With US equity indexes closing moderately weak, the VIX was a little higher, settling +7.8% @ 14.12. Near term outlook threatens (at min') the sp'2020/15 zone.. which should equate to VIX 18/19s. Sustained action above the key 20 threshold remains difficult for at least another few weeks.

VIX'60min

VIX'daily3

Summary

Suffice to add... a net daily gain for the VIX, but falling far short of the Friday opening high.

Equity bears need to see the 16s to offer clarity that a retrace is well underway... but even then... VIX will likely trade no higher than the 18/19s before the next opex.

--

more later... on the indexes

Monday, 4 April 2016

Closing Brief

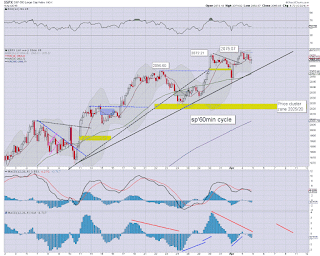

US equity indexes closed moderately weak, sp -6pts @ 2066 (intra high 2074). The two leaders - Trans/R2K, settled lower by -0.9% and -0.8% respectively. Near term outlook offers the sp'2020/15 zone... once rising trend/support (sp'2055 at the Tuesday open) has been broken.

sp'60min

Summary

*closing hour action: a little chop, and leaning on the downside.

--

Little to add.. on what was a pretty tedious day.

Rising trend is clearly still intact... but once broken... equity bears should see at least see 3-4 days lower. The only issue is whether we can briefly trade under the 2K threshold in what is a long overdue retrace.

yours... trying to be patient.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: a little chop, and leaning on the downside.

--

Little to add.. on what was a pretty tedious day.

Rising trend is clearly still intact... but once broken... equity bears should see at least see 3-4 days lower. The only issue is whether we can briefly trade under the 2K threshold in what is a long overdue retrace.

yours... trying to be patient.

--

more later... on the VIX

3pm update - weak chop into the close

US equities remain choppy, and for now, the weakness is simply not remotely significant. Rising trend will be around sp'2055 at the close. Any Tuesday close <2060 will be enough to break rising trend, and open the door to first soft target of the 2020/15 zone, where the 200dma is lurking.

sp'60min

VIX'60min

Summary

Little to add.

*the weakness in Oil is certainly helping to put some downward pressure on the broader market.

--

notable weakness: miners, GDX, -2.7%.. as Gold -$7, and Silver -0.8%.

-

back at the close...

sp'60min

VIX'60min

Summary

Little to add.

*the weakness in Oil is certainly helping to put some downward pressure on the broader market.

--

notable weakness: miners, GDX, -2.7%.. as Gold -$7, and Silver -0.8%.

-

back at the close...

2pm update - when will the sun set on this rally?

Despite the current touch of minor weakness, the core question for the near, mid, and even long term, is at what level will the current rally from sp'1810 max out? A number of indexes have already taken out some key levels (as reflected in such stocks as GE), but for the moment.. it remains broadly borderline.

Nasdaq comp', daily

GE, daily

Summary

It is notable that if you want to form an average of the key indexes - and take a high from the Nov/Dec' time frame, the level on the Nasdaq to watch is around 5150.. specifically, 5176.

The point is... I remain trying to not get overly focused on just one index. Some will lead... others follow, and the challenge is to treat them as a collective.

--

Here in London city....

Rather nice, and its good to still have daylight after 1pm EST.

--

back at 3pm

Nasdaq comp', daily

GE, daily

Summary

It is notable that if you want to form an average of the key indexes - and take a high from the Nov/Dec' time frame, the level on the Nasdaq to watch is around 5150.. specifically, 5176.

The point is... I remain trying to not get overly focused on just one index. Some will lead... others follow, and the challenge is to treat them as a collective.

--

Here in London city....

Rather nice, and its good to still have daylight after 1pm EST.

--

back at 3pm

1pm update - did we close yet?

US equity indexes remain in what is increasingly tedious micro (if not nano scale) chop mode, sp -2pts @ 2070. VIX +4% in the 13.70s, but is still clearly subdued, as for the moment, the market doesn't even appear concerned about a basic retrace to the sp'2020/00 zone. Metals are increasingly weak, Gold -$6, with Silver -0.7%.

sp'60min

GLD, daily2

Summary

Little to add.

There are some interesting movers out there, but really, its a largely dead day in market land.

-

notable weakness, miners, GDX -2.2%.. as the metals cool

--

time for some sun... back at 2'

sp'60min

GLD, daily2

Summary

Little to add.

There are some interesting movers out there, but really, its a largely dead day in market land.

-

notable weakness, miners, GDX -2.2%.. as the metals cool

--

time for some sun... back at 2'

12pm update - still.... minor chop

US equities remain in minor chop mode, with the sp -5pts @ 2067. Whilst the USD is broadly flat in the DXY 94s, the metals are moderately weak, Gold -$4, with Silver -0.4%. Oil is under pressure, swinging from gains of almost 1% to -0.6%.

sp'daily

Dow, daily

Summary

Little to add... on what is a broadly subdued day.

Cyclically, a retrace is due, but equity bears need a clear break of the rising trend, which at the close of today will be around sp'2055. Considering the current style of price action, sub 2055 looks out of range today.

--

notable weakness, Ford, daily

Remaining broadly ugly, and considering how close to new index highs we are... Ford looks especially vulnerable.

-

time for lunch

sp'daily

Dow, daily

Summary

Little to add... on what is a broadly subdued day.

Cyclically, a retrace is due, but equity bears need a clear break of the rising trend, which at the close of today will be around sp'2055. Considering the current style of price action, sub 2055 looks out of range today.

--

notable weakness, Ford, daily

Remaining broadly ugly, and considering how close to new index highs we are... Ford looks especially vulnerable.

-

time for lunch

11am update - more exciting than the current price action

US equity indexes remain in minor chop mode. As of today's close, equity bears need <sp'2055 to break the rising trend. Considering the current price action, that looks out of range today. VIX remains broadly subdued, +7%, but still only in the low 14s.

sp'daily5

VIX'daily3

Summary

Little to add.

Market looks tired, but for the moment, there is no reason why prices are going to see a sustained/significant retrace.

--

For those entirely bored... I suggest you pick a marble.. and watch full screen.

--

time to cook

back at 12pm

sp'daily5

VIX'daily3

Summary

Little to add.

Market looks tired, but for the moment, there is no reason why prices are going to see a sustained/significant retrace.

--

For those entirely bored... I suggest you pick a marble.. and watch full screen.

--

time to cook

back at 12pm

10am update - opening minor chop

US equities open in minor chop mode - leaning a little to the downside. For now, the market is holding within a strong upward trend. As of the Tue' close, rising trend will be around sp'2060. Gold -$4. Oil +0.9% in the $36s.

sp'60min

VIX'60min

Summary

*factory orders (10am): m/m -1.7%... not so great.

--

Little to add.

Its getting tiresome again.. as there appears little reason (other than pure cyclical reasons) for a turn.

Even more than the sp'500, I'm concerned about the Dow breaking back above the Nov' high... any price action >18K, and there will be zero reason to still hold short.

--

notable opening reversal, TSLA daily

You don't often see consecutive black-fail candles. On any basis, TSLA is due a retrace, but as its a momo stock - fueled by media hysteria, it is arguably merely one to watch.. and leave well alone.

-

*cheerleaders on clown finance TV are almost 100% bullish... pretty incredible to hear some of the stuff they are now spouting.

--

time to shop

sp'60min

VIX'60min

Summary

*factory orders (10am): m/m -1.7%... not so great.

--

Little to add.

Its getting tiresome again.. as there appears little reason (other than pure cyclical reasons) for a turn.

Even more than the sp'500, I'm concerned about the Dow breaking back above the Nov' high... any price action >18K, and there will be zero reason to still hold short.

--

notable opening reversal, TSLA daily

You don't often see consecutive black-fail candles. On any basis, TSLA is due a retrace, but as its a momo stock - fueled by media hysteria, it is arguably merely one to watch.. and leave well alone.

-

*cheerleaders on clown finance TV are almost 100% bullish... pretty incredible to hear some of the stuff they are now spouting.

--

time to shop

Pre-Market Brief

Good morning. US equity futures are a little higher, sp +3pts, we're set to open at 2075. USD is broadly flat in the DXY 94.60s. Metals are weak, Gold -$4. Oil is +0.8% in the $36s.

sp'60min

Summary

*awaiting factory orders data @ 10am

--

So... another week to begin, and we're set to open a little higher.

Clearly, market sentiment is now on the extremely high side, it would be truly bizarre if we don't at least get a retrace across the next week or two.

In the days ahead, it will be important to keep in mind the key Nov'2015 high across all the main indexes... not just the sp'500.

Dow 17977, sp'2116, NYSE comp' 10641, R2K' 1200 threshold, Trans' 8358.

Any daily closes above those levels will arguably negate what remains of the broader bearish outlook.

--

Update from a near term bullish Oscar

--

Overnight action

Japan: moderate chop, -0.2% @ 16123

China: latter day recovery, +0.2% @ 3009

Germany: currently +1.0% @ 9896

--

Have a good Monday

-

9.33am.. correction: CHINA.. closed... ty' sutluc.

sp'60min

Summary

*awaiting factory orders data @ 10am

--

So... another week to begin, and we're set to open a little higher.

Clearly, market sentiment is now on the extremely high side, it would be truly bizarre if we don't at least get a retrace across the next week or two.

In the days ahead, it will be important to keep in mind the key Nov'2015 high across all the main indexes... not just the sp'500.

Dow 17977, sp'2116, NYSE comp' 10641, R2K' 1200 threshold, Trans' 8358.

Any daily closes above those levels will arguably negate what remains of the broader bearish outlook.

--

Update from a near term bullish Oscar

--

Overnight action

Japan: moderate chop, -0.2% @ 16123

China: latter day recovery, +0.2% @ 3009

Germany: currently +1.0% @ 9896

--

Have a good Monday

-

9.33am.. correction: CHINA.. closed... ty' sutluc.

Subscribe to:

Comments (Atom)