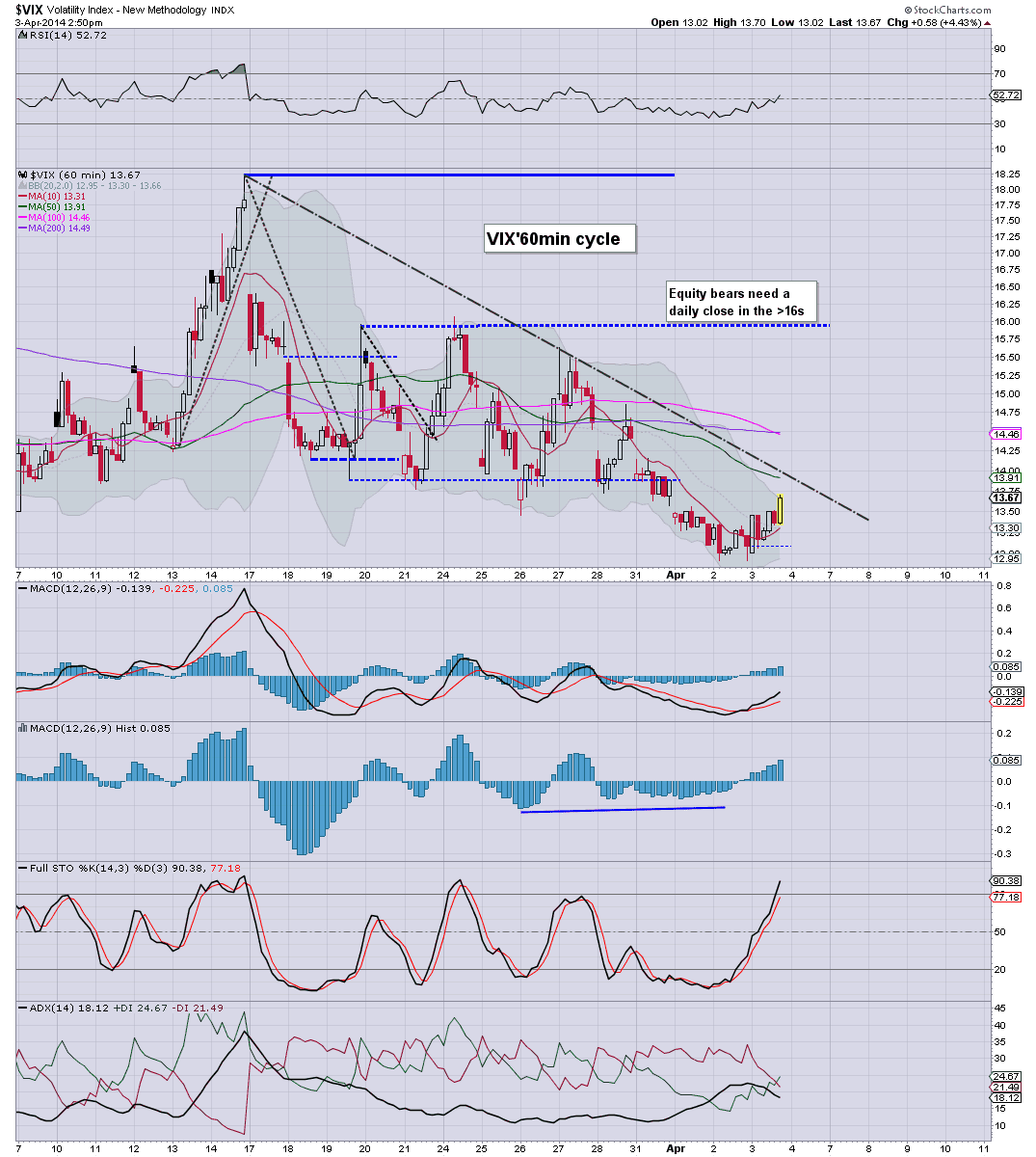

With US indexes turning moderately lower into the afternoon, the VIX turned positive, and achieved its first daily gain in six trading days. The VIX settled +2.1% @ 13.37. Near term outlook offers a VIX in the 14s, before remaining low across much of April/early May.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX remains low, and the big 20 threshold looks unlikely to be hit for at least 6-8 weeks.

It remains the case that the VIX spikes are just getting generally lower and lower, since the giant equity wave began Oct'2011.

The notion of the VIX 30s right now..looks almost inconceivable. After all, neither Syrian or Ukrainian 'issues' never rattled the market enough to break and hold the 20s for more than a day or so.

--

more later, on the indexes

Thursday, 3 April 2014

Closing Brief

US indexes closed moderately lower, having broken another set of new historic highs in early morning, sp -2pts @ 1888. The two leaders - Trans/R2K, settled -0.2% and -1.0% respectively. Near term outlook offers minor weakness for Friday morning, before a latter day rally into the weekend.

sp'60min

Summary

*a closing hour of minor chop, but this is surely just a part of a little retracement.

--

The weakness in the R2K is...curious, and it remains a fair way from breaking a new high. However, the R2K/Nasdaq were very bearish last week, and we saw how that turned out.

VIX settling higher by 2-3%, not much, but it is the first daily gain in six days.

-

more later..on the VIX

sp'60min

Summary

*a closing hour of minor chop, but this is surely just a part of a little retracement.

--

The weakness in the R2K is...curious, and it remains a fair way from breaking a new high. However, the R2K/Nasdaq were very bearish last week, and we saw how that turned out.

VIX settling higher by 2-3%, not much, but it is the first daily gain in six days.

-

more later..on the VIX

3pm update - retracing into the close

Equities have seen a moderate swing to the downside from the morning peak of sp'1893, so far to 1882. There is downside to 1880/75 in the immediate term, which should equate to VIX in the 14s. The momo stocks are again broken, the third time in 8 trading days.

sp'60min

vix'60min

Summary

It is kinda interesting, and I can only hope that many of the doomer bears don't get overly excited about what is surely just a minor retracement.

With new historic highs in the Dow, sp'500, NYSE Comp', and the Transports, the default trade is unquestionably to the upside.

The weekly/monthly trends are bullish, and the weekly is offering the 1900s next week.

-

updates into the close, if I can clear the sand from my eyes

3.05pm.. Hourly lower bol' 1878..and it won't be easy to hold under that for very long.

I still have the hunch that we'll trundle into the 1870s tomorrow..at which point I might get involved.

Momo stocks remain weak..FB/TWTR, both -5% or so.

3.20pm. . minor chop in the mid 1880s....it still looks like a brief foray into the 1870s early tomorrow, before a weekly close in the 1880s.

Notable strength: Oil, with USO +0.95%.

3.32pm... sp'1888, hmm, I'd be real surprised if we close flat..or higher. The momo stocks are pretty indicative at least some weakness in the broader market.

Oh well, I remain on the sidelines, will see how the market reacts to the jobs data.

I will consider a long in the 1870s...with a stop somewhere in the 1850/40s, depends on the price action tomorrow.

DRYS -1.5%, and looks like it will slip into the $2s this summer...which is pretty lousy, considering the current indexes!

3.47pm.. Another stock... AMZN -2.6% @ $333, which is 15% lower than just 3/4 weeks ago.

Dow turns green......no doubt the cheer leaders on clown finance TV will be waving flags..where is Pisani? Wrapped up in HFT cables?

sp'60min

vix'60min

Summary

It is kinda interesting, and I can only hope that many of the doomer bears don't get overly excited about what is surely just a minor retracement.

With new historic highs in the Dow, sp'500, NYSE Comp', and the Transports, the default trade is unquestionably to the upside.

The weekly/monthly trends are bullish, and the weekly is offering the 1900s next week.

-

updates into the close, if I can clear the sand from my eyes

3.05pm.. Hourly lower bol' 1878..and it won't be easy to hold under that for very long.

I still have the hunch that we'll trundle into the 1870s tomorrow..at which point I might get involved.

Momo stocks remain weak..FB/TWTR, both -5% or so.

3.20pm. . minor chop in the mid 1880s....it still looks like a brief foray into the 1870s early tomorrow, before a weekly close in the 1880s.

Notable strength: Oil, with USO +0.95%.

3.32pm... sp'1888, hmm, I'd be real surprised if we close flat..or higher. The momo stocks are pretty indicative at least some weakness in the broader market.

Oh well, I remain on the sidelines, will see how the market reacts to the jobs data.

I will consider a long in the 1870s...with a stop somewhere in the 1850/40s, depends on the price action tomorrow.

DRYS -1.5%, and looks like it will slip into the $2s this summer...which is pretty lousy, considering the current indexes!

3.47pm.. Another stock... AMZN -2.6% @ $333, which is 15% lower than just 3/4 weeks ago.

Dow turns green......no doubt the cheer leaders on clown finance TV will be waving flags..where is Pisani? Wrapped up in HFT cables?

Subscribe to:

Posts (Atom)