US equities have swung from an opening low of sp'2039 to 2054. Clearly, there are still many out there who are holding to the view that the market is set for a major bullish breakout. Even more amusing though is the upward swing in mainstream chatter that rates can be hiked at the next FOMC of June 15th.

sp'60min

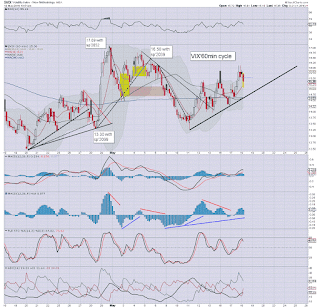

VIX'60min

Summary

*opening reversal candle for equities, with an opening black-fail for the VIX.

--

No doubt a morning bounce has spooked some of the bears.. and given renewed confidence to the bulls that 'everything is just fine'.

Yet.. any look at the bigger daily/weekly cycles makes it crystal clear... we're firmly stuck... with price momentum swinging back to the bears.

A break lower remains due.

--

Meanwhile, on clown finance TV, head cheerleader Sara Eisen...

It is utterly bizarre how the clowns are now touting a viable rate hike in June. When the market swings a mere 2-4% lower in the near term.. these same maniacs will be talking about how a rate hike is now 'off the table'.

Now that IS data dependency.

--

time for an early lunch