US equities open lower, but once again the declines are not significant. There is a notable opening black-fail candle for the VIX.. the fifth consecutive opening one, and that sure doesn't favour the bears. USD is +0.2% in the DXY 95.30s. Metals are under strong downward pressure, Gold -$10, with Silver -2.4%

sp'daily5b

VIX'60min

Summary

*Fed official Dudley is on the loose this hour.

--

Econ-data: Leading indicators: +0.6% vs 0.4% exp.

--

Equity bears really need to break <2034 today.. into the 2020s. Thats not exactly a bold demand, but overall price action remains pretty subdued.. reflected in a VIX that remains stuck in the mid teens.

--

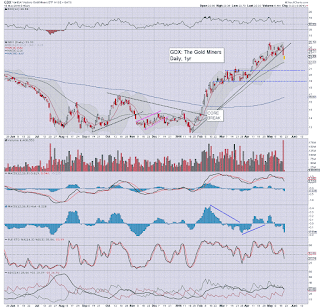

notable weakness... miners, GDX, daily

Yesterday's vol' was monstrously high. GDX opened -3% or so.. but has seen a strong reversal, now -0.5%.

Metals/miners should (in theory) continue broadly higher.. with further capital market unrest.

-

*bonus chart................

sp'weekly6

.. we have our first red candle!

-

CORE break... sp'2033 FAILS. It is a VERY significant issue.

Black-fail candle on the VIX... fully reversed... its actually going to close positive for the opening 30mins!