The Sp'500 climbed almost a full fifty points in this shortened 3.5 day trading week. That is very impressive, and doubtless the bulls are now looking forward to a year end rally. However, I am pretty confident that the only presents Santa is bringing this Christmas for Mr Market, will be sticks of lit dynamite.

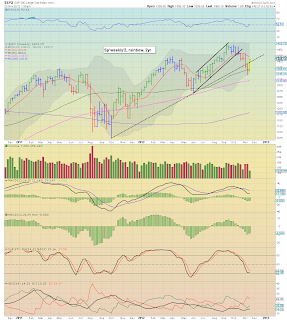

sp'weekly2, rainbow

sp'daily4 - bearish scenario

Summary

I find it very amusing that the last hour ramp achieved what I was seeking most of all this week - a green candle, on the weekly rainbow chart.

Yes, we have a VERY strong green candle, and its very much in the style I was looking for. As I have referred to a number of times, look back to the price action in late June 2011.

So we've likely seen the majority of the gains in this bounce, with maybe just another 1-1.5% left to go..and then some choppy churn*, and then we go down like a rock, with a target of sp'1225.

*How long churning?

It is an issue I do want to note, since it is possible seasonal factors will delay the next decline. Yet, I think that maybe over-thinking things. The sp'daily4 outlook has been right so far, I am trying not to start double-thinking my original outlook.

--

Regardless of my own trading account, and the implications such a fall into the low sp'1200s might mean, I am absolutely fascinated to find out whether this fully plays out as I had originally foreseen.

Goodnight from London