It was a moderately choppy week for US equity indexes, with net weekly changes ranging from +0.5% (Dow, Nasdaq comp', R2K), +0.2% (sp'500, Trans), to u/c (NYSE comp'). Near term outlook threatens cooling of around 1-1.5%, but broadly, the US - and most other world markets, remain very strong.

Lets take our regular look at six of the main US indexes

sp'500

A net weekly gain of 5pts (0.2%), settling @ 2263. Underlying MACD (blue bar histogram) cycle continues to tick upward, and is now on the slightly high side. Its notable that we're scraping along the upper weekly bollinger. The key 10MA will be in the 2200s next week, and indeed, price action <2200 looks unlikely any time soon.

Best guess: near term weakness to the 2240/30s, before renewed upside across January, when the 2300s seem extremely probable.The 2400/500s seem a viable target in summer 2017, if WTIC oil is at least around $60, with copper >$3.00.

Nasdaq comp'

A new historic high of 5489, settling +0.5% @ 5462. There is a lot of support around the 5300s, with core support at the giant psy' level of 5K. The 6000s are a valid target for spring 2017.

Dow

A new historic high of 19987, settling higher for a seventh consecutive week, the best run since Dec'2015. Underlying MACD is on the very high side, with an RSI of 75 - the highest since May 2013. Regardless of any near term cooling, the 20K threshold looks a given.

The mainstream are (understandably) obsessing about 20000. Its interesting that I'm starting to hear talk of 24-26k by end 2017. Things only turn bearish with price action <19k this spring. Even then, core support of 18k looks concrete.

NYSE comp'

The master index closed broadly flat, settling +3pts @ 11128. With the 2015 high of 11252 broken above last week, next big upside target is the 12k threshold. That will clearly take at least another 2-3 months.

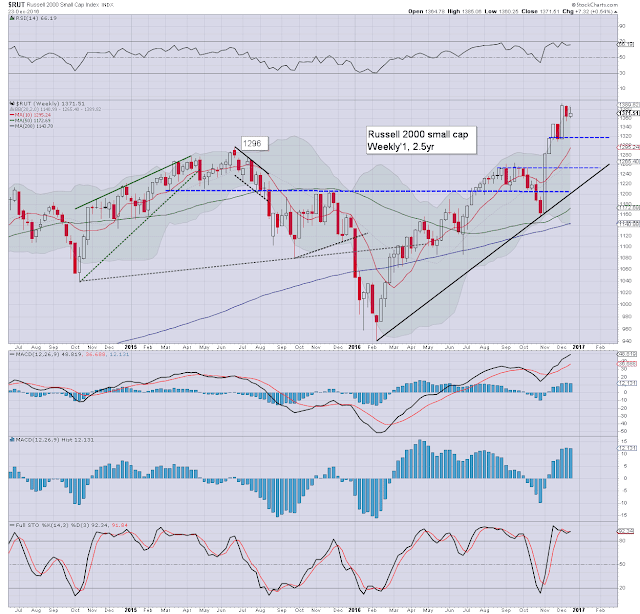

R2K

The second market leader - R2K, settled +0.5% @ 1371. Underlying MACD cycle is on the very high side, and is starting to tick lower. Clearly though, even if the market consistantly cooled, it would take at least 6-8 weeks just to see price momentum reach neutral. On balance, R2K in the 1500s is a valid target for spring 2017.

Trans

The 'old leader' - Transports, settled +0.2% @ 9190. Its notable that the key 10MA will soon be in the 9000s, which is now first soft support. Like the broader market, the tranny is short-term over-stretched, but its hard to imagine the Trans' not hitting 10k in the spring.

--

Summary

Despite a naturally subdued pre-Christmas trading week, the US equity market still managed to achieve another pair of historic highs in the Dow and Nasdaq comp'.

All US indexes are trading close to historic highs.

There is downside buffer for most indexes of around 5%, before the equity bears even test mid term rising trend/support.

Equity bears have nothing to tout unless they can break the market back under the monthly 10MA - which in Jan' will be around sp'2170/80.

--

Looking ahead

It will be a short 4 day trading week (as it will be next week too!), and there isn't much scheduled.

M - CLOSED

T - Case-Shiller HPI, Richmond Fed' , consumer con'

W - Pending home sales

T - weekly jobs, EIA report, intl' trade

F - Chicago PMI

As Friday is the last trading day of 2016, expect higher vol' and more dynamic price action, especially in the late afternoon.

--

Join me for 2017

If you value these posts here, you can support me via a monthly subscription, which will also give you access to my continued intraday postings at permabeardoomster.com.

If you think I'm worth around $1 per trading day... subscribe. Or you could buy two shares of Disney by the end of 2017.

In any case.... Merry Christmas from London