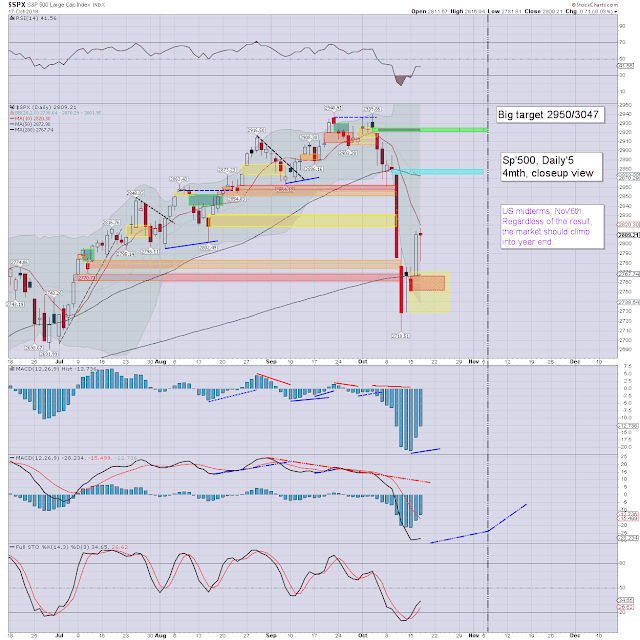

US equity indexes closed a little mixed, sp -0.7pts at 2809. The two

leaders - Trans/R2K, settled -0.6% and -0.4% respectively. VIX settled -1.2% at 17.40. Near term

outlook offers sig' weakness to the sp'2750s, which would likely equate

to VIX 22/23s.

sp'daily5

VIX'daily3

Summary

US equities opened a little weak, and quickly spiraled down to 2781, before a powerful rebound to 2816. The late afternoon saw a lot of chop, leaning on the weaker side, with the spx settling effectively flat.

Volatility was naturally mixed, opening in the 17s, but then swinging to a high of 19.55, before cooling back, settling fractionally lower in the 17s. The daily candle is a hollow red reversal, which leans s/t bullish.

Thursday will (in theory) lean to sig' equity downside to the sp'2750s, which would likely equate to VIX 22/23s.

--

Extra charts in AH (usually around 7pm EDT) @

https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html