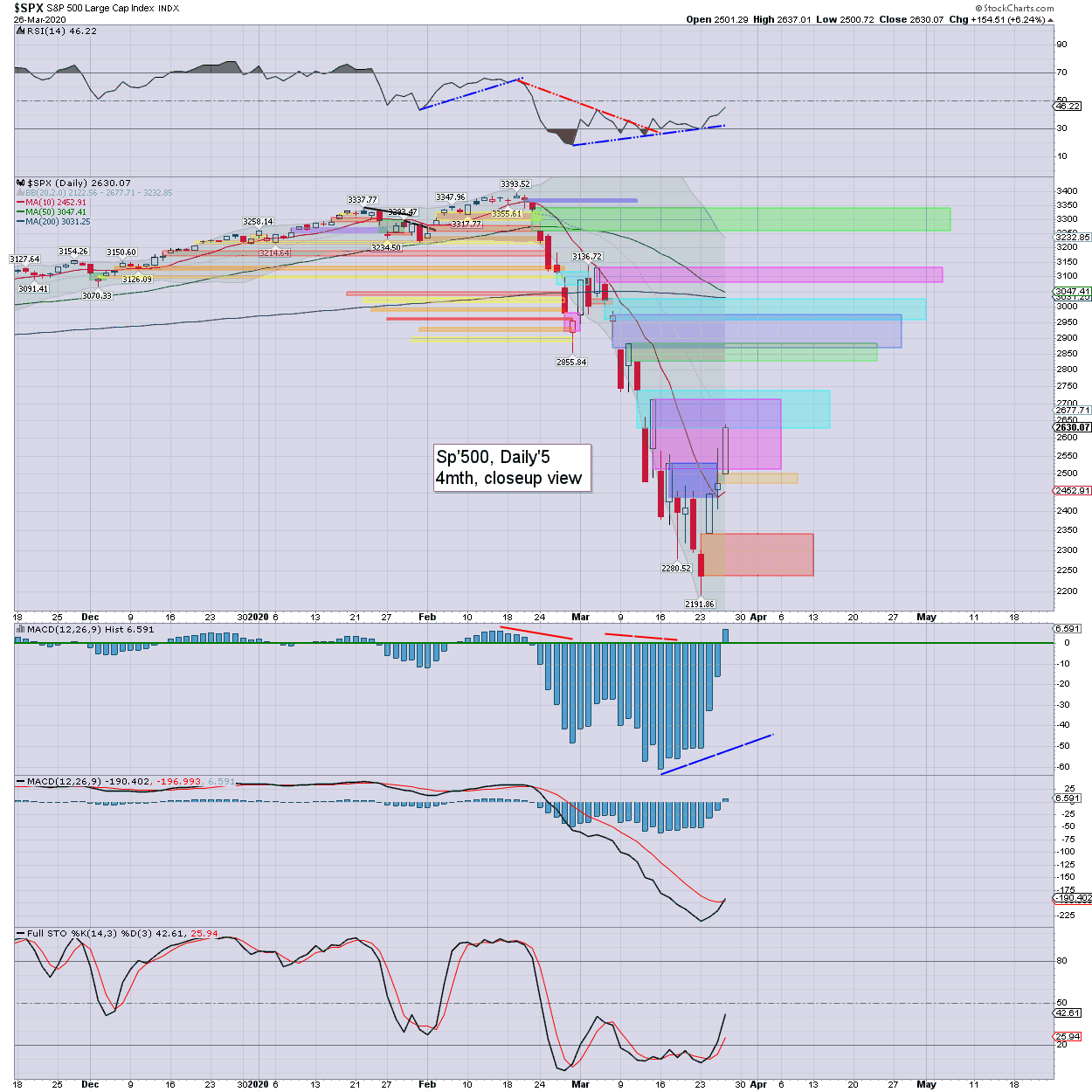

sp'daily5

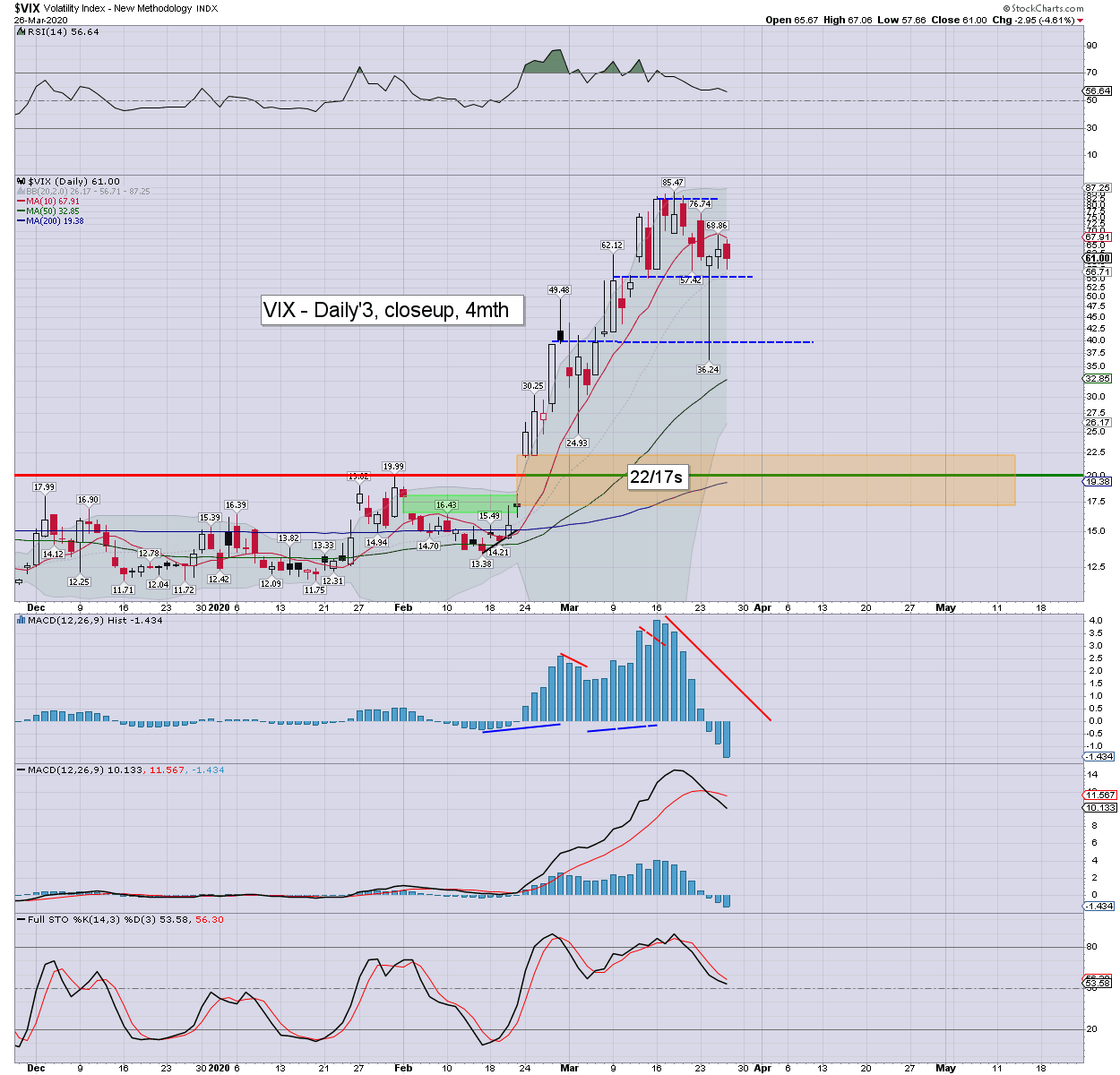

VIX'daily3

Summary

US equities opened on a positive note, which was a distinct improvement from overnight/pre-market. The gains were impressive considering the horrific weekly jobless claims number of 3.283M.

Powell appeared...

.. and duly suggested "... we may well in a recession". Ya think?

The afternoon saw considerable chop, but with a closing ramp to new cycle highs. Volatility was in cooling mode, the VIX settling -4.6% at 61.00.

Leverage at Print Central

The following is highly recommended, even if you can't stand 'the progressives'...

So... a special '$500bn fund'.

That fund is itself arguably to seen as being funded via the US Govt' issuing t-bonds, which will be bought by... can you guess?

Indeed, Print Central will be the buyer of those bonds, well, shortly after they've first been bought by the primary dealers, who then sell them to the Fed with a slight markup. Its good work if you can get it.

Of the $500bn fund, $75bn is set aside, with the other $425bn being credited to the Fed, whom might leverage it up by 10x, offering a possible collective loan of $4.25trn to large/mid cap' US businesses.

In addition to the financial issues, the ethical conflicts and implications of what the Fed have begun are monstrous. The following is more of Dore, but with guest Rattigan. Again, whether you like either, its highly recommended...

ps. If you're not mad after viewing the above, check you have a pulse.

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com