With US equities breaking new cycle highs, the VIX was under downward pressure across the day, but settled +2.8% @ 14.54 (intra low 13.81). Near term outlook still offers an equity retrace.. at least to the 200dma in the sp'2060s... perhaps 2020s. That should equate to VIX at least trading briefly within the 18/20 zone.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX looks set to jump later this week.. first target is the 18/20 zone.

It is possible - depending on style of equity downside, the VIX might break above the 20 threshold. As things are... the very best case is VIX 25... and even if hit, would not be sustained for more than a few hours.

--

more later... on the indexes

Tuesday, 3 November 2015

Closing Brief

US equities closed moderately higher, sp +5pts @ 2109 (intra high 2116). The two leaders - Trans/R2K, settled -0.4% and +0.4% respectively. Near term outlook remains for a retrace, but with each extra point higher, the downside target is raised. First soft target is the 200dma in the 2060s, with secondary in the 2025/20 zone.

sp'60min

Summary

*closing hour, a touch of weakness, but still, a new high is a new high

---

I have to wonder just what some of the doomer bears are looking at. I'm well aware of some of the wave counts/theories out there.. calling for some kind of 'test of the Aug' lows'.. but really... didn't we test the lows in Sept'.. with a marginally higher low for the sp'500 ?

At best.. a retrace is going to maybe test the 50dma... 2020s.. by Nov' opex. The notion of sustained action under the sp'2K threshold seems.. ludicrous.

I realise some of you out there will get riled up at that.. but that is how I see it.

-

*more later... on the VIX

--

awaiting earnings from TSLA

4.16pm.. TSLA earnings (or lack of)... lousy 58 cent loss. Rev. , marginal miss.

Stock has been swinging wildly from $202 to $230.

Conf' call expected.. if that fails to inspired.. could open in the 210/200 zone.

--

sp'60min

Summary

*closing hour, a touch of weakness, but still, a new high is a new high

---

I have to wonder just what some of the doomer bears are looking at. I'm well aware of some of the wave counts/theories out there.. calling for some kind of 'test of the Aug' lows'.. but really... didn't we test the lows in Sept'.. with a marginally higher low for the sp'500 ?

At best.. a retrace is going to maybe test the 50dma... 2020s.. by Nov' opex. The notion of sustained action under the sp'2K threshold seems.. ludicrous.

I realise some of you out there will get riled up at that.. but that is how I see it.

-

*more later... on the VIX

--

awaiting earnings from TSLA

4.16pm.. TSLA earnings (or lack of)... lousy 58 cent loss. Rev. , marginal miss.

Stock has been swinging wildly from $202 to $230.

Conf' call expected.. if that fails to inspired.. could open in the 210/200 zone.

--

3pm update - yet another cycle high

With WTIC Oil prices pushing into the $48s, the US equity market keeps on pushing upward, with a new cycle high of sp'2116.. a mere 18pts (0.9%) from the May high. Metals remain under pressure - as support has been decisively broken, Gold -$16, with Silver -1.0%.

sp'60min

Summary

Without question.. this is beyond crazy... but then.. the Oct' monthly close was a major warning to those still holding to a broadly bearish outlook.

--

With further new highs.. first soft target is now the 200dma.. in the 2060s. At best.. the 2020s by Nov' opex.

Anyone still think 'sustained action <2K'? Are we really going to see some tout sp'1900s... or even lower on some web forums/pages this evening?

--

Earnings due at the close from TSLA

TLSA, daily

Very hard to guess how this one will trade post earnings. Cyclically, it is pushing upward.. but it remains a loss making industrial... and there is ZERO sign of that changing any time soon.

Indeed, it'll likely need an injection of new capital just to keep afloat... whether via new share issue and/or corp' debt.

One to arguably best leave alone... and merely watch for 'entertainment purposes'.

--

back at the close.

sp'60min

Summary

Without question.. this is beyond crazy... but then.. the Oct' monthly close was a major warning to those still holding to a broadly bearish outlook.

--

With further new highs.. first soft target is now the 200dma.. in the 2060s. At best.. the 2020s by Nov' opex.

Anyone still think 'sustained action <2K'? Are we really going to see some tout sp'1900s... or even lower on some web forums/pages this evening?

--

Earnings due at the close from TSLA

TLSA, daily

Very hard to guess how this one will trade post earnings. Cyclically, it is pushing upward.. but it remains a loss making industrial... and there is ZERO sign of that changing any time soon.

Indeed, it'll likely need an injection of new capital just to keep afloat... whether via new share issue and/or corp' debt.

One to arguably best leave alone... and merely watch for 'entertainment purposes'.

--

back at the close.

2pm update - 22pts away

The sp'500 is a mere 22pts (1.1%) from breaking the May historic high of 2134. The hyper-ramp from the Sept' low of 1871 is now 241pts (12.9%).. having taken just 26 trading days. Truly... incredible. Meanwhile, as the market becomes hyper confident... the metals are imploding, Gold -$18, with Silver -1.1%.

sp'60min

GLD, daily

Summary

The downside action in the metals is increasingly strong.. as support has been decisively busted.

First target for spot Gold is the $1100 threshold.. and then the multi-year low of $1072... after that... the giant $1K threshold.. which would seem probable by year end.. if the Fed raise rates.

Not surprisingly, the miners are under pressure, GDX, -1.4%..

--

notable strength in Oil, +4.2%... ahead of the next pair of inventory reports. The daily/weekly cycles are back to bullish, but with the supply issue 100% unresolved... it seems like a risky long.

sp'60min

GLD, daily

Summary

The downside action in the metals is increasingly strong.. as support has been decisively busted.

First target for spot Gold is the $1100 threshold.. and then the multi-year low of $1072... after that... the giant $1K threshold.. which would seem probable by year end.. if the Fed raise rates.

Not surprisingly, the miners are under pressure, GDX, -1.4%..

--

notable strength in Oil, +4.2%... ahead of the next pair of inventory reports. The daily/weekly cycles are back to bullish, but with the supply issue 100% unresolved... it seems like a risky long.

1pm update - precious metals increasingly weak

US equities are holding minor gains, having made a new cycle high of sp'2109.. a mere 25pts (1.2%) from the May historic high of 2134. VIX remains naturally subdued in the 14s. There remains increasing weakness in the precious metals, Gold -$15, with Silver -1.1%

GLD, daily

Summary

Broader price structure is a giant bear flag.. arguably confirmed by today's declines. Indeed, considering the relative lack of news.. today's declines are rather strong.

Miners holding up relatively well, GDX -0.9%

--

notable hyper reversal...

ATVI, daily

Clearly, the market thinks $6bn was an absolute bargain buy for KING. It is a crazy move... probably based largely on short-covering. Cyclically, the stock is on the high end.

*ATVI has earnings at the close.

--

back at 2pm

GLD, daily

Summary

Broader price structure is a giant bear flag.. arguably confirmed by today's declines. Indeed, considering the relative lack of news.. today's declines are rather strong.

Miners holding up relatively well, GDX -0.9%

--

notable hyper reversal...

ATVI, daily

Clearly, the market thinks $6bn was an absolute bargain buy for KING. It is a crazy move... probably based largely on short-covering. Cyclically, the stock is on the high end.

*ATVI has earnings at the close.

--

back at 2pm

12pm update - bearish skies

Despite breaking another fractional new cycle high of sp'2108, US equities remain vulnerable. It is notable that the 50dma (currently sp'1986).. will be around the 38% fib retrace of 2016 in about 7-9 trading days. Sustained action <2K looks unlikely for the remainder of the year.

sp'60min

Summary

We've a lot of data/earnings to come this week.. and Yellen is appearing tomorrow in front of the US congress... on 'regulatory issues'. Maybe the market just won't care about the latter though. It is hard to imagine even clown finance TV wanting to give that live coverage.

-

notable strength: Visa (V), +3.5% in the $77s (thanks to JT for the reminder)

Bizarre to consider V saw a tradeable flash-print of $60.00 on Aug'24th. As ever.. there is money to be made in providing debt to the serfs.

--

Once again in London city, the sun makes its first appearence of the day.. mere minutes before sunset.

--

VIX update from Mr T.

--

time for lunch :)

sp'60min

Summary

We've a lot of data/earnings to come this week.. and Yellen is appearing tomorrow in front of the US congress... on 'regulatory issues'. Maybe the market just won't care about the latter though. It is hard to imagine even clown finance TV wanting to give that live coverage.

-

notable strength: Visa (V), +3.5% in the $77s (thanks to JT for the reminder)

Bizarre to consider V saw a tradeable flash-print of $60.00 on Aug'24th. As ever.. there is money to be made in providing debt to the serfs.

--

Once again in London city, the sun makes its first appearence of the day.. mere minutes before sunset.

--

VIX update from Mr T.

--

time for lunch :)

11am update - back to flat

After a collapse wave to sp'2097.. the market is back to flat.. with the VIX similarly u/c in the 14.10s. There is far more notable action in the precious metals, with Gold -$10, whilst Silver -0.8%. Oil is +2.5% in the $47s.. and that is no doubt part of the reason for the market pushing back upward.

GLD, daily

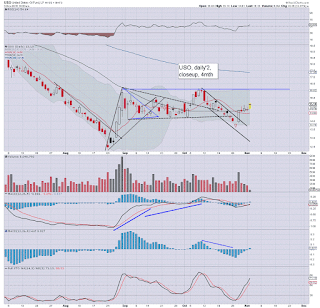

USO, daily2

Summary

re: Oil. Considering the supply issue is 100% unresolved.. sustained action >$50 threshold looks very difficult. Indeed, we've another pair of inventory reports across the next 24hrs, and neither of those will favour the oil bulls.

--

Gold bugs have had a real tough time since last weeks FOMC (note the hyper bearish engulfing candle, marking a key turn).. with Gold now lower for the fifth consecutive day. The bear flag has arguably been confirmed.. with a break of support this morning.

The notion of $1072 being a key low.... makes no more sense than the $1130 low of last year.

Naturally.. the related miners are weak, GDX -1.2%

-

back at 12pm

GLD, daily

USO, daily2

Summary

re: Oil. Considering the supply issue is 100% unresolved.. sustained action >$50 threshold looks very difficult. Indeed, we've another pair of inventory reports across the next 24hrs, and neither of those will favour the oil bulls.

--

Gold bugs have had a real tough time since last weeks FOMC (note the hyper bearish engulfing candle, marking a key turn).. with Gold now lower for the fifth consecutive day. The bear flag has arguably been confirmed.. with a break of support this morning.

The notion of $1072 being a key low.... makes no more sense than the $1130 low of last year.

Naturally.. the related miners are weak, GDX -1.2%

-

back at 12pm

10am update - opening weakness

US equities open a little weak.. and 'little' remains the key word. Despite underlying price momentum continuing to swing back toward the bears... at the current rate, it will not be until Thursday, or even Friday for the first opportunity of a sig' down wave. Metals are notably weak, Gold -$9, with Silver -0.9%.

sp'60min

GLD, daily

Summary

*Gold bugs have a real problem.... broader price structure is arguably a giant bear flag.. and suggestive of new multi-year lows (<$1071) before year end.

If correct.. that will result in another down wave for the related mining stocks.

--

So.. opening equity weakness.. but clearly, its largely still chop, as there are buyers on ALL weakness.

I realise many will be dismissive of a down wave to the 2020/10s by Nov' opex.. but really... its not that bold.

--

notable weakness..

ATVI, daily

Having spent almost $6bn on KING, the outlook on ATVI is not too pretty. I'd much prefer EA.... but then. I like Battlefield 4 ;)

-

10.02am.. Factory Orders... -1.0%... broadly inline... not great for the econ-bulls, but neither end of the world.

sp'60min

GLD, daily

Summary

*Gold bugs have a real problem.... broader price structure is arguably a giant bear flag.. and suggestive of new multi-year lows (<$1071) before year end.

If correct.. that will result in another down wave for the related mining stocks.

--

So.. opening equity weakness.. but clearly, its largely still chop, as there are buyers on ALL weakness.

I realise many will be dismissive of a down wave to the 2020/10s by Nov' opex.. but really... its not that bold.

--

notable weakness..

ATVI, daily

Having spent almost $6bn on KING, the outlook on ATVI is not too pretty. I'd much prefer EA.... but then. I like Battlefield 4 ;)

-

10.02am.. Factory Orders... -1.0%... broadly inline... not great for the econ-bulls, but neither end of the world.

Pre-Market Brief

Good morning. US equity futures are moderately lower, sp -7pts, we're set to open at 2097. USD is +0.2% in the DXY 97.10s. Metals remain weak, Gold -$2... whilst Oil is +0.7%.

sp'daily5

Summary

First soft target for the equity bears is the Friday close of 2079. After yesterdays gains, a break below that looks out of range today.

It is notable that any negative close today will keep the door open to a sig' break lower this Thurs/Friday. Naturally, it would likely be the Friday... with the jobs data.

A retrace IS due, but those hoping for anything more are surely going to be very disappointed by year end.

--

Corp' news. Activision (ATVI) purchase the makers of Candy Crush (KING). This is perhaps the dumbest deal I've seen in some years.

KING, daily

ATVI have paid almost $6bn ($18 a share) for a company that is worth arguably.....nothing. I can only imagine the CEO/board of ATVI are lost for ideas.. and thus went for the old 'lets go buy a company' strategy.

ATVI, daily

This purchase will likely come to haunt ATVI within a few years. At least EA weren't stupid enough to do such a thing.

--

Update from a typically loud Mr C.

--

Have a good Tuesday

-

*awaiting Factory Orders data (10am)

sp'daily5

Summary

First soft target for the equity bears is the Friday close of 2079. After yesterdays gains, a break below that looks out of range today.

It is notable that any negative close today will keep the door open to a sig' break lower this Thurs/Friday. Naturally, it would likely be the Friday... with the jobs data.

A retrace IS due, but those hoping for anything more are surely going to be very disappointed by year end.

--

Corp' news. Activision (ATVI) purchase the makers of Candy Crush (KING). This is perhaps the dumbest deal I've seen in some years.

KING, daily

ATVI have paid almost $6bn ($18 a share) for a company that is worth arguably.....nothing. I can only imagine the CEO/board of ATVI are lost for ideas.. and thus went for the old 'lets go buy a company' strategy.

ATVI, daily

This purchase will likely come to haunt ATVI within a few years. At least EA weren't stupid enough to do such a thing.

--

Update from a typically loud Mr C.

--

Have a good Tuesday

-

*awaiting Factory Orders data (10am)

The week starts bullish

US equities started the week on a particularly bullish note, with the sp' breaking a new cycle high of 2106... making for a monstrous 235pt ramp from the marginally higher low of sp'1871.. a mere 25 trading days ago. New historic highs >2134 still look unlikely before a retrace occurs.

sp'weekly1b

sp'monthly3c

Summary

*second consecutive green candle on the monthly 'rainbow' chart, something we've not seen since Dec 2013. Again, its a reminder of just how extreme the Oct' gain was.. and how it arguably negates ALL of the broader bearish outlooks.

--

Suffice to add, we currently have the sixth consecutive net weekly gain... but by the end of this week, I have to believe we'll be at least moderately red.. somewhere close, or even below the 200dma (2062).

Despite today's positive start to the week, a retrace to the 50dma (2020/10s.. before Nov' opex)... still looks due.

--

Looking ahead

Tuesday will see Factory orders data.... but Mr Market will no doubt be more focused on the monthly jobs data due this Friday.

--

Goodnight from London

sp'weekly1b

sp'monthly3c

Summary

*second consecutive green candle on the monthly 'rainbow' chart, something we've not seen since Dec 2013. Again, its a reminder of just how extreme the Oct' gain was.. and how it arguably negates ALL of the broader bearish outlooks.

--

Suffice to add, we currently have the sixth consecutive net weekly gain... but by the end of this week, I have to believe we'll be at least moderately red.. somewhere close, or even below the 200dma (2062).

Despite today's positive start to the week, a retrace to the 50dma (2020/10s.. before Nov' opex)... still looks due.

--

Looking ahead

Tuesday will see Factory orders data.... but Mr Market will no doubt be more focused on the monthly jobs data due this Friday.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed significantly higher, sp +24pts @ 2104 (intra

high 2106). The two leaders - Trans/R2K, settled higher by 1.4% and 2.1%

respectively. With a new cycle high, the outlook for a retrace is back

on hold.. but is clearly due, with the market having ramped 235pts

(12.5%) from the 1871 low, a mere 25 trading days ago.

sp'daily5

Nasdaq comp'

Summary

*it is very notable that the Nasdaq is within 2% of a new historic high (5231).

--

New cycle high for the sp' @2106.. a monstrous 235pts (12.5%) above the Sept' marginally higher low of 1871.

A retrace remains due to the 2020/10 zone. Sustained action <2K looks highly unlikely for the rest of the year.

--

a little more later...

sp'daily5

Nasdaq comp'

Summary

*it is very notable that the Nasdaq is within 2% of a new historic high (5231).

--

New cycle high for the sp' @2106.. a monstrous 235pts (12.5%) above the Sept' marginally higher low of 1871.

A retrace remains due to the 2020/10 zone. Sustained action <2K looks highly unlikely for the rest of the year.

--

a little more later...

Subscribe to:

Comments (Atom)