With equities battling higher into the sp'1880s, the VIX was unable to hold the very minor gains in early morning, settling -1.9% @ 13.71. Near term outlook is for the VIX to slip into the 12/11s, not least if the sp' can break into the 1900s.

vix'60min

VIX'daily3

Summary

Little to add.

VIX looks set to remain low, and the big 20 threshold looks unlikely to be tested for some weeks.

-

more later..on the indexes

Tuesday, 29 April 2014

Closing Brief

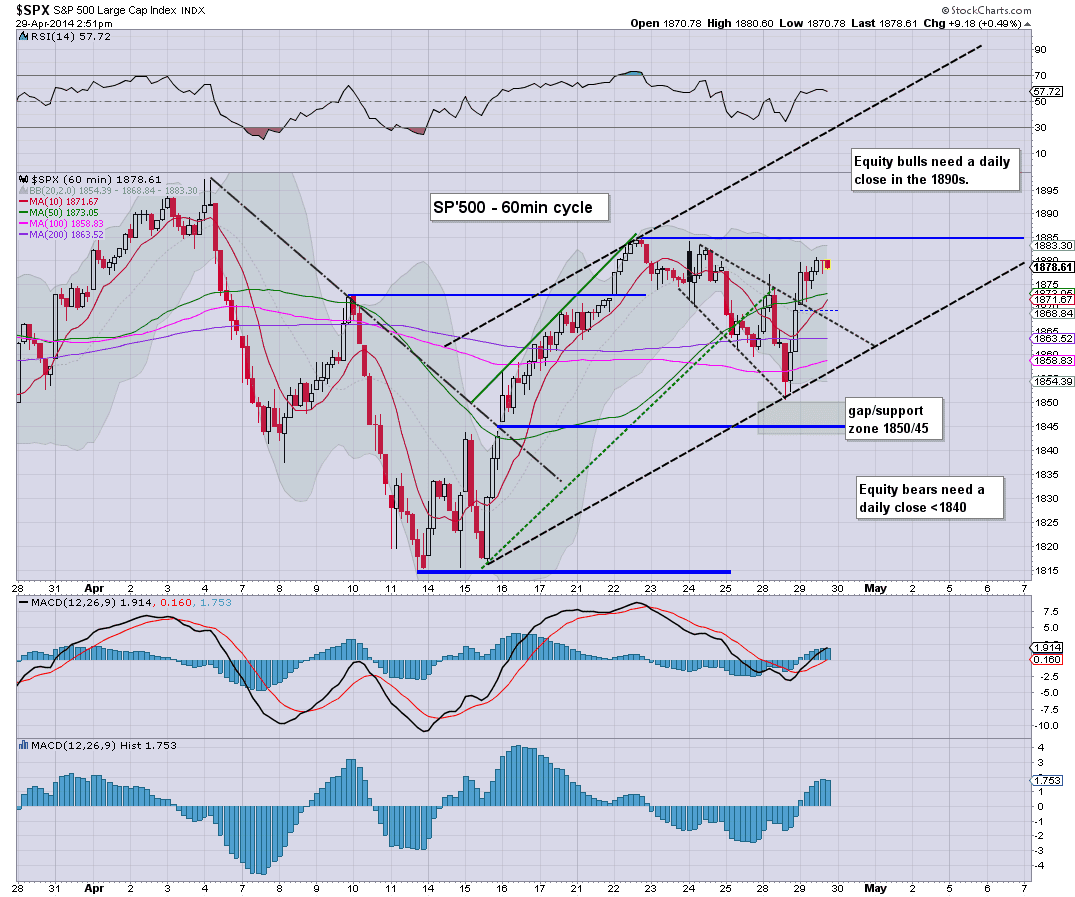

US equities closed higher, sp +8pts @ 1878. The two leaders - Trans/R2K, settled higher by 0.4% and 0.3% respectively. Near term outlook is bullish, with both the daily/weekly charts offering the 1895/1900 zone as early as late Wednesday afternoon.

sp'60min

Summary

*awaiting earnings from EBAY, TWTR, and STX

--

The spike floor of sp'1850 is now looking a fair way lower, and if we do manage to claw into the 1900s - whether this week or next, April will have just been another little tease to the equity bears.

Just reflect on all the bearish hysteria, and yet the sp' only declined 4.4% from 1897 to 1814. It barely ranks as a minor retracement.

Yes, there were more significant declines in the R2K/Nasdaq - never mind the carnage in the momo stocks, but I try to deal with the broader market, not just the weakest parts.

Have a good evening

-

more later..on the VIX

-

4.11pm.. TWTR earnings were fine, but market is still not pleased, and have taken the stock to the 38.50s. This is actually a NEW historic trading low for TWTR.

There is nothing but empty air until the IPO level of $26.

-

STX, beat... $1.34.. vs 1.26 exp..... should rally tomorrow morning..the $55s look viable.

--

EBAY earnings..a touch above, but market is selling the stock a little lower.

-

sp'60min

Summary

*awaiting earnings from EBAY, TWTR, and STX

--

The spike floor of sp'1850 is now looking a fair way lower, and if we do manage to claw into the 1900s - whether this week or next, April will have just been another little tease to the equity bears.

Just reflect on all the bearish hysteria, and yet the sp' only declined 4.4% from 1897 to 1814. It barely ranks as a minor retracement.

Yes, there were more significant declines in the R2K/Nasdaq - never mind the carnage in the momo stocks, but I try to deal with the broader market, not just the weakest parts.

Have a good evening

-

more later..on the VIX

-

4.11pm.. TWTR earnings were fine, but market is still not pleased, and have taken the stock to the 38.50s. This is actually a NEW historic trading low for TWTR.

There is nothing but empty air until the IPO level of $26.

-

STX, beat... $1.34.. vs 1.26 exp..... should rally tomorrow morning..the $55s look viable.

--

EBAY earnings..a touch above, but market is selling the stock a little lower.

-

3pm update - churn into the close

US equities look set to hold moderate gains into the close, with Mr Market comfortably above the Monday spike floor of sp'1850. A weekly close in the 1885/95 zone looks very probable, barring any especially weak econ-data - but as ever, market 'interpretation' of such data is even more important.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.

Subscribe to:

Posts (Atom)