US equity indexes have already managed to swing from sp'2006 to 2018, a daily close in the 2020s is now on the menu.. along with an eleventh consecutive net daily decline in the VIX. Oil has similarly swung upward, currently +1.6% in the $48s.

sp'60min

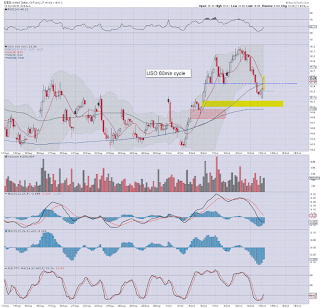

USO'60min

Summary

Well.. those equity bears getting overly excited at the open are now already getting close to throwing bricks at their trading screens.

There is clearly no downside power... and the scary aspect remains if that we see any sustained action >2060.. its over for the bears.. for a very long time. It ain't looking good.

--

notable weakness: TVIX -1.7% in the $7.30s.

--

*having got my ass kicked a week ago, I am extremely cautious in taking any further trades, and have naturally not got involved... after an opening reversal candle in Oil (5min cycle).

So I'm sitting here knowing I could have made an easy 20/25% on USO Dec calls. Its broadly... depressing.

-

back at 12pm... probably.