It was a somewhat mixed week for US equity indexes, with net weekly changes ranging from -0.2% (Dow), +0.3% (sp'500), to +2.2% (Transports). Near term outlook offers further weakness to at least sp'2000/1990, if not a very valid H/S target of the 1970/60s.

Lets take our regular look at six of the main US indexes

sp'500

A minor net weekly gain of 5pts (0.3%), settling at 2052. Most notable, another lower high.. with a lower low, as the key lows of 2040/39, and 33 were decisively broken.

2025 is recognised by a fair few as 'market critical'... although that could be endlessly argued over. What should be clear... the market has been quietly cooling from the April 20th high of 2111. Price action remains very choppy.

Underlying MACD (blue bar histogram) cycle ticked lower for a fourth week. At the current rate, there will be a bearish cross in the last week of May... or first week of June. By definition, that will be the first realistic opportunity for a powerful move lower.

Best guess: near term downside to the 1990/1960 zone... before another bounce of 3-4%.... and then the first big move lower.

Unless equity bulls can break back into the 2100s, they have little reason to be confident, and should instead be concerned about a down wave that should (at minimum) be equivalent in scale to Jan'2016 and Aug'2015.

--

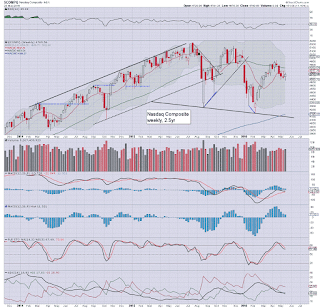

Nasdaq comp'

The tech' saw a net gain of 51pts (1.1%), settling at 4769. The giant psy' level of 5K remains extremely powerful resistance, and unless the equity bulls can break above it, they should be concerned of an eventual break lower. First big target is the 4400/4200 zone.

Dow

The mighty Dow settled lower for the fourth consecutive week, with a notable lower high.. and lower low. The opex close of 17500 was somewhat natural. Equity bulls should be desperate to re-take the 18K threshold, whilst bears should be seeking an eventual break of 17K. First downside target is 16K, and then the Aug' 2015 low of 15370.

NYSE comp'

The master index saw a minor net weekly gain of 0.2%, settling at 10250. First support remains the big 10K threshold. If that fails to hold - as seems probable, an eventual capitulation low around 8K seems viable.

R2K

The second market leader - R2K, settled net higher by 9pts (0.9%) at 1112. Like other indexes, despite the gain, there was a notable lower high.. and lower low. First big target in June is the 1K threshold. Best case downside is the 875/850 zone, a price level not seen since late 2012.

Trans

The 'old leader' - Trans, saw the strongest gains this week, +164pts (2.2%) at 7671. The 8K threshold is very strong resistance, and equity bulls are going to struggle to break any higher into end month/early June. First downside target is 7K. If that fails to hold, the lower bollinger offers fast downside to the 6600s.. which is currently around 13% lower.

--

Summary

So... net weekly gains for 5 of 6 indexes, with only the Dow seeing a minor decline.

Most notable, most indexes saw a lower high.. and lower low... and that is pretty bearish.

Price structure, and also style of price action, is very similar to that seen across Nov/Dec' 2015.

An eventual sig' break lower looks due, with the lower weekly bollinger currently offering the sp'1840s... and that is a clear 10% lower.

--

Looking ahead

M -

T - PMI manu', New home sales, Richmond Fed'

W - Intl' trade, EIA report

T - weekly jobs, Durable Goods Orders, PMI serv, Pending home sales

F - GDP (rev'1), consumer sent', corp' profits

*there is a light sprinkling of fed officials on the loose, notably Bullard - who is touring Asia. Yellen is due at Harvard on Friday... but the appearance is to receive an award (for service to the printing industry?), and I don't expect any policy remarks to be made.

**Monday May'30th is Memorial day - where the US market will be CLOSED. So.. the Friday before will be increasingly subdued.

--

.... back on Monday.... but as noted in the previous post, things will be different.