Despite a lack of QE-pomo, the market has managed to break new highs today, after an opening gap to 1809, which now looks a fair way down. Equity bears have yet another day to forget. Metals continue to slowly build gains, Gold +$9, and within 1% of testing the 200 day MA.

sp'daily5

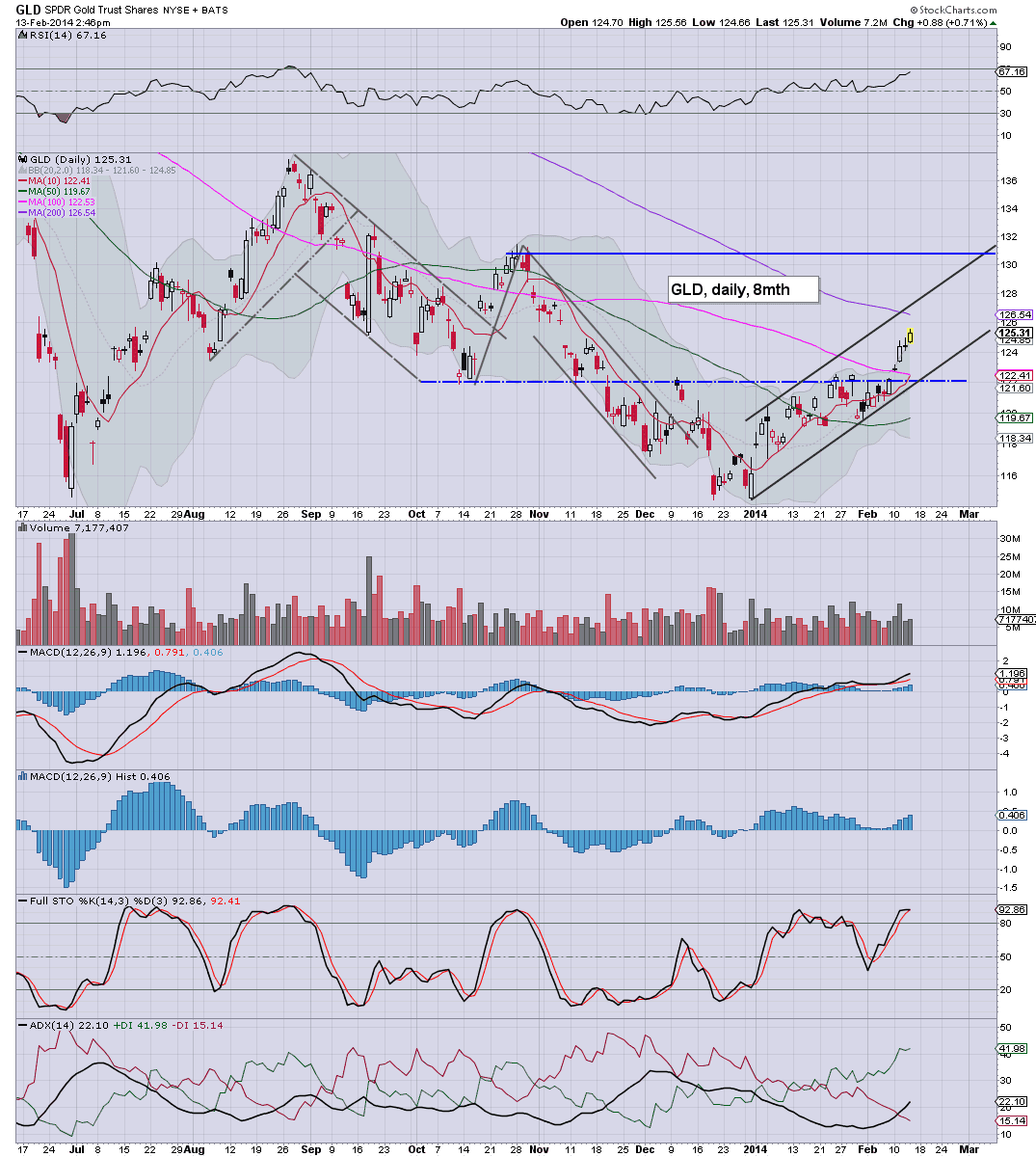

GLD, daily

Summary

*action in the metals and miners is really starting to get interesting. Miners appear to be leading the metals - at least from a 'who is above the 200 day MA' perspective. More on that..after the close, on my other pages.

-

As for the indexes, regardless of the close, this was unquestionably a major fail for the bears, with a latter day recovery/bounce of 21pts (1.3%).

**again, its notable there is no sig' QE-pomo until next week, and yet here we are..having already hit the 1830s. No doubt, there will again be talk of the sp'1900s in March/April...across this weekend.

-

Notable strength: GDX +4.1% - breaking the Tuesday high, and completely reversing yesterday's decline.

-

3.02pm... miners gaining...GDX +4.4%.. a 5% day would be VERY impressive, and bode well for March. Target upside zone would be 30/35. Gold +$10...and looking..'comfortable' at it approaches the big 200 day MA.

3.20pm... The two leaders - Trans/R2K, higher by 0.2% and 1.3% respectively, the latter sure looks bullish on the daily.

3.41pm... Gold and miners still building gains.

As for the indexes, regardless of whether we close in the 1830s..or 20s...it doesn't matter. It'd seem..the best 'minor retracement' was indeed a mere 0.9%..and we're back on the rise.

back at the close.