With the ECB deciding to start buying Govt' bonds with more money from nowhere, equities managed the first weekly gain of the year. Net changes ranged from 2.7% (Nasdaq comp'), 1.6% (sp'500), to 0.9% (Dow). Outlook is broadly bullish, at least into the low sp'2100s.

Lets take our regular look at six of the main US indexes

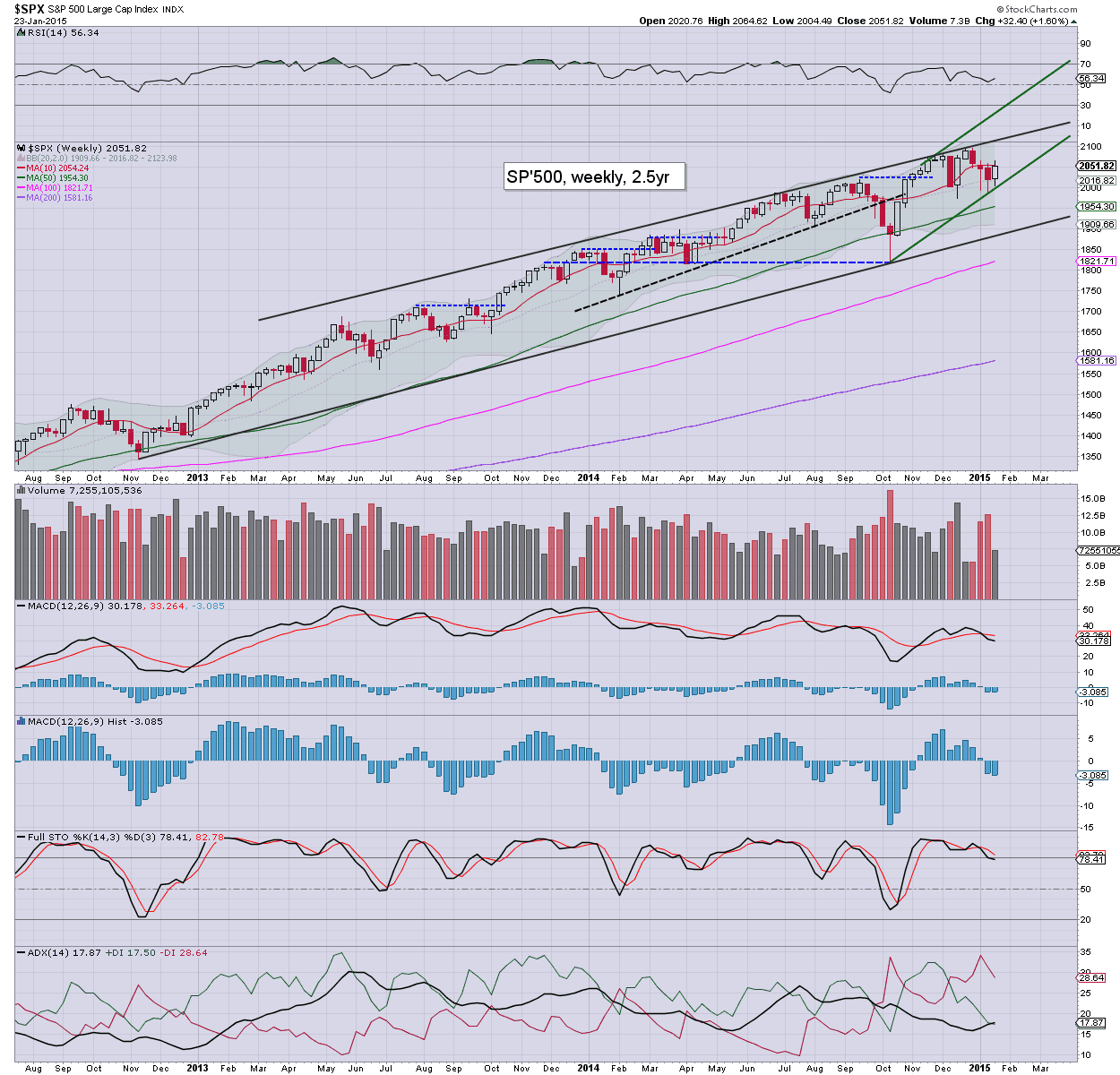

sp'500

Like all other indexes, the sp'500 saw the first net weekly gain of the year, 32pts (1.6%).. settling the week just under the 10MA @ 2051. Despite the gains, the underlying MACD (blue bar histogram) cycle ticked lower for the fourth consecutive week. There is no decisive turn.. yet.

As things are, equity bears need to break under the giant 2k threshold, which would open up the lower weekly bol' around 1910, but frankly... that seems highly unlikely. Far more probable, is that the market will continue higher into February. First target as suggested by the weekly charts are the sp'2120s.

Nasdaq comp'

The tech' is leading the way higher, with a gain of 2.7%... now just 375pts away from challenging the March'2000 bubble high of 5132. With the somewhat significant weekly gain, the MACD cycle ticker higher, but will still likely take another 6 trading days to turn positive cycle.

Dow

The mighty Dow was the laggard this week, climbing a somewhat moderate 0.9%. The Dec' high of 18103 looks set to be broken, upper weekly bol' is offering the 18400/500s by mid/late February. Critical support remains the 17k threshold... and that doesn't look in danger for some months.

NYSE comp'

The master index gained 1.2% this week, and remains within a trading range that has endured since last summer. There is viable upside to the 11200s, which is a clear 5% higher... equiv' to sp'2150 or so.

R2K

The second market leader gained 1% this week. The past 3 weekly candles are all offering rather clear spike floors around the soft threshold of 1150. It would seem highly probable that the R2K will break new historic highs into February. Upper bol' is offering the 1230s in the near term.

What should especially concern the equity bears is that the R2K - having lagged the broader market for most of 2014, broke a new high into year end. R2K in the 1500s remains a very valid target by end 2015, unless there is a very strong inter'4 down wave this late spring/summer. Considering the ECB will be launching their own QE-pomo program for the EU markets in March... any down waves are likely to be very minor.

Trans

The tranny declined by a rather sig' -1.8% at the Friday close (despite lower oil prices), but still saw a net weekly gain of 2.5%. The Nov' high of 9310 looks set to be broken within the next 2-3 weeks.. and the only issue is when the giant 10k threshold will be hit... before end spring... or late 2015?

Summary

So.. net weekly gains for all the main US indexes, and indeed.. the first weekly gain of the year. Tech' is leading the way, followed by the Trans/R2K.

Taken as a collective, it would seem highly probable that the equity bulls will be able to claw the market higher into end month.. if not also the first half of February. The issue is where will the market next get stuck... sp'2100, 10s, 20s.. or even the 2150s (as offered on the giant monthly cycles)?

Best guess.. at least 2110/20s... before the next opportunity for a minor retrace.

--

Looking ahead

Next week is a pretty important one... with the rather important GDP data on Friday. If that comes in higher than 3%, it will again awaken the mainstream that the US economy is still growing. Naturally, the chatter will then turn to when rates will increase.

M - PMI service sector

T - Durable goods, case shiller HPI, consumer con', new home sales

W - FOMC announcement (2pm)

T - weekly jobless claims, pending home sales

F - GDP Q4, Chicago PMI, consumer sent'

--

back on Monday :)