The bears critically failed to break the market decisively lower last week. That failure has now resulted in the weekly charts going back to bullish. The transports are suggestive of the low 7000s this summer, which would equate to sp'1800s, with VIX <10.

sp'weekly2, rainbow

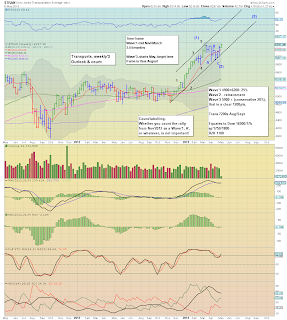

trans'weekly3, rainbow, outlook/count

Summary

Today's gains were enough to provide initial green candles for the SP'500 and Transports weekly charts. The transports is indeed leading the way higher, and that price action from mid-March to last week, sure looks like a wave'2/B. Regardless of how you want to label/count it, the trend is clearly up.

The 7000s look a very viable target, and if that is correct, its not too bold to extrapolate what that might mean for the other indexes. The sp'1800s look very viable, and that is barely 10% higher from where we currently are.

What am I doing?

Having bailed on two major positions last Friday, I'm somewhat adverse to doing anything for at least a few more days. However, I do have eyes for going Long Oil, and short Silver. Current price levels for either are not attractive though, so I'm just sitting back.

Looking ahead

There really isn't anything much at all this week. There is consumer credit tomorrow at 3pm, but really, the main market probably won't even care.

This market is in 100% algo-bot melt mode...bears beware.

Goodnight from London