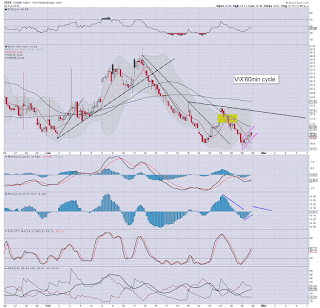

With equity indexes closing moderately weak, the VIX was naturally a little higher, settling +3.7% @ 20.55. Near term outlook threatens renewed equity upside, and that will likely equate to VIX back in the 18s, if not the 17/16s by the end of the week.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX looks set to remain broadly subdued for another few weeks. The 30 threshold looks just about in range by end month... if a March close under sp'1900.

--

more later... on the indexes

Monday, 29 February 2016

Closing Brief

US equities ended the month on a moderately weak note, sp -15pts @ 1932 (intra high 1958). The two leaders - Trans/R2K, settled lower by -0.8% and -0.3% respectively. Near term outlook offers renewed upside, at least to the 1970/80s later this week, with the 2K threshold more viable next week.

sp'60min

Summary

*closing hour action: moderate weakness, with a new intra low of 1931, but holding first soft support of the lower hourly bollinger.

Price structure is still arguably a bull flag... if somewhat bigger.

--

... and February comes to a close.

We saw a marginal lower low in the sp'500 of 1810, before swinging powerfully higher, having already hit 1962.. with VIX cooling from 30 to the mid 18s.

Broadly, the market still looks set climb into mid March... and once the next ECB and FOMC are out of the way, the equity bears will have an open window to break the market much lower.

yours truly remains quietly watching.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: moderate weakness, with a new intra low of 1931, but holding first soft support of the lower hourly bollinger.

Price structure is still arguably a bull flag... if somewhat bigger.

--

... and February comes to a close.

We saw a marginal lower low in the sp'500 of 1810, before swinging powerfully higher, having already hit 1962.. with VIX cooling from 30 to the mid 18s.

Broadly, the market still looks set climb into mid March... and once the next ECB and FOMC are out of the way, the equity bears will have an open window to break the market much lower.

yours truly remains quietly watching.

--

more later... on the VIX

3pm update - a little cooling

US equities have seen a minor wave lower, but it does nothing to change the broader outlook into mid March. It is notable that first support is the hourly lower bollinger, and that is currently at sp'1928.. and rising each hour. There is little reason to expect any sustained price action <1930 in the near term.

sp'60min

VIX'60min

Summary

Despite cooling from the morning high of sp'1958 to 1940, there is little reason to expect we have a short term top.

Price action remains broadly subdued, and is arguably mere consolidation before another push higher.

*With equities cooling a little, its notable that the precious metals are catching a minor fear bid again, with Gold now +$12, and Silver +1.2%

That is naturally helping the miners, with GDX +3.3%.

--

3.19pm... Hmm..... marginally interesting.. with sp -13pts @ 1934. Seems there is some sell side into end month.

Some of the 'smart big money' wants to cash out after what has been a sig' bounce from 1810.

In any case...still seeking renewed upside.

Gold +$14... making for a powerful net monthly gain.... as the miners have also attained.

sp'60min

VIX'60min

Summary

Despite cooling from the morning high of sp'1958 to 1940, there is little reason to expect we have a short term top.

Price action remains broadly subdued, and is arguably mere consolidation before another push higher.

*With equities cooling a little, its notable that the precious metals are catching a minor fear bid again, with Gold now +$12, and Silver +1.2%

That is naturally helping the miners, with GDX +3.3%.

--

3.19pm... Hmm..... marginally interesting.. with sp -13pts @ 1934. Seems there is some sell side into end month.

Some of the 'smart big money' wants to cash out after what has been a sig' bounce from 1810.

In any case...still seeking renewed upside.

Gold +$14... making for a powerful net monthly gain.... as the miners have also attained.

2pm update - churning

US equities remain leaning on the positive side, with the sp +3pts at 1951. The 1965/75 zone looks highly probable within the next few days, with 2K more viable next week. In either case, equity bears don't likely have any realistic opportunity until after the next FOMC (March 16th).

sp'daily

Summary

Little to add.. on what is an increasingly subdued day.

Clearly, equity bears have no downside power. Its just a case of how high we can climb into mid March.

--

notable strength: miners, GDX

Set for a net daily gain of 2-3%, and currently +34.8% for the month.

--

back at 3pm

sp'daily

Summary

Little to add.. on what is an increasingly subdued day.

Clearly, equity bears have no downside power. Its just a case of how high we can climb into mid March.

--

notable strength: miners, GDX

Set for a net daily gain of 2-3%, and currently +34.8% for the month.

--

back at 3pm

1pm update - minor gains

US equities are battling to hold minor gains, with the sp +4pts @ 1952. VIX remains broadly subdued, remaining under the key 20 threshold. If sp'2K or higher, the 16/15s look viable by mid March. Oil continues to help market sentiment, +2.5% in the $33s.

sp'daily

VIX'daily

Summary

Seen on the daily charts, today is indeed very inconsequential.

Price action clearly favours the bulls, as the bears continue to look exhausted.

--

notable strength...

CNX +8%

SDRL +15%

.. but both of those remain as devastatingly low levels relative to summer 2014.

--

back at 2pm

sp'daily

VIX'daily

Summary

Seen on the daily charts, today is indeed very inconsequential.

Price action clearly favours the bulls, as the bears continue to look exhausted.

--

notable strength...

CNX +8%

SDRL +15%

.. but both of those remain as devastatingly low levels relative to summer 2014.

--

back at 2pm

12pm update - clawing upward

US equities are clawing upward, with a break above the baby bull flag. There is open air to the sp'1965/70 zone, along with VIX 18s. The precious metals remain moderately higher, Gold +$8, with Silver +0.7%. Oil is certainly helping the market mood, +2.0% in the $33s.

sp'60min

VIX'60min

Summary

*note the new cycle low of VIX 18.38, although its arguably a 'rogue print'.

--

Suffice to add...for the more patient out there, its a case of sitting back for another 13 trading days (including today). A high at the next FOMC (March 16th) would seem a very natural outcome.

--

VIX update from Mr T.

*no-show*

--

Early morning update from Riley

--

time for lunch :)

sp'60min

VIX'60min

Summary

*note the new cycle low of VIX 18.38, although its arguably a 'rogue print'.

--

Suffice to add...for the more patient out there, its a case of sitting back for another 13 trading days (including today). A high at the next FOMC (March 16th) would seem a very natural outcome.

--

VIX update from Mr T.

*no-show*

--

Early morning update from Riley

--

time for lunch :)

11am update - continued chop

US equities remain in minor chop mode, as the equity bears lack any sig' downside power, despite another recessionary (Chicago PMI: 47.6) econ-data point. Metals are holding gains, Gold +$9, with Silver +0.6%. Oil is +0.6% in the 32/33s.

sp'60min

VIX'60min

Summary

Price structure on the hourly equity cycle remains a clear baby bull flag - with a corresponding baby bear flag on the VIX hourly, and I do expect a bullish equity upward break, whether late today or tomorrow.

Broadly... the 2K level looks rather straight forward..and it certainly doesn't have to hit this week.

--

Here in London city....

... and with March tomorrow, early summer warmth is maybe just 6-7 weeks away. Thank the gods.

--

time to cook

sp'60min

VIX'60min

Summary

Price structure on the hourly equity cycle remains a clear baby bull flag - with a corresponding baby bear flag on the VIX hourly, and I do expect a bullish equity upward break, whether late today or tomorrow.

Broadly... the 2K level looks rather straight forward..and it certainly doesn't have to hit this week.

--

Here in London city....

|

| late winter sun |

|

| Govt' Subsidised solar roofs |

... and with March tomorrow, early summer warmth is maybe just 6-7 weeks away. Thank the gods.

--

time to cook

10am update - opening minor chop

US equities open with very minor price chop. It should be clear there is hardly any downward pressure, and underlying price pressure remains to the upside for another few weeks. Metals are building gains, Gold +$9, but still appears broadly vulnerable into mid March.

sp'60min

sp'weekly6

Summary

*Chicago PMI: 47.6... lousy, and that IS a recessionary number.

--

Note the MACD, now in the -4s.. from -8s. A bullish cross will be viable next Monday.. or at the latest, Mon' March 14th.

It will NOT negate the bigger bearish outlook, unless March closes >2K

--

time for some sun... back soon

sp'60min

sp'weekly6

Summary

*Chicago PMI: 47.6... lousy, and that IS a recessionary number.

--

Note the MACD, now in the -4s.. from -8s. A bullish cross will be viable next Monday.. or at the latest, Mon' March 14th.

It will NOT negate the bigger bearish outlook, unless March closes >2K

--

time for some sun... back soon

Pre-Market Brief

Good morning. US equity futures are a little lower, sp -5pts, we're set to open at 1943. USD is +0.2% in the DXY 98.30. Metals are moderately higher, Gold +$7, with Silver +0.5%. Oil is +0.2% in the $32s.

sp'60min

Summary

*awaiting Chicago PMI data. Market is expecting 52.

Last month saw a bizarre spike reading of 55.6, which made absolutely ZERO sense at all. Equity bears should be seeking anything under the recessionary threshold of 50.

--

Well, its leap year day.... the end of the month. Indeed, the monthly closes will be important.

I will have eyes on the opening MAs tomorrow morning, and expect the monthly 10MA to drop to around sp'2K. I could tolerate a brief foray to the sp'2020/40 zone in mid March.. but equity bears MUST see a close below it.

--

As for today.. I'd expect another daily close above the 50dma... with the market headed to the 2K threshold.

--

Doomer chat - Hunter with Weir

As ever, make of that, what you will. I sure don't agree with some of it.

-

Overnight action

Japan: broad weakness, -1.0% @ 16026

China: -2.9% @ 2687... remaining broadly ugly

Germany: currently -0.8% @ 9432

--

Good wishes for the week ahead

sp'60min

Summary

*awaiting Chicago PMI data. Market is expecting 52.

Last month saw a bizarre spike reading of 55.6, which made absolutely ZERO sense at all. Equity bears should be seeking anything under the recessionary threshold of 50.

--

Well, its leap year day.... the end of the month. Indeed, the monthly closes will be important.

I will have eyes on the opening MAs tomorrow morning, and expect the monthly 10MA to drop to around sp'2K. I could tolerate a brief foray to the sp'2020/40 zone in mid March.. but equity bears MUST see a close below it.

--

As for today.. I'd expect another daily close above the 50dma... with the market headed to the 2K threshold.

--

Doomer chat - Hunter with Weir

As ever, make of that, what you will. I sure don't agree with some of it.

-

Overnight action

Japan: broad weakness, -1.0% @ 16026

China: -2.9% @ 2687... remaining broadly ugly

Germany: currently -0.8% @ 9432

--

Good wishes for the week ahead

Saturday, 27 February 2016

Weekend update - US weekly indexes

US equities continued to rally from the sp'1810 low, with net weekly gains ranging from 2.7% (R2K), 1.6% (sp'500, Trans), to 1.4% (NYSE comp'). Near term outlook is bullish into mid March, but from there, a rather critical rollover is probable, with very powerful equity downside across the spring/early summer.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 saw a net weekly gain of 30pts (1.6%) to settle the week at 1948 (intra high 1962). Underlying MACD (blue bar histogram) ticked higher for a second consecutive week. At the current rate of increase, there will be a bullish cross in 11 trading days (Monday, March 14th).

With a second consecutive daily close above the 50dma, the sp'500 now looks set for the 2K threshold, and almost equally viable, the 200dma.

Best guess: upside to at least 2K, with a secondary target of the 200dma, which by mid March will be in the 2020/25 zone. Best case is a gap fill of 2038/43 by the FOMC of March 16th.

From there, broad and increasingly powerful downside to break the 1810 low - which looks more viable in April. A test of the 2000/2007 double top in the sp'1600/1550 zone looks probable by May/June.

--

Nasdaq comp'

The tech saw a gain of 1.9% to 4590, settling just under the key 10MA (4618). Next viable upside are the 4800s. Sustained action >4900 looks very difficult, and it would seem extremely probable that we'll see price action around 4K.. before we trade back above 5K.

Dow

The mighty Dow climbed for a second consecutive week, settling +247pts (1.5%), at 16639. 17K will be prime resistance across March. Primary downside is the 14200/000 zone, and then 13500/400s. Sustained action <13K looks difficult.

NYSE comp'

The master index saw a net gain of 1.4%, now back in the 9600s. There is a clear price gap around the 10K threshold, but from there, renewed downside to 8K looks due by early summer.

R2K

The second market leader - R2K, lead the way higher this week, with a powerful gain of 2.7% to 1037. Next key resistance is the 1100 threshold. From there, renewed downside to the 875/850 zone.

Trans

The 'old leader' climbed for a notable sixth consecutive week, settling +1.6% @ 7405. The tranny has now climbed a very powerful 15.6% since the Jan'20th low of 6403. Near term upside offers the 200dma in the 7800s, and then renewed downside to the 5500/5000 zone.

--

Summary

So, a second week of gains for most indexes. We have the Tranny leading the charge back upward, followed by the R2K.

With the sp'500 and Dow attaining a Thurs/Friday close above their respective 50dma, near term outlook is bullish into mid March.

Price action will likely become increasingly choppy around the 2K threshold. A brief spike high at the next FOMC (Wed' March 16th) looks possible, as high as the sp'2040s.

From there.. things should get real interesting.

--

Will the old double top - prior resistance, now support, hold?

A massive issue across the coming months will be if the old double top of 2000/2007 (sp'1553/76) holds.

sp'monthly3d

I am pretty confident we'll see the low sp'1600s by May/June, but what then?

The ultimate question is whether capitulation in the oil/gas/mining sector will cause enough capital market upset to see a monthly close <1600.

My original outlook for this year was for a floor in the 1600s.. then a move back higher. For now... I shall hold to that. Whether I will have the stomach to go long in the 1650/1550 zone... is another matter entirely.

--

The wild card of Deutsche bank

The CEO - Cryan, proclaimed the bank is 'absolutely rock-solid' in a Feb'9th memo to employees, and that is precisely the sort of talk I see as an indirect red flag.

Despite the recent broader market bounce, the stock is still struggling.

DB, monthly, 11yr

DB is a clear systemic threat to the EU, and has already broken below the collapse wave low of Jan'2009 ($18.39). If the German DAX is 8K this spring/summer - which seems probable, I find it hard to imagine that DB won't be trading under $10.. if not even $5.

DB remains one to watch very closely indeed.

--

Looking ahead

M - Pending home sales, Chicago PMI

T - PMI/ISM manu', construction

W - ADP jobs, EIA report, Fed Beige book (2pm)

T - weekly jobs, product/costs, PMI/ISM serv', Factory orders

F - monthly jobs, intl' trade.

*the only Fed official on the loose is Williams, due on Wednesday

-

Back on Monday :)

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 saw a net weekly gain of 30pts (1.6%) to settle the week at 1948 (intra high 1962). Underlying MACD (blue bar histogram) ticked higher for a second consecutive week. At the current rate of increase, there will be a bullish cross in 11 trading days (Monday, March 14th).

With a second consecutive daily close above the 50dma, the sp'500 now looks set for the 2K threshold, and almost equally viable, the 200dma.

Best guess: upside to at least 2K, with a secondary target of the 200dma, which by mid March will be in the 2020/25 zone. Best case is a gap fill of 2038/43 by the FOMC of March 16th.

From there, broad and increasingly powerful downside to break the 1810 low - which looks more viable in April. A test of the 2000/2007 double top in the sp'1600/1550 zone looks probable by May/June.

--

Nasdaq comp'

The tech saw a gain of 1.9% to 4590, settling just under the key 10MA (4618). Next viable upside are the 4800s. Sustained action >4900 looks very difficult, and it would seem extremely probable that we'll see price action around 4K.. before we trade back above 5K.

Dow

The mighty Dow climbed for a second consecutive week, settling +247pts (1.5%), at 16639. 17K will be prime resistance across March. Primary downside is the 14200/000 zone, and then 13500/400s. Sustained action <13K looks difficult.

NYSE comp'

The master index saw a net gain of 1.4%, now back in the 9600s. There is a clear price gap around the 10K threshold, but from there, renewed downside to 8K looks due by early summer.

R2K

The second market leader - R2K, lead the way higher this week, with a powerful gain of 2.7% to 1037. Next key resistance is the 1100 threshold. From there, renewed downside to the 875/850 zone.

Trans

The 'old leader' climbed for a notable sixth consecutive week, settling +1.6% @ 7405. The tranny has now climbed a very powerful 15.6% since the Jan'20th low of 6403. Near term upside offers the 200dma in the 7800s, and then renewed downside to the 5500/5000 zone.

--

Summary

So, a second week of gains for most indexes. We have the Tranny leading the charge back upward, followed by the R2K.

With the sp'500 and Dow attaining a Thurs/Friday close above their respective 50dma, near term outlook is bullish into mid March.

Price action will likely become increasingly choppy around the 2K threshold. A brief spike high at the next FOMC (Wed' March 16th) looks possible, as high as the sp'2040s.

From there.. things should get real interesting.

--

Will the old double top - prior resistance, now support, hold?

A massive issue across the coming months will be if the old double top of 2000/2007 (sp'1553/76) holds.

sp'monthly3d

I am pretty confident we'll see the low sp'1600s by May/June, but what then?

The ultimate question is whether capitulation in the oil/gas/mining sector will cause enough capital market upset to see a monthly close <1600.

My original outlook for this year was for a floor in the 1600s.. then a move back higher. For now... I shall hold to that. Whether I will have the stomach to go long in the 1650/1550 zone... is another matter entirely.

--

The wild card of Deutsche bank

The CEO - Cryan, proclaimed the bank is 'absolutely rock-solid' in a Feb'9th memo to employees, and that is precisely the sort of talk I see as an indirect red flag.

Despite the recent broader market bounce, the stock is still struggling.

DB, monthly, 11yr

DB is a clear systemic threat to the EU, and has already broken below the collapse wave low of Jan'2009 ($18.39). If the German DAX is 8K this spring/summer - which seems probable, I find it hard to imagine that DB won't be trading under $10.. if not even $5.

DB remains one to watch very closely indeed.

--

Looking ahead

M - Pending home sales, Chicago PMI

T - PMI/ISM manu', construction

W - ADP jobs, EIA report, Fed Beige book (2pm)

T - weekly jobs, product/costs, PMI/ISM serv', Factory orders

F - monthly jobs, intl' trade.

*the only Fed official on the loose is Williams, due on Wednesday

-

Back on Monday :)

Climbing into mid March

US equities look set to continue broadly climbing for another few weeks, with the sp'500 seeing a net weekly gain of 30pts (1.6%) at 1948 (Friday intra high 1962). Near term outlook offers further upside to the giant psy' level of 2K.

sp'weekly6

sp'monthly1b

Summary

It is notable that we're currently set for a net monthly gain, somewhere in the range of 0.5-1.5%.

No matter how strong next Monday might be, it should be clear, the sp'500 is set for the third consecutive monthly close under the 10MA (currently @ 2025)... and that is NOT bullish.

Goodnight from London

--

*the weekend post will be on the US weekly indexes

sp'weekly6

sp'monthly1b

Summary

It is notable that we're currently set for a net monthly gain, somewhere in the range of 0.5-1.5%.

No matter how strong next Monday might be, it should be clear, the sp'500 is set for the third consecutive monthly close under the 10MA (currently @ 2025)... and that is NOT bullish.

Goodnight from London

--

*the weekend post will be on the US weekly indexes

Daily Index Cycle update

US equity indexes closed moderately mixed, sp -3pts @ 1948 (intra high

1962). The two leaders - Trans/R2K, both settled higher by around 0.5%

Near term outlook offers further upside to at least the 2K threshold.

Best case is the 200dma in the 2020/25 zone, or the 2038/43 gap zone..

by FOMC week (March 14th).

sp'daily

Dow

Summary

Suffice to add, a new cycle high of sp'1962.. well above the marginal double top of 1946/47.

Despite closing net lower, the sp'500 and the Dow both attained a second consecutive daily close above their respective 50dma.

Near term outlook is bullish into next Monday/end month.. and broadly into mid March.

--

a little more later...

sp'daily

Dow

Summary

Suffice to add, a new cycle high of sp'1962.. well above the marginal double top of 1946/47.

Despite closing net lower, the sp'500 and the Dow both attained a second consecutive daily close above their respective 50dma.

Near term outlook is bullish into next Monday/end month.. and broadly into mid March.

--

a little more later...

Friday, 26 February 2016

VIX falls for a second week

Whilst equities closed the week moderately mixed, the VIX clawed moderately higher into the weekend (having seen a notable opening low of 18.46), settling +3.7% @ 19.81. Near term outlook is for volatility to remain broadly subdued into mid March.

VIX'60min

VIX'daily3

VIX'weekly

Summary

*The VIX saw a net weekly decline of -3.5%.

--

Price structure on the hourly chart is a clear bear flag - with a corresponding baby bull flag on the hourly equity cycle.

It would seem we'll see renewed equity upside next Monday, with VIX cooling to the 18/17s.

Broadly, the VIX will likely remain subdued into mid March.. before a key floor is put in. If sp'2020/40 zone, then VIX looks set for a brief foray to the 16/15s.

--

more later... on the indexes

VIX'60min

VIX'daily3

VIX'weekly

Summary

*The VIX saw a net weekly decline of -3.5%.

--

Price structure on the hourly chart is a clear bear flag - with a corresponding baby bull flag on the hourly equity cycle.

It would seem we'll see renewed equity upside next Monday, with VIX cooling to the 18/17s.

Broadly, the VIX will likely remain subdued into mid March.. before a key floor is put in. If sp'2020/40 zone, then VIX looks set for a brief foray to the 16/15s.

--

more later... on the indexes

Closing Brief

US equity indexes closed moderately mixed, sp -3pts @ 1948 (intra high 1962). The two leaders - Trans/R2K, both settled higher by around 0.5% Near term outlook offers further upside to at least the 2K threshold. Best case is the 200dma in the 2020/25 zone, or the 2038/43 gap zone.. by FOMC week (March 14th).

sp'60min

Summary

*closing hour action: micro chop.. leaning slightly on the upside.

--

.. and another week comes to a close. This year is truly flying faster and faster, as financial and political developments unfold at what feels like an ever increasingly pace.

Price structure (marginally redrawn), remains a baby bull flag.. which bodes for the sp'1970s next Monday.

It is notable that CNBC will give no less than THREE hours of coverage to Mr 'Oracle of Omaha' Buffett, with his media lackey - Ms. Quick, next Monday morning. That has to be good for another 20/25pts, right?

--

Yours truly is merely waiting for mid March - FOMC week... when the current 'everything is fine again' bounce from sp'1810, will surely have maxed out.

The Oscars are Sunday night.... with 'Super Tuesday' fast approaching... the entertainment just keeps on coming!

Have a good weekend :)

--

*the usual bits and pieces across the evening to wrap up the week.

sp'60min

Summary

*closing hour action: micro chop.. leaning slightly on the upside.

--

.. and another week comes to a close. This year is truly flying faster and faster, as financial and political developments unfold at what feels like an ever increasingly pace.

Price structure (marginally redrawn), remains a baby bull flag.. which bodes for the sp'1970s next Monday.

It is notable that CNBC will give no less than THREE hours of coverage to Mr 'Oracle of Omaha' Buffett, with his media lackey - Ms. Quick, next Monday morning. That has to be good for another 20/25pts, right?

--

Yours truly is merely waiting for mid March - FOMC week... when the current 'everything is fine again' bounce from sp'1810, will surely have maxed out.

The Oscars are Sunday night.... with 'Super Tuesday' fast approaching... the entertainment just keeps on coming!

Have a good weekend :)

--

*the usual bits and pieces across the evening to wrap up the week.

3pm update - moderate chop

Despite a little cooling to sp'1945 - from the early morning high of 1962, US equities still look on track for the 1970s next Monday... with a viable straight run to the 2K threshold. For now, there is simply no real downside pressure, as the mainstream are increasingly confident that 'everything is fine'.

sp'60min

VIX'60min

Summary

*VIX teasingly breaks back above the key 20 threshold.... but I think we'll settle back under it. It remains notable that we saw 18.46 this morning!

--

The smaller 5/15min cycles are now on the low side. Considering the bigger daily/weekly cycles, renewed upside into the close looks due.

In any case.. its been a week for the equity bulls.

-

back at the close

sp'60min

VIX'60min

Summary

*VIX teasingly breaks back above the key 20 threshold.... but I think we'll settle back under it. It remains notable that we saw 18.46 this morning!

--

The smaller 5/15min cycles are now on the low side. Considering the bigger daily/weekly cycles, renewed upside into the close looks due.

In any case.. its been a week for the equity bulls.

-

back at the close

2pm update - baby bull flag

US equities remain moderately mixed, but price structure is offering a baby bull flag. The sp'1970s look due next Monday... with a viable straight run to the 2K threshold. The only issue seems to be whether the bull maniacs can hit the 200dma.. or even the 2038/43 gap zone in FOMC week.

sp'60min

VIX'60min

Summary

*VIX remains twitchy, having swung from an opening low of 18.46 to the mid 19s. It would seem likely we'll see a weekly close under the key 20 threshold.

--

Little to add.. on what is a subdued day.

The US political developments continue to be rather interesting though.

--

stay tuned

sp'60min

VIX'60min

Summary

*VIX remains twitchy, having swung from an opening low of 18.46 to the mid 19s. It would seem likely we'll see a weekly close under the key 20 threshold.

--

Little to add.. on what is a subdued day.

The US political developments continue to be rather interesting though.

--

stay tuned

1pm update - the bullish hysteria returneth

Not surprisingly, with US equities continuing to broadly climb up and away from the Feb'11th low of sp'1810, the bull maniacs are starting to get overly confident again. Stoltzfus of Oppenheimer is just one of many guests in the mainstream now touting a broad rally to year end.

sp'weekly8f

Summary

Indeed, as expected. with continued upside, the mainstream are starting to increasingly confident again.

It is utterly ironic of course, considering that just a few weeks ago they were getting real upset, with talk of possible QE4 and NIRP.

--

sp'2300s?

My original outlook was for a late spring/summer washout to the 1600s... and then year end to 2185.

For now... I think its merely a case of seeing what the bears can manage in the next wave lower from mid March onward.

A grander issue remains capitulation in the oil/gas/mining industry. How much upset might that cause? Is Deutsche bank going to be taken down? If so... its hard to imagine the sp'500 being able to hold 1600.

-

Just noticed...

Pretty interesting to see another analyst tout the sp'1600s, and I'll give clown finance TV some credit for balancing out some of the bullish hysteria.

--

back at 2pm

sp'weekly8f

Summary

Indeed, as expected. with continued upside, the mainstream are starting to increasingly confident again.

It is utterly ironic of course, considering that just a few weeks ago they were getting real upset, with talk of possible QE4 and NIRP.

--

sp'2300s?

|

| Stoltzfus - sp'2300s by end 2016. |

My original outlook was for a late spring/summer washout to the 1600s... and then year end to 2185.

For now... I think its merely a case of seeing what the bears can manage in the next wave lower from mid March onward.

A grander issue remains capitulation in the oil/gas/mining industry. How much upset might that cause? Is Deutsche bank going to be taken down? If so... its hard to imagine the sp'500 being able to hold 1600.

-

Just noticed...

Pretty interesting to see another analyst tout the sp'1600s, and I'll give clown finance TV some credit for balancing out some of the bullish hysteria.

--

back at 2pm

12pm update - Gold and miners under pressure

Whilst the broader equity market remains pretty subdued, but still leaning on the upside, there is notable weakness in the precious metals. Gold -$16, with Silver -2.7%. The related miners are naturally on the slide, with the miner ETF of GDX -3.5% in the $18.70s.

GLD, daily2

GDX, daily

Summary

As Mr Market looks set to claw upward for another 2-3 weeks, Gold is losing its fear bid... and that is naturally dragging the miners lower.

Note the black-fail candles for GLD and GDX from 2 days ago...marking an exhaustion top. Whether GDX floors in the 17s, 16s.. or 15s.. difficult to say.

Whatever level Gold/miners are trading in FOMC week (March 14th)... I'll be looking to buy.

--

VIX update from Mr T.

--

time for lunch

GLD, daily2

GDX, daily

Summary

As Mr Market looks set to claw upward for another 2-3 weeks, Gold is losing its fear bid... and that is naturally dragging the miners lower.

Note the black-fail candles for GLD and GDX from 2 days ago...marking an exhaustion top. Whether GDX floors in the 17s, 16s.. or 15s.. difficult to say.

Whatever level Gold/miners are trading in FOMC week (March 14th)... I'll be looking to buy.

--

VIX update from Mr T.

--

time for lunch

11am update - moderately higher

US equity indexes remain holding moderate gains, with the sp'500 comfortably above the 50dma. A weekly close in the 1965/75 zone remains probable, as momentum continues to swing toward the bulls on the bigger weekly cycles. Of course, broadly... the monthly charts remain outright bearish.

sp'60min

sp'weekly1b

Summary

*note the floor spike on the weekly candle... HIGHLY suggestive of further upside to at least 2K.

--

Dare I say, its feeling a little tedious, or maybe I'm just tired having returned from retail land.

There is next to zero downside pressure. So... a bit of chop.. but leaning on the upside into the weekend.

--

Here in London city....

Fine enough.. to end the week.

--

time to cook

sp'60min

sp'weekly1b

Summary

*note the floor spike on the weekly candle... HIGHLY suggestive of further upside to at least 2K.

--

Dare I say, its feeling a little tedious, or maybe I'm just tired having returned from retail land.

There is next to zero downside pressure. So... a bit of chop.. but leaning on the upside into the weekend.

--

Here in London city....

Fine enough.. to end the week.

--

time to cook

10am update - opening gains

US equities open moderately higher, and unlike yesterday, having put in a daily close above the 50dma in the sp'1950s, the current gains are arguably less shaky/unreliable than yesterday. It would seem to merely be a case of whether we close in the 1950s, 60s.. or the very viable 1970s.

sp'60min

VIX'60min

Summary

*VIX opens in the mid 18s... reflecting the 'everything is fine again' market complacency.

.. and no.. I don't think the opening VIX reversal candle is anything for the equity bulls to be concerned about.

--

A fair bit of equity price chop seems likely today.. not least as the market will still tend to want to consolidate after the Wednesday reversal. What should be clear, having now broken into the 1960s... 2K is well on the way.

--

notable weakness, miners, GDX, daily

Gold and the related mining stocks look highly vulnerable across the next 2-3 weeks, before the next powerful push higher. Primary upside target is $25/26.. by late April/May... along with Gold $1300.

--

time to shop... back soon

sp'60min

VIX'60min

Summary

*VIX opens in the mid 18s... reflecting the 'everything is fine again' market complacency.

.. and no.. I don't think the opening VIX reversal candle is anything for the equity bulls to be concerned about.

--

A fair bit of equity price chop seems likely today.. not least as the market will still tend to want to consolidate after the Wednesday reversal. What should be clear, having now broken into the 1960s... 2K is well on the way.

--

notable weakness, miners, GDX, daily

Gold and the related mining stocks look highly vulnerable across the next 2-3 weeks, before the next powerful push higher. Primary upside target is $25/26.. by late April/May... along with Gold $1300.

--

time to shop... back soon

Subscribe to:

Comments (Atom)