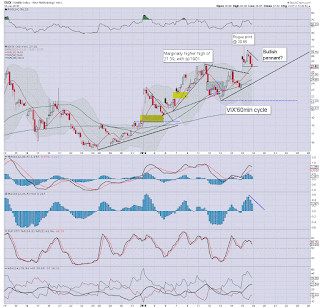

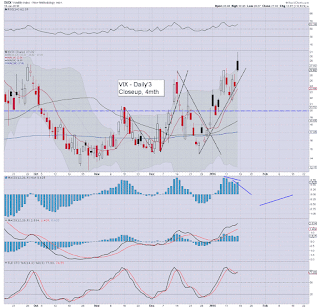

With equities settling lower for a third consecutive week, the VIX was naturally continuing to rise, settling the day +12.8% @ 27.02. Across the week, the VIX attained a fractional net weekly gain of 0.04%. Relative to equities, the VIX is relatively subdued, threatening a short term equity rebound into the next FOMC (Jan'27th).

VIX'60min

VIX'daily3

VIX'weekly

Summary

*there was a 'rogue print' of 30.95 at 10.40am, and I am dismissing it as such.

--

Suffice to add, relative to equities, VIX remains surprisingly subdued.

Just consider that when sp'1867 in Aug'24th 2015, the VIX exploded into the 50s. Yet today.. with sp'1857, the VIX was not able to hold the 30 threshold.

Of course, the style of equity price action is somewhat different, but still, I'd have expected to see front month VIX at least in the 35/40 zone.

In any case.. much higher VIX levels look due in the weeks and months ahead.. as the market increasingly unravels.

--

more later... on the indexes

Friday, 15 January 2016

Closing Brief

US equity indexes closed broadly weak, sp -41pts @ 1880 (intra low 1857). The two leaders - Trans/R2K, settled lower by -1.6 % and -1.7% respectively. Near term outlook is very uncertain, as there is clearly threat of a giant Tuesday gap lower to the 1750/25 zone, whilst there is upside bounce risk to the 1940/60 zone.

sp'60min

Summary

*closing hour action: naturally, a lot of chop

--

... and another week at the wildest and most twisted casino in the world comes to a close.

We've only had 9 trading days of the year, but it feels like so much has happened.

We have a truly wild and crazy year ahead.... at least to the sp'1600/1500s.... and - as I fear, a latter half hyper ramp.. possibly to new historic highs.

As I will keep saying... unless the equity bears can attain a monthly close under sp'1500, any talk of sp'1000.. or the even more crazy 500s.. remains in the realm of fantasy land.

Have a good weekend everyone :)

--

the usual bits and pieces across the evening.. to wrap up the day

sp'60min

Summary

*closing hour action: naturally, a lot of chop

--

... and another week at the wildest and most twisted casino in the world comes to a close.

We've only had 9 trading days of the year, but it feels like so much has happened.

We have a truly wild and crazy year ahead.... at least to the sp'1600/1500s.... and - as I fear, a latter half hyper ramp.. possibly to new historic highs.

As I will keep saying... unless the equity bears can attain a monthly close under sp'1500, any talk of sp'1000.. or the even more crazy 500s.. remains in the realm of fantasy land.

Have a good weekend everyone :)

--

the usual bits and pieces across the evening.. to wrap up the day

3pm update - a third net weekly decline

US equity indexes are set for a third consecutive net weekly decline, having broken a new cycle low of sp'1857.. the lowest level since Oct'2014. VIX is holding gains of around 20% in the 28s... which considering the equity market weakness, is arguably somewhat subdued.

sp'weekly1b

sp'60min2

Summary

Regardless of the closing hour - which frankly.. could see almost anything happen, its a third week for the equity bears.

Clearly, any bounces are to be shorted in the weeks and months ahead.

The sp'1600/1500s look a rather easy target.

From a pure technical perspective, by this April, the leading/headline indexes (sp'500, dow, nasdaq) will have the same MACD setup as Sept'2008.. and we remember how that month traded, right?

-

Say hello...

I'll keep DISQUS open for the 3pm post on my screen in the closing hour.. so.. if you want to say hello... please do !

yours.... not short... but neither getting his ass kicked on the long side.

I live to fight another day :)

-

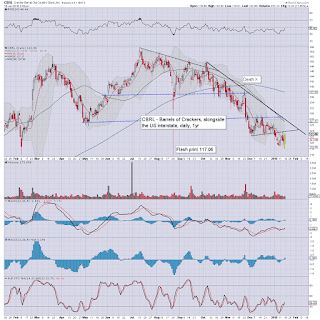

3.04pm.. I can't remember who highlighted CBRL to me recently.....

Today its offering a rather powerful hyper-reversal candle. First upside target would be the 50dma in the $127s

-

Another sign of a 'natural floor'...

APA, daily

H/S formation has played out... a bounce to 40/42 zone would not be overly bold.

-

3.09pm

'hollow red' reversal candles appearing all over the place...

AAPL, daily

First target is the 102/105 zone.

-

3.12pm.. As things are, the hourly MACD cycle is set to turn positive early Tuesday, but who wants to seriously go long on such a trend, whilst price action remains broadly weak?

Today was day'12.. and typically... that is usually the max number of days in a short term down wave.

Arguing against that is that the VIX remains relatively subdued, and there is no sign of capitulation.

--

Market twitchy... sp -43pts @ 1878 VIX 27.90

-

3.27pm... We could still close as high as 1890.. as there might be a fair few short side traders who fear the PBOC doing something this weekend.

-

3.37pm... Increasingly looking like the market makers are striving to pin the market at sp'1885/90

sp'weekly1b

sp'60min2

Summary

Regardless of the closing hour - which frankly.. could see almost anything happen, its a third week for the equity bears.

Clearly, any bounces are to be shorted in the weeks and months ahead.

The sp'1600/1500s look a rather easy target.

From a pure technical perspective, by this April, the leading/headline indexes (sp'500, dow, nasdaq) will have the same MACD setup as Sept'2008.. and we remember how that month traded, right?

-

Say hello...

I'll keep DISQUS open for the 3pm post on my screen in the closing hour.. so.. if you want to say hello... please do !

yours.... not short... but neither getting his ass kicked on the long side.

I live to fight another day :)

-

3.04pm.. I can't remember who highlighted CBRL to me recently.....

Today its offering a rather powerful hyper-reversal candle. First upside target would be the 50dma in the $127s

-

Another sign of a 'natural floor'...

APA, daily

H/S formation has played out... a bounce to 40/42 zone would not be overly bold.

-

3.09pm

'hollow red' reversal candles appearing all over the place...

AAPL, daily

First target is the 102/105 zone.

-

3.12pm.. As things are, the hourly MACD cycle is set to turn positive early Tuesday, but who wants to seriously go long on such a trend, whilst price action remains broadly weak?

Today was day'12.. and typically... that is usually the max number of days in a short term down wave.

Arguing against that is that the VIX remains relatively subdued, and there is no sign of capitulation.

--

Market twitchy... sp -43pts @ 1878 VIX 27.90

-

3.27pm... We could still close as high as 1890.. as there might be a fair few short side traders who fear the PBOC doing something this weekend.

-

3.37pm... Increasingly looking like the market makers are striving to pin the market at sp'1885/90

2pm update - remaining broadly weak

US equities remain very significantly lower, sp -46pts @ 1875, having seen an earlier low of 1857.. decisively breaking the Aug' low, and confirming the much earlier breaks in the Trans/R2K. VIX remains elevated, +22%, but relative to the equity weakness, is somewhat surprisingly only in the 29s.

sp'60min2

VIX'60min

Summary

*VIX is looking somewhat toppy, and it is indeed surprising to see VIX still not trading into the 35/40 zone.

--

With each new low, the equity bounce target is lowered, and it should be clear to even the cheerleaders on clown finance TV, we ain't going to be >2k for a long.... long time.

--

other issues today...

Gold, +$11, classic fear-bid gains... with GDX +0.4%... a bad week overall though for ALL miners

Oil -5.3% in the $29s... next support is around $25. Sub $20 looks due for 'industry capitulation'.

--

Two hours to go... opex... expect more chop... and increasing vol'.

-

2.17pm.. Cyclically, hourly MACD cycle is offering a turn/floor from sp'1857... but there are an awful lot of reason to dismiss the smaller cycles right now.

sp'60min2

VIX'60min

Summary

*VIX is looking somewhat toppy, and it is indeed surprising to see VIX still not trading into the 35/40 zone.

--

With each new low, the equity bounce target is lowered, and it should be clear to even the cheerleaders on clown finance TV, we ain't going to be >2k for a long.... long time.

--

other issues today...

Gold, +$11, classic fear-bid gains... with GDX +0.4%... a bad week overall though for ALL miners

Oil -5.3% in the $29s... next support is around $25. Sub $20 looks due for 'industry capitulation'.

--

Two hours to go... opex... expect more chop... and increasing vol'.

-

2.17pm.. Cyclically, hourly MACD cycle is offering a turn/floor from sp'1857... but there are an awful lot of reason to dismiss the smaller cycles right now.

1pm update - why the 1750/25 zone?

The December close was definitively bearish, and at such time, consideration of the bigger weekly/monthly cycles provided a first key target zone of sp'1750/25, specifically, 1730. That is clearly viable in the immediate term, and would make for a natural short term capitulation before a bounce.

sp'weekly8d

sp'monthly2b

Summary

There are a fair few reasons why the 1750/25 zone should be hit, but I do like the basic fib' retrace (of the 2011/15 wave), along with the 60EMA, aka the Jan'2008 analogy.

Things are clearly very bearish today.. and there is serious threat things will unravel across this afternoon.

Keep in mind, the circuit breakers kick in at -7%... (1921.84 x 0.07) = -134.52pts

1921.84-134.52: market would be suspended @ 1787.32

-

It should be clear to anyone who decides to hold short across the weekend, the China leadership might lower rates, change the RRR, or hit the BUY button.

A further concern should be that most short term down waves never exceed 12 trading days... and today is day'12.

--

For now... stay tuned... the next 3 hours could be rather entertaining.

sp'weekly8d

sp'monthly2b

Summary

There are a fair few reasons why the 1750/25 zone should be hit, but I do like the basic fib' retrace (of the 2011/15 wave), along with the 60EMA, aka the Jan'2008 analogy.

Things are clearly very bearish today.. and there is serious threat things will unravel across this afternoon.

Keep in mind, the circuit breakers kick in at -7%... (1921.84 x 0.07) = -134.52pts

1921.84-134.52: market would be suspended @ 1787.32

-

It should be clear to anyone who decides to hold short across the weekend, the China leadership might lower rates, change the RRR, or hit the BUY button.

A further concern should be that most short term down waves never exceed 12 trading days... and today is day'12.

--

For now... stay tuned... the next 3 hours could be rather entertaining.

12pm update - ultimate uncertainty

From a trading perspective, Mr Market is trading in no mans land... too low to short.. but too risky to go long, with threat of much lower levels at next Tuesday's open. Considering it is opex, and with a 3 day weekend ahead, it is surely a case of sitting it out.. and keeping things simple.

sp'60min'2

VIX'60min

Summary

The 60min equity chart is the 'best bounce' scenario.. which were one to occur, would now drag out into FOMC week.

However, it should be clear.. with the market remaining broadly weak, there is LOW confidence in such an outlook... not least as the bigger weekly/monthly cycles are both suggestive of the 1700s in the near term.

.. and yes, I'd accept that is a sit on the fence viewpoint.

--

VIX update from Mr S... aka.. the Godfather

--

time for lunch :)

-

12.06pm.. new low sp'1871.... VIX 28s

12.30pm...new low sp'1862... VIX 29s... the cheerleaders on clown finance TV are still refusing to talk 'sp'1700s'.

sp'60min'2

VIX'60min

Summary

The 60min equity chart is the 'best bounce' scenario.. which were one to occur, would now drag out into FOMC week.

However, it should be clear.. with the market remaining broadly weak, there is LOW confidence in such an outlook... not least as the bigger weekly/monthly cycles are both suggestive of the 1700s in the near term.

.. and yes, I'd accept that is a sit on the fence viewpoint.

--

VIX update from Mr S... aka.. the Godfather

--

time for lunch :)

-

12.06pm.. new low sp'1871.... VIX 28s

12.30pm...new low sp'1862... VIX 29s... the cheerleaders on clown finance TV are still refusing to talk 'sp'1700s'.

11am update - its clearly a mess

US equities break a new cycle low of sp'1872.. a mere 5pts above the Aug' low, whilst keeping in mind the Trans/R2K are well below last Aug'. VIX is so far unable to break above the opening high of 28.96... and considering we saw VIX 50s when sp'1867... the current VIX is surprisingly low.

sp'60min

VIX'60min

Summary

*around 10.40am, there was a 'rogue print' on the VIX of 30.95, and is arguably to be dismissed.

--

So much for the Thursday short term floor of sp'1878.

I've adjusted (yet again) the fib' retrace. Right now.. best case for the bulls is a bounce to 1952/77.. which would not be until the FOMC of Jan'27th.

Indeed, a bounce peak on Fed day is often the case.

--

However, lets be absolutely clear....

From a trading perspective, this is a real mess...

Would you really want to chase short from these levels?

.. but then.. do you want to buy the dip, knowing that the 1700s are viable next Tuesday?

For most.. its arguably a case of sitting it out ahead of the long weekend.

--

Here in London city...

Its pretty icy in the giant metropolis... but hey, its sunny :)

--

Bonus chart...

notable weakness... INTC

Bear flag confirmed... 200dma lost. Gap fill to $31/32 in FOMC week.. before next collapse wave?

--

time to cook

sp'60min

VIX'60min

Summary

*around 10.40am, there was a 'rogue print' on the VIX of 30.95, and is arguably to be dismissed.

--

So much for the Thursday short term floor of sp'1878.

I've adjusted (yet again) the fib' retrace. Right now.. best case for the bulls is a bounce to 1952/77.. which would not be until the FOMC of Jan'27th.

Indeed, a bounce peak on Fed day is often the case.

--

However, lets be absolutely clear....

From a trading perspective, this is a real mess...

Would you really want to chase short from these levels?

.. but then.. do you want to buy the dip, knowing that the 1700s are viable next Tuesday?

For most.. its arguably a case of sitting it out ahead of the long weekend.

--

Here in London city...

|

| Icy sunshine |

|

| 'Giant sale, now on', somewhat appropriate. |

Its pretty icy in the giant metropolis... but hey, its sunny :)

--

Bonus chart...

notable weakness... INTC

Bear flag confirmed... 200dma lost. Gap fill to $31/32 in FOMC week.. before next collapse wave?

--

time to cook

10am update - opening sharp declines, but...

US equities open sharply lower.. but well above the levels that the futures/index ETFs were suggesting (SPY was offering sp -52pts @ 1869). VIX opens higher, but the opening hourly black-fail candle is a major problem for the equity bears.

sp'60min

vix'60min

Summary

*awaiting consumer sent', business invent'

--

A VERY long day ahead.

First... I'm not expecting a crash today, but unless there is some miracle recovery across today... the equity bulls are in dire trouble of a Tuesday drop to sp'1750/25 zone - where there are multiple aspects of support.

Across many charts, the 1750/25 zone would make for an initial floor... the following is one to be aware of...

sp'monthly2b

I would refer anyone to the Jan'2008 candle, and what is currently happening in Jan' 2016. The 60 EMA in the 1730s would be a valid target.. and is also a key fib' level.

--

What am I doing?

Well, I sure ain't 'buying the dip'.... as that seems utter madness.. I'd only be tempted in the 1750/25 zone.

With a 3 day weekend ahead, I'm not in the mood to chase lower at these levels.

Its frustrating... but it could be worse.. I could be heavy long on margin.

time for some sun... back soon

sp'60min

vix'60min

Summary

*awaiting consumer sent', business invent'

--

A VERY long day ahead.

First... I'm not expecting a crash today, but unless there is some miracle recovery across today... the equity bulls are in dire trouble of a Tuesday drop to sp'1750/25 zone - where there are multiple aspects of support.

Across many charts, the 1750/25 zone would make for an initial floor... the following is one to be aware of...

sp'monthly2b

I would refer anyone to the Jan'2008 candle, and what is currently happening in Jan' 2016. The 60 EMA in the 1730s would be a valid target.. and is also a key fib' level.

--

What am I doing?

Well, I sure ain't 'buying the dip'.... as that seems utter madness.. I'd only be tempted in the 1750/25 zone.

With a 3 day weekend ahead, I'm not in the mood to chase lower at these levels.

Its frustrating... but it could be worse.. I could be heavy long on margin.

time for some sun... back soon

Pre-Market Brief

Good morning. US equity futures are sharply lower, sp -31pts, we're set to open around 1890 - just 12pts above the Thursday low. Oil is imploding again, -5.1% in the low $30s. Gold is catching a minor fear bid, +$7.

sp'60min2

Summary

Q. why the big overnight drop?

1. Oil is clearly a problem, as it remains vulnerable to cooling to next support in the $25s.

2. INTC results were okay, but the outlook is not great

3. Overnight Asia/EU action... broadly weak

4. OPEX... ahead of a long 3 day weekend, the 'rats want to close out'.

-

Yesterday mornings price action was highly indicative of a short term floor, so unless 1878 is broken under today, the near term outlook will not change.

Again, it remains the case that anyone trying to play the bounces is going to be at high risk to an overnight snap lower. The default trade remains to the short side.

If 1878 is broken today, then the 1750/25 zone will be back on the menu, but I'm guessing no... and with a long weekend ahead, I don't intend to get involved.

early movers...

INTC -6% @ $30.80

FCX -7%

AA -4% in the $6s... the $4s look due by early summer

GDX +1.1%

TVIX +13% @ $10.00

TLT +0.9%... as bonds rise.. and yields fall

--

Overnight action..

Japan: -0.5% in the 17100s

China: unravelling into the weekend, -3.5% @ 2900... well under the 3K threshold, on the way to the 2500s.

Germany:currently -1.2% in the 9600s.

--

awaiting a truck load of data...

Have a good Friday

-

8.04am... Citi (C) and Wells Fargo (WFC) results were a touch about expectations.

Most do not realise, C remains -90% from the pre-2008 collapse levels. Even BAC still can't get a monthly close >$18.

Financials... stuck. Energy amashed. Miners..... obliterated.

Were it not for tech and the momo stocks, this market sure wouldn't have made it >2K

-

8.31am... Retail sales m/m -0.1%... lousy.

Empire state: -19.3 borderline apocalypse

PPI m/m -0.2%... deflationary.. and the market won't like it.

-

sp -40pts... 1881..... 3pts from breaking the key low....

8.48am.. sp -42pts... 1879... and it looks like the Thursday low will be broken.

If <1878... equity bears should seek a VIX >27.39.. to confirm the renewed weakness

SNAP... as the low is taken out...

sp -46pts.. 1875.....

sp-50pts... 1871.... 4pts from the Aug' 2015 low

-

9.12am.. sp is holding powerful declines of -45pts... 1876....

Gold has build fear-bid gains, +$17... .but those never endure of course.

-

9.16am.. Industrial production, -0.4%... lousy. Utilisation 76.9.... lousy.

GDP Q4 is due in two weeks time.. to end the month... sub <1.0% looks a given.

9.31am.. sp -52pts.... VIX +20% in the upper 28s... confirming the move.

Window is wide open to 1750/25... not today... but next week it sure is viable.

sp'60min2

Summary

Q. why the big overnight drop?

1. Oil is clearly a problem, as it remains vulnerable to cooling to next support in the $25s.

2. INTC results were okay, but the outlook is not great

3. Overnight Asia/EU action... broadly weak

4. OPEX... ahead of a long 3 day weekend, the 'rats want to close out'.

-

Yesterday mornings price action was highly indicative of a short term floor, so unless 1878 is broken under today, the near term outlook will not change.

Again, it remains the case that anyone trying to play the bounces is going to be at high risk to an overnight snap lower. The default trade remains to the short side.

If 1878 is broken today, then the 1750/25 zone will be back on the menu, but I'm guessing no... and with a long weekend ahead, I don't intend to get involved.

early movers...

INTC -6% @ $30.80

FCX -7%

AA -4% in the $6s... the $4s look due by early summer

GDX +1.1%

TVIX +13% @ $10.00

TLT +0.9%... as bonds rise.. and yields fall

--

Overnight action..

Japan: -0.5% in the 17100s

China: unravelling into the weekend, -3.5% @ 2900... well under the 3K threshold, on the way to the 2500s.

Germany:currently -1.2% in the 9600s.

--

awaiting a truck load of data...

Have a good Friday

-

8.04am... Citi (C) and Wells Fargo (WFC) results were a touch about expectations.

Most do not realise, C remains -90% from the pre-2008 collapse levels. Even BAC still can't get a monthly close >$18.

Financials... stuck. Energy amashed. Miners..... obliterated.

Were it not for tech and the momo stocks, this market sure wouldn't have made it >2K

-

8.31am... Retail sales m/m -0.1%... lousy.

Empire state: -19.3 borderline apocalypse

PPI m/m -0.2%... deflationary.. and the market won't like it.

-

sp -40pts... 1881..... 3pts from breaking the key low....

8.48am.. sp -42pts... 1879... and it looks like the Thursday low will be broken.

If <1878... equity bears should seek a VIX >27.39.. to confirm the renewed weakness

SNAP... as the low is taken out...

sp -46pts.. 1875.....

sp-50pts... 1871.... 4pts from the Aug' 2015 low

-

9.12am.. sp is holding powerful declines of -45pts... 1876....

Gold has build fear-bid gains, +$17... .but those never endure of course.

-

9.16am.. Industrial production, -0.4%... lousy. Utilisation 76.9.... lousy.

GDP Q4 is due in two weeks time.. to end the month... sub <1.0% looks a given.

9.31am.. sp -52pts.... VIX +20% in the upper 28s... confirming the move.

Window is wide open to 1750/25... not today... but next week it sure is viable.

Short term floor

US equity indexes have seen a clear short term floor of sp'1878, already rebounding into the 1930s. The fib' retrace/bounce zone of 1956/80 looks highly probable, along with VIX cooling back under the 20 threshold. However, the broader outlook remains absolutely bearish... as in ABSOLUTELY.

sp'weekly1c - bear flag scenario

sp'monthly1b

Summary

I shall highlight the monthly cycle again, to note that until the bulls attain a monthly close back above the monthly 10MA (currently @ 2037), they have nothing to be pleased about.

As it is, a second consecutive net monthly decline looks a given, and that will further clarify that a bearish spring/early summer is ahead.

re: weekly cycle - bear flag. If you consider that this week will close at least moderately net positive, with another net gain next week, but with equities likely to unravel again, no later than FOMC week.

Right now, a break under this mornings low of sp'1878 looks viable in the first half of February.

-

Looking ahead

The week concludes with a truck load of data...

PPI, Retail sales, Empire state manu'

Indust' prod', consumer sent', bus' inventories

*a trio of Fed officials are set to appear, most notable.. Dudley

It is also important to note it is OPEX, so expect increasing chop into the weekly close. Further, because next Monday is CLOSED, there will likely be increased volume as some traders (long and short) wish to close out ahead of a 3 day weekend.

--

Goodnight from London

sp'weekly1c - bear flag scenario

sp'monthly1b

Summary

I shall highlight the monthly cycle again, to note that until the bulls attain a monthly close back above the monthly 10MA (currently @ 2037), they have nothing to be pleased about.

As it is, a second consecutive net monthly decline looks a given, and that will further clarify that a bearish spring/early summer is ahead.

re: weekly cycle - bear flag. If you consider that this week will close at least moderately net positive, with another net gain next week, but with equities likely to unravel again, no later than FOMC week.

Right now, a break under this mornings low of sp'1878 looks viable in the first half of February.

-

Looking ahead

The week concludes with a truck load of data...

PPI, Retail sales, Empire state manu'

Indust' prod', consumer sent', bus' inventories

*a trio of Fed officials are set to appear, most notable.. Dudley

It is also important to note it is OPEX, so expect increasing chop into the weekly close. Further, because next Monday is CLOSED, there will likely be increased volume as some traders (long and short) wish to close out ahead of a 3 day weekend.

--

Goodnight from London

Daily Index Cycle update

US equities opened a little shaky - with a new cycle low of sp'1878, but

then surged, building powerful gains, sp +31pts @ 1921 (intra high

1934). The two leaders - Trans/R2K, settled higher by 1.2% and 1.5%

respectively. Near term outlook offers the 1956/80 zone, along with VIX

back under the key 20 threshold.

sp'daily5

R2K

Summary

*it is notable that the R2K broke under the giant psy' threshold of 1000, for the first time since July 2013. Regardless of a short term bounce into late Jan', the 800s look due by May/June.

--

Suffice to add, opening shaky gains, but then building solid gains into the mid afternoon. There was a touch of cooling in the closing hour, but further gains look due into next week.

Best guess.. sp'1956/80...then breaking powerfully lower into the 1750/25 zone.

--

Update from Riley

--

a little more later...

sp'daily5

R2K

Summary

*it is notable that the R2K broke under the giant psy' threshold of 1000, for the first time since July 2013. Regardless of a short term bounce into late Jan', the 800s look due by May/June.

--

Suffice to add, opening shaky gains, but then building solid gains into the mid afternoon. There was a touch of cooling in the closing hour, but further gains look due into next week.

Best guess.. sp'1956/80...then breaking powerfully lower into the 1750/25 zone.

--

Update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)