sp'60min

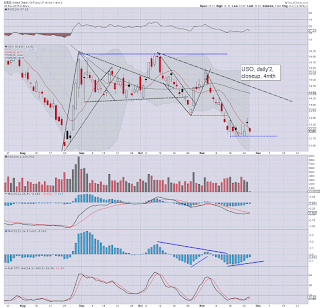

USO, daily2

Summary

|

| Santa @ the NYSE... Dr Evil @ Nasdaq ? |

---

Equity bulls need to see the market react at least moderately favourable to the latest EIA oil report.. due at 10.30am.

Some algo-bot melt is possible today.. but.. in theory.. it won't likely be much.. as price action will likely get increasingly subdued. I guess that will offer me opportunity to highlight all sorts of things this afternoon.

-

PMI service sector: 56.5... nothing bad there.

New home sales.. 495k... a touch under expectations.. but better than the previous 468k.

Consumer sentiment: 91.3... a little weak. Do we blame the weather for that?

.. back at 10.30am.. for the Oil report.

-

10.31am.. 961k oil inventory surplus... not horrific, but then... neither is it a negative number.

Consider the current daily cycle... I'd guess Oil will still manage to hold $40 in the near term... and proceed at least to $45.

.. as things are.. Oil is -1.5%.... battling to turn positive by the close.