With equities sliding to a new cycle low of sp'1820, the VIX built on opening gains, hitting a new peak of 31.06, but settling +15.2% @ 26.25. Near term outlook is for another wave lower in equities, which should equate to VIX once again in the low 30s.

VIX'daily3

VIX'weekly

Summary

Most notable aspect of the day, VIX breaking the summer 2012 high of 27s, into the 31s. We're now back to levels last seen in late 2011.

I am still seeking a significant bounce back into the sp'1900s, which would like equate to VIX back in the upper/mid teens.. before VIX going nuclear in November.. to the 40s.

--

more later... on the indexes

Wednesday, 15 October 2014

Closing Brief

US equities closed well above the lows, but price action was fiercely bearish, sp'500 settling -15pts @1862 (intra range 1869/20). The two leaders - Trans/R2K, settled +0.2% and +1.1% respectively. Near term outlook is for sp'1815/00 zone, before a rebound into the 1900s.

sp'60min

Summary

... a pretty exciting day, and with another wave of declines, the bigger picture is even more clearer.

Having slipped from 2019 to 1820... that is almost a full 10% from the Alibaba high of Sept'19th.

We look headed for a sig' bounce... back into the 1900s.. by early November.. and then we should see an even stronger down wave... to the sp'1600s.. with VIX 40s.

-

Crazy days are ahead.... the phrase 'don't lose your head' comes to mind.

--

more later... on the VIX

-

4.06pm... NFLX missed on earnings...

Urghhhhhhh

sp'60min

Summary

... a pretty exciting day, and with another wave of declines, the bigger picture is even more clearer.

Having slipped from 2019 to 1820... that is almost a full 10% from the Alibaba high of Sept'19th.

We look headed for a sig' bounce... back into the 1900s.. by early November.. and then we should see an even stronger down wave... to the sp'1600s.. with VIX 40s.

-

Crazy days are ahead.... the phrase 'don't lose your head' comes to mind.

--

more later... on the VIX

-

4.06pm... NFLX missed on earnings...

Urghhhhhhh

3pm update - best guess... before a sustained bounce

US equities remain significantly lower, having broken a new cycle low of sp'1820, with VIX 31s. There remains high likelihood of another wave lower, before the bull maniacs can sustain some degree of sustained rally. Key resistance is now the 1920/50 zone.

sp'daily5b

Summary

*the above count is merely my vain attempt to make some sense of this. It is to be treated 'lightly'...no doubt some of you could detail a hundred valid reasons to disagree with it.

--

A break below today's low of 1820 does seem likely, with a key floor somewhere in the 1815/00 zone. The issue then is... 'what about upside?'

Now that we've fallen so far below the old 1900 neckline, the notion of a H/S formation is DROPPED... and thus 1990/70s are out. More likely, we'll get stuck in the 1920/50 zone...before an even stronger move down in November.

-

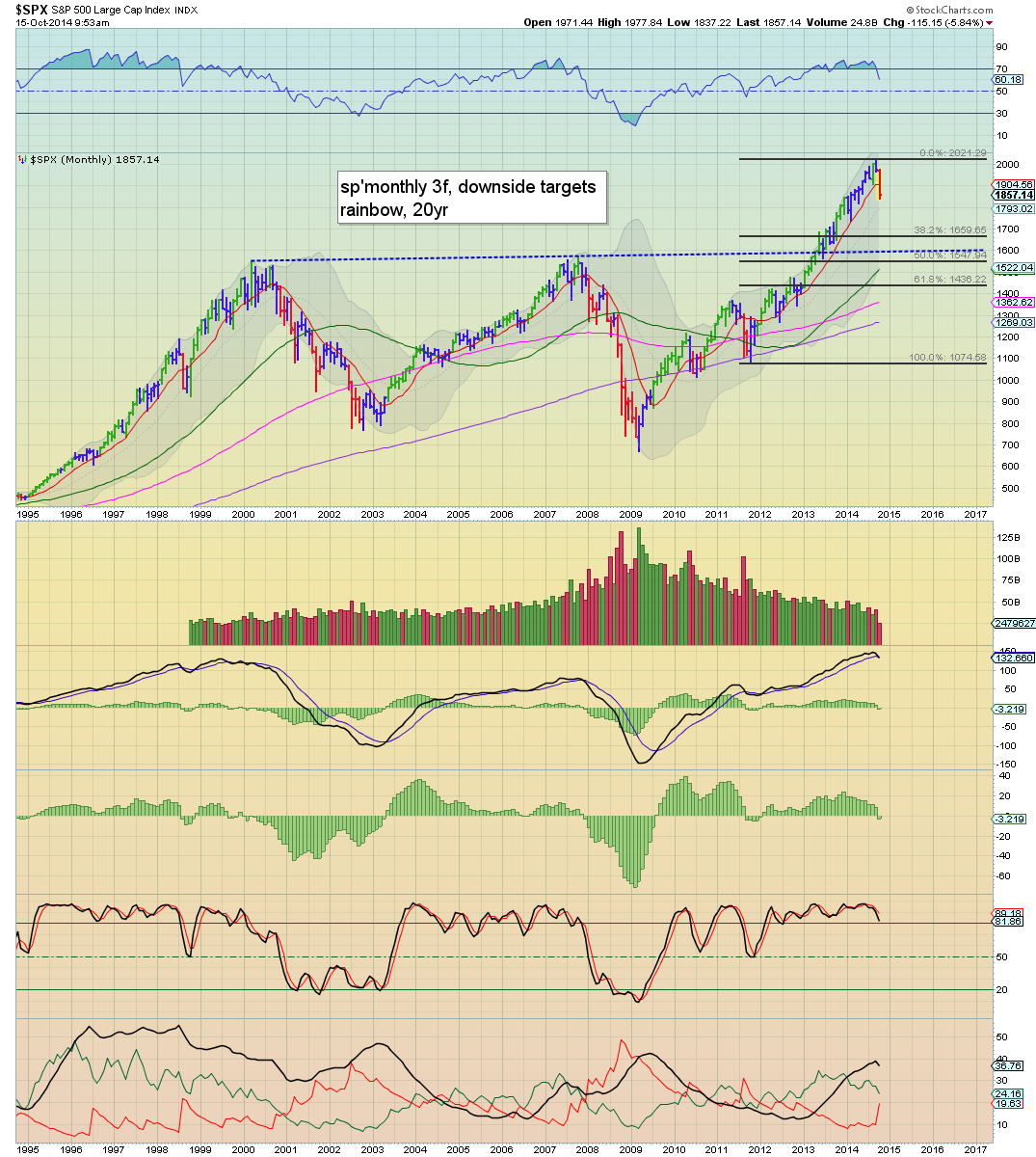

Anyone with doubts should go stare at the following monthly chart for the rest of today...

sp'monthly3f

We're headed for 1650 or so... some kind of back test of the old 2000/2007 double top.

--

updates...into the close....

3.18pm.... afternoon bounce to 1855 looks done.. .and we're already -10pts again...

Friday opex for a key turn? Would be unusual, but...it'd fit... with the current price action.

3.26pm... hourly 10MA remains key resistance, early tomorrow.. that will be around 1820... and it really isn't too hard to envision 1815/00 zone.. with VIX 30s again.

Notable weakness: FCX -3%, with Copper u/c @ $3.00

3.33pm.. Bears getting short-stopped out.... sp' 1858.... VIX 25s.... regardless... its just another wacky intra bounce.

Still look headed for 1815/00 zone on the next wave.

Notable strength: R2K +0.7%.....

3.42pm... R2K +1.2%..... VIX still cooling +9% in the 25s.

Wild swings, but then... to be expected.

3.51pm.. Well, its been a long day.... the bigger picture is absolutely clear.... and for me, that is what matters... but more on that later...

back at the close.

sp'daily5b

Summary

*the above count is merely my vain attempt to make some sense of this. It is to be treated 'lightly'...no doubt some of you could detail a hundred valid reasons to disagree with it.

--

A break below today's low of 1820 does seem likely, with a key floor somewhere in the 1815/00 zone. The issue then is... 'what about upside?'

Now that we've fallen so far below the old 1900 neckline, the notion of a H/S formation is DROPPED... and thus 1990/70s are out. More likely, we'll get stuck in the 1920/50 zone...before an even stronger move down in November.

-

Anyone with doubts should go stare at the following monthly chart for the rest of today...

sp'monthly3f

We're headed for 1650 or so... some kind of back test of the old 2000/2007 double top.

--

updates...into the close....

3.18pm.... afternoon bounce to 1855 looks done.. .and we're already -10pts again...

Friday opex for a key turn? Would be unusual, but...it'd fit... with the current price action.

3.26pm... hourly 10MA remains key resistance, early tomorrow.. that will be around 1820... and it really isn't too hard to envision 1815/00 zone.. with VIX 30s again.

Notable weakness: FCX -3%, with Copper u/c @ $3.00

3.33pm.. Bears getting short-stopped out.... sp' 1858.... VIX 25s.... regardless... its just another wacky intra bounce.

Still look headed for 1815/00 zone on the next wave.

Notable strength: R2K +0.7%.....

3.42pm... R2K +1.2%..... VIX still cooling +9% in the 25s.

Wild swings, but then... to be expected.

3.51pm.. Well, its been a long day.... the bigger picture is absolutely clear.... and for me, that is what matters... but more on that later...

back at the close.

2pm update - VIX reflecting the mainstream concern

With equities breaking to a new cycle low of sp'1820, the VIX has continued to climb, hitting a new three year high of 31.06. Some kind of 'full capitulation' looks imminent.. whether late today, or within a few days. Without question, it sure is ugly out there.

VIX'monthly

sp'60min

Summary

*fed beige book due at 2pm.... if that ain't positive about growth prospects, then another wave lower...

--

Price action remains wild.... so... stay strapped in !

*a good update on the Dow/market from Armstrong, see HERE

-

2.01pm.. Beige book .... growth 'modest to moderate'.... not inspiring.. there is nothing for the bulls in that.

VIX holding 29s..... indexes sliding...

2.30pm.. chop chop... sp'1830s.. VIX cooling... 28s... but still.... bears are in FULL control.

Looks like we'll take out 1820... and eventually floor in the 1810/00 zone.. before a sustained rebound.

2.40pm... A 25pt bounce to 1845.... call it a sub'4.. or whatever.... still seeking another push lower... <1820.

VIX'monthly

sp'60min

Summary

*fed beige book due at 2pm.... if that ain't positive about growth prospects, then another wave lower...

--

Price action remains wild.... so... stay strapped in !

*a good update on the Dow/market from Armstrong, see HERE

-

2.01pm.. Beige book .... growth 'modest to moderate'.... not inspiring.. there is nothing for the bulls in that.

VIX holding 29s..... indexes sliding...

2.30pm.. chop chop... sp'1830s.. VIX cooling... 28s... but still.... bears are in FULL control.

Looks like we'll take out 1820... and eventually floor in the 1810/00 zone.. before a sustained rebound.

2.40pm... A 25pt bounce to 1845.... call it a sub'4.. or whatever.... still seeking another push lower... <1820.

1pm update - new equity lows

The late morning bounce from sp'1837 to 1866 has been entirely negated, and we're breaking new lows... confirmed via new highs in the VIX of 28.32. It remains a deeply shaky market, and there appears threat of some kind of major capitulation sell off.

sp'60min

vix'daily3

Summary

Without question, the VIX is the most notable issue, having broken to levels not seen since late 2011. Volatility is back... and is likely here to stay for some months, as we battle lower to the sp'1600s... effectively a giant wave lower in the style of summer 2011.

--

*Market is understandably increasingly concerned with Ebola.. and the periodic press conferences from the CDC are not helping sentiment.

Airlines are naturally battered, DAL -4%, UAL -5%

-

Update from Riley

--

stay tuned

-

1.18pm... Looking at the broader weekly cycle, there is a lot of price cluster around sp'1820/10 zone... so... I could agree with Hawke on his ES target of 1809.

Regardless, for now... this is real messy. VIX 29s.....

1.21pm... Dow -412... VIX 30s look imminent.... wow....

Typical turn is 2.30pm (as ever), but really, a capitulation sell off this afternoon looks in progress.

1.30pm... Capitulation sell off... VIX 31s.... ZERO sign of a turn.. bears probably have another hour at least. sp'1822....

sp'60min

vix'daily3

Summary

Without question, the VIX is the most notable issue, having broken to levels not seen since late 2011. Volatility is back... and is likely here to stay for some months, as we battle lower to the sp'1600s... effectively a giant wave lower in the style of summer 2011.

--

*Market is understandably increasingly concerned with Ebola.. and the periodic press conferences from the CDC are not helping sentiment.

Airlines are naturally battered, DAL -4%, UAL -5%

-

Update from Riley

--

stay tuned

-

1.18pm... Looking at the broader weekly cycle, there is a lot of price cluster around sp'1820/10 zone... so... I could agree with Hawke on his ES target of 1809.

Regardless, for now... this is real messy. VIX 29s.....

1.21pm... Dow -412... VIX 30s look imminent.... wow....

Typical turn is 2.30pm (as ever), but really, a capitulation sell off this afternoon looks in progress.

1.30pm... Capitulation sell off... VIX 31s.... ZERO sign of a turn.. bears probably have another hour at least. sp'1822....

12pm update - the battle continues

US equities remain significantly lower, with most indexes lower by around -1.8%. Unlike yesterday afternoon, VIX is confirming the weakness, with a sig' gain of 21% in the 27s. USD is markedly lower, -0.8%, which is probably helping the metals, Gold +$10

sp'60min

vix'60min

Summary

It remains a real mess, there is certainly high threat of new lows later today, although there are reversal candles on many of the daily charts - notably, the R2K.

--

..still expecting a bounce, as no doubt many others are, but for now, zero sign of it.

The point is, the bounce.. when it comes... will be a simple one to short... with huge downside potential to the sp'1600s, with VIX 40s.... next month.

Notable weakness, airlines, DAL -4%, UAL -6%, no doubt, on Ebola air travel concerns

--

VIX update from Mr T.

--

time for lunch

-

12.27pm.. Possible double top on the VIX in the low 28s, with equity floor of 1837/40.

Hmm..

*fed beige book due at 2pm.... something to watch for.

12.45pm.. a CDC press' conf. is due any minute.

Market upset.... new equity lows.... CONFIRMED with new VIX high.

sp'60min

vix'60min

Summary

It remains a real mess, there is certainly high threat of new lows later today, although there are reversal candles on many of the daily charts - notably, the R2K.

--

..still expecting a bounce, as no doubt many others are, but for now, zero sign of it.

The point is, the bounce.. when it comes... will be a simple one to short... with huge downside potential to the sp'1600s, with VIX 40s.... next month.

Notable weakness, airlines, DAL -4%, UAL -6%, no doubt, on Ebola air travel concerns

--

VIX update from Mr T.

--

time for lunch

-

12.27pm.. Possible double top on the VIX in the low 28s, with equity floor of 1837/40.

Hmm..

*fed beige book due at 2pm.... something to watch for.

12.45pm.. a CDC press' conf. is due any minute.

Market upset.... new equity lows.... CONFIRMED with new VIX high.

11am update - battling to hold the opening floor

US equities remain exceptionally weak, with rather extreme price chop. So far the opening floor of sp'1837 is holding. Notably, the VIX opening 30min candle was a black-fail of 28.10, breaking the summer 2012 high.

sp'60min

vix'60min

Summary

Suffice to say... it remains VERY wild out there today. Price action is extremely dynamic... and even though we have some strong indications of a floor... that was the case yesterday.. only to fail.

--

The bigger picture is without question... bearish.. to the sp'1650s, with VIX 40s.

However, I'm still concerned of a 2-3 week bounce.. and let there be no doubt, the sp'1950s are very viable on such a bounce.. which would crush the VIX back into the teens.

-

Regardless... its already been one hell of a day....

11.30am.. Renewed weakness, but we're still holding the low.. with VIX still some way below the earlier high of 28s.

sp'60min

vix'60min

Summary

Suffice to say... it remains VERY wild out there today. Price action is extremely dynamic... and even though we have some strong indications of a floor... that was the case yesterday.. only to fail.

--

The bigger picture is without question... bearish.. to the sp'1650s, with VIX 40s.

However, I'm still concerned of a 2-3 week bounce.. and let there be no doubt, the sp'1950s are very viable on such a bounce.. which would crush the VIX back into the teens.

-

Regardless... its already been one hell of a day....

11.30am.. Renewed weakness, but we're still holding the low.. with VIX still some way below the earlier high of 28s.

10am update - the carnage continues

US equities open sharply lower, slipping to a new cycle low of sp'1837. Perhaps even more important, the VIX broke a new high of 28.10, breaking the summer 2012 high of 27.73. We're back to the style of price action from late 2011.

sp'monthly3

Dow'monthly3

Summary

*rather than get lost in the minor noise, I want to again highlight the giant monthly charts...

--

Is there ANYONE still doubting a key intermediate top is now in?

We have clear turns/breaks on all the main indexes, and we're headed for a major multi-month drop...

Primary downside target is now sp'1650s.... with Dow 14700.. R2K low 900s.

--

*there remains HIGH threat of a bounce back into the sp'1900s, but clearly, the lower we go... the lower the upside bounce target will be. Even 1950 now looks a damn long way up.

-

10.04am... A viable spike floor of sp'1837.. with VIX 28s...

A very long day still ahead though...

-

10.15am.. The bounce continues... but the further damage has been done.

It would seem the sp'1650s are now a given... probably late next month... along with VIX 40s.

Incredible times....

10.30am.. R2K turns positive, Transports set to follow.

sp'monthly3

Dow'monthly3

Summary

*rather than get lost in the minor noise, I want to again highlight the giant monthly charts...

--

Is there ANYONE still doubting a key intermediate top is now in?

We have clear turns/breaks on all the main indexes, and we're headed for a major multi-month drop...

Primary downside target is now sp'1650s.... with Dow 14700.. R2K low 900s.

--

*there remains HIGH threat of a bounce back into the sp'1900s, but clearly, the lower we go... the lower the upside bounce target will be. Even 1950 now looks a damn long way up.

-

10.04am... A viable spike floor of sp'1837.. with VIX 28s...

A very long day still ahead though...

-

10.15am.. The bounce continues... but the further damage has been done.

It would seem the sp'1650s are now a given... probably late next month... along with VIX 40s.

Incredible times....

10.30am.. R2K turns positive, Transports set to follow.

Pre-Market Brief

Good morning. Futures are significantly lower, sp -19pts, we're set to open at 1859. Metals are a little higher, Gold +$3, Oil continues to effectively collapse, -0.8%. VIX looks set to gap higher in the 26/28 zone.

sp'daily5

Summary

*retail sales miss... -0.3%, not exactly inspiring.

---

Well... the open sure is going to surprise many... myself included. The sp'1850s... which will probably equate to VIX in the 26/27s. Indeed, if VIX 28s today, then it will surpass the 2012 high.

---

Doom chat, Hunter with Mr Shadowstats.

--

Early movers...

DRYS -6%... still sinking

INTC -3.5%, post earnings.. even though the numbers were arguably fine.

Long day ahead... and it sure won't be dull...

9.19am.. sp -20pts, .... so that is 1857. .. 163pts below the Sept' top.... -8%

9.22am.. sp-21pts... 1856.

The big question remains... where the hell is this going to find support? Are we really just going to keep falling into the 1700s? On any basis, this is still some kind of first wave down... just consider what the next major wave lower will be like...

9.27am... sp -24pts... 1853.....

'Enjoy the open'....I guess you could say....

9.31am.. VIX jumps 15%... to the 26s.... today... confirming the equity weakness.

9.34am.. Dow/SP' monthly 'rainbow' candles turn red for the first time since Sept'2011.

9.40am.. sp'1830s... with VIX 26s.... I'm almost surprised the VIX isn't exploding higher far more. hmmm

9.43am.. VIX still climbing...+20% in the 27s.... testing the summer 2012 high.

VIX breaks the 2012 high of 27.73,,,,

We're back to levels not seen since 2011.

--

9.48am.. micro bounce... 1938 to 1952... . VIX cooling.

Regardless, I ain't buying, we could easily see another down cycle by 11am...

Carnage in the miners... BTU -6%... low $10s.

sp'daily5

Summary

*retail sales miss... -0.3%, not exactly inspiring.

---

Well... the open sure is going to surprise many... myself included. The sp'1850s... which will probably equate to VIX in the 26/27s. Indeed, if VIX 28s today, then it will surpass the 2012 high.

---

Doom chat, Hunter with Mr Shadowstats.

--

Early movers...

DRYS -6%... still sinking

INTC -3.5%, post earnings.. even though the numbers were arguably fine.

Long day ahead... and it sure won't be dull...

9.19am.. sp -20pts, .... so that is 1857. .. 163pts below the Sept' top.... -8%

9.22am.. sp-21pts... 1856.

The big question remains... where the hell is this going to find support? Are we really just going to keep falling into the 1700s? On any basis, this is still some kind of first wave down... just consider what the next major wave lower will be like...

9.27am... sp -24pts... 1853.....

'Enjoy the open'....I guess you could say....

9.31am.. VIX jumps 15%... to the 26s.... today... confirming the equity weakness.

9.34am.. Dow/SP' monthly 'rainbow' candles turn red for the first time since Sept'2011.

9.40am.. sp'1830s... with VIX 26s.... I'm almost surprised the VIX isn't exploding higher far more. hmmm

9.43am.. VIX still climbing...+20% in the 27s.... testing the summer 2012 high.

VIX breaks the 2012 high of 27.73,,,,

We're back to levels not seen since 2011.

--

9.48am.. micro bounce... 1938 to 1952... . VIX cooling.

Regardless, I ain't buying, we could easily see another down cycle by 11am...

Carnage in the miners... BTU -6%... low $10s.

Patiently awaiting a sustained bounce

Despite another particularly weak late afternoon, equities did manage to hold net daily gains. An equity bounce spanning 2-3 weeks still appears likely, along with a VIX that would be knocked back into the mid teens.

sp'weekly7

Summary

So, a bit of a mixed day for the market, with significant gains for the Trans/R2K, but new cycle lows for the Dow/SP'500.

Most notable, the VIX did NOT confirm the new cycle lows, and thus we have a key discrepancy to be mindful of.

As things are, we continue to hold the third consecutive red candle on the weekly 'rainbow' cycle. Primary upside on a bounce would be the weekly 10MA... somewhere in the 1950/60 zone... that is very viable within 2-3 weeks.

WTIC Oil, headed much lower

The monthly 'rainbow' candle is an absolutely clear outright bearish red candle. Outlook is for further declines into early 2015.

The only issue is whether we get stuck around $70, $60, or a brief foray into the $50s. Regardless, lower energy prices are bullish for the broader economy, and will most certainly help growth prospects across Q4 and the first half of 2015.

Looking ahead

We have a quartet of data, PPI, retail sales, empire state manu', and business inventories.

There is also the latest Fed beige book at 2pm. No doubt Mr Market will be desperately looking for any signs that economic growth is continuing.

*there is QE of around $1bn

--

Goodnight from London

sp'weekly7

Summary

So, a bit of a mixed day for the market, with significant gains for the Trans/R2K, but new cycle lows for the Dow/SP'500.

Most notable, the VIX did NOT confirm the new cycle lows, and thus we have a key discrepancy to be mindful of.

As things are, we continue to hold the third consecutive red candle on the weekly 'rainbow' cycle. Primary upside on a bounce would be the weekly 10MA... somewhere in the 1950/60 zone... that is very viable within 2-3 weeks.

WTIC Oil, headed much lower

The monthly 'rainbow' candle is an absolutely clear outright bearish red candle. Outlook is for further declines into early 2015.

The only issue is whether we get stuck around $70, $60, or a brief foray into the $50s. Regardless, lower energy prices are bullish for the broader economy, and will most certainly help growth prospects across Q4 and the first half of 2015.

Looking ahead

We have a quartet of data, PPI, retail sales, empire state manu', and business inventories.

There is also the latest Fed beige book at 2pm. No doubt Mr Market will be desperately looking for any signs that economic growth is continuing.

*there is QE of around $1bn

--

Goodnight from London

Daily Index Cycle update

US equities saw some further swings across the day, having peaked at sp'1898, but seeing latter day weakness, sp' +2pts @ 1877. The two leaders - Trans/R2K, settled higher by 2.6% and 1.1% respectively. Near term outlook remains a 2-3 week bounce.

sp'daily5

Dow

Summary

We have new cycle lows for the Sp'500 and the Dow, although the two leaders - Trans/R2K, closed with some significant gains.

Another discrepancy of high importance is that the VIX did NOT confirm the new equity lows with a higher high.

Taken together, the broader market still looks due a 2-3 week bounce into late Oct/early November, before things get really wild on the downside.

--

Closing update from Riley (audio issues)

--

a little more later...

sp'daily5

Dow

Summary

We have new cycle lows for the Sp'500 and the Dow, although the two leaders - Trans/R2K, closed with some significant gains.

Another discrepancy of high importance is that the VIX did NOT confirm the new equity lows with a higher high.

Taken together, the broader market still looks due a 2-3 week bounce into late Oct/early November, before things get really wild on the downside.

--

Closing update from Riley (audio issues)

--

a little more later...

Subscribe to:

Comments (Atom)