With the ECB announcing what is effectively QE-pomo for the EU equity markets, the USD continued to climb, settling higher by a very significant 164bps (1.8%) @ 94.72. The giant 100 threshold looks a given in the first half of this year.

USD, monthly

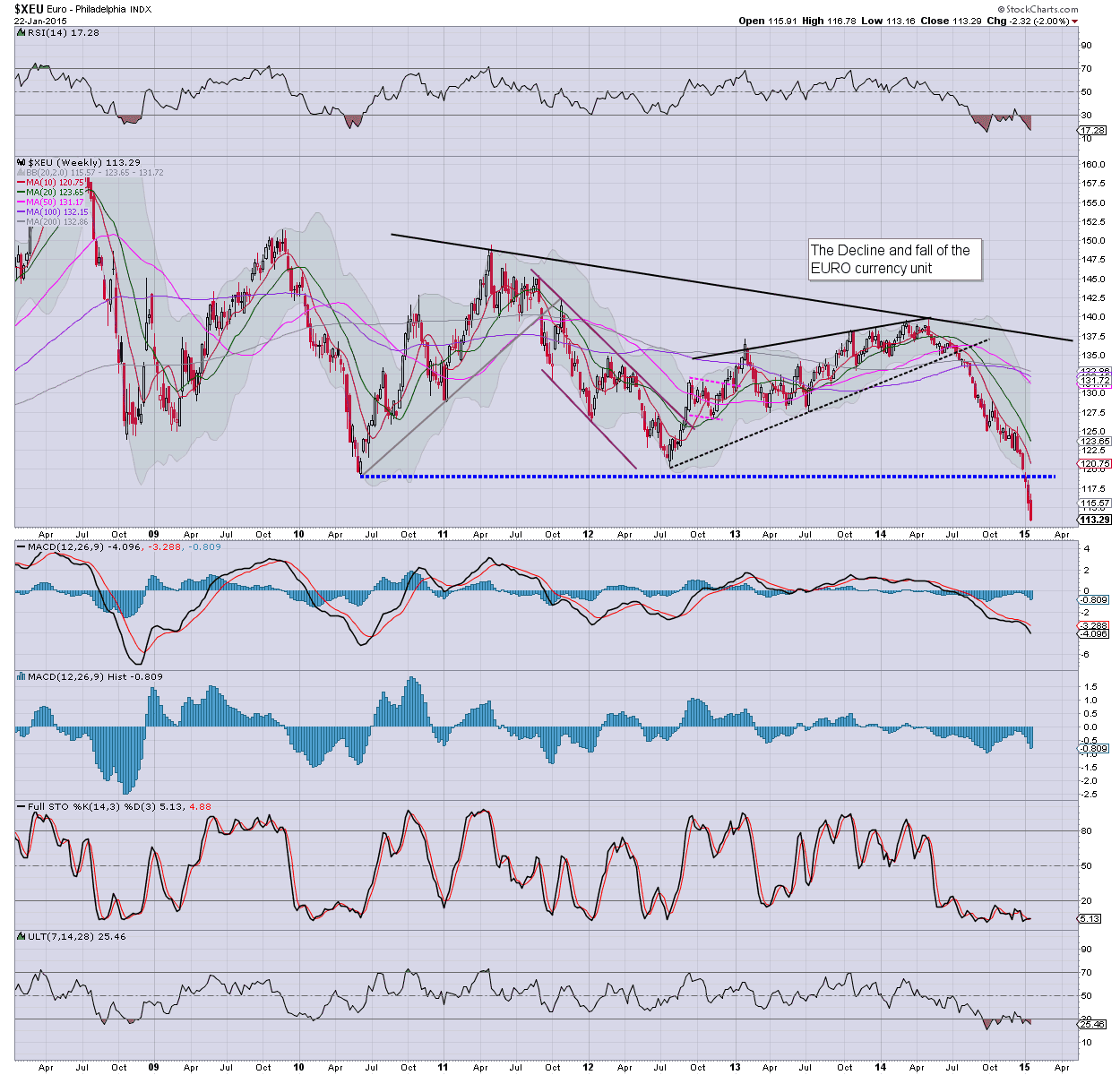

Euro, weekly

Summary

So.. the ECB has finally cracked, and is now planning to start buying Govt. bonds in March, and at least continue until Sept' 2016. The whole program should be seen as equivalent to the US Fed's QE-pomo.

Not surprisingly, the Euro continues to implode... parity is coming. Even then... the bigger issue is what happens across the next few years?

Scenario'1 - One (if not 2-3) of the weaker EU members, namely Greece, Spain, Portugal, abruptly leave

2 - an agreement is made for a two tier euro, although that is hard to believe as viable.

3 - complete disintegration of the euro.. with ALL member states going back to their original currency.

The third scenario would be a horror story for the European Union, and right now.. it remains a VERY valid outcome, considering the underlying structural problems.. few of which are being addressed.

--

As for the US equity market...

sp'weekly7

The first green candle of the year... and a weekly close in the sp'2070s is now viable.. as the daily charts would suggest. First key target are the sp'2120/30s by mid February.

--

Looking ahead

Friday will see a trio of data - PMI manu', existing home sales, leading indicators. If those all come in 'reasonable' that will be enough to kick the market into the sp'2070s.. a mere 1% from breaking a new historic high.

-

Update from Mr C

--

Goodnight from London