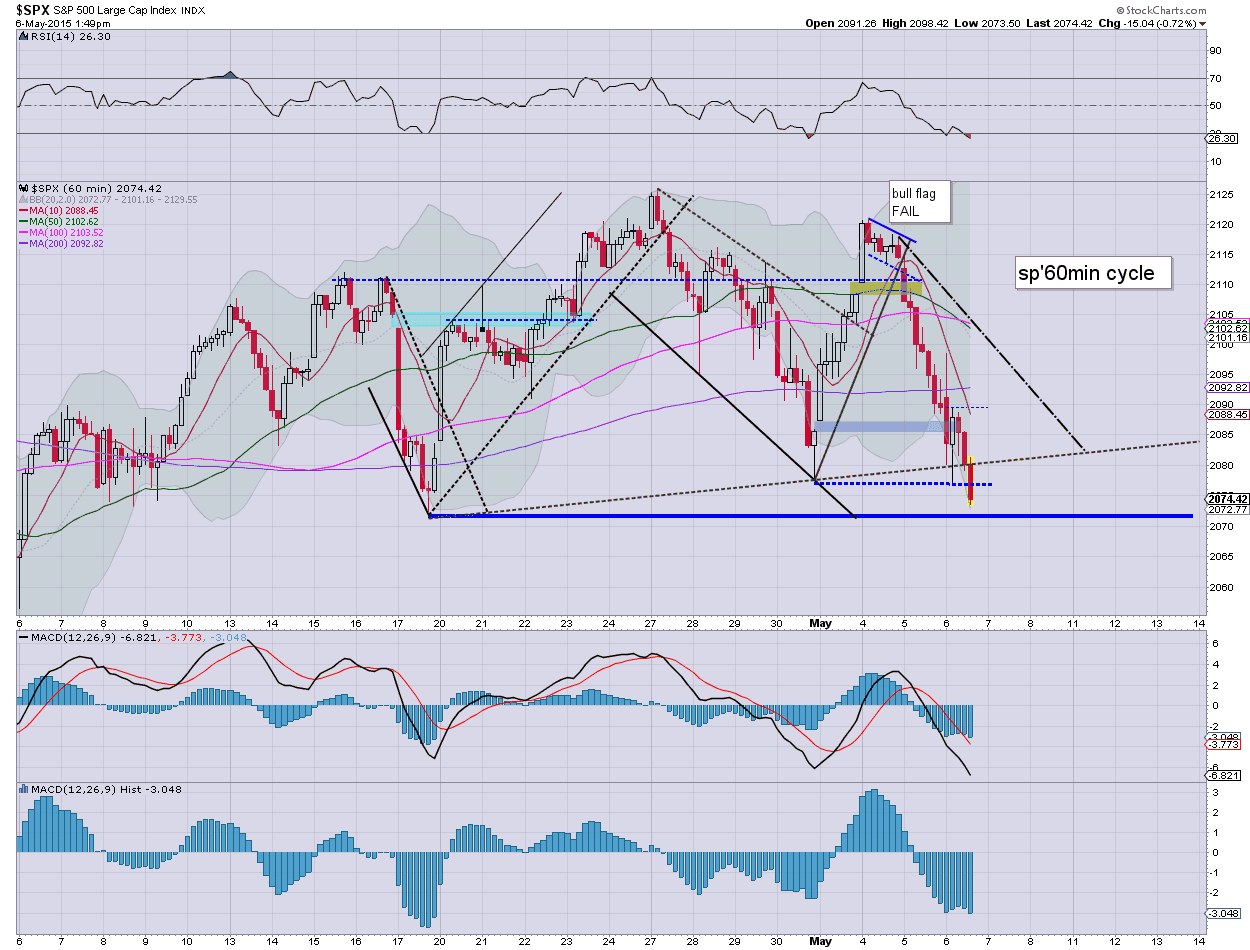

Equities are still weak, and have broken a marginally lower low.. to sp'2075. Next support is the April 17'th low of 2072. After that.. there really isn't anything until the 200dma.. @ 2028. Metals remain weak, Gold -$2.. and looking vulnerable. Even Oil is now battling to stay positive, +0.6%.

sp'60min

GLD, 60min'2

Summary

*I am short GLD, price structure remains a large H/S formation, within the broader down trend from 2011. Considering the weaker USD, Gold is performing exceptionally poorly.

--

So much for the double floor of sp'2077... we're clearly still slipping lower.

Where are the buyers?

Can the bull maniacs really blame the Yellen this morning with her equity comments?

--

notable strength: BABA +0.4%.. ahead of Thursday morning earnings. Despite the current gain though, the break of the $80 threshold yesterday is extremely bearish.. and the door is open to $70/68.. which is around 15% lower.

2.21pm.. approaching afternoon turn time of 2.30pm (don't ask why.. it just often is)....

Market with a soft floor of sp'2073... regardless of where we close.. and even tomorrow.. now its a case of how the Friday jobs data is perceived.

notable weakness: AAPL, -1.5% in the $123s.

-

2.37pm... most indexes taking out the April 17'th low (equiv' to sp'2072)...

A daily close <2072 would be very bearish, and suggestive of weakness to the 2040/30 zone.. where the 200dma will soon be lurking.

Regardless of the close... some notable technical damage has now been done on the daily/weekly cycles.

VIX reflecting the concern... +12% in the 16s.