US equity indexes climbed for a second consecutive week, with net weekly gains ranging from 3.4% (Nasdaq comp', R2K), 2.3% (sp'500), to 1.3% (Transports). Near term outlook is extremely borderline, as the market remains broadly stuck within a narrow trading range of 2111-2025.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 saw a rather powerful gain of 46pts (2.3%), settling at 2099, a mere 35pts (1.7%) from the May'2015 historic high of 2134.

Underlying MACD (blue histogram) cycle is starting to tick higher again, but there will be high threat of a divergent lower high forming in first half of June. Right now, a bearish cross looks out of range for 3-4 weeks, which will (interestingly) line up with BREXIT week.

Best guess: a break of the sp'2025 low by June 10th, which will open the door to the lower monthly bollinger - around 1950 in late June.

However, if equity bulls can break the Nov'2015 high of 2116, that would likely spiral to a new historic high, at which point the market will (from a pure technical perspective) be inclined to grind higher across the rest of the year.

--

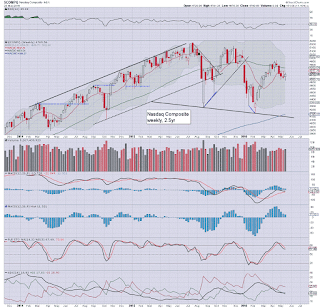

Nasdaq comp'

The tech' gained an impressive 3.4%, settling at 4933, teasingly close to the giant psy' level of 5K. Indeed, if equity bulls can break 5K in early June, it'll open the door to new historic highs (>5231) this summer. Equity bears really need to see renewed downside, back to the 4600s.

Dow

The mighty Dow gained 372pts (2.1%), settling @ 17873. The 18K threshold remains strong resistance. If that is re-taken, then new historic highs >18351 will be probable. If the market starts to unravel, first downside is the 16500/400 zone, which is still a clear 1000pts above the Aug' 2015 low.

NYSE comp'

The master index gained 2.1%, settling @ 10469. A break into the 10600s would be very bullish, and suggestive that the main market is headed broadly higher across the rest of 2016.

R2K

The second market leader - R2K, gained a powerful 3.4%, settling at the soft psy' level of 1150. Next resistance is the 1180/1200 zone. The June 2015 high of 1296 is still a long way higher.

Trans

The 'old leader' - Trans, was the weakest index/sector this week, but still climbed a net 1.3% @ 7772. Declining trend/resistance will be around 8K in early June, and that will be a key level to keep in mind. If the equity bulls are willing to buy the Transports >8K (the 8200s to make it decisive), the broader bearish outlook will have to be dropped.

--

Summary

Unquestionably, a week for the equity bulls. Yet, broadly, the market remains stuck in the same range it has for much of the past year.

The headline indexes - sp'500, dow, nasdaq, continue to lead the NYSE comp', R2K, and the laggard... Transports.

Equity bulls just need another 2-3% higher to achieve a provisional breakout.

Equity bears need to take out the recent low of sp'2025, and break to the mid/low 1900s by end June.

--

Looking ahead

A short week of course, as the US market is closed on Monday, but there is plenty of key data due.

M - CLOSED

T - Pers' income/outlays, Case-Shiller HPI, Chicago PMI, consumer con'

W - ADP jobs, PMI/ISM manu', construction, Fed Beige book

T - weekly jobs, EIA report

F - monthly jobs, PMI/ISM serv', factory orders

*the only scheduled fed officials are Powell and Evans on Thurs/Friday respectively.

--

If you have valued my postings since 2012, then support me via a subscription.

*I will return here on Tuesday, 7pm EST.

Saturday, 28 May 2016

Daily Wrap

US equity indexes ended the week on a moderately positive note, sp +8pts

@ 2099. The two leaders - Trans/R2K, settled higher by 0.6% and 0.9%

respectively. VIX cooled into the weekend, -2.3% @ 13.12. Outlook remains extremely borderline, as the market is a mere 1.7% from breaking a new historic high.

sp'daily5

VIX, daily3

Summary

sp'500: the fourth net daily gain of the last seven trading days. A notable fourth day above the 50dma. Underlying MACD (blue bar histogram) is the highest it has been since late March - when sp' 2050s.

VIX: naturally melting lower into the long weekend, with a notable black-fail candle on Monday, followed by four net daily declines.

--

Update on the USD, weekly

A fourth consecutive net weekly gain. Underlying MACD is set for a bullish cross at the Tuesday open, and the DXY 96/97s looks highly probable in June.

It is a curious thought as to when the mainstream will start getting twitchy about the strengthening dollar. Similarly, the 'dollar doomers', what are they going to say as the USD (as seems inevitable) breaks above the DXY 100 threshold.. and keeps on going?

--

A big move is coming

Many now recognise that a big move is coming. Either the market is going to see a massive breakout to new historic highs, or the recent rally from sp'2025 is just another tease to the bulls, before renewed significant downside in June.

My best guess? Considering an array of threats - not least the BREXIT vote, I'm still leaning for another wave lower.

Clearly though, if we break >2111, that will likely lead >2134, in which case, the short side trade is arguably dead for the better part of a year or two.

Yours... trying to be open minded.

Goodnight from London

--

*the weekend post will appear here (as normal), Sat' 12pm EST, and will detail the US weekly indexes

sp'daily5

VIX, daily3

Summary

sp'500: the fourth net daily gain of the last seven trading days. A notable fourth day above the 50dma. Underlying MACD (blue bar histogram) is the highest it has been since late March - when sp' 2050s.

VIX: naturally melting lower into the long weekend, with a notable black-fail candle on Monday, followed by four net daily declines.

--

Update on the USD, weekly

A fourth consecutive net weekly gain. Underlying MACD is set for a bullish cross at the Tuesday open, and the DXY 96/97s looks highly probable in June.

It is a curious thought as to when the mainstream will start getting twitchy about the strengthening dollar. Similarly, the 'dollar doomers', what are they going to say as the USD (as seems inevitable) breaks above the DXY 100 threshold.. and keeps on going?

--

A big move is coming

Many now recognise that a big move is coming. Either the market is going to see a massive breakout to new historic highs, or the recent rally from sp'2025 is just another tease to the bulls, before renewed significant downside in June.

My best guess? Considering an array of threats - not least the BREXIT vote, I'm still leaning for another wave lower.

Clearly though, if we break >2111, that will likely lead >2134, in which case, the short side trade is arguably dead for the better part of a year or two.

Yours... trying to be open minded.

Goodnight from London

--

*the weekend post will appear here (as normal), Sat' 12pm EST, and will detail the US weekly indexes

Friday, 27 May 2016

Daily Wrap

US equity indexes closed moderately mixed, sp -0.4pts @ 2090. The two

leaders - Trans/R2K, settled lower by -0.3% and -0.1% respectively. VIX remained in cooling mode, -3.4% @ 13.43. Near

term outlook threatens a minor wave higher to attempt to clear the

sp'2100 threshold, but it should fail.

sp'daily5

VIX, daily3

Summary

A day of very minor chop, much like the price action of May 20th/23rd. There is clearly threat of another minor lurch higher, but broadly... we're seeing increased selling as we're close to the sp'2100 threshold.

Price action remains much the same since summer 2015. A big move is coming, as many are starting to recognise.

--

Update on the USD, weekly

The DXY 91s mark a clear spike low. Underlying MACD (blue bar histogram) is set for a bullish cross within 2-6 trading days.

The market is trying to price in a possible second rate hike - which is inherently bullish for the USD, although I'm still highly dubious the Fed will raise until the Dec' FOMC.

What should be clear, any price action above the double top of DXY 100, and the door will be wide open for a straight run to the 120s. That would have a great many implications for just about everything.

--

Looking forward to a three day weekend

Its been a tiresome week, not least as I've been battling to build my new home site, but also to keep this page (and a few others) routinely updated.

Once the GDP data is out of the way tomorrow, by 11am, price action will likely be even more muted that today's narrow range of 7pts (0.3%).

Yes.. Yellen is speaking, but its just an award ceremony, and I'm bemused that the mainstream seem to be giving it so much attention. Do they really expect Yellen to give a long speech on monetary policy?

Goodnight from London

sp'daily5

VIX, daily3

Summary

A day of very minor chop, much like the price action of May 20th/23rd. There is clearly threat of another minor lurch higher, but broadly... we're seeing increased selling as we're close to the sp'2100 threshold.

Price action remains much the same since summer 2015. A big move is coming, as many are starting to recognise.

--

Update on the USD, weekly

The DXY 91s mark a clear spike low. Underlying MACD (blue bar histogram) is set for a bullish cross within 2-6 trading days.

The market is trying to price in a possible second rate hike - which is inherently bullish for the USD, although I'm still highly dubious the Fed will raise until the Dec' FOMC.

What should be clear, any price action above the double top of DXY 100, and the door will be wide open for a straight run to the 120s. That would have a great many implications for just about everything.

--

Looking forward to a three day weekend

Its been a tiresome week, not least as I've been battling to build my new home site, but also to keep this page (and a few others) routinely updated.

Once the GDP data is out of the way tomorrow, by 11am, price action will likely be even more muted that today's narrow range of 7pts (0.3%).

Yes.. Yellen is speaking, but its just an award ceremony, and I'm bemused that the mainstream seem to be giving it so much attention. Do they really expect Yellen to give a long speech on monetary policy?

Goodnight from London

Thursday, 26 May 2016

Daily Wrap

US equities settled broadly higher for a second consecutive day, sp

+14pts @ 2090 (intra high 2094). The two leaders - Trans/R2K, settled

higher by 0.8% and 0.5% respectively. VIX remained in cooling mode, -3.6% @ 13.90. Near term outlook is extremely

borderline, as the sp'2100 threshold remains major resistance.

sp'daily5

VIX'daily3

Summary

So, a second day of equity gains, with the VIX continuing to cool from last week's high of 17.65.

With a three day holiday weekend approaching, price action will be leaning on the quieter side, and that will favour the equity bulls.

A move back above the key VIX 20 threshold looks inevitable in June, but then, are we only looking at a brief foray to the low/mid 20s, before renewed equity upside (to new historic highs) across the summer?

--

Market chatter from the Schiff

--

Three days left

With next Monday CLOSED in the US market for Memorial day, my attention is increasingly focused on how the month will settle.

sp'monthly2 - boll/Keltner

I highlight the above monthly chart as I see some people posting overly bearish downside targets for June.

As I often like to say... first things first.

First, the equity bears need to break last week's low of sp'2025, then the giant psy' level of 2K, and then show some downside power to the low 1900s.

Indeed, across June, the lower monthly bollinger will be around 1930/20s. Any initial break <1900 looks overly difficult.

The lower Keltner band will be offering first viable chance of the low 1800s in July.

...and of course, any break above sp'2134, with Dow >18351, would negate ALL bearish targets, and open up an entirely different outlook, the far more scary inflationary scenario.

Goodnight from London

sp'daily5

VIX'daily3

Summary

So, a second day of equity gains, with the VIX continuing to cool from last week's high of 17.65.

With a three day holiday weekend approaching, price action will be leaning on the quieter side, and that will favour the equity bulls.

A move back above the key VIX 20 threshold looks inevitable in June, but then, are we only looking at a brief foray to the low/mid 20s, before renewed equity upside (to new historic highs) across the summer?

--

Market chatter from the Schiff

--

Three days left

With next Monday CLOSED in the US market for Memorial day, my attention is increasingly focused on how the month will settle.

sp'monthly2 - boll/Keltner

I highlight the above monthly chart as I see some people posting overly bearish downside targets for June.

As I often like to say... first things first.

First, the equity bears need to break last week's low of sp'2025, then the giant psy' level of 2K, and then show some downside power to the low 1900s.

Indeed, across June, the lower monthly bollinger will be around 1930/20s. Any initial break <1900 looks overly difficult.

The lower Keltner band will be offering first viable chance of the low 1800s in July.

...and of course, any break above sp'2134, with Dow >18351, would negate ALL bearish targets, and open up an entirely different outlook, the far more scary inflationary scenario.

Goodnight from London

|

Wednesday, 25 May 2016

Daily Wrap

US equity indexes closed significantly higher, sp +28pts @ 2076, with the two leaders - Trans/R2K, higher by 0.6% and 2.1% respectively. The VIX was naturally ground lower across the day, settling -8.8% @ 14.42. The mainstream mood is back to almost maximum complacency, as rate hikes and a BREXIT vote are no longer seen as a problem.

sp'daily5

VIX'daily3

Summary

It was a pretty damn bizarre day in market land, with even some of the cheerleaders on clown finance TV recognising that the degree of gains were not remotely justified.

It is understandable that some of the bull maniacs are now seriously looking for a break back into the sp'2100s, broadly higher across the summer, and indeed... the rest of 2016.

Yet... has anything really changed?

Today's gains do nothing, as the market remains stuck in a relatively narrow trading range. Aside from a few brief forays >2100, and the two down waves to the 1800s, the market has been broadly stuck in a 4-5% range for an entire year.

Trading ranges won't last forever... and whichever side we do break, will likely determine the market direction for many months.. if not years.

--

The bare bones view...

sp'monthly3c

We've been broadly stuck for an entire year (1.5yrs for the 'old leader' - Transports). The obvious break levels are >2134 and <1810.

Very few in the mainstream now consider the latter as remotely possible this year, and its that degree of near total complacency that should actually concern the bulls right now.

*I realise a fair few of the wave counters out there are calling the move from 2134-1810, a giant 4, with a fifth now underway. But hey... I'm not much one for counting this nonsense.

--

So.. what about the Fed/rates... and the BREXIT vote?

I'm still of the view the Fed will not raise rates ahead of the BREXIT vote, which many realise would be a very valid excuse for the market to at least cool (if briefly) back under sp'2K.

As for how the UK populace will vote (June 23rd), the outcome is likely to be pretty close - much like the Scottish independence vote in 2014. I'm still leaning on the conservative side.. which would see a 'STAY' outcome. Were that the case.. the market would rally.. at least initially.

--

Goodnight from London

sp'daily5

VIX'daily3

Summary

It was a pretty damn bizarre day in market land, with even some of the cheerleaders on clown finance TV recognising that the degree of gains were not remotely justified.

It is understandable that some of the bull maniacs are now seriously looking for a break back into the sp'2100s, broadly higher across the summer, and indeed... the rest of 2016.

Yet... has anything really changed?

Today's gains do nothing, as the market remains stuck in a relatively narrow trading range. Aside from a few brief forays >2100, and the two down waves to the 1800s, the market has been broadly stuck in a 4-5% range for an entire year.

Trading ranges won't last forever... and whichever side we do break, will likely determine the market direction for many months.. if not years.

--

The bare bones view...

sp'monthly3c

We've been broadly stuck for an entire year (1.5yrs for the 'old leader' - Transports). The obvious break levels are >2134 and <1810.

Very few in the mainstream now consider the latter as remotely possible this year, and its that degree of near total complacency that should actually concern the bulls right now.

*I realise a fair few of the wave counters out there are calling the move from 2134-1810, a giant 4, with a fifth now underway. But hey... I'm not much one for counting this nonsense.

--

So.. what about the Fed/rates... and the BREXIT vote?

I'm still of the view the Fed will not raise rates ahead of the BREXIT vote, which many realise would be a very valid excuse for the market to at least cool (if briefly) back under sp'2K.

As for how the UK populace will vote (June 23rd), the outcome is likely to be pretty close - much like the Scottish independence vote in 2014. I'm still leaning on the conservative side.. which would see a 'STAY' outcome. Were that the case.. the market would rally.. at least initially.

--

Goodnight from London

|

Tuesday, 24 May 2016

Daily Wrap

US equities closed a little weak, sp -4pts @ 2048. The two leaders –

Trans/R2K, settled lower by -0.4% and -0.1% respectively. VIX managed a minor gain of 4.1% @ 15.82. Near term

outlook offers a break of the recent sp’2025 low, and that will re-open

the door to a valid H/S target of 1970/60s.

sp'daily5b

VIX, daily3

Summary

It was not exactly the most exciting start to a week, as the market saw a great deal of price chop... but was distinctly leaning weak into the close.

VIX is still broadly subdued. A move to the key 20 threshold looks due... the bigger weekly chart is offering the 24/27 zone into early June.. although I realise most would be dismissive of that kind of powerful (if brief) spike.

--

Day'1.. again

Today sure was different for yours truly. After four years here, it was kinda bizarre not to be posting via blogger/google. I'm not great with change, and my mind has been spinning just trying to figure out a type of DTP software.

If you have liked my work since 2012, then subscribe to me - see HERE, where I now reside each and every trading day.

Goodnight from London

Saturday, 21 May 2016

Weekend update - US weekly indexes

It was a somewhat mixed week for US equity indexes, with net weekly changes ranging from -0.2% (Dow), +0.3% (sp'500), to +2.2% (Transports). Near term outlook offers further weakness to at least sp'2000/1990, if not a very valid H/S target of the 1970/60s.

Lets take our regular look at six of the main US indexes

sp'500

A minor net weekly gain of 5pts (0.3%), settling at 2052. Most notable, another lower high.. with a lower low, as the key lows of 2040/39, and 33 were decisively broken.

2025 is recognised by a fair few as 'market critical'... although that could be endlessly argued over. What should be clear... the market has been quietly cooling from the April 20th high of 2111. Price action remains very choppy.

Underlying MACD (blue bar histogram) cycle ticked lower for a fourth week. At the current rate, there will be a bearish cross in the last week of May... or first week of June. By definition, that will be the first realistic opportunity for a powerful move lower.

Best guess: near term downside to the 1990/1960 zone... before another bounce of 3-4%.... and then the first big move lower.

Unless equity bulls can break back into the 2100s, they have little reason to be confident, and should instead be concerned about a down wave that should (at minimum) be equivalent in scale to Jan'2016 and Aug'2015.

--

Nasdaq comp'

The tech' saw a net gain of 51pts (1.1%), settling at 4769. The giant psy' level of 5K remains extremely powerful resistance, and unless the equity bulls can break above it, they should be concerned of an eventual break lower. First big target is the 4400/4200 zone.

Dow

The mighty Dow settled lower for the fourth consecutive week, with a notable lower high.. and lower low. The opex close of 17500 was somewhat natural. Equity bulls should be desperate to re-take the 18K threshold, whilst bears should be seeking an eventual break of 17K. First downside target is 16K, and then the Aug' 2015 low of 15370.

NYSE comp'

The master index saw a minor net weekly gain of 0.2%, settling at 10250. First support remains the big 10K threshold. If that fails to hold - as seems probable, an eventual capitulation low around 8K seems viable.

R2K

The second market leader - R2K, settled net higher by 9pts (0.9%) at 1112. Like other indexes, despite the gain, there was a notable lower high.. and lower low. First big target in June is the 1K threshold. Best case downside is the 875/850 zone, a price level not seen since late 2012.

Trans

The 'old leader' - Trans, saw the strongest gains this week, +164pts (2.2%) at 7671. The 8K threshold is very strong resistance, and equity bulls are going to struggle to break any higher into end month/early June. First downside target is 7K. If that fails to hold, the lower bollinger offers fast downside to the 6600s.. which is currently around 13% lower.

--

Summary

So... net weekly gains for 5 of 6 indexes, with only the Dow seeing a minor decline.

Most notable, most indexes saw a lower high.. and lower low... and that is pretty bearish.

Price structure, and also style of price action, is very similar to that seen across Nov/Dec' 2015.

An eventual sig' break lower looks due, with the lower weekly bollinger currently offering the sp'1840s... and that is a clear 10% lower.

--

Looking ahead

M -

T - PMI manu', New home sales, Richmond Fed'

W - Intl' trade, EIA report

T - weekly jobs, Durable Goods Orders, PMI serv, Pending home sales

F - GDP (rev'1), consumer sent', corp' profits

*there is a light sprinkling of fed officials on the loose, notably Bullard - who is touring Asia. Yellen is due at Harvard on Friday... but the appearance is to receive an award (for service to the printing industry?), and I don't expect any policy remarks to be made.

**Monday May'30th is Memorial day - where the US market will be CLOSED. So.. the Friday before will be increasingly subdued.

--

.... back on Monday.... but as noted in the previous post, things will be different.

Lets take our regular look at six of the main US indexes

sp'500

A minor net weekly gain of 5pts (0.3%), settling at 2052. Most notable, another lower high.. with a lower low, as the key lows of 2040/39, and 33 were decisively broken.

2025 is recognised by a fair few as 'market critical'... although that could be endlessly argued over. What should be clear... the market has been quietly cooling from the April 20th high of 2111. Price action remains very choppy.

Underlying MACD (blue bar histogram) cycle ticked lower for a fourth week. At the current rate, there will be a bearish cross in the last week of May... or first week of June. By definition, that will be the first realistic opportunity for a powerful move lower.

Best guess: near term downside to the 1990/1960 zone... before another bounce of 3-4%.... and then the first big move lower.

Unless equity bulls can break back into the 2100s, they have little reason to be confident, and should instead be concerned about a down wave that should (at minimum) be equivalent in scale to Jan'2016 and Aug'2015.

--

Nasdaq comp'

The tech' saw a net gain of 51pts (1.1%), settling at 4769. The giant psy' level of 5K remains extremely powerful resistance, and unless the equity bulls can break above it, they should be concerned of an eventual break lower. First big target is the 4400/4200 zone.

Dow

The mighty Dow settled lower for the fourth consecutive week, with a notable lower high.. and lower low. The opex close of 17500 was somewhat natural. Equity bulls should be desperate to re-take the 18K threshold, whilst bears should be seeking an eventual break of 17K. First downside target is 16K, and then the Aug' 2015 low of 15370.

NYSE comp'

The master index saw a minor net weekly gain of 0.2%, settling at 10250. First support remains the big 10K threshold. If that fails to hold - as seems probable, an eventual capitulation low around 8K seems viable.

R2K

The second market leader - R2K, settled net higher by 9pts (0.9%) at 1112. Like other indexes, despite the gain, there was a notable lower high.. and lower low. First big target in June is the 1K threshold. Best case downside is the 875/850 zone, a price level not seen since late 2012.

Trans

The 'old leader' - Trans, saw the strongest gains this week, +164pts (2.2%) at 7671. The 8K threshold is very strong resistance, and equity bulls are going to struggle to break any higher into end month/early June. First downside target is 7K. If that fails to hold, the lower bollinger offers fast downside to the 6600s.. which is currently around 13% lower.

--

Summary

So... net weekly gains for 5 of 6 indexes, with only the Dow seeing a minor decline.

Most notable, most indexes saw a lower high.. and lower low... and that is pretty bearish.

Price structure, and also style of price action, is very similar to that seen across Nov/Dec' 2015.

An eventual sig' break lower looks due, with the lower weekly bollinger currently offering the sp'1840s... and that is a clear 10% lower.

--

Looking ahead

M -

T - PMI manu', New home sales, Richmond Fed'

W - Intl' trade, EIA report

T - weekly jobs, Durable Goods Orders, PMI serv, Pending home sales

F - GDP (rev'1), consumer sent', corp' profits

*there is a light sprinkling of fed officials on the loose, notably Bullard - who is touring Asia. Yellen is due at Harvard on Friday... but the appearance is to receive an award (for service to the printing industry?), and I don't expect any policy remarks to be made.

**Monday May'30th is Memorial day - where the US market will be CLOSED. So.. the Friday before will be increasingly subdued.

--

.... back on Monday.... but as noted in the previous post, things will be different.

Permabear Space

US equities ended the week on a moderately positive note, sp +12pts @ 2052, which made for a minor net weekly gain of 5pts (0.3%). Despite the gain, the market remains highly vulnerable to a significant move lower, the third since the May 20'th 2015 high of 2134.72.

sp'weekly1b

sp'monthly1b

Summary

re: weekly1b: a minor net weekly gain of 5pts (0.3), settling at 2052. Most notable, a lower high... and lower low. First resistance is the 10MA... around 2060. A break back into the 2100s looks out of range, not least as the market is (mistakenly) now under the belief the Fed might raise rates in June (or July)... and there is the looming BREXIT vote of course.

re: monthly1b: a May close under the 10MA - currently 2014, should be a target for those equity bears seeking major market upset in June.. and perhaps across many months ahead. It not absolutely essential.. but it sure would help instill some confidence!

---

Permabear Space

Four years ago I started this blog, having originated from the ERX board on Yahoo! finance. The only intention was to post once a week. Naturally, being the obsessive person that I am, it soon spiralled to eleven posts a day.

As of this post, I'm at 11,020, which is a pretty bizarre thought.

I have endeavoured to strike a balance between the 'end of the world' crowd at Zerohedge, and the cheerleaders of clown finance TV. Despite being self-titled 'Permabear Doomster, I think I've managed to achieve something more balanced than either of them.

Like the lead character in the movie Office Space, I don't want to have any bosses ever again. Nor do I want to do the daily commute ever again.

The point is... I want to do this for the long term.... a writer... and a trader.

I simply don't want, and can't imagine doing anything else. If I'm to continue though for many years to come, I need to derive at least some income to justify it.

If you think I'm worth around $1 a day... then subscribe to me. See HERE for details

--

Posts from next Monday

Subscribers @ http://subscriber.permabeardoomster.com

Will have access to everything normally posted here from 8.30am into the late evening.

--

For those that don't wish to subscribe...

I will post after each trading @ http://permabeardoomster.blogspot.com, with a 'Daily wrap' - compromising of a few indexes, the VIX, and probably some other miscell' bits and pieces.

The weekend post will also remain here.

--

For me, this is a major change, and a personal risk (although arguably less risky than being margin long the US equity market this summer/autumn). I sincerely hope some of you choose to subscribe in the days ahead.

Goodnight from London

--

*the weekend post will appear at 5pm EST, and will detail the US weekly indexes

sp'weekly1b

sp'monthly1b

Summary

re: weekly1b: a minor net weekly gain of 5pts (0.3), settling at 2052. Most notable, a lower high... and lower low. First resistance is the 10MA... around 2060. A break back into the 2100s looks out of range, not least as the market is (mistakenly) now under the belief the Fed might raise rates in June (or July)... and there is the looming BREXIT vote of course.

re: monthly1b: a May close under the 10MA - currently 2014, should be a target for those equity bears seeking major market upset in June.. and perhaps across many months ahead. It not absolutely essential.. but it sure would help instill some confidence!

---

Permabear Space

Four years ago I started this blog, having originated from the ERX board on Yahoo! finance. The only intention was to post once a week. Naturally, being the obsessive person that I am, it soon spiralled to eleven posts a day.

As of this post, I'm at 11,020, which is a pretty bizarre thought.

I have endeavoured to strike a balance between the 'end of the world' crowd at Zerohedge, and the cheerleaders of clown finance TV. Despite being self-titled 'Permabear Doomster, I think I've managed to achieve something more balanced than either of them.

Like the lead character in the movie Office Space, I don't want to have any bosses ever again. Nor do I want to do the daily commute ever again.

The point is... I want to do this for the long term.... a writer... and a trader.

I simply don't want, and can't imagine doing anything else. If I'm to continue though for many years to come, I need to derive at least some income to justify it.

If you think I'm worth around $1 a day... then subscribe to me. See HERE for details

--

Posts from next Monday

Subscribers @ http://subscriber.permabeardoomster.com

Will have access to everything normally posted here from 8.30am into the late evening.

--

For those that don't wish to subscribe...

I will post after each trading @ http://permabeardoomster.blogspot.com, with a 'Daily wrap' - compromising of a few indexes, the VIX, and probably some other miscell' bits and pieces.

The weekend post will also remain here.

--

For me, this is a major change, and a personal risk (although arguably less risky than being margin long the US equity market this summer/autumn). I sincerely hope some of you choose to subscribe in the days ahead.

Goodnight from London

--

*the weekend post will appear at 5pm EST, and will detail the US weekly indexes

Daily Index Cycle update

US equities closed broadly higher, sp +12pts @ 2052 (intra high 2058).

The two leaders - Trans/R2K, settled higher by 1.1% and 1.1%

respectively. Near term outlook offers another rollover, with the recent

low of 2025 set to be tested. If that fails to hold... open air to

2000/1990s.. if not the H/S target of 1970/60s.

sp'daily5b

Trans

Summary

sp'500: the fourth consecutive day under the 50dma, with a failed attempt to break/hold the key 10MA. A renewed push lower looks due.. first soft target - the Thurs' low of 2025, and then 2000/1990s. The bigger H/S scenario is highly suggestive of the 1970/60s.

Trans: it is highly notable that the 'old leader', remains sustainably below the 50/200 day MAs. Next support is the 7200/7000 zone.

--

a little more later

sp'daily5b

Trans

Summary

sp'500: the fourth consecutive day under the 50dma, with a failed attempt to break/hold the key 10MA. A renewed push lower looks due.. first soft target - the Thurs' low of 2025, and then 2000/1990s. The bigger H/S scenario is highly suggestive of the 1970/60s.

Trans: it is highly notable that the 'old leader', remains sustainably below the 50/200 day MAs. Next support is the 7200/7000 zone.

--

a little more later

Friday, 20 May 2016

VIX cools into the weekend

With equities closing broadly higher, the VIX ended the week in cooling mode, settling -6.9% @ 15.20. Across the week, the VIX saw a minor net weekly gain of 1.1%. Broadly, volatility remains due to increase into the summer.

VIX'60min

VIX'daily3

VIX'weekly

Summary

Broadly, despite the sp'500 declining from 2111 to a new multi-month low of 2025, the VIX remains broadly subdued, stuck in the mid/low teens.

The bigger weekly MACD (blue bar histogram) cycle is set to see a bullish cross before end month... and that does bode for a powerful increase in volatility into June.

--

more later... on the indexes

VIX'60min

VIX'daily3

VIX'weekly

Summary

Broadly, despite the sp'500 declining from 2111 to a new multi-month low of 2025, the VIX remains broadly subdued, stuck in the mid/low teens.

The bigger weekly MACD (blue bar histogram) cycle is set to see a bullish cross before end month... and that does bode for a powerful increase in volatility into June.

--

more later... on the indexes

Closing Brief

US equities closed broadly higher, sp +12pts @ 2052 (intra high 2058). The two leaders - Trans/R2K, settled higher by 1.1% and 1.1% respectively. Near term outlook offers another rollover, with the recent low of 2025 set to be tested. If that fails to hold... open air to 2000/1990s.. if not the H/S target of 1970/60s.

sp'60min

Summary

*closing hour action: a little cooling to 2048.. as news of a White House 'lawn incident' gave the algo-bots an excuse for a nano scale brief drop.

The hourly 10MA notably held.

--

.. and thus concludes another week.

Certainly, it was not the bearish end that some (yours truly included) were hoping for, but then... opex is often a frustrating day for equity bears.

In any case... equity bears did achieve a lower high this week.. and a lower low.

It has been somewhat bemusing to see some on clown finance TV talk about how the market is back above sp'2040... so.. 'everything is fine again'. I'd imagine it'll be the same next week if we break 2025... cool to 2000/1990s. and then eventually bounce to the 2030s.

-

With just six trading days left of May, my attention is already shifting to how the month will settle. A close back under the monthly 10MA (currently 2014)... would really offer a clue that June will see a move to the low 1900s.. if not the mid 1800s.

Regardless... thanks for the comments/emails this week

Have a good weekend

--

the usual bits and pieces across the evening to wrap up the week

sp'60min

Summary

*closing hour action: a little cooling to 2048.. as news of a White House 'lawn incident' gave the algo-bots an excuse for a nano scale brief drop.

The hourly 10MA notably held.

--

.. and thus concludes another week.

Certainly, it was not the bearish end that some (yours truly included) were hoping for, but then... opex is often a frustrating day for equity bears.

In any case... equity bears did achieve a lower high this week.. and a lower low.

It has been somewhat bemusing to see some on clown finance TV talk about how the market is back above sp'2040... so.. 'everything is fine again'. I'd imagine it'll be the same next week if we break 2025... cool to 2000/1990s. and then eventually bounce to the 2030s.

-

With just six trading days left of May, my attention is already shifting to how the month will settle. A close back under the monthly 10MA (currently 2014)... would really offer a clue that June will see a move to the low 1900s.. if not the mid 1800s.

Regardless... thanks for the comments/emails this week

Have a good weekend

--

the usual bits and pieces across the evening to wrap up the week

3pm update - 2050 for the opex close?

US equities remain moderately higher, and considering its opex... with resistance at 2060, the market makers will be inclined to attempt to pin the SPY ETF to 205... equiv' to sp'2050. With another equity bounce, the VIX is naturally subdued in the 15s.

sp'weekly1b

VIX'60min

Summary

*VIX sitting on rising trend... equity bears could do with a weekly close >15.50.

--

Well, its been another week of swings.. and we look set to close around sp'2050.. with VIX 15s.

Sure, bulls can argue they've (probably) managed a net weekly gain... breaking the downward run.

Yet.. bears achieved a lower high.. and a lower low, breaking the key lows of 2040/39 and (arguably, even more important... 2033).

Clearly, next week the target will be <2025... and then 2000/1990s.. if not the actual H/S target of 1970/60s.

--

back at the close

sp'weekly1b

VIX'60min

Summary

*VIX sitting on rising trend... equity bears could do with a weekly close >15.50.

--

Well, its been another week of swings.. and we look set to close around sp'2050.. with VIX 15s.

Sure, bulls can argue they've (probably) managed a net weekly gain... breaking the downward run.

Yet.. bears achieved a lower high.. and a lower low, breaking the key lows of 2040/39 and (arguably, even more important... 2033).

Clearly, next week the target will be <2025... and then 2000/1990s.. if not the actual H/S target of 1970/60s.

--

back at the close

2pm update - a touch of cooling

US equities are starting to show upside exhaustion, having seen a viable cycle peak of sp'2058 - with VIX 15.38. Were it not for opex.. the probability of increasing weakness into the weekend would be rather significant. As it is, a weekly close in the 2055/45 zone looks likely.

sp'60min

VIX'60min

Summary

So... two hours to go.. and its a case of whether we see a minor net weekly gain... or a fractional net weekly decline. The dividing line is 2046.61.

--

Here in London city... ending the week with some goldilocks sunshine...

--

back at 3pm

sp'60min

VIX'60min

Summary

So... two hours to go.. and its a case of whether we see a minor net weekly gain... or a fractional net weekly decline. The dividing line is 2046.61.

--

Here in London city... ending the week with some goldilocks sunshine...

|

| Bearish shadow |

|

| Bullish sunshine |

back at 3pm

1pm update - somewhat stuck

US equities are holding moderate gains, and are somewhat stuck under resistance of sp'2060. With three hours left of the trading week, its merely a case of whether a significant number of the rats decide to jump ship into the weekend.. as the once touted key floor of 2040/39.. remains broken.

sp'60min

VIX'60min

Summary

Little to add.

If Mr Market wants to cause max upset.... it'll run the 2060s stop... but then cool after 2.30pm.

In any case... I can't take any upside seriously unless >2080... if not the 2100s.

--

notable weakness, CHK, daily

Despite some hysteria in early March, and again in early April, Chesapeake Energy continues to broadly struggle, and remains on the disappear list.

--

time for some sun.... back at 2pm

sp'60min

VIX'60min

Summary

Little to add.

If Mr Market wants to cause max upset.... it'll run the 2060s stop... but then cool after 2.30pm.

In any case... I can't take any upside seriously unless >2080... if not the 2100s.

--

notable weakness, CHK, daily

Despite some hysteria in early March, and again in early April, Chesapeake Energy continues to broadly struggle, and remains on the disappear list.

--

time for some sun.... back at 2pm

12pm update - still battling upward

US equities continue to build gains, sp +17pts @ 2057, with next resistance at 2060. With the USD +0.1% in the DXY 95.40s, the metals continue to cool, Gold -$4, with Silver -0.1%. Oil is in minor chop mode, -0.1% in the $48s.

sp'60min

VIX'60min

Summary

Little to add... on what is likely to be an increasingly choppy OPEX.

Market makers would be more inclined to try to pin the SPY to 205 (aka.. sp'2050).. rather than 204 or 206.

The only remaining issue for today is whether a significant wave of rats want to sell into the weekend. Certainly... it has to be asked.. who would want to be buying at this time.. or price?

--

notable weakness, agri', DE, monthly

Deere is net lower for today by around -5%. Seen on a monthly cycle chart, we have a giant bear flag.. with massive resistance @ $85. DE looks highly vulnerable to the mid $50s before year end.

To be clear though, I like the company for the super long term.. I'll be looking to buy in the $50s... agriculture is one of the ultimate economic core sectors. Bullish... food.

-

time for lunch

sp'60min

VIX'60min

Summary

Little to add... on what is likely to be an increasingly choppy OPEX.

Market makers would be more inclined to try to pin the SPY to 205 (aka.. sp'2050).. rather than 204 or 206.

The only remaining issue for today is whether a significant wave of rats want to sell into the weekend. Certainly... it has to be asked.. who would want to be buying at this time.. or price?

--

notable weakness, agri', DE, monthly

Deere is net lower for today by around -5%. Seen on a monthly cycle chart, we have a giant bear flag.. with massive resistance @ $85. DE looks highly vulnerable to the mid $50s before year end.

To be clear though, I like the company for the super long term.. I'll be looking to buy in the $50s... agriculture is one of the ultimate economic core sectors. Bullish... food.

-

time for lunch

Subscribe to:

Comments (Atom)