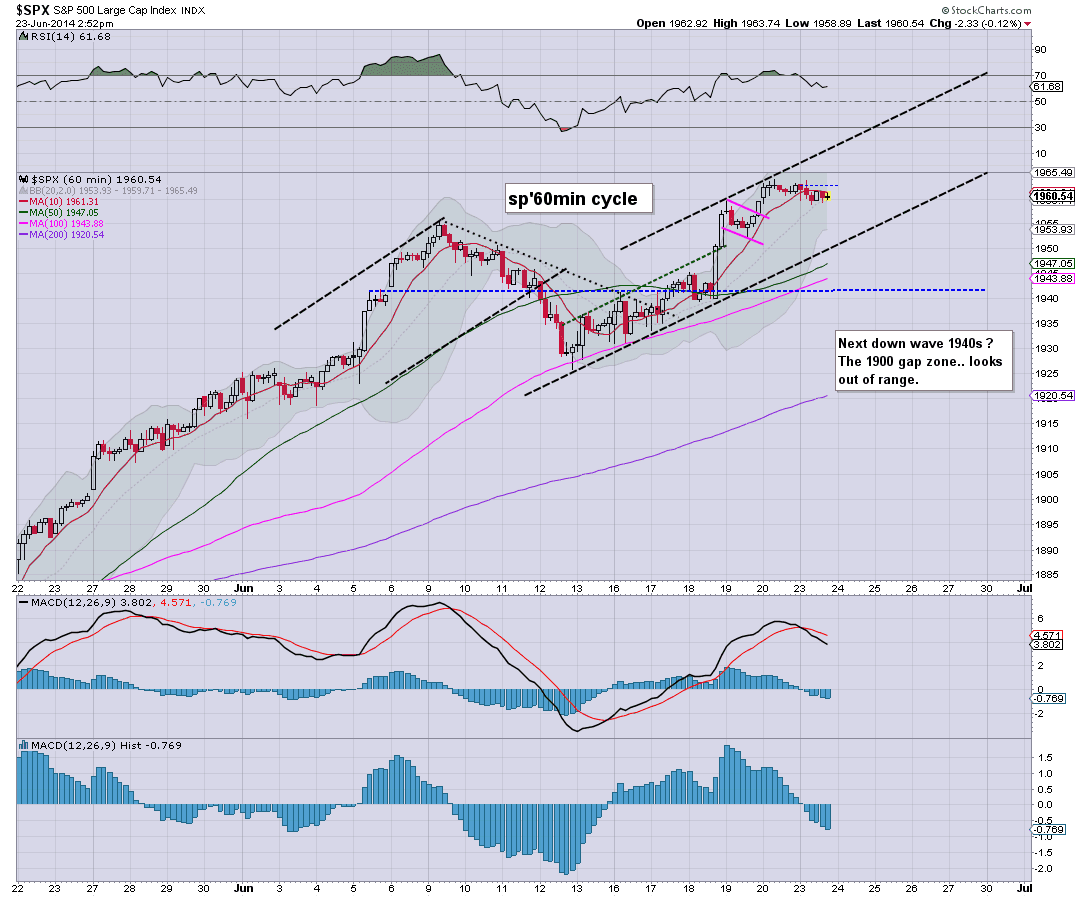

A quiet start to what will probably be a quiet week. Equity bears remain powerless, and even the sp'1940s look a stretch on the downside. Hourly charts are offering a further wave higher, to the 1970s tomorrow. Metals are holding minor gains, Gold +$3.

sp'60min

Summary

*more importantly though...another two World cup games coming up....but not until 4pm EST.

--

So..a pretty dull day...and frankly..that is likely to be the case for much of this week.

In some ways, I think market is going to remain in a holding pattern until the next set of earnings in 2-3 weeks.

-

*the train wreck that is WFM (which I remain long) is moderately higher, but even the big $40 looks a big level to break over..and more importantly..hold. I'll be surprised if this can break into the 43s before the July'4th long weekend.

3.06pm... Lets play a game...

Spot the doomer bear....

Can you work out which one?

-

The bear is calling for a 300pt sp' drop within 'the next few months'. The bears philosophy was that once we see a drop of 150pts..it would be enough to spook the mainstream into a further 150pt drop...

...which would take us pretty close to my primary downside target zone of sp'1625/1575.

--

The correct answer....top row... the guy in purple (bearish?) shirt.

Interesting to see a doomer bear brought on by clown TV, other than Harry Dent. I guess the latter is on holiday.. somewhere on bear Island (Alaska?).

3.43pm.. Looking at the AAPL chart, makes me think we won't even go below 1940s in the near term.

As many recognise....'broad upside' into mid July...and we'll see how we trade from there.

..back at the close