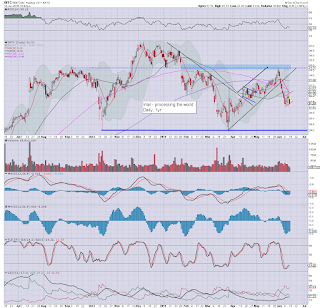

Whilst the broader market is only moderately lower, Intel (INTC) remains a real problem for those equity bull maniacs (myself included?) who are seeking new highs in the near term. Current price structure is a rather clear bear flag.. with viable downside to the low $29s... all within a much grander H/S formation.

INTC, daily

INTC, weekly

Summary

*a diversion from the main indexes/VIX... for this hour...

--

I have been increasingly watching INTC across the last few days... and we now have a smaller scale bear flag.. that is arguably already being confirmed with today's sig' decline.

Is INTC an appropriate stock to extrapolate to the broader market?

I guess some could argue about that for hours... but I think it is a very important issue.

-

meanwhile... clown finance TV asking the obvious question...

Mainstream consensus remains pretty tight in the 2200s Such a yearly close won't be easy if we're trading around 2000/1900s in Sept/Oct.

--

stay tuned