solid floor.

The closing hour showed no hint of any broader turn to the upside. Despite some 'risk' of a bounce - the hourly index/VIX cycles are clearly pushing the limit, the market still looks very weak in the days ahead.

I will hold to the broader weekly charts, suggestive of sp'1570/60s..with VIX in the low 20s.

I have to note, I think the Syria situation is being grossly under-estimated by Mr Market. There is the real threat of military action over the coming three day holiday-weekend, and I find it hard to imagine the market rallying on 'missiles are flying'.

Some interesting comments from a guy in the casino pit...

--

*I am LONG VIX, seeking an exit in the 20/21s..sometime before the Friday close.

a little more later...