US equity indexes closed broadly higher, sp +17pts @ 2168. The two

leaders – Trans/R2K, settled higher by 1.2% and 1.1% respectively.

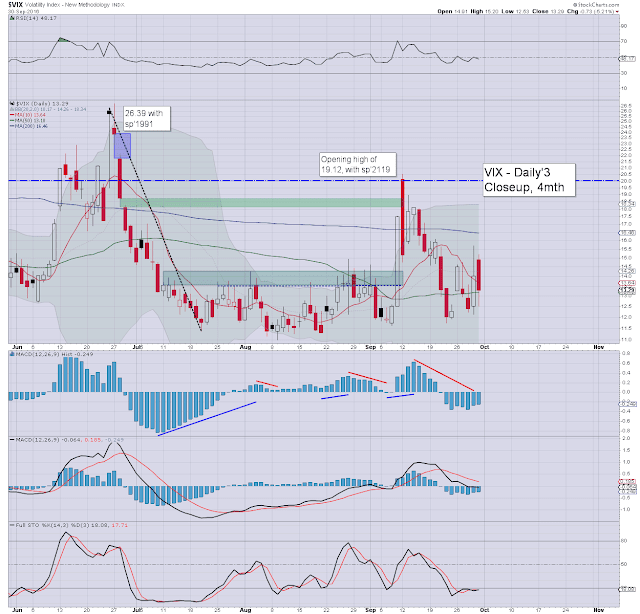

VIX settled -5.2% @ 13.29. Outlook for early October is bullish, with the bigger weekly/monthly

cycles both offering the 2200s.

sp'daily5

VIX'daily3

Summary

Cyclically, the market was due some choppy upside today, but even I was surprised to see the sp'2170s.

Ohh how quickly the 'spooky news' about DB was shrugged off, and it was quite amusing to see many chasing Deutsche Bank (DB) back into the $13s. Cyclically, DB looks set for the $15/16s in the near term, but what kind of maniac wants to get involved in that trade?

As for volatility, with equities higher, the VIX was naturally in cooling mode, trading in the 12s for much for the day.

*The market looks vulnerable next Monday to sp'2155/50 - with VIX 14s, but we should still see another net weekly gain, as a break to new historic highs in the 2200s are due.

--

This is an intraday update from Riley, but the issues raised about next week are important.

--

Fed/market chatter from Schiff

--

Q3 comes to a close...

|

| Sun down in London, 1.20pm EST |

Goodnight from a somewhat chilly London

--

*The weekend post will appear Sat' 12pm EST, and will detail the world monthly indexes.