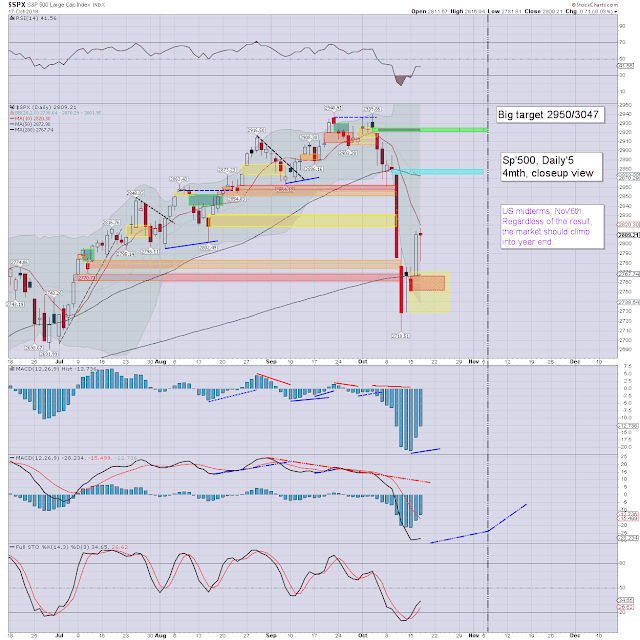

US equity indexes closed a little mixed, sp -0.7pts at 2809. The two

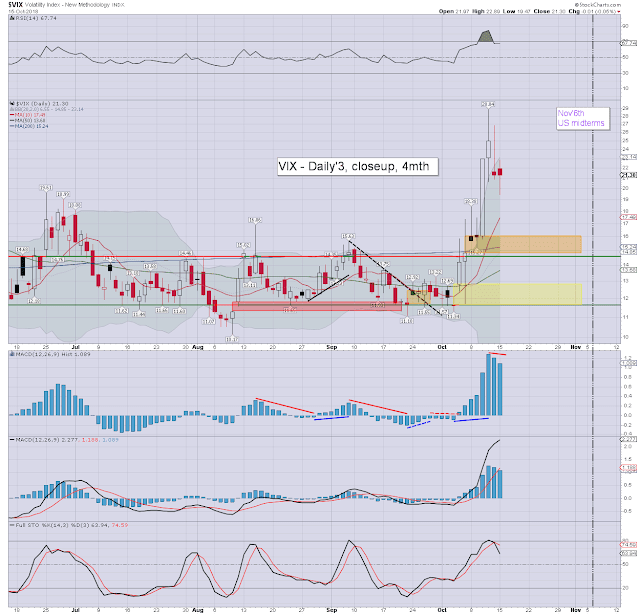

leaders - Trans/R2K, settled -0.6% and -0.4% respectively. VIX settled -1.2% at 17.40. Near term

outlook offers sig' weakness to the sp'2750s, which would likely equate

to VIX 22/23s.

sp'daily5

VIX'daily3

Summary

US equities opened a little weak, and quickly spiraled down to 2781, before a powerful rebound to 2816. The late afternoon saw a lot of chop, leaning on the weaker side, with the spx settling effectively flat.

Volatility was naturally mixed, opening in the 17s, but then swinging to a high of 19.55, before cooling back, settling fractionally lower in the 17s. The daily candle is a hollow red reversal, which leans s/t bullish.

Thursday will (in theory) lean to sig' equity downside to the sp'2750s, which would likely equate to VIX 22/23s.

--

Extra charts in AH (usually around 7pm EDT) @

https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Wednesday, 17 October 2018

Tuesday, 16 October 2018

Bears getting cooked

US equity indexes closed powerfully higher, sp +59pts (2.1%) at 2809.

Nasdaq comp' +2.9% to 7645. The two leaders - Trans/R2K, settled +1.8%

and +2.8% respectively. VIX settled -17.3% at 17.62. Near term outlook offers a cooling wave, some

sporadic 'spooky news' would help, especially on Thursday.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and relentlessly built gains all the way into the late afternoon. The sp' saw a closing hour high of 2813, which is 113pts (4.2%) above the Thursday low.

With equities powerfully higher, volatility was ground lower for a third day, with the VIX settling in the mid 17s. S/t outlook still offers an equity cooling wave, but its going to take some sporadic spooky news to get anywhere near last weeks low.

--

Bonus chart: Germany, monthly

With 11 trading days left of the month, the DAX is currently -3.8% at 11776. This remains a concern.

-

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and relentlessly built gains all the way into the late afternoon. The sp' saw a closing hour high of 2813, which is 113pts (4.2%) above the Thursday low.

With equities powerfully higher, volatility was ground lower for a third day, with the VIX settling in the mid 17s. S/t outlook still offers an equity cooling wave, but its going to take some sporadic spooky news to get anywhere near last weeks low.

--

Bonus chart: Germany, monthly

With 11 trading days left of the month, the DAX is currently -3.8% at 11776. This remains a concern.

-

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Monday, 15 October 2018

Still leaning weak

US equity indexes closed rather mixed, sp -16pts (0.6%) at 2750. Nasdaq

comp' -0.9% to 7430. The two leaders - Trans/R2K, settled +0.6% and

+0.4% respectively. VIX settled -0.05% at 21.30. Near term outlook offers a marginally lower low to

around sp'2700.

sp'daily5

VIX'daily3

Summary

US equities opened little weak, seeing a low of 2749, and then clawing upward to 2775.99 in the 2pm hour.. fractionally breaking above the Friday high. The closing hour saw a distinct reversal, settling moderately lower at 2750.

Volatility saw a mixed day, settling effectively u/c in the 21s. S/t outlook offers equity cooling of around 2% to 2700, and that will likely equate to VIX 24/27s.

-

Bonus chart: China, monthly

The Shanghai comp' saw a Monday decline of -1.5%, and with 12 trading days left of the month, that makes for a current net monthly decline of -9.0%. Ugly... real ugly. Again, I have to wonder that the communist leadership are actually happy to see the capitalistic speculators hurt by lower prices.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

sp'daily5

VIX'daily3

Summary

US equities opened little weak, seeing a low of 2749, and then clawing upward to 2775.99 in the 2pm hour.. fractionally breaking above the Friday high. The closing hour saw a distinct reversal, settling moderately lower at 2750.

Volatility saw a mixed day, settling effectively u/c in the 21s. S/t outlook offers equity cooling of around 2% to 2700, and that will likely equate to VIX 24/27s.

-

Bonus chart: China, monthly

The Shanghai comp' saw a Monday decline of -1.5%, and with 12 trading days left of the month, that makes for a current net monthly decline of -9.0%. Ugly... real ugly. Again, I have to wonder that the communist leadership are actually happy to see the capitalistic speculators hurt by lower prices.

--

Extra charts in AH (usually around 7pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Subscribe to:

Posts (Atom)