After some early weakness, most US and world equity indexes built gains across August, ranging from a very powerful 9.8% (Brazil), 3.2% (USA - Dow), to -1.3% (Japan). The outlook for September is for continued upside.

Lets take our monthly look at ten of the world equity markets.

Greece

The Athex was fractionally lower for August, but notably, around 9% above the intra-month low of 1044. Price structure since the start of the year is a rather large bull flag, although there remains strong resistance in the 1300s.

Brazil

The Bovespa soared a very powerful 9.8% in August, breaking into the 60,000s. Next resistance is around 65k, which makes for a clear 5% of near term viable upside.

France

The CAC gained a somewhat impressive 3.2%, having held the somewhat important 4100s. There is viable upside to the giant 5k level within 3-5 months. Equity bears seeking a major intermediate top need a clear break <4k, but that sure doesn't look likely in the immediate term.

Germany

The economic powerhouse of the EU gained just 0.7%. However the monthly candle is a somewhat bullish spike-floor. The 10000s look viable in September, with 10500 by Oct/Nov.

UK

The UK market clawed 1.3% higher, and held above the old resistance/trend that stretches all the way back to late 1999. It is notable that the UK market is yet to break the historic high of 6950. A break into the 7000s would be highly suggestive of a charge to 10k by the end of the current multi-year equity cycle.

Spain

One of the major EU PIIGS, Spain struggled in August, with a fractional net gain of just 0.2%. However, like many other indexes, the monthly candle was a rather bullish spike floor, and it bodes for September upside. Next level is 12k, and that is around 13% higher.

USA

The mighty US Dow gained 535pts (3.2%) in August, having fractionally broken a new historic high of 17153. Upper bollinger is offering the 17500/600s in September. It is notable that by end year, the lower boll' will provide core support around 14k. Under no mid-term outlook is the market likely to be trading <14k

Italy

The Italian market saw a net monthly decline of -0.6%, but that was a clear 8% above the intra-month low. The monthly candle was a spike-floor, and is offering upside in September.

Best case upside looks to be around 23k, some 12% higher.

Japan

The Japanese market remains weak, slipping -1.3%, and is still stuck under the declining resistance that stretches back some two decades. Underlying MACD (green bar histogram) cycle remains negative for a second month. 16k remains a huge level for the bulls to break & hold over.

China

The Shanghai market only gained 0.7% in August, but it was the fourth consecutive monthly gain - the best run since late 2010. The broader downward channel has been broken, and there looks to be near term upside of a further 5% to 2375. Any monthly closes above 2500, should clarify that 3500 - back to the mid 2009 'post crash bounce', is due.

Summary

Despite some weakness in early August, all world indexes saw a very significant rebound into end month. Perhaps most notable, there were quite a few spike-floor candles, which certainly are suggestive of further upside into September.

Unless equity bears can break the early August lows, there is little reason to be particularly bearish for the remainder of the year.

Looking ahead

It will of course be a shortened week, with the US market closed on Monday.

Tuesday will see PMI & ISM manufacturing, along with construction data.

Wed' ADP jobs, factory orders, Fed beige book

Thur' weekly jobs, PMI & ISM service sector

Fri' monthly jobs data

There are a few Fed' officials speaking across Thur/Friday, and as ever.. Mr Market will be listening, notably... Plosser (Fri' morning).

*there is QE next Wed' $1bn, Thurs' $1.5bn

--

Back on Tuesday :)

Saturday, 30 August 2014

Strong gains for August

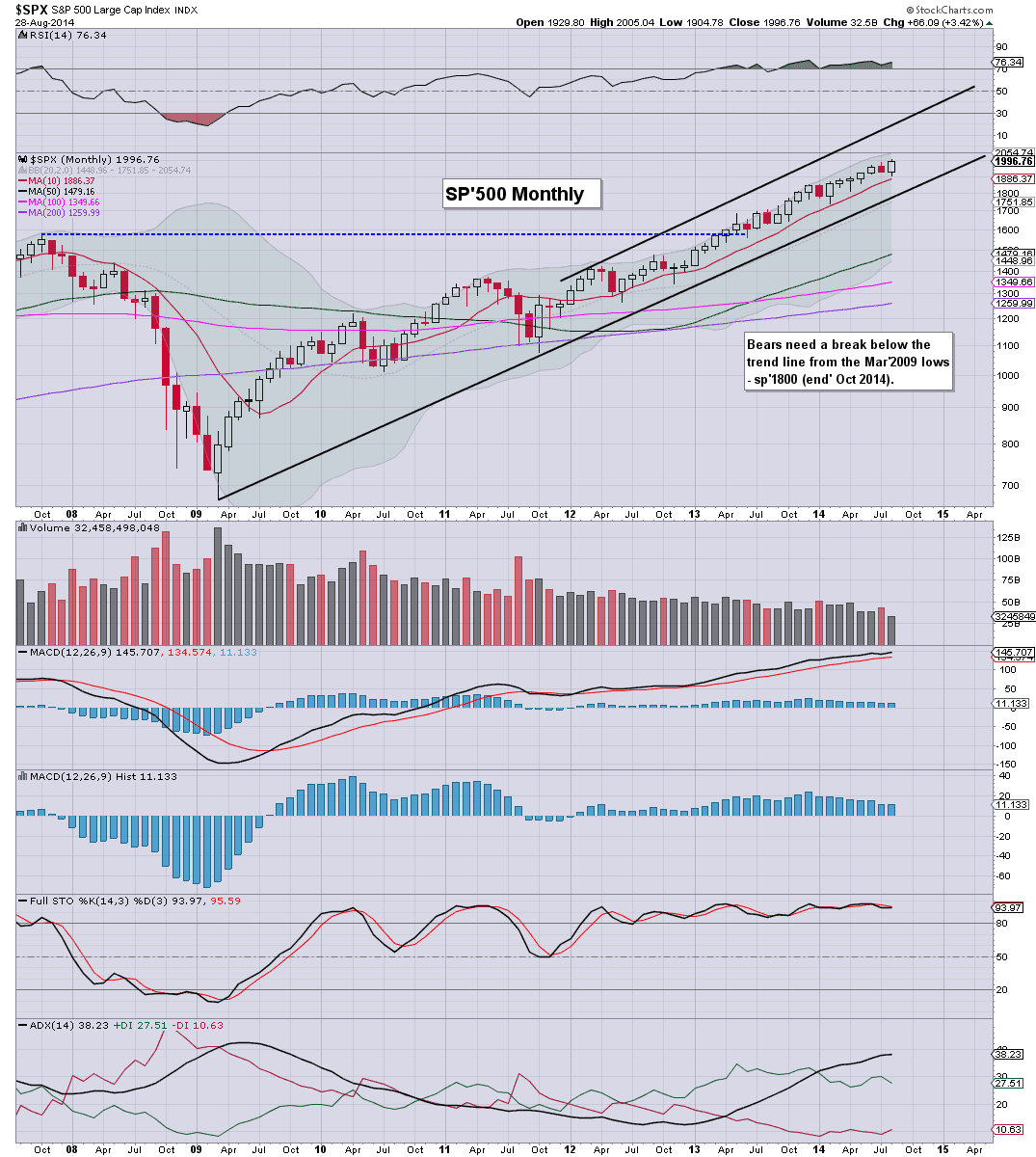

All US equity indexes saw strong net monthly gains, with the sp'500 gaining 72pts (3.8%), having climbed from an early August low of 1904 to a new historic high of 2005. Outlook into September is bullish, with a primary target zone of 2030/50.

sp'monthly

R2K, monthly'2, rainbow

Summary

Unquestionably, it was a month for the equity bulls. Even the laggy R2K saw rather powerful gains of 4.8%.

With bullish engulfing candles on many of the monthly charts, the outlook for September is bullish.. at least to the 2020s, if not the 2030/50 zone.

For me, the only issue is whether the 2100s are coming, before some form of major intermediate correction (on the order of 15% or so). Right now, that is too hard to call, we'll have a much better idea by late September.

Goodnight from London

---

*the weekend update will be on the World monthly indexes

sp'monthly

R2K, monthly'2, rainbow

Summary

Unquestionably, it was a month for the equity bulls. Even the laggy R2K saw rather powerful gains of 4.8%.

With bullish engulfing candles on many of the monthly charts, the outlook for September is bullish.. at least to the 2020s, if not the 2030/50 zone.

For me, the only issue is whether the 2100s are coming, before some form of major intermediate correction (on the order of 15% or so). Right now, that is too hard to call, we'll have a much better idea by late September.

Goodnight from London

---

*the weekend update will be on the World monthly indexes

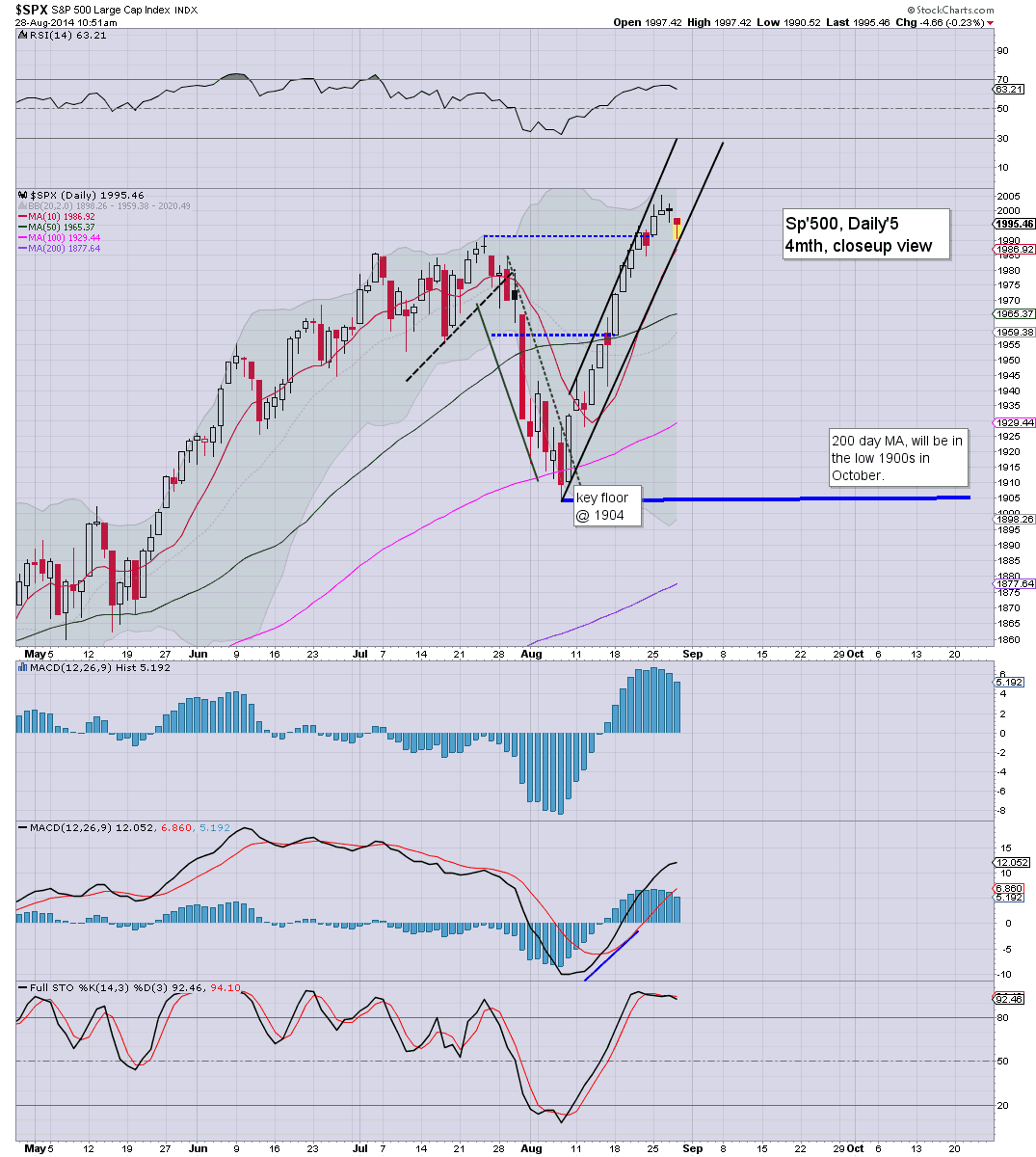

Daily Index Cycle update

US equities closed the week with some minor chop, sp +6pts @ 2003. The two leaders - Trans/R2K, settled u/c and +0.7% respectively. Near term outlook is for the sp'2020s, with 2030/50 in the latter half of September.

sp'daily5

Dow

Summary

Little to add.

A bullish month...a bullish week...and most indexes even managed some tiny gains to end the week.

There is clearly some way to go to test the upper channel on most indexes, probably another 2-3%.

-

Closing update from Riley

--

a little more later...

sp'daily5

Dow

Summary

Little to add.

A bullish month...a bullish week...and most indexes even managed some tiny gains to end the week.

There is clearly some way to go to test the upper channel on most indexes, probably another 2-3%.

-

Closing update from Riley

--

a little more later...

Friday, 29 August 2014

Volatility knocked lower into the weekend

With some underlying geo-political concerns, the VIX held up for most of the day, but was knocked lower into the close settling -0.6% @ 11.98. Near term outlook is for continued equity strength, which will likely keep the VIX within the 13/10 zone.

VIX'60min

VIX'daily3

VIX'weekly

Summary

*across the week, the VIX gained a moderate 4.4% .

--

As is often the case, the VIX was duly knocked lower in the closing hour.. ahead of the long weekend.

VIX in the 11s remains a bizarrely low level, and reflects a market that has effectively zero fear of anything 'significantly scary' in the near term.

VIX 20s look unlikely until at least October.

--

more later.. on the indexes

VIX'60min

VIX'daily3

VIX'weekly

Summary

*across the week, the VIX gained a moderate 4.4% .

--

As is often the case, the VIX was duly knocked lower in the closing hour.. ahead of the long weekend.

VIX in the 11s remains a bizarrely low level, and reflects a market that has effectively zero fear of anything 'significantly scary' in the near term.

VIX 20s look unlikely until at least October.

--

more later.. on the indexes

Closing Brief

US indexes clawed higher into the holiday weekend, sp +6pts @ 2003. The two leaders - Trans/R2K, settled u/c and +0.7% respectively. Near term outlook is for 2020s next week, with 2030/50 in the latter half of September.

sp'60min

Summary

...and another month in the crazy & twisted market comes to a close.

--

It has been a really bullish month, having seen a ramp from sp'1904 to a new historic high of 2005.

Daily/weekly cycles are offering the 2020s next week, which seems very probable.

Sincerely.. have a great holiday weekend everyone!

-

more later... on the VIX

sp'60min

Summary

...and another month in the crazy & twisted market comes to a close.

--

It has been a really bullish month, having seen a ramp from sp'1904 to a new historic high of 2005.

Daily/weekly cycles are offering the 2020s next week, which seems very probable.

Sincerely.. have a great holiday weekend everyone!

-

more later... on the VIX

3pm update - micro melt into the holiday weekend

US equities look set to close the day..week..and the trading month around the giant sp'2000 threshold. It has unquestionably been a very bullish month, with the sp' ramping from 1904 to a new historic high of 2005, along with a VIX that has fallen from the mid 17s.

sp'60min

Summary

Well, it has been one hell of a month.

Many I know were touting sp'1860s at the start of the month.. we never got there..and with a break above the giant psy' level of 2000, Mr Market continues on a very bullish path.

To be clear..

I am VERY open to a short/mid term top in mid/late September, somewhere in the 2030/50 zone.

Problem is..I still fear a pull back in October might only be 3% or so.

-

*I hold long across the weekend, via SDRL, (almost back to flat, after the post earnings miss). Will hold until next Wed/Thursday, seeking 38.50/39s.

--

3.39pm... Indexes all currently fractionally green... and with the 3.33pm howling out of the way.. market looks set for melt higher into the close.

....back at the close.

sp'60min

Summary

Well, it has been one hell of a month.

Many I know were touting sp'1860s at the start of the month.. we never got there..and with a break above the giant psy' level of 2000, Mr Market continues on a very bullish path.

To be clear..

I am VERY open to a short/mid term top in mid/late September, somewhere in the 2030/50 zone.

Problem is..I still fear a pull back in October might only be 3% or so.

-

*I hold long across the weekend, via SDRL, (almost back to flat, after the post earnings miss). Will hold until next Wed/Thursday, seeking 38.50/39s.

--

3.39pm... Indexes all currently fractionally green... and with the 3.33pm howling out of the way.. market looks set for melt higher into the close.

....back at the close.

2pm update - Transports bull flag

US equities continue to quietly churn ahead of a holiday weekend. The sp'500 looks set for a monthly close around the giant 2000 threshold. The 'old leader' Transports is offering a 2 week bull flag.. with the 8500/600s next week.

Trans'daily

Summary

Little to add..

--

Notable weakness: airlines, DAL -1.4%, UAL, 2.1%

Trans'daily

Summary

Little to add..

--

Notable weakness: airlines, DAL -1.4%, UAL, 2.1%

1pm update - net weekly gains

US indexes are holding minor net gains, with the sp'500 hovering around the giant 2000 threshold. VIX is +1%, but will likely get knocked back to negative into the monthly close.

sp'weekly8

Summary

All indexes look set for another net weekly gain. For the sp'500, that will make for the fourth consecutive gain..pretty impressive..and we're almost a clear 100pts above the 1904 low.

-

Weekly MACD cycle will turn positive at the Tuesday open.... the 2020s look an easy target.

sp'weekly8

Summary

All indexes look set for another net weekly gain. For the sp'500, that will make for the fourth consecutive gain..pretty impressive..and we're almost a clear 100pts above the 1904 low.

-

Weekly MACD cycle will turn positive at the Tuesday open.... the 2020s look an easy target.

12pm update - melting higher

With no 'spooky news' this morning, the bears have zero downside power, and market is back into slow algo-bot melt mode to sp'2002. VIX is a touch lower...set for a weekly close in the 11s. Metals remain a touch weak, Gold -$2.

sp'daily5

Summary

...Mr Riley returns... :)

--

VIX update from Mr T.

--

time for lunch

sp'daily5

Summary

...Mr Riley returns... :)

--

VIX update from Mr T.

--

time for lunch

11am update - micro chop

Equities are back to flat, and look set for micro chop across the rest of the day. With the Chicago PMI coming in at a very strong 64.3, and consumer sentiment at 82, there is little for the econ-bears to tout.

sp'60min

Summary

Little to add... micro chop...

Sp'2020s look very likely next week, if the ECB can placate the QE needy markets.

--

Notable strength: TSLA +2%

sp'60min

Summary

Little to add... micro chop...

Sp'2020s look very likely next week, if the ECB can placate the QE needy markets.

--

Notable strength: TSLA +2%

10am update - opening minor gains

US equities open a little higher, back above the giant sp'2000 threshold. Hourly cycles are offering upside into the Friday/monthly close. VIX is melting lower, with a likely close in the 11s. Metals are weak, Gold -$3, and that is not helping the miners.

sp'60min

VIX'60min

Summary

*Most notable, the upper bollinger on the daily, now in the 2020s. Consider that the weekly cycle is also offering the 2020s... it seems a viable level next week.

-

As things are.. we have opening gains... failing.. .and a reversal candle on the VIX.

The problem for the bears... barring a sporadic 'spooky' news headline... just where is the downside power going to come from?

At best.. 1985/80...if that... and then up next week.

10.33am.. sp -1pt..... exciting huh?

Really, for most, nothing to see here today.... turn off ya screens...and enjoy the last days of summer.

sp'60min

VIX'60min

Summary

*Most notable, the upper bollinger on the daily, now in the 2020s. Consider that the weekly cycle is also offering the 2020s... it seems a viable level next week.

-

As things are.. we have opening gains... failing.. .and a reversal candle on the VIX.

The problem for the bears... barring a sporadic 'spooky' news headline... just where is the downside power going to come from?

At best.. 1985/80...if that... and then up next week.

10.33am.. sp -1pt..... exciting huh?

Really, for most, nothing to see here today.... turn off ya screens...and enjoy the last days of summer.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +5pts, we're set to open at 2001. Metals are a touch weak, Gold -$4, whilst Oil is +0.3%. Equity bulls look set to close higher for the fourth consecutive week.

sp'daily5

Summary

*awaiting a trio of econ-data, most notably, Chicago PMI @ 9.45am.

---

So..we're set to open back in the 2000s. Whether the bull maniacs can attain a weekly/monthly close in the 2000s, it is not really important...would merely be a bonus.

Once this mornings econ-data is out of the way, it will likely be a very quiet day..leading into a 3 day holiday weekend.

There are of course end-month trading issues, with (I believe) some degree of rebalancing.

--

9.15am.. Notable early strength: TSLA +2%

9.34am.. Upper bollinger on the daily is now up to 2024..... so..we could easily be in the 2020s next week.

9.45am.. PMI: 64.3 vs 56.4 exp' .. a hugely bullish number... best since May.

sp'daily5

Summary

*awaiting a trio of econ-data, most notably, Chicago PMI @ 9.45am.

---

So..we're set to open back in the 2000s. Whether the bull maniacs can attain a weekly/monthly close in the 2000s, it is not really important...would merely be a bonus.

Once this mornings econ-data is out of the way, it will likely be a very quiet day..leading into a 3 day holiday weekend.

There are of course end-month trading issues, with (I believe) some degree of rebalancing.

--

9.15am.. Notable early strength: TSLA +2%

9.34am.. Upper bollinger on the daily is now up to 2024..... so..we could easily be in the 2020s next week.

9.45am.. PMI: 64.3 vs 56.4 exp' .. a hugely bullish number... best since May.

Minor churn into end month

US equities continued to see subdued trading conditions ahead of the long holiday weekend. All US indexes are set for powerful net monthly gains, and with bullish engulfing candles all over the place, the outlook for September is for further upside of another 1-3%.

sp'weekly8

sp'monthly

Summary

Barring some bizarre Friday decline of 25/30pts, the weekly 'rainbow' chart is set to conclude the week with a second consecutive green candle.

Far more important though, the monthly charts are set to close with very powerful net monthly gains of 3-5%.

Looking ahead

There is a trio of econ-data to wrap up the week... Pers' income/outlays, Chicago PMI, and consumer sentiment. Those should give the market the excuse it needs to either wash out the weaker bulls in another minor down wave to the 1985/80 zone... or just gap right back into the 2000s.

Regardless of any minor moves tomorrow, net week looks set for new highs, into the sp'2010/20s.

*the next QE schedule will be issued tomorrow afternoon at 3pm.

--

Goodnight from London

sp'weekly8

sp'monthly

Summary

Barring some bizarre Friday decline of 25/30pts, the weekly 'rainbow' chart is set to conclude the week with a second consecutive green candle.

Far more important though, the monthly charts are set to close with very powerful net monthly gains of 3-5%.

Looking ahead

There is a trio of econ-data to wrap up the week... Pers' income/outlays, Chicago PMI, and consumer sentiment. Those should give the market the excuse it needs to either wash out the weaker bulls in another minor down wave to the 1985/80 zone... or just gap right back into the 2000s.

Regardless of any minor moves tomorrow, net week looks set for new highs, into the sp'2010/20s.

*the next QE schedule will be issued tomorrow afternoon at 3pm.

--

Goodnight from London

Daily Index Cycle update

US indexes saw minor weak chop across the day, sp -3pts @ 1996. The two leaders - Trans/R2K, settled lower by -0.3% and -0.6% respectively. Near term outlook offers 1985/80 for the bears (at best), but with broader upside across September.

sp'daily5

NYSE Comp'

Summary

Another day closer to a 3 day holiday weekend, and the market is naturally very subdued.

Contrary to what some are saying, whether the sp'500 manages a weekly/monthly close in the 2000s is of no importance. The primary trend remains strongly bullish.

--

a little more later...

sp'daily5

NYSE Comp'

Summary

Another day closer to a 3 day holiday weekend, and the market is naturally very subdued.

Contrary to what some are saying, whether the sp'500 manages a weekly/monthly close in the 2000s is of no importance. The primary trend remains strongly bullish.

--

a little more later...

Thursday, 28 August 2014

Volatility climbs for a second day

With equities seeing minor weak chop across the day, the VIX managed a minor gain for the second consecutive day, settling +2.6% @ 12.09. Near term outlook is for VIX to remain within the 13/10 zone. The 20s look highly unlikely until at least October.

VIX'daily3

Summary

It is notable that the broad down trend from the 17.50s was today broken. However, we're still a good 2-3 days away from a bullish MACD cross..and that would likely require sp'500 to remain under the big 2000 threshold.

The equity monthly cycles have powerful net monthly gains, and it bodes for further upside into September. If that is the case, then VIX will remain very subdued for at least some weeks to come.

Right now, it is arguable that VIX won't break into the 20s, even if the market slipped to test the recent low of sp'1904, and that sure doesn't look feasible until at least October.

--

more later.. on the indexes

VIX'daily3

Summary

It is notable that the broad down trend from the 17.50s was today broken. However, we're still a good 2-3 days away from a bullish MACD cross..and that would likely require sp'500 to remain under the big 2000 threshold.

The equity monthly cycles have powerful net monthly gains, and it bodes for further upside into September. If that is the case, then VIX will remain very subdued for at least some weeks to come.

Right now, it is arguable that VIX won't break into the 20s, even if the market slipped to test the recent low of sp'1904, and that sure doesn't look feasible until at least October.

--

more later.. on the indexes

Closing Brief

US equities closed a touch weak, sp -3pts @ 1996. The two leaders - Trans/R2K, settled lower by -0.3% and -0.6% respectively. Near term outlook offers a chance at a further wave lower to 1985/80, but the primary trend remains very... very strong.

sp'60min

Summary

Little to add, on what was a very... very quiet day.

--

*I hold long overnight, via SDRL.. which managed a moderate gain.

-

more later.. on the VIX

sp'60min

Summary

Little to add, on what was a very... very quiet day.

--

*I hold long overnight, via SDRL.. which managed a moderate gain.

-

more later.. on the VIX

3pm update - micro churn into the close

Equities continue to trade within a very tight range, with the sp'500 set to close in the upper 1990s. No doubt some will be getting overly excited that the market failed to close in the 2000s.... the reality is that it is of no consequence. Primary trend remains the same.

sp'daily5

Summary

Little to add...on what was just another day closer to the long weekend.

-

Notable gains, CHK +2.3% in the $27s... 30/32 seems viable in this new up wave.

-

3.21pm... minor chop continues.

*SDRL +1.1% in the low $37s... which I will hold overnight..and probably across the first half of next week.

-

back at the close.

sp'daily5

Summary

Little to add...on what was just another day closer to the long weekend.

-

Notable gains, CHK +2.3% in the $27s... 30/32 seems viable in this new up wave.

-

3.21pm... minor chop continues.

*SDRL +1.1% in the low $37s... which I will hold overnight..and probably across the first half of next week.

-

back at the close.

2pm update - the crawl continues

Equity indexes continue to attempt to claw back to positive.. which still seems very viable. VIX is holding minor gains of 2% in the low 12s. Metals holding gains, Gold +$7. Oil is +0.7%.

sp'daily5

Summary

Little to add.

I suppose you could argue micro price structure is offering a baby bear flag... with a small wave lower early tomorrow to sp'1985/80 zone.

Regardless...August has arguably been the best month of the year for the bull maniacs. Sept' looks due for further gains.

-

Notable weakness, coal miners, BTU -2.0%

sp'daily5

Summary

Little to add.

I suppose you could argue micro price structure is offering a baby bear flag... with a small wave lower early tomorrow to sp'1985/80 zone.

Regardless...August has arguably been the best month of the year for the bull maniacs. Sept' looks due for further gains.

-

Notable weakness, coal miners, BTU -2.0%

1pm update - creeping back upward

Equities are clawing higher from the early morning low of sp'1990, with most indexes set to turn green this afternoon. Metals are holding moderate gains, Gold +$8. Oil is +0.6%.

sp'daily5

Summary

There is little to add... a quiet afternoon is ahead.

There are a few pieces of econ-data tomorrow morning, notable the Chicago PMI, but most will have already turned their screens off for the long weekend.

Notable strength, TWTR +3.5%

back at 2pm.

sp'daily5

Summary

There is little to add... a quiet afternoon is ahead.

There are a few pieces of econ-data tomorrow morning, notable the Chicago PMI, but most will have already turned their screens off for the long weekend.

Notable strength, TWTR +3.5%

back at 2pm.

12pm update - back to the tedium

US equities remain slightly weak, but with the smaller 60/15min cycles all floored, there remains high probability of indexes turning positive this afternoon. Regardless of the minor noise... August is set to close with powerful gains for all indexes.

sp'daily5

Summary

...tiresome....

It is probably more interesting to watch the ice on top of Bardarbunga volcano in Iceland.

--

VIX update from Mr T.

-

time for lunch

sp'daily5

Summary

...tiresome....

It is probably more interesting to watch the ice on top of Bardarbunga volcano in Iceland.

--

VIX update from Mr T.

-

time for lunch

11am update - was that it?

Equities have apparently already floored at sp'1990.. which is another rather pitiful performance from the bears. The broader trend remains strongly to the upside. Metals are holding moderate gains, Gold +$6, whilst Oil is +0.7%

sp'daily5

Summary

Little to add..., and with GDP out of the way, there is zero reason why price action won't remain largely flat for the remainder of the week/month.

We're at the typical morning turn time of 11am...and that probably is it for the bears.

-

notable strength: TWTR +3.4% @ $49.60s... a break >50 will open up 58/60.

sp'daily5

Summary

Little to add..., and with GDP out of the way, there is zero reason why price action won't remain largely flat for the remainder of the week/month.

We're at the typical morning turn time of 11am...and that probably is it for the bears.

-

notable strength: TWTR +3.4% @ $49.60s... a break >50 will open up 58/60.

10am update - opening weakness

US indexes open moderately lower, with the sp' in the low 1990s. Metals are holding gains, Gold +$10. Equity bulls could sustain the low 1970s.. and it does nothing to dent the rally from 1904.

sp'60min

vix'60min

Summary

*there is a clear gap zone in the VIX.. the 15s, but that looks out of range.

--

Well....despite a far better GDP number than could have been expected, market is seeing a minor down wave. At best...bears will see the market floor around 11am.

What matters is the broader trend..and that is strongly to the upside.

-

*notable resilience: TWTR +2.7%..headed for the big $50

-

10.01am. Pending home sales +3.3%...well above an expected 0.5%

Notable weakness: shippers, DRYS -2.8%

-

10.27am... Equity bears failing (somewhat embarrassingly) to even break 1990.

With GDP out of the way, there is nothing now until next week... aside from a few minor 'end month' trading issues tomorrow afternoon.

Metals are cooling... Gold +$6

sp'60min

vix'60min

Summary

*there is a clear gap zone in the VIX.. the 15s, but that looks out of range.

--

Well....despite a far better GDP number than could have been expected, market is seeing a minor down wave. At best...bears will see the market floor around 11am.

What matters is the broader trend..and that is strongly to the upside.

-

*notable resilience: TWTR +2.7%..headed for the big $50

-

10.01am. Pending home sales +3.3%...well above an expected 0.5%

Notable weakness: shippers, DRYS -2.8%

-

10.27am... Equity bears failing (somewhat embarrassingly) to even break 1990.

With GDP out of the way, there is nothing now until next week... aside from a few minor 'end month' trading issues tomorrow afternoon.

Metals are cooling... Gold +$6

Pre-Market Brief

Good morning. Futures are moderately lower, sp -7pts, we're set to open at @ 1993. Metals are strongly higher, Gold +$14, with Silver +1.6%.

sp'60min

Summary

*GDP (second reading): 4.2%... a somewhat surprising upward revision from the initial 4.0%.

--

Hourly bull flag.. set to fail at the open.

If the market does sell lower, then we've two clear gaps lower down, although the second one @ 1958 is a relatively long way down.

--

Video update from Carboni

--

Good wishes for Thursday

-

9.48am... hmm...clear break of the up trend.... sp'1992... but still, we're only talking -0.4%..barely rates as 'moderate'.

sp'60min

Summary

*GDP (second reading): 4.2%... a somewhat surprising upward revision from the initial 4.0%.

--

Hourly bull flag.. set to fail at the open.

If the market does sell lower, then we've two clear gaps lower down, although the second one @ 1958 is a relatively long way down.

--

Video update from Carboni

--

Good wishes for Thursday

-

9.48am... hmm...clear break of the up trend.... sp'1992... but still, we're only talking -0.4%..barely rates as 'moderate'.

Just another day

It was just another quiet day in market land, ahead of a three day holiday weekend. Price action remains relatively muted, but the broader daily, weekly, and monthly cycles are all 100% bullish.

sp'weekly8b

Summary

Really, there is very little to be said. Green candle... bullish into September.

We've a long weekend ahead (US markets are closed next Monday)... and there is little reason why trading volume will not continue to decline. The only issue is late Friday when there is a rebalancing, along with other end-month trading issues.

Overall, for many...it is arguably a case of switch your screens off, and come back next month.

-

Looking ahead

Thursday will be largely about the second reading for Q2 GDP. Market is expecting an unchanged 4.0% number.

*next QE-pomo is not until sometime next week.

-

Clown TV wheeling out the doomers

Maybe its just me, but I sure have seen a lot of doomers being wheeled out across clown finance TV in the past few days. There has been talk of sp'1000, 800, or even lower... it all seems like crazy talk, even to me.

The monthly (US, and many world markets) charts - as I highlighted just yesterday, are very bullish for September. Typically, we'd hit the upper monthly bollinger before a major correction, and that is in the 2050s right now.

Is the latest bout of doomers on clown TV just another sign that we're far from 'bear capitulation' or 'bull euphoria? All things considered, I'm resigned to at least another 2-3% higher in the near term.

Goodnight from London

sp'weekly8b

Summary

Really, there is very little to be said. Green candle... bullish into September.

We've a long weekend ahead (US markets are closed next Monday)... and there is little reason why trading volume will not continue to decline. The only issue is late Friday when there is a rebalancing, along with other end-month trading issues.

Overall, for many...it is arguably a case of switch your screens off, and come back next month.

-

Looking ahead

Thursday will be largely about the second reading for Q2 GDP. Market is expecting an unchanged 4.0% number.

*next QE-pomo is not until sometime next week.

-

Clown TV wheeling out the doomers

Maybe its just me, but I sure have seen a lot of doomers being wheeled out across clown finance TV in the past few days. There has been talk of sp'1000, 800, or even lower... it all seems like crazy talk, even to me.

The monthly (US, and many world markets) charts - as I highlighted just yesterday, are very bullish for September. Typically, we'd hit the upper monthly bollinger before a major correction, and that is in the 2050s right now.

Is the latest bout of doomers on clown TV just another sign that we're far from 'bear capitulation' or 'bull euphoria? All things considered, I'm resigned to at least another 2-3% higher in the near term.

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately mixed, sp'500 u/c @ 2000. The two leaders - Trans/R2K, settled +0.1% and -0.2% respectively. Near term outlook is for continued upside melt into early September.

sp'daily5

Dow, daily

Summary

Little to add.

The broader daily/weekly cycles remain very bullish... with the giant monthly cycle especially bullish for September.

--

a little more later...

sp'daily5

Dow, daily

Summary

Little to add.

The broader daily/weekly cycles remain very bullish... with the giant monthly cycle especially bullish for September.

--

a little more later...

Wednesday, 27 August 2014

Minor gains for the VIX

With equities seeing a touch of weak chop in the closing hour, the VIX managed minor gains, settling +1.3% @ 11.78. Near term outlook is for the VIX to remain within the 12/10 zone into early September.

VIX'daily3

Summary

The broader downward trend is holding, but clearly, there is always going to be a threat of a 2-3 day jump.

Underlying MACD (blue bar histogram) is turning upward, but it will likely take another 3 days or so to get a bullish cross, and even then, it could easily fail on the first attempt.

On any basis, VIX looks set to remain low for a few more weeks, not least if sp'2050 or even higher.

--

more later.. on the indexes

VIX'daily3

Summary

The broader downward trend is holding, but clearly, there is always going to be a threat of a 2-3 day jump.

Underlying MACD (blue bar histogram) is turning upward, but it will likely take another 3 days or so to get a bullish cross, and even then, it could easily fail on the first attempt.

On any basis, VIX looks set to remain low for a few more weeks, not least if sp'2050 or even higher.

--

more later.. on the indexes

Closing Brief

US equities closed fractionally mixed, sp'500 u/c @ 2000. The two leaders - Trans/R2K, settled +0.1% and -0.2% respectively. Near term outlook is for continued minor upside into the Friday/monthly close.

sp'60min

Summary

*price structure is a bull flag on the hourly cycle, and does bode for upside tomorrow morning.

--

..and another very quiet day comes to a close.

Certainly, there were some interesting moves in a few stocks, but overall...it is a market devoid of any decent price action.

-

*I hold long overnight, via a weak SDRL (already an annoying position, urghh)

--

more later... on the VIX

sp'60min

Summary

*price structure is a bull flag on the hourly cycle, and does bode for upside tomorrow morning.

--

..and another very quiet day comes to a close.

Certainly, there were some interesting moves in a few stocks, but overall...it is a market devoid of any decent price action.

-

*I hold long overnight, via a weak SDRL (already an annoying position, urghh)

--

more later... on the VIX

3pm update - melt into the close

Equities look set for micro melt into the close, after yet another quiet day. Metals/miners are flat. VIX will probably close fractionally lower (why wouldn't it?).. with the 10s as a viable weekly close.

sp'60min

Summary

*hourly bollinger bands are getting super tight.. 2003/1996. Usually suggestive of a break..one way or another. Considering the broader trends..the Thursday break would be to the upside.

--

No reason to expect much price action in the closing hour for the main indexes.

-

As for tomorrow, it will largely depend on how the market deals with the revised GDP for Q2. Even if the number if revised a little lower, with such low' volume...will anyone even notice?

Overall.. market looks set for minor upward chop into the Friday/monthly close.

-

3.43pm.. price structure on the 15/60min cycles... a bull flag.

I realise some are still calling for the 1980s..before 2050... but still..we look likely to close the week in the 2010s..with 2025/30 next week.

sp'60min

Summary

*hourly bollinger bands are getting super tight.. 2003/1996. Usually suggestive of a break..one way or another. Considering the broader trends..the Thursday break would be to the upside.

--

No reason to expect much price action in the closing hour for the main indexes.

-

As for tomorrow, it will largely depend on how the market deals with the revised GDP for Q2. Even if the number if revised a little lower, with such low' volume...will anyone even notice?

Overall.. market looks set for minor upward chop into the Friday/monthly close.

-

3.43pm.. price structure on the 15/60min cycles... a bull flag.

I realise some are still calling for the 1980s..before 2050... but still..we look likely to close the week in the 2010s..with 2025/30 next week.

2pm update - holding minor gains

US equity indexes are holding very minor gains, on what is yet another very quiet trading day. The NYSE Comp' is +0.1% in the 11030s. There looks to be viable upside to the 11300s in September.. which would equate to sp'2050 or so.

NYSE Comp' weekly2

Summary

Little to add...

The 'master index' is comfortably holding the 11000s again.. another 3% higher really isn't expecting too much within 2-3 weeks.

--

time for a late lunch...

--

*I've eyes on SDRL of course, a daily close in the low $37s would be somewhat useful to clarify a reversal.

NYSE Comp' weekly2

Summary

Little to add...

The 'master index' is comfortably holding the 11000s again.. another 3% higher really isn't expecting too much within 2-3 weeks.

--

time for a late lunch...

--

*I've eyes on SDRL of course, a daily close in the low $37s would be somewhat useful to clarify a reversal.

1pm update - micro melt

US equity indexes are all fractionally higher, with the hourly cycles offering upside into early Thursday. A Friday close in the 2010s remains a very viable target.. which would really setup Sept' for the grander target of 2050..or so.

sp'60min

Summary

Little to add.

-

I really should go cook.. back at 2pm.

-

*SDRL is continuing to battle upward from the morning low...a green close? Rest of the sector is strong..so.. that will help.

sp'60min

Summary

Little to add.

-

I really should go cook.. back at 2pm.

-

*SDRL is continuing to battle upward from the morning low...a green close? Rest of the sector is strong..so.. that will help.

12pm update - churn is the best the bears can manage

Since the key low of sp'1904, in each of the natural down cycles, the best that the bears have managed is to churn the market sideways for a few hours. US equities look set to continue clawing higher into the weekly/monthly close.

sp'60min

Summary

There really isn't much to add. A few points down.. that appears all the bears can manage. No news is 'good news' right?

Rather the usual 2 steps up.. 1 down..its now a case of 1 up...sideways....then up again. It is all rather tiresome, and for now, essentially pointless for the bears to get involved.

The big issue is can the market hit the upper bol' in September, but that will likely be in the 2060/70s?

--

As for SDRL, which naturally I'm long (did I manage to curse another stock, really?)

Its a battle... sigh.

--

VIX update from Mr T.

--

time for lunch, wine, valium... or something

sp'60min

Summary

There really isn't much to add. A few points down.. that appears all the bears can manage. No news is 'good news' right?

Rather the usual 2 steps up.. 1 down..its now a case of 1 up...sideways....then up again. It is all rather tiresome, and for now, essentially pointless for the bears to get involved.

The big issue is can the market hit the upper bol' in September, but that will likely be in the 2060/70s?

--

As for SDRL, which naturally I'm long (did I manage to curse another stock, really?)

Its a battle... sigh.

--

VIX update from Mr T.

--

time for lunch, wine, valium... or something

Subscribe to:

Comments (Atom)