With US equity indexes closing moderately lower, the VIX managed the fifth net daily gain of the past seven trading days (intra high 17.65), settling +2.4% @ 16.33. Near term outlook offers at least the 19/21 zone, with the sp'2000/1990s. If sp'1970/60s... a very brief spike into the 24/27 zone is viable.

VIX'60min

VIX'daily3

Summary

Suffice to add... VIX is still relatively subdued.. and we're yet to see any kind of powerful upside.

It seems to be a case of whether we max out around the key 20 threshold... or a brief powerful spike to 24/27.. but then rapidly cooling.

Hyper upside to the 30s... or even higher is on the menu for June.

--

more later... on the indexes

Thursday, 19 May 2016

Closing Brief

US equities closed moderately lower, sp -7pts @ 2040 (intra low 2025). The two leaders - Trans/R2K, settled lower by -0.6% and -0.8% respectively. Near term outlook offers further downside to at least the 2000/1990s. A H/S formation (with the neckline now broken) is suggestive of more dynamic action to the 1970/60s.

sp'60min

Summary

*closing hour action: choppy, but leaning higher, as (understandably) some equity bears are cautious about the Friday opex.

--

... and another day at the twisted casino comes to a close.

Clearly... the market is trying to price in a June rate hike.. not that I believe we'll get one anyway.

Further downside to the giant psy' level of 2K looks highly probable. However, the price structure is pretty clean, and the H/S offers the 1970/60s... before end month.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: choppy, but leaning higher, as (understandably) some equity bears are cautious about the Friday opex.

--

... and another day at the twisted casino comes to a close.

Clearly... the market is trying to price in a June rate hike.. not that I believe we'll get one anyway.

Further downside to the giant psy' level of 2K looks highly probable. However, the price structure is pretty clean, and the H/S offers the 1970/60s... before end month.

--

more later... on the VIX

3pm update - this market remains a beast

US equities remain broadly lower, but well above the earlier low of sp'2025. USD is set for a third consecutive daily gain.. as the mainstream continue to believe a rate hike is on the menu at the June FOMC... which will NOT be the case... as a deeply negative BREXIT vote looms.

sp'daily5b

VIX'daily3

Summary

*VIX set for the fifth daily gain of last seven days.

--

So.. yes.. many bears spooked by the usual intraday bounces.

Its likely merely a case of whether we close in the sp'2030s.. or 20s. A test of the 200dma looks due tomorrow.. or more viable.. after opex is out of way.

**it is HIGHLY notable that the Trans, R2K, and Nasdaq are already sustainably trading under their respective 200dma.

--

As for the beast...

'Sicario' remains one of the most tense and moody movies in recent years. If you've not seen it.... go find it!

--

3.24pm... well, I guess you could say we've had our back test of the broken floor of 2039/40.

Oil is no doubt still helping, +0.7% in the $48s.

sp'daily5b

VIX'daily3

Summary

*VIX set for the fifth daily gain of last seven days.

--

So.. yes.. many bears spooked by the usual intraday bounces.

Its likely merely a case of whether we close in the sp'2030s.. or 20s. A test of the 200dma looks due tomorrow.. or more viable.. after opex is out of way.

**it is HIGHLY notable that the Trans, R2K, and Nasdaq are already sustainably trading under their respective 200dma.

--

As for the beast...

'Sicario' remains one of the most tense and moody movies in recent years. If you've not seen it.... go find it!

--

3.24pm... well, I guess you could say we've had our back test of the broken floor of 2039/40.

Oil is no doubt still helping, +0.7% in the $48s.

2pm update - Oil is not helping the equity bears

The reversal in oil is helping prop up the equity market, with Oil currently +0.2% in the $48s. No doubt the latest bounce from sp'2025 to 2037 is spooking some of the bears. However, with the floor decisively broken.. further downside seems a given, at least to the 2000/1990s.

USO, daily2

sp'60min

Summary

Regardless of the minor noise... it remains a series of lower highs... and lower lows since the sp'2111 high.

The bigger daily/weekly cycles are pretty clear... in terms of which direction we are headed into June.

re: VIX +6% in the 16.90s... the 18s look tough.. unless <sp'2025 into the close.

--

notable strength, energy, KMI, daily

Currently +1.3%.. but still broadly stuck... a break to the 15s looks far more probable than a key break >$19.

USO, daily2

sp'60min

Summary

Regardless of the minor noise... it remains a series of lower highs... and lower lows since the sp'2111 high.

The bigger daily/weekly cycles are pretty clear... in terms of which direction we are headed into June.

re: VIX +6% in the 16.90s... the 18s look tough.. unless <sp'2025 into the close.

--

notable strength, energy, KMI, daily

Currently +1.3%.. but still broadly stuck... a break to the 15s looks far more probable than a key break >$19.

1pm update - broadly weak

Despite some price chop, equities remain broadly weak, with a daily close <sp'2025 very viable. VIX is showing some marginally interesting upside power, +8% in the 17s. The 19/21 zone looks a given.. with sp'2000/1990s. Oil remains choppy, -0.3% in the $47s.

sp'daily5b

sp'weekly6

Summary

It is notable that the fourth blue weekly candle has turned to an outright bearish red.

At the current rate, we'll see a MACD bearish cross late next week... or certainly by end month.

--

So... underlying downward pressure.. as the old floor is decisively taken out. The 200dma awaits.

--

The bearish fleet!

--

stay tuned

sp'daily5b

sp'weekly6

Summary

It is notable that the fourth blue weekly candle has turned to an outright bearish red.

At the current rate, we'll see a MACD bearish cross late next week... or certainly by end month.

--

So... underlying downward pressure.. as the old floor is decisively taken out. The 200dma awaits.

--

The bearish fleet!

--

stay tuned

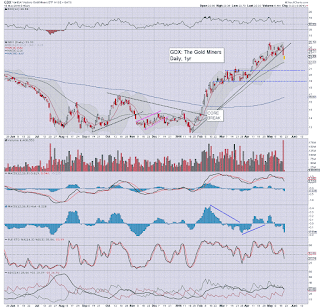

12pm update - the miners remain an indirect signal

The miners (via the precious metals) remain an indirect signal of underlying capital market unrest. The miner ETF of GDX opened sharply lower by around -3% to $22.78.. but has seen a very powerful reversal.. currently +1.9% in the $24s.

GDX, daily

sp'daily5b

Summary

*I realise some would disagree, but the metals and miners appear to be a rather kooky... but important indirect signal of underlying capital market unrest.

Gold to the $1400/1500s appears a pretty realistic target this summer/early autumn, and if that is the case, GDX would probably be in the 35/40 zone... which would be an incredible hyper ramp, having traded at $12.40 in January.

--

As for the equity market.... it appears the mainstream have recognised we've seen a core break of support.. and now seem resigned to sp'2000 within the near term.

... and of course.. there is the H/S target of 1970/60s.

--

Meanwhile... a covert signal to the Desert Fox...

--

time for tea

GDX, daily

sp'daily5b

Summary

*I realise some would disagree, but the metals and miners appear to be a rather kooky... but important indirect signal of underlying capital market unrest.

Gold to the $1400/1500s appears a pretty realistic target this summer/early autumn, and if that is the case, GDX would probably be in the 35/40 zone... which would be an incredible hyper ramp, having traded at $12.40 in January.

--

As for the equity market.... it appears the mainstream have recognised we've seen a core break of support.. and now seem resigned to sp'2000 within the near term.

... and of course.. there is the H/S target of 1970/60s.

--

Meanwhile... a covert signal to the Desert Fox...

--

time for tea

11am update - the break of 2033 is significant

Across the past few weeks, an increasing number have recognised the April 7th low of sp'2033 as particularly important. This morning's break into the 2020s is significant, and has given initial clarity and confidence that 2111 is a key mid term high. Equity bulls should be at least somewhat.... concerned.

sp'daily5

VIX'daily3

Summary

*trying not to get lost in the minor noise.. hence a few daily charts.

--

So.. 2039 failed yesterday... 2033 today... next stop is the 200dma.. which is currently @ 2011.

The H/S scenario offers a straight run to the 1970/60s... within days.

--

notable weakness.... airlines, BA, daily

A very ugly candle.. and as I highlighted yesterday.. its a very fair representation of the main market that has been broadly stuck for around two months. We now have a clear break lower, next support @ 122/120.

--

time for an early lunch

sp'daily5

VIX'daily3

Summary

*trying not to get lost in the minor noise.. hence a few daily charts.

--

So.. 2039 failed yesterday... 2033 today... next stop is the 200dma.. which is currently @ 2011.

The H/S scenario offers a straight run to the 1970/60s... within days.

--

notable weakness.... airlines, BA, daily

A very ugly candle.. and as I highlighted yesterday.. its a very fair representation of the main market that has been broadly stuck for around two months. We now have a clear break lower, next support @ 122/120.

--

time for an early lunch

10am update - opening weakness

US equities open lower, but once again the declines are not significant. There is a notable opening black-fail candle for the VIX.. the fifth consecutive opening one, and that sure doesn't favour the bears. USD is +0.2% in the DXY 95.30s. Metals are under strong downward pressure, Gold -$10, with Silver -2.4%

sp'daily5b

VIX'60min

Summary

*Fed official Dudley is on the loose this hour.

--

Econ-data: Leading indicators: +0.6% vs 0.4% exp.

--

Equity bears really need to break <2034 today.. into the 2020s. Thats not exactly a bold demand, but overall price action remains pretty subdued.. reflected in a VIX that remains stuck in the mid teens.

--

notable weakness... miners, GDX, daily

Yesterday's vol' was monstrously high. GDX opened -3% or so.. but has seen a strong reversal, now -0.5%.

Metals/miners should (in theory) continue broadly higher.. with further capital market unrest.

-

*bonus chart................

sp'weekly6

.. we have our first red candle!

-

CORE break... sp'2033 FAILS. It is a VERY significant issue.

Black-fail candle on the VIX... fully reversed... its actually going to close positive for the opening 30mins!

sp'daily5b

VIX'60min

Summary

*Fed official Dudley is on the loose this hour.

--

Econ-data: Leading indicators: +0.6% vs 0.4% exp.

--

Equity bears really need to break <2034 today.. into the 2020s. Thats not exactly a bold demand, but overall price action remains pretty subdued.. reflected in a VIX that remains stuck in the mid teens.

--

notable weakness... miners, GDX, daily

Yesterday's vol' was monstrously high. GDX opened -3% or so.. but has seen a strong reversal, now -0.5%.

Metals/miners should (in theory) continue broadly higher.. with further capital market unrest.

-

*bonus chart................

sp'weekly6

.. we have our first red candle!

-

CORE break... sp'2033 FAILS. It is a VERY significant issue.

Black-fail candle on the VIX... fully reversed... its actually going to close positive for the opening 30mins!

Pre-Market Brief

Good morning. US equity futures are a little weak, sp -4pts, we're set to open at 2043. USD continues to grind upward, +0.2% in the DXY 95.30s. Metals remain weak, Gold -$5, with Silver -1.4%. Oil is -1.2% in the $47s.

sp'60min

Summary

So.... market is still leaning lower, but once again.. the declines are nothing remotely significant.

Clearly, first soft target is yesterday's low of 2034... and there is the soft low of 2033.... a level which UBS - and many others, recognise as very important.

As things are... a test of the 200dma in the sp'2010s is very viable (if not probable) within the next 2-3 trading days.

The H/S formation is offering 1970/60s... but that is clearly out of range until after opex.

--

early movers...

WMT +8.5% in the $68s. Earnings were above consensus, but its notable that EPS was still net lower y/y by almost -5%

GDX: -1.1%.. as the metals continue to cool.

TSLA +1.1%... as the company is raising $2bn via a share issue

--

Overnight action

Japan: minor chop, settling u/c @ 16646

China: minor chop, settling u/c @ 2806

Germany: leaning weak, currently -0.5% @ 9891

Have a good Thursday

-

8.40am... USD jumps a bit... on some econ-data.

sp -8pts... 2039.....

Phil' fed -1.8... vs exp +3.0. .. pretty ugly number.

*'leading indicators at 10am... market is seeking +0.4... which seems overly optimistic.

sp'60min

Summary

So.... market is still leaning lower, but once again.. the declines are nothing remotely significant.

Clearly, first soft target is yesterday's low of 2034... and there is the soft low of 2033.... a level which UBS - and many others, recognise as very important.

As things are... a test of the 200dma in the sp'2010s is very viable (if not probable) within the next 2-3 trading days.

The H/S formation is offering 1970/60s... but that is clearly out of range until after opex.

--

early movers...

WMT +8.5% in the $68s. Earnings were above consensus, but its notable that EPS was still net lower y/y by almost -5%

GDX: -1.1%.. as the metals continue to cool.

TSLA +1.1%... as the company is raising $2bn via a share issue

--

Overnight action

Japan: minor chop, settling u/c @ 16646

China: minor chop, settling u/c @ 2806

Germany: leaning weak, currently -0.5% @ 9891

Have a good Thursday

-

8.40am... USD jumps a bit... on some econ-data.

sp -8pts... 2039.....

Phil' fed -1.8... vs exp +3.0. .. pretty ugly number.

*'leading indicators at 10am... market is seeking +0.4... which seems overly optimistic.

USD climbing on another rate threat

With the latest FOMC minutes effectively threatening a rate hike in June, the USD was back on the rise, managing a net daily gain of 0.7% into the DXY 95s. Next resistance is the 96.50/97.00 zone. An eventual break >100 looks probable and then onward to the 120s.

USD, daily

USD, monthly

Summary

It is highly notable that the monthly candle is (almost) of the bullish engulfing type, and that bodes for much higher levels this summer.

Broadly, the USD looks set to break and HOLD above the giant psy' level of DXY 100. That will arguably be the case regardless of what the maniacs at Print central decide to do.

.. and if we do indeed break >100.. what will the 'dollar doomers' say then? I'll continue to highlight Schiff (as I have today), but his negative outlook on the USD is simply... wrong.

--

Market/Fed chatter from.... Schiff

As ever... I don't agree with all of it.. but it merits highlighting.

--

WTIC, daily

A net daily decline of almost 1%, but having come close to the big psy' level of $50.00. Even a move to the $40 threshold won't break back under the 200dma.

I remain of the view that the over-supply issue remains completely unresolved, and there is no question that with prices close to $50, a fair number of wells will have been turned back on recently.

--

Looking ahead

Thursday will see the usual weekly jobs, phil' fed, and leading indicators.

*fed official Dudley is on the loose in the 10am hour.

--

Goodnight from London

USD, daily

USD, monthly

Summary

It is highly notable that the monthly candle is (almost) of the bullish engulfing type, and that bodes for much higher levels this summer.

Broadly, the USD looks set to break and HOLD above the giant psy' level of DXY 100. That will arguably be the case regardless of what the maniacs at Print central decide to do.

.. and if we do indeed break >100.. what will the 'dollar doomers' say then? I'll continue to highlight Schiff (as I have today), but his negative outlook on the USD is simply... wrong.

--

Market/Fed chatter from.... Schiff

As ever... I don't agree with all of it.. but it merits highlighting.

--

WTIC, daily

A net daily decline of almost 1%, but having come close to the big psy' level of $50.00. Even a move to the $40 threshold won't break back under the 200dma.

I remain of the view that the over-supply issue remains completely unresolved, and there is no question that with prices close to $50, a fair number of wells will have been turned back on recently.

--

Looking ahead

Thursday will see the usual weekly jobs, phil' fed, and leading indicators.

*fed official Dudley is on the loose in the 10am hour.

--

Goodnight from London

Daily Index Cycle update

US equities closed moderately mixed, sp' u/c @ 2047 (intra range

2060/34). The two leaders - Trans/R2K, settled higher by 0.3% and 0.5%

respectively. With the break of core support, near term outlook offers

at least 2000/1990s, with a H/S scenario offering 1970/60s... certainly

by end month.

sp'daily5b - H/S scenario

Dow

Summary

Suffice to add.. opening weakness.. a 1% swing higher... but a full reversal, as the market was somewhat upset at the latest rate hike threat from the Fed.

With the break of key support at sp'2039, the door is open to 2000/1990s. The H/S scenario is highly suggestive of a more dynamic down wave to 1970/60s.. before next bounce of 3-4%.

--

a little more later...

sp'daily5b - H/S scenario

Dow

Summary

Suffice to add.. opening weakness.. a 1% swing higher... but a full reversal, as the market was somewhat upset at the latest rate hike threat from the Fed.

With the break of key support at sp'2039, the door is open to 2000/1990s. The H/S scenario is highly suggestive of a more dynamic down wave to 1970/60s.. before next bounce of 3-4%.

--

a little more later...

Subscribe to:

Comments (Atom)