The short term daily action remains choppy - as is often the case, but the multi-month trend remains absolutely clear.

We remain in a downtrend since the rollover in April.

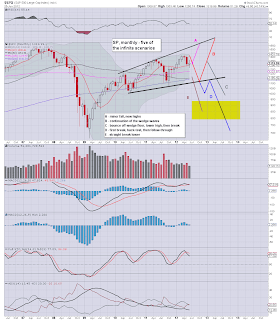

sp'monthly, scenario outlook

Summary

A significant decline is anticipated in July, and we could swiftly decline all the way the target zone of 1150/00, although it may take as long as August to reach the target. In the scheme of things, I don't much care how many weeks it takes. As I increasingly like to say..'the good bear..is a patient bear'.

---

My 'best guess' scenario target remains B.

B for Bernanke...you might say. If Benny does not at least overtly hint at QE3 in August though..we'll soon break the 1100 level, at which point there will be two key levels/zones to look for.

1. Sp'1060s would clearly take out last years low

2. Sp'999, would break the ultimate psychological level. The market has not been <1000, since Sept'2009..

Looking ahead to Wednesday

Some key econ-data pre-market...so be sure not to oversleep! I'd be content to exit my latest short around sp'1300, but its viable we could even go a little lower than that. As ever..good short-stops..will make things simpler.

Goodnight from London