Regardless of how the indexes close today, the bears have unquestionably suffered again. The overnight drop of barely 1% is now a distant memory, with sp' already hitting 1709. New historic highs look viable in the days ahead..and again I shall ask..why will it ever stop?

sp'60min

Summary

The micro 5/15min index cycle charts are offering a turn to the downside, but really, bulls should be able to hold the big 1700 threshold..which would still make for one major recovery from the opening declines.

-

For many out there, I realise today was rough, never mind the disappointment after overnight price action.

You have my sympathies.

updates into the close...

*yours truly will hold USO overnight...

Looks okay for the mid 37s..but it still needs to break the down trend resistance.

-

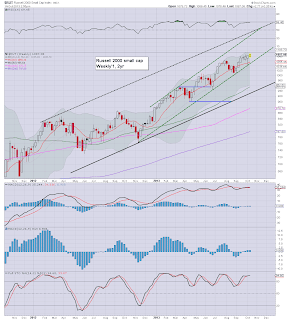

R2K..new highs...the 1200s look possible by end year.

I'd guess is R2K 1200, the sp'1850/1900 ..urghh

-

3.16pm..and there go the sp'1710 stops. Well, there really isn't any resistance now until the 1729 high.

So..if a provisional agreement is announced..it looks like we'll be testing the old high..and likely break it. Not least..since the R2K already has.

3.48pm...micro 5/15min cycles look weak..a little move lower into the close. The hourly 10MA should provide support at 1702/00.

back at the close.