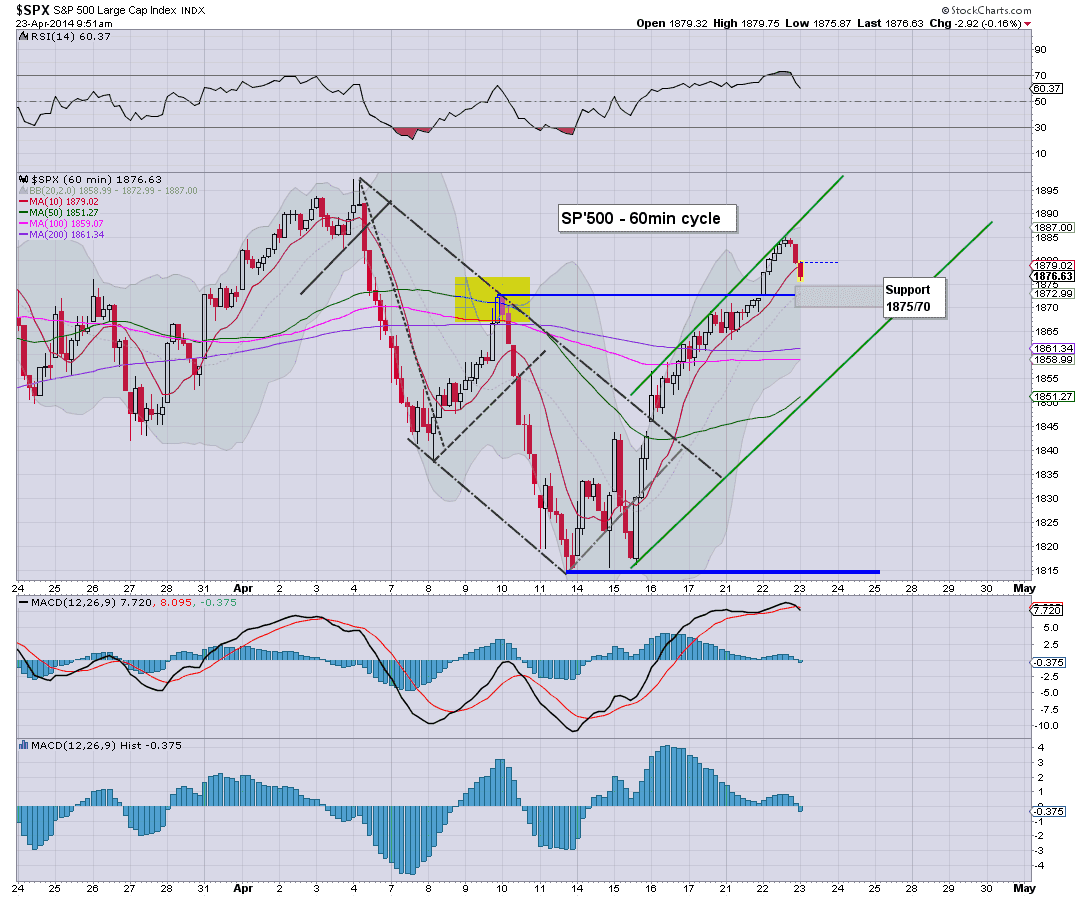

US indexes open a little lower, with likely support in the sp'1875/70 zone. Metals open a touch higher, but look vulnerable...as ever. VIX is +2%, but even the mid teens look difficult to reach.

sp'60min

Summary

*picked up a few positions, (I am in the mood)...

LONG, RIG

SHORT, SLV.

I will probably post something on RIG later this evening.

--

As for the broader market, it remains a case that the equity bears have little downside power. I realise some are still seeking a retrace to the 1850s, but really, that looks difficult.

There is a sig' QE today, and with another two next Mon/Tuesday, bears face the usual problems.

-

notable weakness: NFLX -2.5%, on news that AMZN has a deal with HBO.

10.03am.. minor weakness...I'd be surprised to see the 1860s.

10.09am.. LONG... FCX. , from $33.20s

..and that will suffice for me today. Now its the waiting game.

-

10.36am... Notable strength in Ford (F), +1.1%. A break >16.50 would be bullish for May/June.