As 2014 turns to 2015... it has unquestionably been a sixth year for the equity bull maniacs. The sp'500 saw a net gain of 210pts (11.4%) settling at 2058. Perhaps the most notable aspect of the year, was the collapse in energy prices, with WTIC Oil swinging from a June high of $107 to the $52s.

Lets take a look at a few random bits and pieces to wrap up the year

*see my Gold page for details on the precious metals.

--

sp'monthly8 - QE phases

A key aspect of 2014 was QE taper. Despite some distinct weakness from the Alibaba top of September to mid October, the market has coped very well with the cessation of Fed money printing. As many have recognised, despite the Fed ending QE.. the BoJ and the ECB are continuing to print, and much of that money is flowing into the US. It is now a case of indirect QE... helping to push US equities broadly higher.

R2K, monthly

The R2K was the big laggard across the year, having seen a classic double top of 1212/13 in March/July.. to hit a cycle low of 1040. Surprisingly, the R2K managed to break a new historic high before year end of 1221.. and now looks set for 1250 in the near term. A much grander target of the 1500s look very viable in late 2015.

Copper, monthly

Across 2014, Copper declined by -16.5%, and looks set for the low $2s in first half of 2015. The $3 threshold is going to be tough resistance, and considering the broader economic picture, it is entirely possible that $3 won't be seen again until well into 2016.

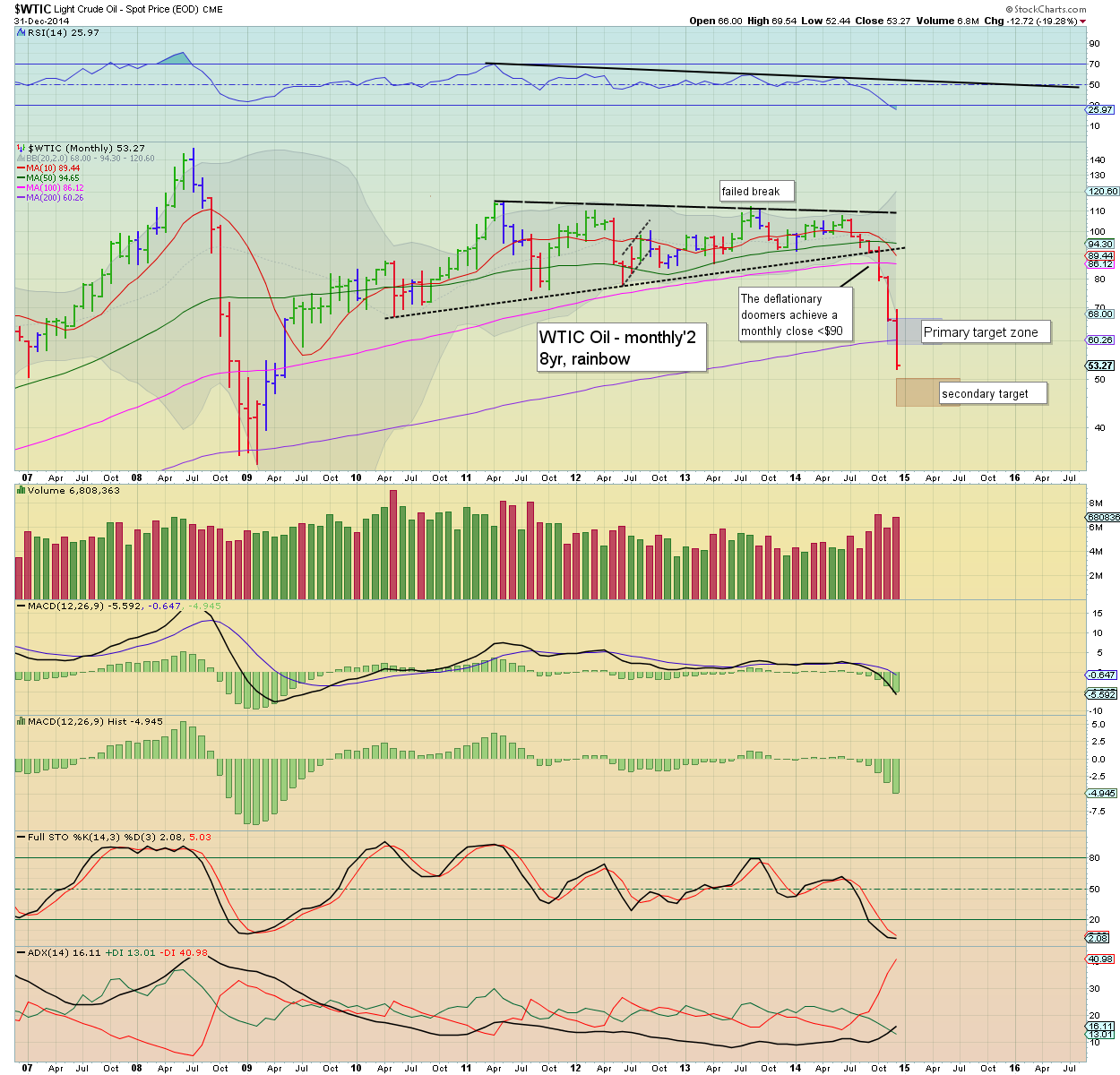

WTIC Oil, monthly'2

Oil declined from $98.70 (June peak $107.68).. to settle at $53.27.. a net yearly decline of $45.43.. a simply astounding drop of 46%. I thought I was being bold to call for the $65/60 zone - when Oil broke support of $90 in October, but to see the low $50s... it really is amazing.

Lower Oil is unquestionably a good thing for just about every sector (notably not energy!). Yes there are issues of debt, and lower capital expenditure... but those should be hugely outweighed by more money for the average consumer. Further.. most industry - whether manufacturing or service sector, should see significant efficiency gains via much lower energy/input costs.

If Oil can remain under $70 for the entirety of 2015 - which now seems increasingly likely, it will be a massive stimulus boost to not just the US... but the world economy.

USD, monthly2

The USD saw continued chop in the first half of the year, but since July... six months.. straight up. The yearly close in the 90s is VERY significant.. and bodes for 100 in first half of 2015. Higher USD will be a huge downward pressure on the precious metals and Oil.

US 10yr t-bond yield, with outlook

Yields peaked in January at 3.01.. and broadly fell across the year. The year end close of 2.17% does not offer a definitive floor, but I'm guessing yields have likely floored at 2.07. Will need to see 2.50s or higher.. for clarity. MACD (grey bar histogram) cycle is offering no sign of a turn yet.. but is clearly on the low end.

In terms of the outlook... merely extrapolating the previous cycle provides a target turn time of late 2015... which might equate to equities maxing out in late 2016.. and collapsing into mid 2018. Certainly, its something I think merits consideration.

New Years day

I'll post my 2015 outlook... along with others end-2015 submissions this Thursday.

Regardless of that.... good wishes for 2015

Goodnight from London