Urgh, yet another

frustrating day. Bears had the opportunity today to see follow

through on yesterdays action. They failed. Totally. They even had the

10am ISM data..and still they could not whack this market into the

red.

The econ-data lately

remains mixed. Some has been arguably reasonable, but much remains

pretty bad (Durable goods, today's ISM). Yet, even when we do get bad

data it has never been enough to dampen down the market more than 1%, for

more than a few hours.

Endless melt-up. Again the SP' maintains itself above the important 10MA.

Mr $ is offering a little hope for the bears. UUP has possibly completed its down cycle. If it can hold its present level, the best case target would be $23 sometime in April. A resuming uptrend in the $ would certainly help to pressure equities (and more interestingly, the metals!) in the coming weeks.

Its tense out there!

There is so much

underlying tension out in the economic world right right now – not

least of which is the rising price of Oil. That is going to really

start annoying the summer drivers soon. $4 gas in the US seems a

given within the next few months. Of course, here in the UK, gas is

now around $8.50 (yeah, quit your whining Americans!), yet western

Europe is admittedly not imploding. Even the average car-centric

Americans could adapt to $5, or even $10 gas.

If WTIC can break 120..it should get a free-run to challenge the big $150 level

TVIX remains primed to

move higher, although today's volumn was the lowest in 3 weeks. However, it remains interesting that whilst the SP' closes at yet

another new high, the VIX (and TVIX) are not making new lows. The TVIX low of 14 is still a fair

bit lower, and there are doubtless a lot of last-ditch stop sell-orders there.

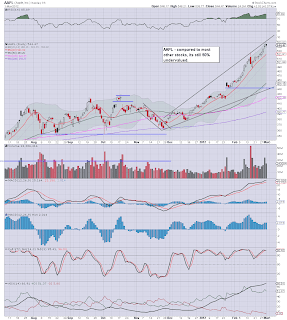

A small note on AAPL

I have never traded it, what

'average retail person' buys a $500 stock anyway? Now, I'm

no fan of the hysteria surrounding what is just another consumer

tech' company. However, we have to consider the fact that AAPL is

still cheap relative to the rest of the nonsense out there. When the

PE for the main SP' index is around 23, AAPL is roughly half that, I

have to admit its not unfair for the cheerleaders on clown channel to

endorse the 'AAPL to $1000 a share, along with a $1trn market cap.

A fair few of the well

known commentators out there all seem to suggest that when AAPL

breaks, it will suck down the rest of the market. I can agree with that sentiment. Yet, is AAPL ever

really going to go much below $400/450 this year? I can only imagine,

if the market is still cruising along on near zero vol' this April,

and if AAPL can post even moderately good earnings, it will be in the

mid 600s.

Relentless buying support for AAPL at the 10MA level, currently $521

A tedious Friday

There is no data

tomorrow, no planned financial 'events', it does not look to be any

good from a volatility/entertainment point of view.

It is almost the

weekend (thank the gods), with the new month now well under way, we

have already seen more low vol' melt-up nonsense. Right now even a 3%

retracement is the stuff of dreams. Incredible.

Like many out there, I

sit patiently awaiting 'something' to start off a new market cycle.

Hopefully, it will be no longer than a few more days/weeks, rather

than months.

Good wishes