After a collapse wave to sp'2097.. the market is back to flat.. with the VIX similarly u/c in the 14.10s. There is far more notable action in the precious metals, with Gold -$10, whilst Silver -0.8%. Oil is +2.5% in the $47s.. and that is no doubt part of the reason for the market pushing back upward.

GLD, daily

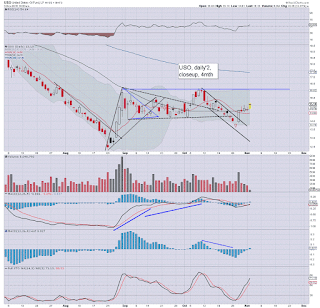

USO, daily2

Summary

re: Oil. Considering the supply issue is 100% unresolved.. sustained action >$50 threshold looks very difficult. Indeed, we've another pair of inventory reports across the next 24hrs, and neither of those will favour the oil bulls.

--

Gold bugs have had a real tough time since last weeks FOMC (note the hyper bearish engulfing candle, marking a key turn).. with Gold now lower for the fifth consecutive day. The bear flag has arguably been confirmed.. with a break of support this morning.

The notion of $1072 being a key low.... makes no more sense than the $1130 low of last year.

Naturally.. the related miners are weak, GDX -1.2%

-

back at 12pm