The VIX had a pretty quiet day, closing lower by just 3%. Considering the main indexes, that decline is indeed just mere noise.

VIX'60min

VIX, daily, rainbow

VIX, weekly

Summary

The 60min cycle is pretty low now, there should be good upside to around 22/24 by this Friday.

The weekly cycle continues to crawl upward..and is warning of 30s..even 40s in July.

Tuesday, 26 June 2012

Closing Brief

A choppy day, where the micro-cycles are now arguably close to being fully reset for some more serious downside across the rest of the week. I am indeed already looking ahead to Wednesday. We have some significant econ-data in the morning that should remind Mr Market of recessionary trouble ahead.

Holding to all main targets. The second half of yesterday and today, is very much of a similar style to last Friday, and Monday turned out kinda good for the bears ;)

Those closing hourly index cycles...

IWM (representing rus'2000 small cap)

Dow

Sp

*I am very uncertain of the micro-count right now, not that it matters for those looking at the bigger picture.

Summary

Bears failed to close below the hourly 10MA, which is not such a great thing, but the daily cycles are VERY bearish for Wednesday...more on that later. Tomorrow should be a good day for the bears.

More across the evening,

Holding to all main targets. The second half of yesterday and today, is very much of a similar style to last Friday, and Monday turned out kinda good for the bears ;)

Those closing hourly index cycles...

IWM (representing rus'2000 small cap)

Dow

Sp

*I am very uncertain of the micro-count right now, not that it matters for those looking at the bigger picture.

Summary

Bears failed to close below the hourly 10MA, which is not such a great thing, but the daily cycles are VERY bearish for Wednesday...more on that later. Tomorrow should be a good day for the bears.

More across the evening,

3pm update - every bounce is a bonus to the bears

The market remains content to remain in what is now a two day bear flag on the small 15min cycle.

I'm certainly not going to get 'lost in the noise' of these tiny moves. The bigger trends remain clear, and for those who can keep that in mind...they'll probably do very well this July.

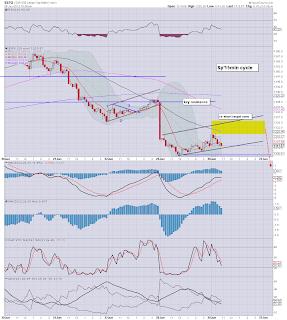

sp'15min

vix'15min

Summary

*special note on the VIX, the minor decline to the 19.50 level arguably fills the gap from yesterdays leap higher. From a cycle perspective...VIX looks pretty floored

--

Every index bounce should be treated as a bonus opportunity to re-short at higher levels, by all those bears who believe we are indeed headed to the low sp'1100s this summer.

I will hold short overnight, seeking sp'1300/1290s for my next exit - which can easily still occur by this Friday.

More after the close

---

*update. 3.30pm

sp'15min

Market showing a little weakness now, look at the cycle starting to rollover.

I'm certainly not going to get 'lost in the noise' of these tiny moves. The bigger trends remain clear, and for those who can keep that in mind...they'll probably do very well this July.

sp'15min

vix'15min

Summary

*special note on the VIX, the minor decline to the 19.50 level arguably fills the gap from yesterdays leap higher. From a cycle perspective...VIX looks pretty floored

--

Every index bounce should be treated as a bonus opportunity to re-short at higher levels, by all those bears who believe we are indeed headed to the low sp'1100s this summer.

I will hold short overnight, seeking sp'1300/1290s for my next exit - which can easily still occur by this Friday.

More after the close

---

*update. 3.30pm

sp'15min

Market showing a little weakness now, look at the cycle starting to rollover.

2pm update - weakness in late afternoon?

Its certainly been another one of those choppy days..but then we are in a clear bear flag still..so its to be expected. With the econ-data now giving out what are warnings of a US recession in Q4, its amazing we're not already in the low sp'1100s.

Yet here we are, and the bull maniacs are still trying to battle upward, and take out the FOMC sp'1363 peak.

sp'15min

sp'60min

Summary

I will hold short overnight (from sp'1319), and am seeking a gap lower to 1305/00...an exit in the 1290s tomorrow would be more than an acceptable exit.

A close under the hourly 10MA - sp'1314, will be quite important for the bears to achieve. Anything under 1312/10 by the close would be bonus points.

Stay tuned!

Yet here we are, and the bull maniacs are still trying to battle upward, and take out the FOMC sp'1363 peak.

sp'15min

sp'60min

Summary

I will hold short overnight (from sp'1319), and am seeking a gap lower to 1305/00...an exit in the 1290s tomorrow would be more than an acceptable exit.

A close under the hourly 10MA - sp'1314, will be quite important for the bears to achieve. Anything under 1312/10 by the close would be bonus points.

Stay tuned!

1pm update - another chance to short

The market's morning weakness has again reversed to test the opening spike high of 1319/20. It is arguably a bonus opportunity to re-position for those who have not already done so.

Daily cycles are warning of a test of the big 1300 level tomorrow. I'm expecting it to not hold.

sp'15min

sp'60min

Summary

I am content to ride out any minor up cycles. The bigger daily cycles are what matter, and they are warning of trouble for Wednesday.

As the smaller cycles clearly show..we are merely in another bear flag. We saw what happened to the flag from last Friday.

Daily cycles are warning of a test of the big 1300 level tomorrow. I'm expecting it to not hold.

sp'15min

sp'60min

Summary

I am content to ride out any minor up cycles. The bigger daily cycles are what matter, and they are warning of trouble for Wednesday.

As the smaller cycles clearly show..we are merely in another bear flag. We saw what happened to the flag from last Friday.

12pm update - daily cycles warn of trouble tomorrow

Whilst the market is seeing a micro-cycle higher, lets take a quick look on the daily index/VIX cycles.

sp, daily5, 4mth

vix, daily, rainbow

Summary

The daily index cycle is due to turn negative MACD cycle tomorrow. The VIX might go positive cycle by late Wednesday if we can break into the low sp'1290s.

Wednesday should be a pretty bearish day, especially if can break 1300...it does open up a much bigger move lower..and a first attempt on the recent wave'1 low of 1266 by Friday.

--

I remain short (from sp'1319 this morning)..looking to hold overnight into Wednesday, first exit target 1300/1290.

More later!

sp, daily5, 4mth

vix, daily, rainbow

Summary

The daily index cycle is due to turn negative MACD cycle tomorrow. The VIX might go positive cycle by late Wednesday if we can break into the low sp'1290s.

Wednesday should be a pretty bearish day, especially if can break 1300...it does open up a much bigger move lower..and a first attempt on the recent wave'1 low of 1266 by Friday.

--

I remain short (from sp'1319 this morning)..looking to hold overnight into Wednesday, first exit target 1300/1290.

More later!

11am update - Permabear back on the short train

Well..that was a pretty exciting opening 90mins. The first 30mins was a bit of a mess, especially for IWM/Rus'2000 index. VIX opened lower by 3/4%...nothing too dramatic.

*econ-data at 10am ...both sucked..but somehow market managed to still get a micro-bounce.

As noted earlier, I am short from sp'1319.75. Yeah, so long as we don't break over that, I seem to have managed to re-short at the very top of the bounce.

sp'5min

sp'15min

sp'60min

Summary

I will look to stay short until 1300/1290 tomorrow. That would make for a nice exit, before a potential intra-day bounce.

Primary trend remains DOWN.

*MACD cycles set to snap lower tomorrow. -more on that in the next hour.

*econ-data at 10am ...both sucked..but somehow market managed to still get a micro-bounce.

As noted earlier, I am short from sp'1319.75. Yeah, so long as we don't break over that, I seem to have managed to re-short at the very top of the bounce.

sp'5min

sp'15min

sp'60min

Summary

I will look to stay short until 1300/1290 tomorrow. That would make for a nice exit, before a potential intra-day bounce.

Primary trend remains DOWN.

*MACD cycles set to snap lower tomorrow. -more on that in the next hour.

10am update - waiting

A very busy early 30 minutes..still watching...so far, the weird action was in IWM/Rus'2000 which opened quite a bit lower, but now back in sync with other indexes.

VIX is lower by 3.6%...supporting the indexes.

10am econ-data:

sp'15min

Summary

Still waiting to re-short...the only is 'how good a level can I get'. Its that simple.

UPDATE 10.09 am

Am short, from sp'1319 level

--

target 1290 by late Wednesday. I WILL hold overnight Tuesday.

sp'5min

VIX is lower by 3.6%...supporting the indexes.

10am econ-data:

sp'15min

Summary

Still waiting to re-short...the only is 'how good a level can I get'. Its that simple.

UPDATE 10.09 am

Am short, from sp'1319 level

--

target 1290 by late Wednesday. I WILL hold overnight Tuesday.

sp'5min

Pre-Market Brief

Good morning. Well, here we go again.. Futures are moderately higher - and have been holding up relatively well, sp is set to open +3pts to 1316.

We have two pieces of econ-data at 10am, they might be the excuse for a renewed turn lower. I am especially looking forward to Wednesdays (8.30am EST) Durable Goods Orders, which I believe will be a major market mover to the downside.

Sp'60min

sp'daily9c, bearish outlook

sp, monthly2b - H/S theory

Summary

First resistance will be the hourly 10MA at 1319 (although it will probably open around 1316/17). We could quite conceivably max out in the opening 5-10 minutes.

Look for hollow red reversal candles on the VIX, and black 'fail' candles on the indexes (especially IWM/Rus'2000, which often fails first). If I see them in the opening 30 minutes, I'll have high confidence for an early short position.

My re-short target zone remains 1320/25.

--

I see 'some' out there touting a minute wave 2 of 3 now due. I think they are wrong, and that a multi-day bounce won't start until late this Friday/early Monday.

Primary trend remains DOWN...I will short every spike/bounce I see.

Good wishes for Tuesday trading.

We have two pieces of econ-data at 10am, they might be the excuse for a renewed turn lower. I am especially looking forward to Wednesdays (8.30am EST) Durable Goods Orders, which I believe will be a major market mover to the downside.

Sp'60min

sp'daily9c, bearish outlook

sp, monthly2b - H/S theory

Summary

First resistance will be the hourly 10MA at 1319 (although it will probably open around 1316/17). We could quite conceivably max out in the opening 5-10 minutes.

Look for hollow red reversal candles on the VIX, and black 'fail' candles on the indexes (especially IWM/Rus'2000, which often fails first). If I see them in the opening 30 minutes, I'll have high confidence for an early short position.

My re-short target zone remains 1320/25.

--

I see 'some' out there touting a minute wave 2 of 3 now due. I think they are wrong, and that a multi-day bounce won't start until late this Friday/early Monday.

Primary trend remains DOWN...I will short every spike/bounce I see.

Good wishes for Tuesday trading.

Keep your eyes on the World Index Chart

If there is one chart to watch this summer...it remains the VEU chart.With the main markets suffering renewed losses, the VEU fell 2% today.

We are getting real close to triggering the first warning. Those bulls looking for new highs later in the year...are going to be real dismayed....real soon.

VEU, daily

VEU, weekly

Summary

First target remains a break under the recent low of 37.5 - equivalent to sp'1266. That is viable as early as this Friday - although somewhat unlikely.

I do expect the critical 35.0 line in the sand to be tested by mid-July..and to fail.

At that point..no more warnings...merely..a road trip to hell.

Goodnight from London

We are getting real close to triggering the first warning. Those bulls looking for new highs later in the year...are going to be real dismayed....real soon.

VEU, daily

VEU, weekly

Summary

First target remains a break under the recent low of 37.5 - equivalent to sp'1266. That is viable as early as this Friday - although somewhat unlikely.

I do expect the critical 35.0 line in the sand to be tested by mid-July..and to fail.

At that point..no more warnings...merely..a road trip to hell.

Goodnight from London

Daily Index Cycles - Market set to drop much lower

The market confirmed the bear flags - as seen on the hourly cycles, and now looks set for falls into this Friday. Yes, lets be clear, I'm looking for sub sp'1300 either late Tuesday or Wednesday. That will open up much lower levels for Thur/Friday. An attempt to break the recent 1266 low is still very viable by this Friday.

My near term outlook is to close all short positions by this Friday afternoon, and sit it out until the following Thursday July'5 - after a minute wave'2 'holiday reversal'.

IWM, bearish outlook

Dow

Sp, 4mth

Transports

Summary

The tranny closed below the key 5k level again - a very nice sign for the bears. Both IWM and SP' closed significantly lower, off the lows, but still...that's a nice fall to start the week.

The sp'1300 level will be a key marker this week. I have VERY high confidence we will soon be trading below 1300, and that will be a key indicator that the broader sp'1150/00 target for late July/August is firmly on track.

Tuesday is re-short day.

As permabear, I will be cheering the market UP overnight, and into the Tuesday open. ANY bounce/spike is a gift to the bears. I will definately start hitting buttons in the 1320/25 zone, and look for an exit late Wednesday around 1290.

If market does open high at the open...

Look for a red reversal candle on the VIX hourly chart by 10/10.30am...and black candles on the indexes (especially IWM) around the same time.

Can they kick the market up to 7/10pts by 9.45am or so? It does seem very viable. Regardless, the default trade is to short EVERY spike/bounce..and I will continue to do that for the rest of this week

A little more later...

My near term outlook is to close all short positions by this Friday afternoon, and sit it out until the following Thursday July'5 - after a minute wave'2 'holiday reversal'.

IWM, bearish outlook

Dow

Sp, 4mth

Transports

Summary

The tranny closed below the key 5k level again - a very nice sign for the bears. Both IWM and SP' closed significantly lower, off the lows, but still...that's a nice fall to start the week.

The sp'1300 level will be a key marker this week. I have VERY high confidence we will soon be trading below 1300, and that will be a key indicator that the broader sp'1150/00 target for late July/August is firmly on track.

Tuesday is re-short day.

As permabear, I will be cheering the market UP overnight, and into the Tuesday open. ANY bounce/spike is a gift to the bears. I will definately start hitting buttons in the 1320/25 zone, and look for an exit late Wednesday around 1290.

If market does open high at the open...

Look for a red reversal candle on the VIX hourly chart by 10/10.30am...and black candles on the indexes (especially IWM) around the same time.

Can they kick the market up to 7/10pts by 9.45am or so? It does seem very viable. Regardless, the default trade is to short EVERY spike/bounce..and I will continue to do that for the rest of this week

A little more later...

Subscribe to:

Comments (Atom)