Despite equities breaking under the Monday low of sp'1772, the VIX failed to break the Monday high of 18.99. The VIX settled +9.8% @ 17.35. Equity bears should be mindful of this divergence, and there remains potential for upside to the sp'1810/15 zone within the next 2-4 trading days.

vix'60min

vix'daily3

Summary

*a very notable black-fail candle on the daily charts, which should concern any equity bears holding short into Thursday.

--

So..the VIX did manage some significant gains, but the divergence between the sp' - breaking the Monday low..whilst VIX only managed the low 18s..should be a real concern to the equity bears.

I do broadly expect the key zone of sp'1767/65 to be tested, but that now seems more likely next week.

Any snap <sp'1765, and the VIX will snap into the 19s..if not the low 20s. The 2013 high of 21.91 is an obvious target, along with the 2012 high in the 27s, but the latter sure is a long way up from here.

--

more later..on the indexes

Wednesday, 29 January 2014

Closing Brief

With the Fed cutting monthly QE by a further $10bn, the indexes battled hard to hold above the critical sp'1767/65 zone, sp closed -18pts @ 1774. The two leaders declined by -1.2% and -1.4% respectively. There remains opportunity for upside to the 1810/15 zone, before the next major rollover.

sp'60min

Summary

*earnings due: FB, QCOM

--

Well, that was a choppy and real messy afternoon.

The break under the Monday low of 1772 will have kicked out some of the bulls..and worse..drawn in some bears..only to then whipsaw into the 1780s.

The daily close in the low 1770s still keeps open a move to the 1810/15 zone.

More than anything today, most notable was the divergence between the indexes and the VIX. Whilst sp' broke a new weekly low..the VIX is still a fair way from the Monday spike of 18.99. Maybe I am making too much of it, but really, I think its a problem for those equity bears seeking a clear break <1767/65.

--

the usual bits and pieces across the evening

-

EARNINGS update...

QCOM...numbers were marginally better than expected...stock ..flat.

FB, beat...stock is 1-2% higher..but certainly nothing of note.

sp'60min

Summary

*earnings due: FB, QCOM

--

Well, that was a choppy and real messy afternoon.

The break under the Monday low of 1772 will have kicked out some of the bulls..and worse..drawn in some bears..only to then whipsaw into the 1780s.

The daily close in the low 1770s still keeps open a move to the 1810/15 zone.

More than anything today, most notable was the divergence between the indexes and the VIX. Whilst sp' broke a new weekly low..the VIX is still a fair way from the Monday spike of 18.99. Maybe I am making too much of it, but really, I think its a problem for those equity bears seeking a clear break <1767/65.

--

the usual bits and pieces across the evening

-

EARNINGS update...

QCOM...numbers were marginally better than expected...stock ..flat.

FB, beat...stock is 1-2% higher..but certainly nothing of note.

3pm update - Taper'2 is a GO

The Fed have cut QE by $10bn a month (starting next Monday) to $65bn a month, as the market had expected. Despite a brief break <1772..the bears look exhausted today, and the door is now open to the 1810/15 zone..with VIX in the 15/14.50 zone.

sp'60min

vix'60min

Summary

Okay..so..a really tricky hour..but then.post Fed hours are often a real mess.

-

It would appear the market has stabilised after breaking the Monday low..and we're now set for a claw into the 1800s.

Primary target...remains 1810/15..where there are 4 or 5 key aspects of resistance.

I STILL expect the 1760s to be tested..but that now seems unlikely until next week.

--

updates into the close..

3.03pm another small wave lower.. sp'1774....it sure is a mess out there..but.....

VIX is NOT showing any real concern. Equity bears really need to keep that in mind. Baring a break into the 19s....bears have a real problem right now.

3.13pm...it remains an ugly mess..now we have the hourly MACD cycle rolling over...bearish crosses all over the place... 1767/65 remains the key zone.

Despite the move under the Monday equity low, VIX is still well below the Monday spike of 18.99.

3.19pm... FB earnings at the close...one to watch! Trend is broadly bullish, but short term bearish. Upside to $59/60...kinda reminds me of NFLX.

VIX +12%..but still...not in the 18s

3.33pm..it remains very marginal. I still think the one issue bears need to keep in mind..VIX is NOT showing any real upside kick. I'd be concerned of upside risk across Thur/Friday - not least with $5bn QE on Friday..to conclude the month.

3.44pm.. market again trying to push back upward.

Eyes on the VIX..which has FAILED to break a new high..whilst sp' did marginally break the Monday low.

Bears...beware!

3.49pm.. VIX cooling down...equity day-trading bears should be making a run for it Real risk of sp'1810/15..before the next major wave lower.

Notable strength: STX, +4.7%, but still..a likely dead-cat bounce.

sp'60min

vix'60min

Summary

Okay..so..a really tricky hour..but then.post Fed hours are often a real mess.

-

It would appear the market has stabilised after breaking the Monday low..and we're now set for a claw into the 1800s.

Primary target...remains 1810/15..where there are 4 or 5 key aspects of resistance.

I STILL expect the 1760s to be tested..but that now seems unlikely until next week.

--

updates into the close..

3.03pm another small wave lower.. sp'1774....it sure is a mess out there..but.....

VIX is NOT showing any real concern. Equity bears really need to keep that in mind. Baring a break into the 19s....bears have a real problem right now.

3.13pm...it remains an ugly mess..now we have the hourly MACD cycle rolling over...bearish crosses all over the place... 1767/65 remains the key zone.

Despite the move under the Monday equity low, VIX is still well below the Monday spike of 18.99.

3.19pm... FB earnings at the close...one to watch! Trend is broadly bullish, but short term bearish. Upside to $59/60...kinda reminds me of NFLX.

VIX +12%..but still...not in the 18s

3.33pm..it remains very marginal. I still think the one issue bears need to keep in mind..VIX is NOT showing any real upside kick. I'd be concerned of upside risk across Thur/Friday - not least with $5bn QE on Friday..to conclude the month.

3.44pm.. market again trying to push back upward.

Eyes on the VIX..which has FAILED to break a new high..whilst sp' did marginally break the Monday low.

Bears...beware!

3.49pm.. VIX cooling down...equity day-trading bears should be making a run for it Real risk of sp'1810/15..before the next major wave lower.

Notable strength: STX, +4.7%, but still..a likely dead-cat bounce.

2pm update - here comes the Fed

Time for another FOMC announcement. Market consensus is for QE taper'2 of $10bn, taking monthly QE down to $65bn a month..starting next week. Ironically, if the Fed don't cut QE, it'd likely greatly concern and upset both the US..and world capital markets.

sp'60min

Summary

The levels are clear...

If take out morning low 1774..then test of the very important 1767/65 area. If that fails..then it gets really fast and dirty in market land....with a drop to 1705/1680

Otherwise...another push higher..best case 1810/15..before a rollover..and then a test of the mid 1760s.

In either case...the mid 1760s look to be tested...whether today..tomorrow..or next week

--

...standing by!

2.01pm.. TAPER 2...is a GO... $10bn..cut starting next Monday.

Markets reacting with some relief..with uncertainty out of the way.

Metals...real twitchy...still vulnerable to turning red this hour.

...so far.. the 1774 morning low is holding...and there is very high risk of late day ramp.

2.05pm...VIX cooling down..as uncertainty is gone.... Gold sure looks vulnerable.

2.13pm... Market on the edge of breaking <1774..if so...then 1765....

Things sure are borderline. Bulls need to appear soon..or this market is in trouble for the remainder fo the week.

VIX +9%...real choppy... Gold...holding moderate gains...

Still no clear direction yet. !!!

2.18pm...bears running out of time here...longer we remain >1774... the more likely we snap higher into the close....

BREAK 1773... new intraday low...door is open to 1767/65 in the remainder of today.

1771..on our way to test 1767/65 zone....

--

2.20pm... a CLEAR break of the Monday low....so..can the bulls hold the CRITICAL 1767/75 zone..or ..straight down to 1705/1680...within 'days'?

The safer 'chase it lower' level is on any break <1765. Clearly, the earlier ABC count is now invalid.

2.29pm. crazy market...trying to put in a spike floor.... equity bulls need >1785 to rip out of the danger zone. VIX is churning largely sideways, +7%

2.36pm...market battling to retake the hourly 10MA of 1785.... if broken..then upside to the low 1800s is again viable.

Crazy day..not least since the Monday low was taken out...only to whipsaw back upward. VIX still cooling down. +6%

2.44pm fiercely tricky day....with that FAILED break <1772...only to whipsaw higher. Bears are likely exhausted in this move....bulls have the ball... 1st and 10...right ?

sp'60min

Summary

The levels are clear...

If take out morning low 1774..then test of the very important 1767/65 area. If that fails..then it gets really fast and dirty in market land....with a drop to 1705/1680

Otherwise...another push higher..best case 1810/15..before a rollover..and then a test of the mid 1760s.

In either case...the mid 1760s look to be tested...whether today..tomorrow..or next week

--

...standing by!

2.01pm.. TAPER 2...is a GO... $10bn..cut starting next Monday.

Markets reacting with some relief..with uncertainty out of the way.

Metals...real twitchy...still vulnerable to turning red this hour.

...so far.. the 1774 morning low is holding...and there is very high risk of late day ramp.

2.05pm...VIX cooling down..as uncertainty is gone.... Gold sure looks vulnerable.

2.13pm... Market on the edge of breaking <1774..if so...then 1765....

Things sure are borderline. Bulls need to appear soon..or this market is in trouble for the remainder fo the week.

VIX +9%...real choppy... Gold...holding moderate gains...

Still no clear direction yet. !!!

2.18pm...bears running out of time here...longer we remain >1774... the more likely we snap higher into the close....

BREAK 1773... new intraday low...door is open to 1767/65 in the remainder of today.

1771..on our way to test 1767/65 zone....

--

2.20pm... a CLEAR break of the Monday low....so..can the bulls hold the CRITICAL 1767/75 zone..or ..straight down to 1705/1680...within 'days'?

The safer 'chase it lower' level is on any break <1765. Clearly, the earlier ABC count is now invalid.

2.29pm. crazy market...trying to put in a spike floor.... equity bulls need >1785 to rip out of the danger zone. VIX is churning largely sideways, +7%

2.36pm...market battling to retake the hourly 10MA of 1785.... if broken..then upside to the low 1800s is again viable.

Crazy day..not least since the Monday low was taken out...only to whipsaw back upward. VIX still cooling down. +6%

2.44pm fiercely tricky day....with that FAILED break <1772...only to whipsaw higher. Bears are likely exhausted in this move....bulls have the ball... 1st and 10...right ?

1pm update - chop ahead of the FOMC

The market is remaining in a standard holding pattern, ahead of the FOMC announcement at 2pm. Metals are moderately higher, but look especially vulnerable this afternoon. VIX is holding gains of around 10% in the mid 17s, but a daily close in the 15s is very viable.

sp'60min

Summary

..nothing to add, other than likely C wave upside..baring a break <1774.

--

*just noticed a VIX update from optionmonster..the first in a few weeks...

Bizarrely..its like a flashback to 2005, with screen res' of 240x, urgh

--

One hour to go...

*again, for the record, my guess... Taper'2 of $10bn, to a mere $65bn a month. Hey, thats only $780bn annual rate..still greater than the 2008 emergency 'stop the end of the world' TARP program, lol

---

More than anything, look for the metals to get smacked lower, whilst equities might jump..and make a vain play for the low sp'1800s.

As ever though...it'll probably take until 2.30pm to discern a clear direction.

-

1.16pm continued chop...in the 1780s.

Bears must be mindful...unless <1774...real risk of a jump into the low 1800s by the close..regardless of taper..or not.

1.32pm Notable strength in Natural Gas.. DGAZ +13%..so..nat gas prices must be around 4.5% higher today.

sp'60min

Summary

..nothing to add, other than likely C wave upside..baring a break <1774.

--

*just noticed a VIX update from optionmonster..the first in a few weeks...

Bizarrely..its like a flashback to 2005, with screen res' of 240x, urgh

--

One hour to go...

*again, for the record, my guess... Taper'2 of $10bn, to a mere $65bn a month. Hey, thats only $780bn annual rate..still greater than the 2008 emergency 'stop the end of the world' TARP program, lol

---

More than anything, look for the metals to get smacked lower, whilst equities might jump..and make a vain play for the low sp'1800s.

As ever though...it'll probably take until 2.30pm to discern a clear direction.

-

1.16pm continued chop...in the 1780s.

Bears must be mindful...unless <1774...real risk of a jump into the low 1800s by the close..regardless of taper..or not.

1.32pm Notable strength in Natural Gas.. DGAZ +13%..so..nat gas prices must be around 4.5% higher today.

12pm update - a wild afternoon ahead

Mr Market is likely to remain in mild upside-chop mode for the next two hours. However, we're very likely to see some pretty dynamic action once the FOMC announcement is made. The precious metals look extremely vulnerable to snapping lower.

sp'60min

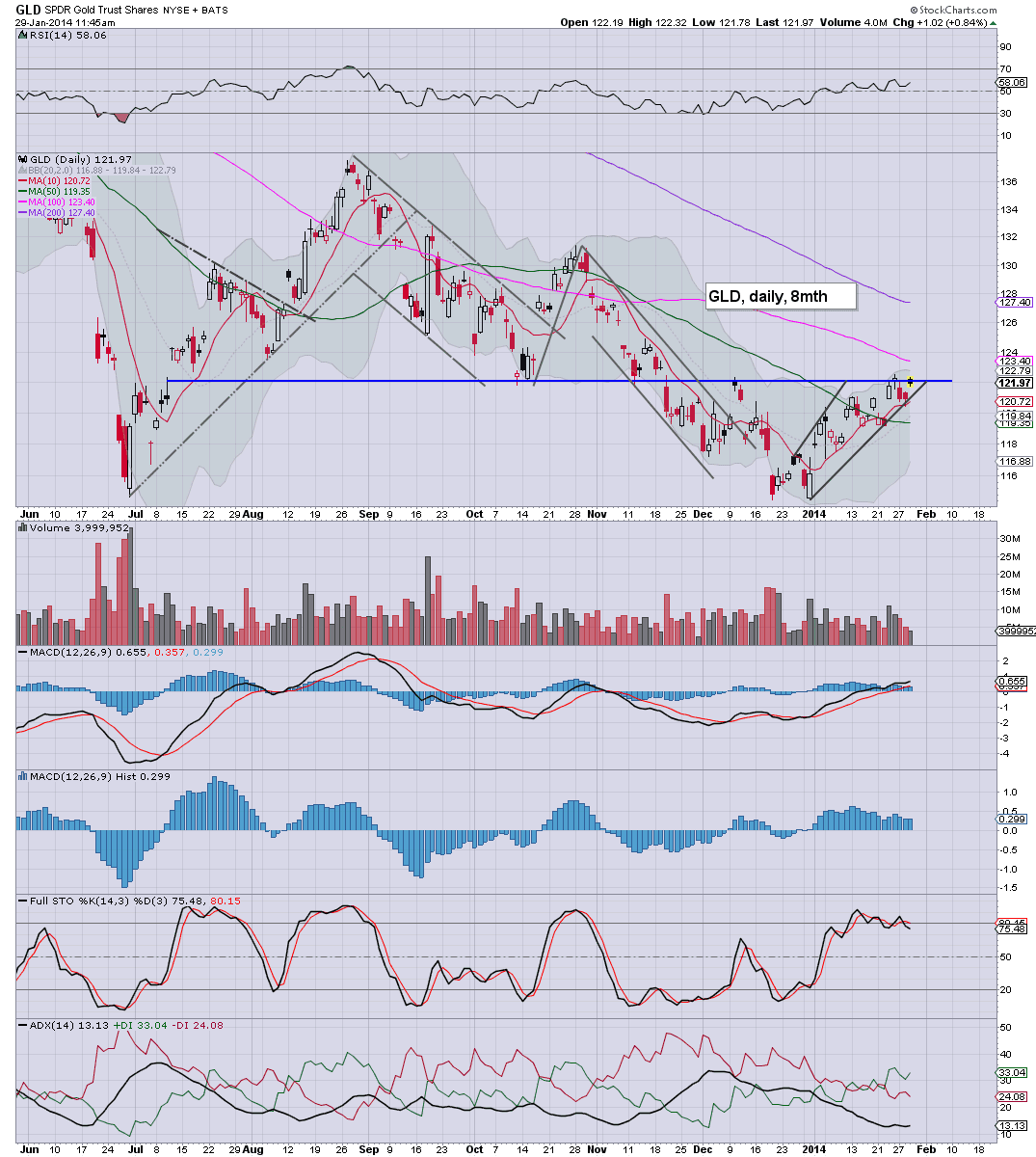

GLD, daily

Summary

*there is a lot to cover..I'll battle hard to cover it..

Gold is holding gains of around $10..but there is very real risk of a snap lower..with a daily close -$25/35. Daily charts look....very vulnerable, not least with the current black-fail candle..at resistance!

-

As for equities, upside to 1800 looks likely..but it'll be damn hard to break much above 1805/10.

Best case for the bulls..a spike high, early tomorrow 1810/15...on US/EU GDP data, but we might simply fail this afternoon. We'll just have to see what sort of price action we get in the 2pm hour.

--

time for lunch !

12.31pm... chop chop...still in the 1780s...but importantly..holding well above the early 1774 low.

Gold looks weak, now +$8..things sure will get interesting in <90mins.

sp'60min

GLD, daily

Summary

*there is a lot to cover..I'll battle hard to cover it..

Gold is holding gains of around $10..but there is very real risk of a snap lower..with a daily close -$25/35. Daily charts look....very vulnerable, not least with the current black-fail candle..at resistance!

-

As for equities, upside to 1800 looks likely..but it'll be damn hard to break much above 1805/10.

Best case for the bulls..a spike high, early tomorrow 1810/15...on US/EU GDP data, but we might simply fail this afternoon. We'll just have to see what sort of price action we get in the 2pm hour.

--

time for lunch !

12.31pm... chop chop...still in the 1780s...but importantly..holding well above the early 1774 low.

Gold looks weak, now +$8..things sure will get interesting in <90mins.

11am update - small C wave underway

Some real wild price chop this morning, and no doubt..many are already starting to get confused. It looks like we have a B wave floor of sp'1774..and we're now in a small C wave to the upside. Primary upside remains 1810/15..but..we could easily fall short of that...1800/05.

sp'60min

sp'daily5

Summary

Reflect on the daily chart...there is is clear multiple resistance in the 1810/15 zone. I just can't see the bull maniacs breaking above that to new highs, at least not in the current cycle.

--

So..we have a clear re-short zone...later today/early tomorrow. Just a case of waiting for a clear rollover/levelling phase on the hourly MACD cycle.

Arguably, the pro traders out there will be building shorts from 1800/05....with short-stops in the 1820s.

--

Notable strength: STX, +2.9% @ $53, but that is likely a dead cat bounce, after the -12% post earnings drop. Primary downside is 47/46.

-

11.30am.. sp'1785.. looks pretty clear now. The maniacs are making a play for the 1800s...later this afternoon. VIX probably set to turn red later..if briefly.

sp'60min

sp'daily5

Summary

Reflect on the daily chart...there is is clear multiple resistance in the 1810/15 zone. I just can't see the bull maniacs breaking above that to new highs, at least not in the current cycle.

--

So..we have a clear re-short zone...later today/early tomorrow. Just a case of waiting for a clear rollover/levelling phase on the hourly MACD cycle.

Arguably, the pro traders out there will be building shorts from 1800/05....with short-stops in the 1820s.

--

Notable strength: STX, +2.9% @ $53, but that is likely a dead cat bounce, after the -12% post earnings drop. Primary downside is 47/46.

-

11.30am.. sp'1785.. looks pretty clear now. The maniacs are making a play for the 1800s...later this afternoon. VIX probably set to turn red later..if briefly.

10am update - opening black VIX candle

The indexes open with borderline significant declines to sp'1774, but we're seeing a notable bounce already. Traders need to be very careful on what is a key Fed day. VIX is higher, but has failed to hold the low 18s. Metals are higher, Gold +$11

sp'60min

vix'60min

Summary

*frankly, the opening VIX candle, a black-fail, should concern the bears. Often..that is the first sign of trouble.

Further, whilst sp' got to 1774 - just 2pts above the Monday low..the VIX was 97bps lower than the high of 18.99. A divergence..to keep in mind.

--

Without question, the only reasonable 'chase it lower' level is on a break <1765...and a decent re-short zone remains...1810/15.

Stay sharp everyone....we've a long day ahead!

-

10.15am.. notable mover, AAPL, despite the index bounce..looks weak...a break <$500, opens up 480 within days - where the 200 day is!

10.24am.. what a chop fest. Baring a break <1774...we'll battle higher from here. I just very concerned at the opening VIX candle..more often than not..that does not end well for those in bear land.

AAPL loses $500...and the volume surges..as huge amount of stops are hit.

10.40am.. best case for the bulls still looks to be 1810/15...but that makes for a very easy re-short zone...along with VIX 15/14.50.

sp'60min

vix'60min

Summary

*frankly, the opening VIX candle, a black-fail, should concern the bears. Often..that is the first sign of trouble.

Further, whilst sp' got to 1774 - just 2pts above the Monday low..the VIX was 97bps lower than the high of 18.99. A divergence..to keep in mind.

--

Without question, the only reasonable 'chase it lower' level is on a break <1765...and a decent re-short zone remains...1810/15.

Stay sharp everyone....we've a long day ahead!

-

10.15am.. notable mover, AAPL, despite the index bounce..looks weak...a break <$500, opens up 480 within days - where the 200 day is!

10.24am.. what a chop fest. Baring a break <1774...we'll battle higher from here. I just very concerned at the opening VIX candle..more often than not..that does not end well for those in bear land.

AAPL loses $500...and the volume surges..as huge amount of stops are hit.

10.40am.. best case for the bulls still looks to be 1810/15...but that makes for a very easy re-short zone...along with VIX 15/14.50.

Pre-Market Brief

Good morning. Futures have swung moderately lower - after being +10/15pts, the sp' is set to open -4pts @ 1788. Metals are a little higher, Gold +$8 - but looks very vulnerable this afternoon. Equity bulls still have a 'bounce window'...but its closing fast.

sp'60min

Summary

So..the overnight 'higher interest rates in Turkey is good news' has completely failed to hold, and we're actually likely to open a little lower.

However, hourly charts are still suggestive of continued crawl higher into FOMC this afternoon.

From there..things will likely get wild.

Any move to 1810/15 zone..whether late today..or early tomorrow (Q4 GDP)...is likely one of the best re-short opportunities in many..many months.

One prime scenario is we briefly drop on the FOMC..but then still close somewhat higher,..and max out tomorrow.

--

A very busy day ahead..but especially in the closing two hours.

*FOMC announce @ 2pm..but no press conf. (so I gather).

-

Notable early movers: BA (Boeing) -3.7%,. T (AT & T) -2.3%

Neither of those will be helping the Dow, now -80pts in pre-market.

-

8.48am... Dow -117 now....and we're set to open at 1781 .. a mere 9pts above the recent low. No doubt the markets are trying to assimilate the Turkish..and Indian rate hikes.

Kinda amusing how a mere 10bn taper'1 has already caused real trembles out there.

9.15am ..pre-market slipping away... Dow -153pts... a break of the recent sp'1772 low is now a real danger to the bull maniacs.

KEY level remains 1765.. if that fails this morning...then....it'll be car crash TV for the rest of today.

9.20am...a problem for the bulls..a break <1770 will damage the semi-bearish formation that many has been looking for...

sp'daily1b

So, the big level.1765..that is -27pts...won't be easy

-

Arguably anyone short overnight..at least tighten stops....not least since its a fed day!

9.33am.. Cramer on clown TV ' ...can I urge people to be calm?'.

Yeah, I'll highlight that one again if we break <1765.

-

9.38am.. a pretty key battle underway....if we lose 1772..then we'll test 1765 by late morning.

I can only add though..anyone short should have tightened stops...its a fed day..high caution.

9.46am...7pt jump from the opening low.......and no doubt some bears are closing out.

More than anything though.this is going to be one hell of a big day...got popcorn, although thats less important than a trading stop!

sp'60min

Summary

So..the overnight 'higher interest rates in Turkey is good news' has completely failed to hold, and we're actually likely to open a little lower.

However, hourly charts are still suggestive of continued crawl higher into FOMC this afternoon.

From there..things will likely get wild.

Any move to 1810/15 zone..whether late today..or early tomorrow (Q4 GDP)...is likely one of the best re-short opportunities in many..many months.

One prime scenario is we briefly drop on the FOMC..but then still close somewhat higher,..and max out tomorrow.

--

A very busy day ahead..but especially in the closing two hours.

*FOMC announce @ 2pm..but no press conf. (so I gather).

-

Notable early movers: BA (Boeing) -3.7%,. T (AT & T) -2.3%

Neither of those will be helping the Dow, now -80pts in pre-market.

-

8.48am... Dow -117 now....and we're set to open at 1781 .. a mere 9pts above the recent low. No doubt the markets are trying to assimilate the Turkish..and Indian rate hikes.

Kinda amusing how a mere 10bn taper'1 has already caused real trembles out there.

9.15am ..pre-market slipping away... Dow -153pts... a break of the recent sp'1772 low is now a real danger to the bull maniacs.

KEY level remains 1765.. if that fails this morning...then....it'll be car crash TV for the rest of today.

9.20am...a problem for the bulls..a break <1770 will damage the semi-bearish formation that many has been looking for...

sp'daily1b

So, the big level.1765..that is -27pts...won't be easy

-

Arguably anyone short overnight..at least tighten stops....not least since its a fed day!

9.33am.. Cramer on clown TV ' ...can I urge people to be calm?'.

Yeah, I'll highlight that one again if we break <1765.

-

9.38am.. a pretty key battle underway....if we lose 1772..then we'll test 1765 by late morning.

I can only add though..anyone short should have tightened stops...its a fed day..high caution.

9.46am...7pt jump from the opening low.......and no doubt some bears are closing out.

More than anything though.this is going to be one hell of a big day...got popcorn, although thats less important than a trading stop!

QE Taper, part two?

With the recent 3 day market decline of around 3% (ohh the humanity!), has the Fed been spooked enough, to cull the next taper? Or, will we see another $10bn less QE-fuel beginning next week? Tomorrow might have some pretty dynamic price action in the late afternoon. Strap in!

sp'weekly7

sp'weekly9 - the next fib retracement

Summary

So, a positive day for the market, but really, the past two days of price action don't nullify what we saw last Friday. Friday was the first, and most important down wave we've seen in 20 months. The recent VIX action is similarly indicative of some 'trembles in the market', that should be taken seriously.

We have two consecutive red candles on the 'rainbow' weekly cycle charts, and we've not seen that since Nov' 2012.

As for weekly'9, the sp'1550s would be a very natural target in the months ahead...assuming 1850 is not broken above. For the big money out there..it makes for a very simple ultimate short-stop level.

The alternative

I endeavour to keep an open mind, and the following chart highlights the original count, one that I'd been holding to since last summer.

sp'weekly'8

If bears don't break <1765 within the next week or two, and the market puts in a few daily closes >1820..then I'll revert back to this. In the grand scheme of things, it just means the bears will have to wait an extra month or two.

The following chart links directly to the above weekly'8 scenario

sp'daily3b

We'll know soon enough. either 1765 is taken out..or the bulls will manage to break back into the 1820s..and keep pushing. As ever..for the serious money..trading stops will be vital.

--

Looking ahead

Wednesday will of course be all about the FOMC, the announcement is made at 2pm..and on this occasion, I believe there will not be a follow up press conference.

*next sig' QE-pomo is not until Friday - which will be a VERY heavy one of $5bn or so.

--

Taper'2, yes or no?

Trying to guess what the paper printing maniacs at the US Federal Reserve will decide is largely a pointless exercise. Even more of a waste of time, is trying to fathom how the market might react to any particular decision.

Regardless, I'll make a guess... monthly QE cut from $75 to $65bn a month. No doubt the market will also be interested (if not somewhat placated) with the usual talk of 'extended low rates'.

Considering the bigger weekly index charts, bears should be roaring..and clawing, for a hard reversal..either late tomorrow..or early Thursday (post GDP Q4 data). Any daily closes >1820..and that is a real problem for those on the short side.

Goodnight from London

sp'weekly7

sp'weekly9 - the next fib retracement

Summary

So, a positive day for the market, but really, the past two days of price action don't nullify what we saw last Friday. Friday was the first, and most important down wave we've seen in 20 months. The recent VIX action is similarly indicative of some 'trembles in the market', that should be taken seriously.

We have two consecutive red candles on the 'rainbow' weekly cycle charts, and we've not seen that since Nov' 2012.

As for weekly'9, the sp'1550s would be a very natural target in the months ahead...assuming 1850 is not broken above. For the big money out there..it makes for a very simple ultimate short-stop level.

The alternative

I endeavour to keep an open mind, and the following chart highlights the original count, one that I'd been holding to since last summer.

sp'weekly'8

If bears don't break <1765 within the next week or two, and the market puts in a few daily closes >1820..then I'll revert back to this. In the grand scheme of things, it just means the bears will have to wait an extra month or two.

The following chart links directly to the above weekly'8 scenario

sp'daily3b

We'll know soon enough. either 1765 is taken out..or the bulls will manage to break back into the 1820s..and keep pushing. As ever..for the serious money..trading stops will be vital.

--

Looking ahead

Wednesday will of course be all about the FOMC, the announcement is made at 2pm..and on this occasion, I believe there will not be a follow up press conference.

*next sig' QE-pomo is not until Friday - which will be a VERY heavy one of $5bn or so.

--

Taper'2, yes or no?

Trying to guess what the paper printing maniacs at the US Federal Reserve will decide is largely a pointless exercise. Even more of a waste of time, is trying to fathom how the market might react to any particular decision.

Regardless, I'll make a guess... monthly QE cut from $75 to $65bn a month. No doubt the market will also be interested (if not somewhat placated) with the usual talk of 'extended low rates'.

Considering the bigger weekly index charts, bears should be roaring..and clawing, for a hard reversal..either late tomorrow..or early Thursday (post GDP Q4 data). Any daily closes >1820..and that is a real problem for those on the short side.

Goodnight from London

Daily Index Cycle update

The main indexes closed moderately higher, with the sp +10pts @ 1792. The two leaders - Trans/R2K, settled higher by 1.1% and 0.9% respectively. There looks to be continued bounce upside to the sp'1810/15 zone, no later than early Thursday.

sp'daily5

R2K

Trans

Summary

So..the first up day for the sp' since last Wednesday. Nothing for the bulls to get overly excited about though, not least after the very powerful Friday down wave.

The issue now of course is whether 1772 is a key floor, or are we just in the process of a bounce..before another wave lower?

On any basis - considering the bigger weekly cycles (with up trends from 2012 broken), I have to think we'll get stuck around 1810/15..rollover..and then at least test 1765 - a level many are looking for.

Any daily close <1765..and we'll likely see a fast and furious move straight to the 200 day MA..which is currently 1703.

--

a little more later...

sp'daily5

R2K

Trans

Summary

So..the first up day for the sp' since last Wednesday. Nothing for the bulls to get overly excited about though, not least after the very powerful Friday down wave.

The issue now of course is whether 1772 is a key floor, or are we just in the process of a bounce..before another wave lower?

On any basis - considering the bigger weekly cycles (with up trends from 2012 broken), I have to think we'll get stuck around 1810/15..rollover..and then at least test 1765 - a level many are looking for.

Any daily close <1765..and we'll likely see a fast and furious move straight to the 200 day MA..which is currently 1703.

--

a little more later...

Subscribe to:

Posts (Atom)