US equity indexes closed moderately mixed, sp +3pts at 2423 (intra high

2432). The two leaders - Trans/R2K, settled +0.9% and -0.1%

respectively. Near term outlook offers renewed downside. Most bearish

case in first half of July would be sp'2352/48, with Nasdaq in the low

5900s. Broadly though, still bullish, as earnings and econ-data are

still coming in 'reasonable'.

sp'daily5

VIX'daily3

Summary

It was a rather choppy day, as opening gains failed, with the Nasdaq comp' turning fractionally red. Yet with WTIC oil building very sig' gains of 3%, equities leaned upward into the late afternoon.

The final hour of the week/month/Q2/H1 was rather interesting. After a new intraday high of 2432, there was a distinct case of 'rats bailing into the weekend', with the sp' settling just fractionally higher. Nasdaq notably closed a touch red.

It was a mixed day for volatility, generally in 'cooling mode' (intra low 10.40 in early morning), but climbing into the close, as equities rapidly cooled.

Near term outlook is bearish, and note today's black-fail candle for the sp'500. Such candles are not to be dismissed lightly!

--

sp'monthly

The sp' broke a new historic high of 2453, but settled June net higher by 11pts (0.5%) at 2423. Underlying MACD (blue bar histogram) is showing a fractional rollover, but remains strong positive. Even if the market was to decline from current levels, we'd not seen a critical bearish cross until at least Sept/Oct.

--

Special update on the freakshow entertainment that is Blue Apron (APRN)

With no underwriter support today, Mr Market has started to discover the 'real value', which is a lot closer to $0.00 than $10.00. APRN settled -6.5% at $9.35, having seen an intra low of just $9.17. If the main market drops more than 1% next week, the $8s are a given.. perhaps even the 7s.

--

Here in the city of towers...

... many are in the early phase of having flammable panels (produced by Arconic) removed. I imagine some like Krugman would call such a situation a positive for the UK economy, not least in terms of employment.

Goodnight from London

--

*the weekend post will appear Sat'12pm EST, and will detail the World monthly indexes. It remains my most important post of the month.

Friday, 30 June 2017

Back on the slide

US equity indexes closed broadly weak, sp -20pts at 2419 (intra low

2405). The two leaders - Trans/R2K, settled lower by -0.4% and -0.6%

respectively. VIX settled +14.1% at 11.44. Near term outlook offers further weakness to the 2390/80s.

Any daily closes <2400 would threaten a gap fill of 2352/48 by July

11th.

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, but quickly leaned lower. Things spiralled into the afternoon, as the Tuesday closing low of 2419 was broken under. There was a key break of the 50dma, although settling well above it.

With equities breaking multiple aspects of support, the VIX soared into the afternoon, maxing out at 15.16. This notably filled a gap of 13.25/14.75 from May 19th.

Further downside? The breaks of the 50dma in multiple indexes certainly leans toward the bears. If the market can break under the 2400 threshold within the next 1-5 trading days, then a bonus washout to around 2352/48 is on the menu. That would give the mainstream cheerleaders of clown finance TV a good scare, and that is always a good thing.

--

A sideline distraction

Today saw the IPO of Blue Apron (APRN). Just a few days ago, many were looking for an initial offering price >$15. Instead, all the market was willing to offer this morning was $10.

Across today it was pretty amusing to see the underwriters - GS, JPM, MS, and Barclays (of the UK) have to periodically initiate an 'infinity support bid', to keep the stock above the $10.00 threshold. In the above screenie, you can see the massively big numbers on the bid side across multiple regional exchanges. Clearly, 'they' won't be doing that for very long.

Is was notable there were a couple of trades that did manage to get through the 'infinity support bid', just after the close.

--

Podcast from Coffey and Dr J.

--

Awaiting the weekend...

Tomorrow will be important, as its not just the weekly close, but end month, Q2, and the first half. For those with an interest in the bigger picture, this weekend's post covering the World monthly indexes will be a must-read!

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, but quickly leaned lower. Things spiralled into the afternoon, as the Tuesday closing low of 2419 was broken under. There was a key break of the 50dma, although settling well above it.

With equities breaking multiple aspects of support, the VIX soared into the afternoon, maxing out at 15.16. This notably filled a gap of 13.25/14.75 from May 19th.

Further downside? The breaks of the 50dma in multiple indexes certainly leans toward the bears. If the market can break under the 2400 threshold within the next 1-5 trading days, then a bonus washout to around 2352/48 is on the menu. That would give the mainstream cheerleaders of clown finance TV a good scare, and that is always a good thing.

--

A sideline distraction

Today saw the IPO of Blue Apron (APRN). Just a few days ago, many were looking for an initial offering price >$15. Instead, all the market was willing to offer this morning was $10.

Across today it was pretty amusing to see the underwriters - GS, JPM, MS, and Barclays (of the UK) have to periodically initiate an 'infinity support bid', to keep the stock above the $10.00 threshold. In the above screenie, you can see the massively big numbers on the bid side across multiple regional exchanges. Clearly, 'they' won't be doing that for very long.

Is was notable there were a couple of trades that did manage to get through the 'infinity support bid', just after the close.

--

Podcast from Coffey and Dr J.

--

Awaiting the weekend...

Tomorrow will be important, as its not just the weekly close, but end month, Q2, and the first half. For those with an interest in the bigger picture, this weekend's post covering the World monthly indexes will be a must-read!

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

Thursday, 29 June 2017

A bounce day

US equity indexes closed broadly higher, sp +21pts at 2440. The two

leaders - Trans/R2K, settled higher by 1.4% and 1.5% respectively. VIX settled -9.3% at 10.03. Near

term outlook offers another wave lower, at least to partly fill the gap

zone of 2428/19. Many stocks - such as AAPL, are still highly suggestive

of more significant downside to 2400/2390s.

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and built rather strong gains into the early afternoon.

I recognise that some won't be calling today a bounce, and will instead now be seeking a straight run to new historic highs into early July. Its notable that the R2K did come very close to breaking a new historic high today.

With equities on the rise, market volatilty was crushed, with the VIX falling back into the 9s (intra low 9.76), but settling in the 10s.

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

sp'daily5

VIX'daily3

Summary

US equities opened moderately higher, and built rather strong gains into the early afternoon.

I recognise that some won't be calling today a bounce, and will instead now be seeking a straight run to new historic highs into early July. Its notable that the R2K did come very close to breaking a new historic high today.

With equities on the rise, market volatilty was crushed, with the VIX falling back into the 9s (intra low 9.76), but settling in the 10s.

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

Wednesday, 28 June 2017

Short term downside break

US equity indexes closed broadly weak, sp -19pts at 2419. The two

leaders - Trans/R2K, settled lower by -0.6% and -0.9% respectively. VIX settled +11.7% at 11.06. Near

term outlook offers the 2415/10 zone. Some stocks - such as AAPL, are

highly suggestive of the sp'2390s before resuming upward.

sp'daily5

VIX'daily3

Summary

US equities opened a little lower, saw a fair amount of chop, but ended the day broadly weak. The break of soft support of sp'2431/30 was somewhat important, and offers further downside Wed-Thursday. Some stocks - such as AAPL, are highly suggestive that the Nasdaq will fall around 4% within 1-4 days, which would likely equate to sp'2405/2390s.

Market volatility remains broadly subdued, but we did see the VIX settle in the 11s today. The 12s look a given, the only issue is whether we get stuck in the 13s or 14s.

As ever, extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened a little lower, saw a fair amount of chop, but ended the day broadly weak. The break of soft support of sp'2431/30 was somewhat important, and offers further downside Wed-Thursday. Some stocks - such as AAPL, are highly suggestive that the Nasdaq will fall around 4% within 1-4 days, which would likely equate to sp'2405/2390s.

Market volatility remains broadly subdued, but we did see the VIX settle in the 11s today. The 12s look a given, the only issue is whether we get stuck in the 13s or 14s.

As ever, extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

Tuesday, 27 June 2017

Almost halfway

US equity indexes closed moderately mixed, sp +0.7pts at 2439 (intra

high 2450). The two leaders - Trans/R2K, settled higher by 0.6% and 0.1%

respectively. VIX settled -1.2% at 9.90. Near term outlook offers 2420/15 zone. More broadly, the

2500s still appear viable as early as late July, not least if Q2 GDP

comes in >2.5%.

sp'daily5

VIX'daily3

Summary

The week began on a moderately positive note, but there was a rather fierce little reversal in early morning, with most indexes turning red. With WTIC swinging upward from -0.7% to +0.7% in the $43s, equities saw a little bounce into the afternoon. Again, there was something of closing hour weakness.. which should carry into Tuesday. Further, the black-fail candle is a warning of trouble.

Market volatility remains broadly subdued, with the VIX settling in the upper 9s. Near term offers the 12/13s, if sp'2420/15, which really isn't that bold a target.

Half of 2017

This Friday will be the end of Q2 and indeed, the first half of 2017. Regardless of how the rest of this week trades, so far, its been a year for the equity bulls, with new historic highs in all six of the indexes I regularly highlight.

However, even more notable than the equity gains are how commodities have been relentlessly weak.

CRB, monthly, 8yr

At the current rate, we'll see the CRB at the Jan'2016 lows within 3-4 months. Does the fed notice... or remotely care? At some point this summer/autumn, commodities are going to see another upswing, and that will be bullish for energy and most resource/mining stocks, which of course will help kick the main market upward.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

The week began on a moderately positive note, but there was a rather fierce little reversal in early morning, with most indexes turning red. With WTIC swinging upward from -0.7% to +0.7% in the $43s, equities saw a little bounce into the afternoon. Again, there was something of closing hour weakness.. which should carry into Tuesday. Further, the black-fail candle is a warning of trouble.

Market volatility remains broadly subdued, with the VIX settling in the upper 9s. Near term offers the 12/13s, if sp'2420/15, which really isn't that bold a target.

Half of 2017

This Friday will be the end of Q2 and indeed, the first half of 2017. Regardless of how the rest of this week trades, so far, its been a year for the equity bulls, with new historic highs in all six of the indexes I regularly highlight.

However, even more notable than the equity gains are how commodities have been relentlessly weak.

CRB, monthly, 8yr

At the current rate, we'll see the CRB at the Jan'2016 lows within 3-4 months. Does the fed notice... or remotely care? At some point this summer/autumn, commodities are going to see another upswing, and that will be bullish for energy and most resource/mining stocks, which of course will help kick the main market upward.

Goodnight from London

--

Saturday, 24 June 2017

Weekend update - US weekly indexes

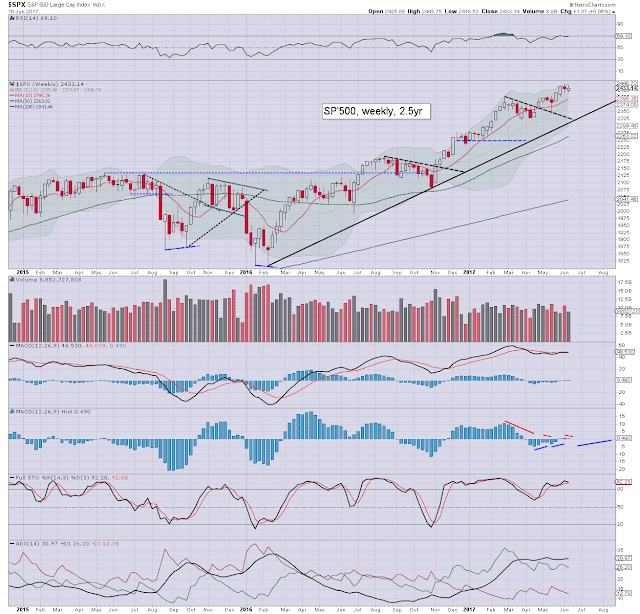

It was a mixed week for US equity indexes,

with net weekly changes ranging from +1.8%

(Nasdaq comp'), +0.6% (R2K), +0.2% (sp'500), +0.05% (Dow), to

-0.3% (NYSE comp', Trans). Near term outlook offers moderate weakness, but broadly, the US market remains super strong.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 climbed for a second consecutive week, settling net higher by 5pts (0.2%) at 2438. There was a notable new historic high of 2453.82. Underlying MACD (blue bar histogram) is fractionally positive, indicative of underlying market strength. The key 10MA is at 2406, and will offer support within the 2410/15 zone into end month.

Best guess: no sustained price action <2400 this summer. Technically, the 2500s will be viable as early as late July, but that will require almost everything to be Goldilocks. Equity bears will have their best chance of a 5% retrace in Sept'/Oct. The year end target of 2683 remains on track.

Equity bears have nothing to tout unless a break of core rising trend - from Feb'2016 is broken. Right now that stands around 2270, and is climbing by around 25pts a month. Within the 'delicate' period of Sept/Oct, things would turn exceptionally bearish on any daily close <2370. If that occurred, the first target would be the lower monthly bollinger.. currently around 1900.

--

Nasdaq comp'

The Nasdaq continues to lead the way, settling higher by a rather significant 1.8% at 6265, which isn't that far below the recent high of 6341. Short term support is around 6100, and considering ongoing price action, the 6k threshold looks secure for the summer. The 7000s are highly probable before year end.

Dow

The mighty Dow settled higher for a fifth consecutive week, but by just 10pts (0.05%), settling at 21394. There was a notable new historic high of 21535. Underlying MACD is set to turn positive within 1-2 weeks, as the upper bollinger will keep prices restrained to around 21500/600 into early July. The giant psy' level of 20k is powerful support, and should hold for the rest of the year.

NYSE comp'

The master index settled -0.3% at 11733, but did notably break a new historic high of 11836. The mid term trend from Feb'2016 remains comfortably intact. Things only turn bullish if any price action <11500 in July or onward. The 12000s will be viable by late July/early August.

R2K

The second market leader - R2K, settled +0.6% at 1414, which is just 17pts shy of the recent high. Underlying MACD is set to turn positive within 1-2 weeks, and bodes for the 1420/30s. The 1500s are a realistic target by late September. Things only turn provisionally bearish if <1390, and that is admittedly not that far down.

Trans

The 'old leader' - Transports, settled net lower by -0.3% at 9388. Underlying MACD is set to turn positive within 1-2 weeks. Low energy prices are especially bullish for the fuel consuming transportation stocks, and thus further upside to the giant 10k threshold seems probable this summer. Things only turn bearish with price action under the May low of 8744. Even then, core rising trend will offer support around 8600 in August.

--

Summary

All the main US indexes are holding within their mid term bullish trends from early 2016.

The Nasdaq is broadly leading the way, followed by the sp'500, Dow, and NYSE comp'

The laggards - Trans/R2K, are both close to breaking new historic highs.

--

Looking ahead

M - Durable goods orders

T - Case-Shiller HPI, consumer con', Richmond fed'

W - Intl' trade, pending home sales, EIA Pet' report

T - Weekly jobs, Q1 GDP (3rd/final)

F - Pers' income/outlays, Chicago PMI, consumer sent'.

*There are a handful of fed officials on the loose, notably, Bullard (Thurs, 1pm EST), who will be just a few miles away from yours truly in London, giving a lecture on the US economy and monetary policy.

**Friday will be end month/Q2, and indeed.. the first half of 2017. There is high threat of an element of 'window dressing', which most certainly will favour the equity bulls.

--

If you value my work, subscribe to me.

For $20pcm, I typically provide 200 posts a month (40,000 words a month), 500 charts (at minimum), covering everything from the equity indexes, VIX, oil, gold, silver, bonds, currencies, and a broad array of individual stocks.

Have a good weekend

--

*the next post on this page will likely appear 7pm EST on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 climbed for a second consecutive week, settling net higher by 5pts (0.2%) at 2438. There was a notable new historic high of 2453.82. Underlying MACD (blue bar histogram) is fractionally positive, indicative of underlying market strength. The key 10MA is at 2406, and will offer support within the 2410/15 zone into end month.

Best guess: no sustained price action <2400 this summer. Technically, the 2500s will be viable as early as late July, but that will require almost everything to be Goldilocks. Equity bears will have their best chance of a 5% retrace in Sept'/Oct. The year end target of 2683 remains on track.

Equity bears have nothing to tout unless a break of core rising trend - from Feb'2016 is broken. Right now that stands around 2270, and is climbing by around 25pts a month. Within the 'delicate' period of Sept/Oct, things would turn exceptionally bearish on any daily close <2370. If that occurred, the first target would be the lower monthly bollinger.. currently around 1900.

--

Nasdaq comp'

The Nasdaq continues to lead the way, settling higher by a rather significant 1.8% at 6265, which isn't that far below the recent high of 6341. Short term support is around 6100, and considering ongoing price action, the 6k threshold looks secure for the summer. The 7000s are highly probable before year end.

Dow

The mighty Dow settled higher for a fifth consecutive week, but by just 10pts (0.05%), settling at 21394. There was a notable new historic high of 21535. Underlying MACD is set to turn positive within 1-2 weeks, as the upper bollinger will keep prices restrained to around 21500/600 into early July. The giant psy' level of 20k is powerful support, and should hold for the rest of the year.

NYSE comp'

The master index settled -0.3% at 11733, but did notably break a new historic high of 11836. The mid term trend from Feb'2016 remains comfortably intact. Things only turn bullish if any price action <11500 in July or onward. The 12000s will be viable by late July/early August.

R2K

The second market leader - R2K, settled +0.6% at 1414, which is just 17pts shy of the recent high. Underlying MACD is set to turn positive within 1-2 weeks, and bodes for the 1420/30s. The 1500s are a realistic target by late September. Things only turn provisionally bearish if <1390, and that is admittedly not that far down.

Trans

The 'old leader' - Transports, settled net lower by -0.3% at 9388. Underlying MACD is set to turn positive within 1-2 weeks. Low energy prices are especially bullish for the fuel consuming transportation stocks, and thus further upside to the giant 10k threshold seems probable this summer. Things only turn bearish with price action under the May low of 8744. Even then, core rising trend will offer support around 8600 in August.

--

Summary

All the main US indexes are holding within their mid term bullish trends from early 2016.

The Nasdaq is broadly leading the way, followed by the sp'500, Dow, and NYSE comp'

The laggards - Trans/R2K, are both close to breaking new historic highs.

--

Looking ahead

M - Durable goods orders

T - Case-Shiller HPI, consumer con', Richmond fed'

W - Intl' trade, pending home sales, EIA Pet' report

T - Weekly jobs, Q1 GDP (3rd/final)

F - Pers' income/outlays, Chicago PMI, consumer sent'.

*There are a handful of fed officials on the loose, notably, Bullard (Thurs, 1pm EST), who will be just a few miles away from yours truly in London, giving a lecture on the US economy and monetary policy.

**Friday will be end month/Q2, and indeed.. the first half of 2017. There is high threat of an element of 'window dressing', which most certainly will favour the equity bulls.

--

If you value my work, subscribe to me.

For $20pcm, I typically provide 200 posts a month (40,000 words a month), 500 charts (at minimum), covering everything from the equity indexes, VIX, oil, gold, silver, bonds, currencies, and a broad array of individual stocks.

Have a good weekend

--

*the next post on this page will likely appear 7pm EST on Monday.

Choppy end to the week

US equity indexes closed moderately higher, sp +3pts at 2438. The two

leaders - Trans/R2K, both settled higher by around 0.7%. VIX settled -4.4% at 10.02. Near term

outlook offers weakness to around sp'2415. More broadly, the 2500s are

viable as early as late July.

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode.. leaning a touch weak. The market hit sp'2431, and then it became apparent that some were already hitting the buy button. There was a moderate swing upward into the afternoon to 2441, before cooling to 2433, and then spiking upward into the re-balancing weekly close.

Volatility remained subdued, and with an anticipated sleepy weekend ahead, the VIX even failed to stay out of the 9s... which was something of a surprise.

--

Goodnight from London

--

*the weekend post will appear Sat'12pm EST, and will fully detail the US weekly indexes

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode.. leaning a touch weak. The market hit sp'2431, and then it became apparent that some were already hitting the buy button. There was a moderate swing upward into the afternoon to 2441, before cooling to 2433, and then spiking upward into the re-balancing weekly close.

Volatility remained subdued, and with an anticipated sleepy weekend ahead, the VIX even failed to stay out of the 9s... which was something of a surprise.

--

Goodnight from London

--

*the weekend post will appear Sat'12pm EST, and will fully detail the US weekly indexes

Friday, 23 June 2017

Leaning weak

US equity indexes closed moderately mixed, sp -1pt at 2434. The two

leaders - Trans/R2K, settled higher by 0.3% and 0.4% respectively. Near

term outlook offers the sp'2415/00 zone.

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, clawing upward to 2441. There was a clear rollover into the close.

Market volatility remains broadly subdued, although the VIX is still managing to stay out of the 9s.

Near term outlook offers at least sp'2422/20, which should equate to VIX 12s. If sp'2415/00 zone, then 13/14s are viable. The key 20 threshold looks out of range until at least late September. The only wild card would be a weekend 'North Korean surprise'.

--

Meanwhile... here in London city...

The 'Tower' story keeps on running.. see: http://www.bbc.co.uk/news/uk-40366646

The latest is there are around 600 'clad' towers in England, although no one yet knows how many are covered in the flammable version. I'd guess at least a quarter, as the flammable version is (naturally) cheaper.

Yours truly prefers nothing higher than a few floors, and simple unclad brick.

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, clawing upward to 2441. There was a clear rollover into the close.

Market volatility remains broadly subdued, although the VIX is still managing to stay out of the 9s.

Near term outlook offers at least sp'2422/20, which should equate to VIX 12s. If sp'2415/00 zone, then 13/14s are viable. The key 20 threshold looks out of range until at least late September. The only wild card would be a weekend 'North Korean surprise'.

--

Meanwhile... here in London city...

The 'Tower' story keeps on running.. see: http://www.bbc.co.uk/news/uk-40366646

The latest is there are around 600 'clad' towers in England, although no one yet knows how many are covered in the flammable version. I'd guess at least a quarter, as the flammable version is (naturally) cheaper.

Yours truly prefers nothing higher than a few floors, and simple unclad brick.

Goodnight from London

--

Thursday, 22 June 2017

A midsummer's day market

US equity indexes closed moderately mixed, sp -1pt at 2435. The two

leaders - Trans/R2K, settled lower by -0.1% and -0.3% respectively. VIX settled -1.0% at 10.75. Near

term outlook offers the 2415/00 zone, which might equate to VIX 13/14s.

Broadly, the 2500s are a given.. as early as late July.

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, and saw some moderate weakness to sp'2430 - fully filling the opening gap from Monday morning. There was an attempt to bounce in the afternoon, but it was pretty weak. A break <2430 will offer 2415/00 before the weekend. This was something that should have happened last week, but quad-opex was something of a hindrance.

Market volatility popped to 11.40 - with sp'2430, but settling in the 10s. Its something of an irony to note we've not traded VIX 9s in 9 trading days.

--

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, and saw some moderate weakness to sp'2430 - fully filling the opening gap from Monday morning. There was an attempt to bounce in the afternoon, but it was pretty weak. A break <2430 will offer 2415/00 before the weekend. This was something that should have happened last week, but quad-opex was something of a hindrance.

Market volatility popped to 11.40 - with sp'2430, but settling in the 10s. Its something of an irony to note we've not traded VIX 9s in 9 trading days.

--

|

| Midsummer's day concludes |

|

| So many planes... bullish UAL? |

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

Wednesday, 21 June 2017

A little weakness

US equity indexes closed broadly weak, sp -16pts at 2437. The two

leaders - Trans/R2K, settled lower by -1.8% and -1.1% respectively. VIX settled 4.7% at 10.86. Near

term outlook offers short term weakness to sp'2415/00, but broader

price action remains 'scary strong'.

sp'daily5

VIX'daily3

Summary

US equities opened a little lower, and leaned moderately weak across the day. Its notable that the Dow did break a new historic high of 21535. The very sig' downside in the Tranports though does bode for main market weakness of another 1-1.5% before the weekend.

Market volatility remains broadly subdued, still stuck in the 10s. There is a notable open gap of 13.25/14.75 from May 19th. To see VIX 14s, we'd likely need sp'2400/390s, and that sure won't be easy. In any case, the key 20 threshold looks out of range until at least late Sept/Oct.

--

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened a little lower, and leaned moderately weak across the day. Its notable that the Dow did break a new historic high of 21535. The very sig' downside in the Tranports though does bode for main market weakness of another 1-1.5% before the weekend.

Market volatility remains broadly subdued, still stuck in the 10s. There is a notable open gap of 13.25/14.75 from May 19th. To see VIX 14s, we'd likely need sp'2400/390s, and that sure won't be easy. In any case, the key 20 threshold looks out of range until at least late Sept/Oct.

--

|

| Midsummers eve |

|

| 4.10pm EST |

|

| 4.15pm EST |

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

Tuesday, 20 June 2017

Beginning positive

US equity indexes closed broadly higher, sp +20pts at 2453. The two

leaders - Trans/R2K, settled higher by 0.6% and 0.8% respectively. VIX settled -0.1% at 10.37. Near

term outlook offers weakness to the 2442/33 gap zone. More broadly, the

2500s are viable as early as late July.

sp'daily5

VIX'daily3

Summary

The week began on a rather positive note, with a trio of new historic highs in the Dow, sp'500, and the NYSE comp'. The closing hour was itself bullish with a new historic high for the sp'500 of 2453.82. This morning's opening gap of 2442/33 will surely be filled within the next few days. Its notable that the 50dma will soon be above the 2400 threshold.

Market volatility remained very subdued, but the VIX did notably hold the 10s.. despite new index highs. Near term.. the 11s look due with sp'2442/33. Things only get marginally interesting with a daily close <2433.

--

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

-

sp'daily5

VIX'daily3

Summary

The week began on a rather positive note, with a trio of new historic highs in the Dow, sp'500, and the NYSE comp'. The closing hour was itself bullish with a new historic high for the sp'500 of 2453.82. This morning's opening gap of 2442/33 will surely be filled within the next few days. Its notable that the 50dma will soon be above the 2400 threshold.

Market volatility remained very subdued, but the VIX did notably hold the 10s.. despite new index highs. Near term.. the 11s look due with sp'2442/33. Things only get marginally interesting with a daily close <2433.

--

|

| A batwing drone under a hazy sun |

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

-

Saturday, 17 June 2017

Weekend update - US weekly indexes

It was a mixed week for US equity indexes, with net weekly changes ranging from -1.0% (R2K), +0.1% (sp'500), +0.5% (Dow) to +0.9% (Trans). Near term outlook offers threat of downside of 1-2%, before clawing back upward into July for Q2 earnings. The year end target of sp'2683 remains on track.

Lets take our regular look at six of the main US indexes

sp'500

A weekly trading range of 25pts (1.0%), settling +1.4pts (0.1%) at 2433. The key 10MA is at 2395, and will offer support around the 2400 threshold next week. Note the rising lower bollinger, currently at 2299, which also intersects with rising trend from Feb'2016.

Best guess: short term weakness to around the 2400 threshold, the 2390s on a stretch, before clawing back upward into July and across the summer. A retrace of around 5% is due in Sept/Oct. Broadly, a year end close in the mid/upper 2600s appears very much within range.

Equity bears have nothing to tout unless a break under multiple aspects of support, currently 2280/300, and rising by around 25pts a month.

--

Nasdaq comp'

The Nasdaq has broadly lead the US market higher, but is clearly seeing some short term weakness, with a second consecutive net weekly decline, settling -0.9% to 6151. It is notable that underlying MACD (blue bar histogram) cycle will turn negative at next Monday's open. The 6K threshold will offer initial support. No price action <5900 can be expected in the near term. The 7000s seem a given before year end.

Dow

The mighty Dow broke a new historic high this week of 21391, settling +0.5% at 21384. A bullish MACD cross is due next week, as the upper bollinger will be offering the 21500s for end June. The 22k threshold is just about within range by end July, but that will clearly require Q2 earnings to come in at least marginally 'better than expected'. The 23000s are a valid target by year end, but that will require no retrace much above >5% in Sept/Oct, and at least one, if not two, more rate hikes.

NYSE comp'

The NYSE comp' broke a new historic high of 11811, climbing for a fourth consecutive week, settling +0.2% at 11772. Underlying MACD has turned positive for the first time since late March.Things only turn bearish if a break <11500 from July onward.

R2K

The second market leader - R2K, was the weakest index this week, settling -1.0% at 1406, but that is just 27pts below last week's historic high. There are a few aspects of support around 1390. Things only turn a little bearish <1360. Underlying MACD cycle remains negative, but price momentum is continuing to claw back toward the zero threshold.

Trans

The 'old leader' - Transports, was the strongest index this week, settling +0.9% at 9414, which is just 2.4% below the historic high of 9639 from February. Underlying MACD is set to turn positive cycle next week, and bodes for the 9600/700s in July/August. The giant 10k threshold looks highly probable by late summer.

--

Summary

All US equity indexes remain within their upward trends that stretch back to early 2016.

The US equity market is still regularly generating new historic highs, usually lead by the Nasdaq.

There is downside buffer of around 5% for most indexes, before core support is at risk of being broken.

--

Looking ahead

There is very little of significance scheduled, and that will give the Mr Market more time to dwell on geo-political issues.

M - -

T - -

W - Existing home sales, EIA Pet' report

T - Weekly jobs, FHFA house price index, leading indict', EIA Nat' gas report

F - New home sales

*there a fair few fed officials on the loose, notably vice-chair Fischer (early Tuesday), and Bullard (Friday).

--

If you value my work, subscribe to me.

Have a good weekend

--

*the next post on this page will likely appear 7pm EST on Monday.

Lets take our regular look at six of the main US indexes

sp'500

A weekly trading range of 25pts (1.0%), settling +1.4pts (0.1%) at 2433. The key 10MA is at 2395, and will offer support around the 2400 threshold next week. Note the rising lower bollinger, currently at 2299, which also intersects with rising trend from Feb'2016.

Best guess: short term weakness to around the 2400 threshold, the 2390s on a stretch, before clawing back upward into July and across the summer. A retrace of around 5% is due in Sept/Oct. Broadly, a year end close in the mid/upper 2600s appears very much within range.

Equity bears have nothing to tout unless a break under multiple aspects of support, currently 2280/300, and rising by around 25pts a month.

--

Nasdaq comp'

The Nasdaq has broadly lead the US market higher, but is clearly seeing some short term weakness, with a second consecutive net weekly decline, settling -0.9% to 6151. It is notable that underlying MACD (blue bar histogram) cycle will turn negative at next Monday's open. The 6K threshold will offer initial support. No price action <5900 can be expected in the near term. The 7000s seem a given before year end.

Dow

The mighty Dow broke a new historic high this week of 21391, settling +0.5% at 21384. A bullish MACD cross is due next week, as the upper bollinger will be offering the 21500s for end June. The 22k threshold is just about within range by end July, but that will clearly require Q2 earnings to come in at least marginally 'better than expected'. The 23000s are a valid target by year end, but that will require no retrace much above >5% in Sept/Oct, and at least one, if not two, more rate hikes.

NYSE comp'

The NYSE comp' broke a new historic high of 11811, climbing for a fourth consecutive week, settling +0.2% at 11772. Underlying MACD has turned positive for the first time since late March.Things only turn bearish if a break <11500 from July onward.

R2K

The second market leader - R2K, was the weakest index this week, settling -1.0% at 1406, but that is just 27pts below last week's historic high. There are a few aspects of support around 1390. Things only turn a little bearish <1360. Underlying MACD cycle remains negative, but price momentum is continuing to claw back toward the zero threshold.

Trans

The 'old leader' - Transports, was the strongest index this week, settling +0.9% at 9414, which is just 2.4% below the historic high of 9639 from February. Underlying MACD is set to turn positive cycle next week, and bodes for the 9600/700s in July/August. The giant 10k threshold looks highly probable by late summer.

--

Summary

All US equity indexes remain within their upward trends that stretch back to early 2016.

The US equity market is still regularly generating new historic highs, usually lead by the Nasdaq.

There is downside buffer of around 5% for most indexes, before core support is at risk of being broken.

--

Looking ahead

There is very little of significance scheduled, and that will give the Mr Market more time to dwell on geo-political issues.

M - -

T - -

W - Existing home sales, EIA Pet' report

T - Weekly jobs, FHFA house price index, leading indict', EIA Nat' gas report

F - New home sales

*there a fair few fed officials on the loose, notably vice-chair Fischer (early Tuesday), and Bullard (Friday).

--

If you value my work, subscribe to me.

Have a good weekend

--

*the next post on this page will likely appear 7pm EST on Monday.

Subscribe to:

Posts (Atom)