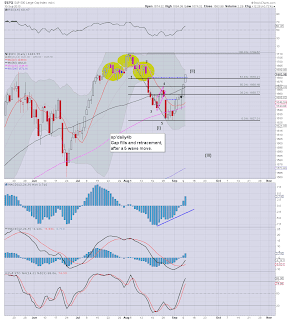

sp'weekly8 - mid term bullish outlook

Summary

The weekly 'rainbow' chart looks even more disturbing after a second day of rather significant gains.

We've now climbed almost 29pts so far this week, and a break into the 1690s will surely clarify that something 'hyper-bullish' is underway. Anyone who suggest otherwise, I can only refer them to the Nasdaq weekly/monthly charts, which are now very bullish.

There is obviously going to be stiff resistance in the 1680s tomorrow, but frankly..the bulls don't 'have to push any higher this week. They've already accomplished more than enough for this week. It is up to the bears to start selling this market lower.

Which way from here?

Right now..on a sleepy Tuesday evening, my best guess...we just keep on going higher. The bulls have not only the daily and weekly charts on their side now, but they have the Nasdaq at new highs, and the VIX is back into 'melt lower' mode.

Consensus in the mainstream is for QE to be reduced by 10/15bn next week, so..that's already factored in. Frankly, the only thing that might spook the market (if briefly) is if the Fed raise interest rates by 25bps. That is something to keep in mind for next Wednesday afternoon.

10yr yield, monthly2

We have a clear breakout, the 3s are a given..and then 3.25. The only issue is how will equities cope when the 10yr yield is consistently putting in daily closes in the low 3s?

Looking ahead

There is no major econ-data of note tomorrow. Neither is there any sig' QE-pomo.

--

*I remain long VIX (from 15.50s, so I'm now almost 1 full pt down). If the sp' breaks into the 1690s tomorrow..or later this week...and if the price action shows no sign of an equity down turn..there seems absolutely zero point in holding short the market.

I hope it won't come to that.

Goodnight from London