Equities have seen a moderate swing to the downside from the morning peak of sp'1893, so far to 1882. There is downside to 1880/75 in the immediate term, which should equate to VIX in the 14s. The momo stocks are again broken, the third time in 8 trading days.

sp'60min

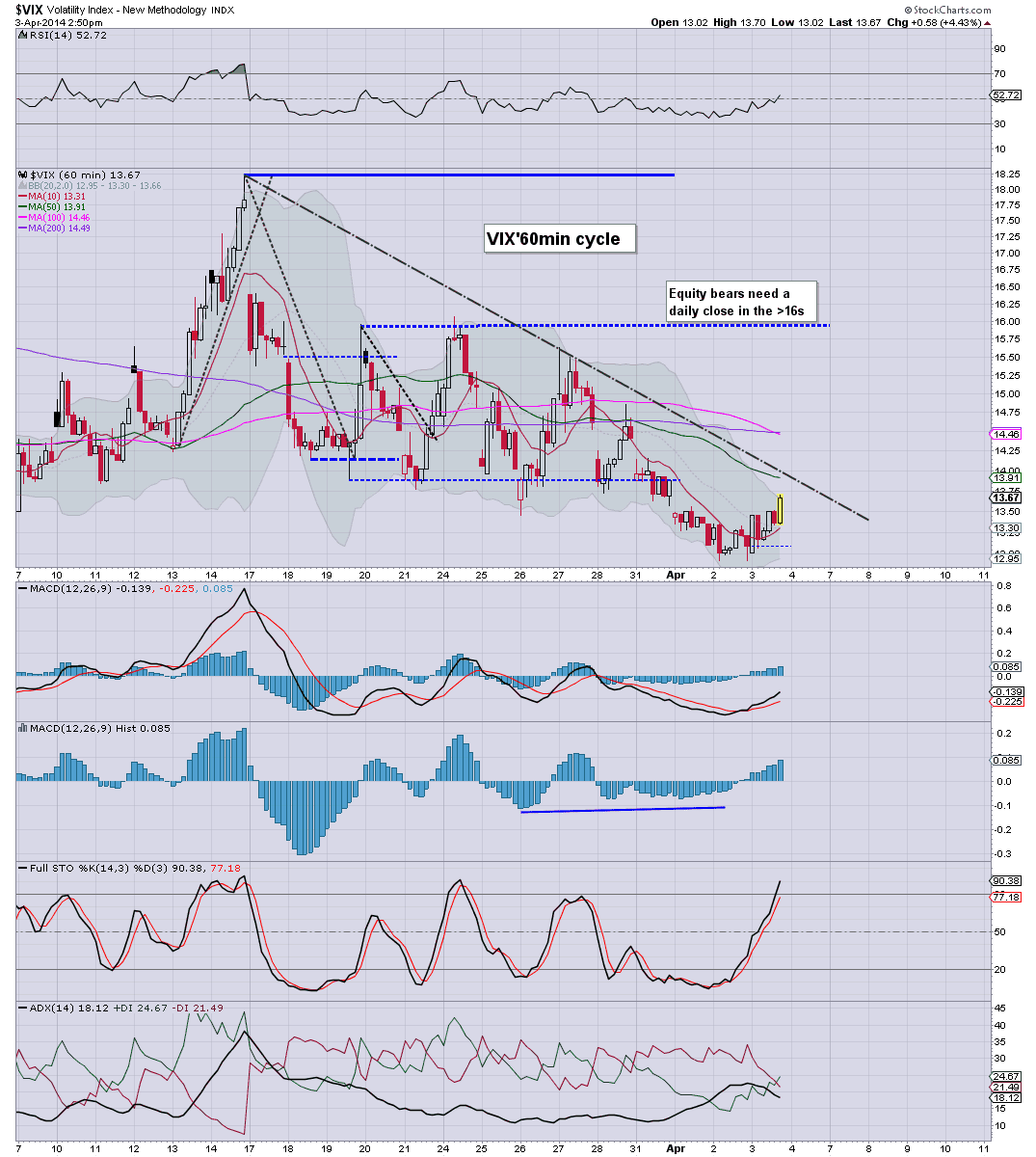

vix'60min

Summary

It is kinda interesting, and I can only hope that many of the doomer bears don't get overly excited about what is surely just a minor retracement.

With new historic highs in the Dow, sp'500, NYSE Comp', and the Transports, the default trade is unquestionably to the upside.

The weekly/monthly trends are bullish, and the weekly is offering the 1900s next week.

-

updates into the close, if I can clear the sand from my eyes

3.05pm.. Hourly lower bol' 1878..and it won't be easy to hold under that for very long.

I still have the hunch that we'll trundle into the 1870s tomorrow..at which point I might get involved.

Momo stocks remain weak..FB/TWTR, both -5% or so.

3.20pm. . minor chop in the mid 1880s....it still looks like a brief foray into the 1870s early tomorrow, before a weekly close in the 1880s.

Notable strength: Oil, with USO +0.95%.

3.32pm... sp'1888, hmm, I'd be real surprised if we close flat..or higher. The momo stocks are pretty indicative at least some weakness in the broader market.

Oh well, I remain on the sidelines, will see how the market reacts to the jobs data.

I will consider a long in the 1870s...with a stop somewhere in the 1850/40s, depends on the price action tomorrow.

DRYS -1.5%, and looks like it will slip into the $2s this summer...which is pretty lousy, considering the current indexes!

3.47pm.. Another stock... AMZN -2.6% @ $333, which is 15% lower than just 3/4 weeks ago.

Dow turns green......no doubt the cheer leaders on clown finance TV will be waving flags..where is Pisani? Wrapped up in HFT cables?