The US equity market begins the last month of the year with some moderate weakness. The real dynamic action though remains in commodities. Precious metals are soaring, Gold +$27, with Silver +4%. Energy prices remain weak, Oil -0.4%, Nat' gas -4.3%

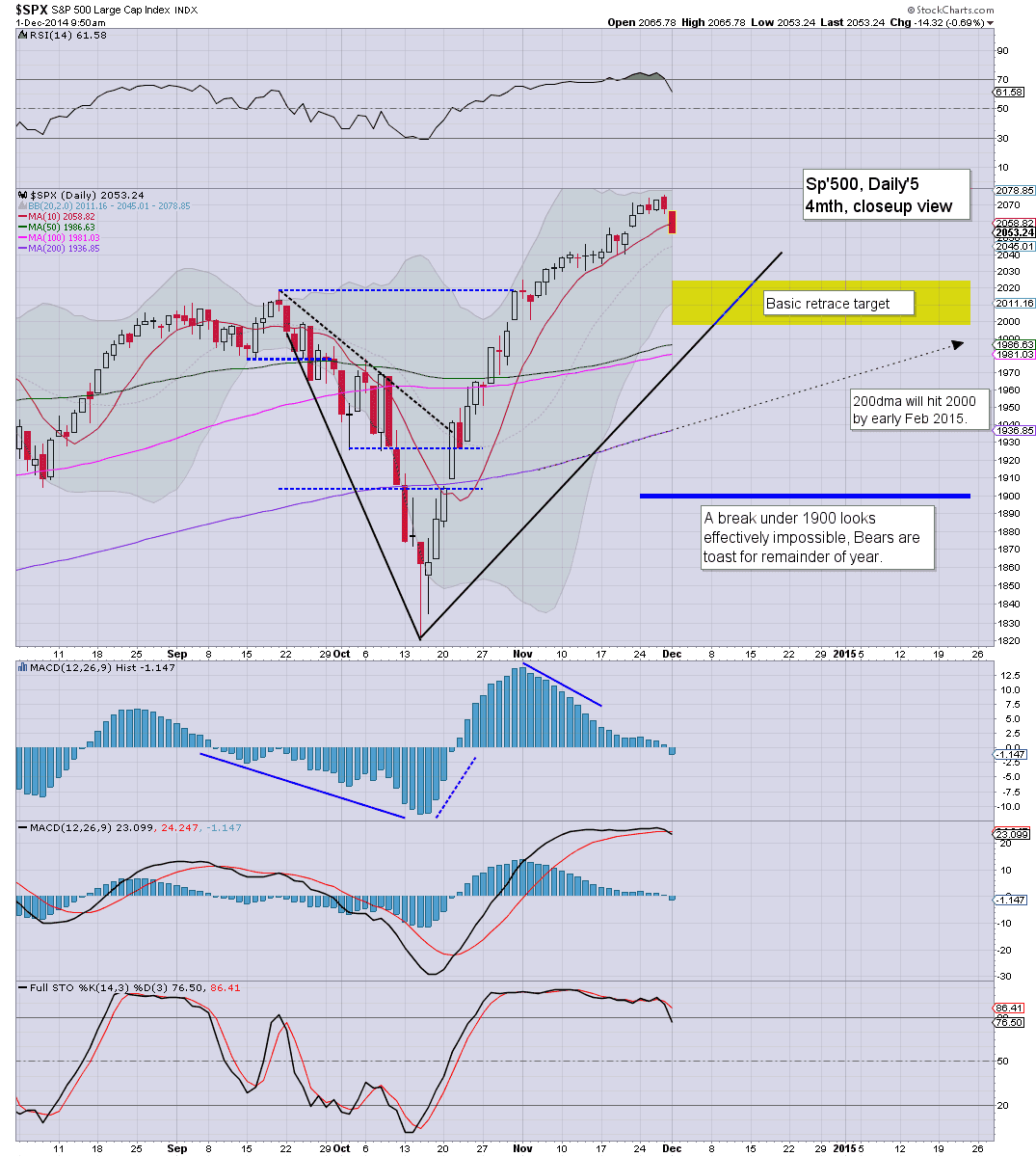

sp'daily5

GLD, daily

Summary

*USD is -0.55%, and that is no doubt helping the metals get an extra kick higher.

---

So, we're a little lower. At best.. perhaps sp'2020/00 zone.. but in the scheme of things, is that really anything to get excited about?

-

The move in the metals is pretty bizarre, not least after overnight action. No doubt right now, most of those short across the weekend have been stopped out.

-

notable weakness...

FCX -2%.. testing the low from summer 2013

DRYS -3%... sub $1 looks viable... ugly.

Coal miners.. BTU -2%.. with BTU breaking new multi-year lows.

-

VIX is +9%, but still.. only in the mid 14s. Even a brief test of the key 20 threshold looks damn tough.. even if the market can manage to go sub sp'2000 for a few days.

-

10.01am.. ISM/PMI manufacturing.. come in 'reasonable'...

sp -12pts @ 2054... still...just 'moderate' declines.

-

10.11am.. Oil/gas drillers seeing major declines...

SDRL.. -4%... in the 13s.

RIG -3%.. set to lose the $20s.