With the indexes closing higher again, the VIX slipped for a third consecutive day, -6.3% @ 13.48. VIX is still above the April'11 low - when sp' was 1597. Bears need to see a daily turn by the end of this week. First upside target is the big 20 threshold.

VIX'60min

VIX'daily3

Summary

So, after 3 days of the indexes battling back upward from the sp'1536 low, the VIX is back in the mid 13s again.

I suppose 12s are 'briefly' viable early Wednesday - if the indexes open higher, but still, I am holding to the original outlook.

As it is, I am seeking VIX testing the big 20 threshold within the next week or so. The big issue is whether we can get a weekly closing above the important 200 weekly MA @ 21.

more later..on the indexes

Tuesday, 23 April 2013

Closing Brief

The market closed moderately higher, with gains of around 1% for most indexes. The VIX again closed lower by around 6%, settling in the mid 13s - nothing less than near 100% market complacency. First downside target for the bears should be a daily close <sp'1570.

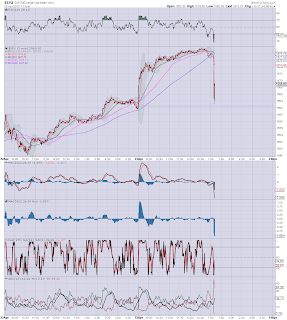

sp'60min

Summary

Not much weakness into the close, but still...hourly charts look bearish for the next few days.

I would argue the general H/S formation is STILL valid, although I realise some might disagree after a few hours trading >1573.

--

*I hold heavy short overnight.

sp'60min

Summary

Not much weakness into the close, but still...hourly charts look bearish for the next few days.

I would argue the general H/S formation is STILL valid, although I realise some might disagree after a few hours trading >1573.

--

*I hold heavy short overnight.

3pm update - closing hour weakness

The hourly index and volatility charts are pretty clear, we should generally be cycling lower across much of Wednesday, if not all the way into the Friday close. A VIX close in the low 14s would be.. a start. Bears should be aiming for a break into the sp'1550s by early Thursday.

sp'60min

vix'60min

Summary

Its the closing hour, lets see how those twitter reading algo-bots end the day.

More than anything, I want to see VIX in the 14s, that will open up the upper 15s for early Thursday.

--

*I hold heavy short overnight.

--

sp'60min

vix'60min

Summary

Its the closing hour, lets see how those twitter reading algo-bots end the day.

More than anything, I want to see VIX in the 14s, that will open up the upper 15s for early Thursday.

--

*I hold heavy short overnight.

--

2pm update - hourly charts now look stupid

With the AP twitter feed hacked, that bit of brief drama had many falling out of their chairs. The SP' flashed lower by 15pts in barely a minute. Naturally, things have rebounded, but...as stated prior to this event, a rollover into the close remains viable, with VIX in the 14s.

sp'60min

vix'60min

Summary

Well, I'm still reeling from that flash-drop.

--

Regardless of that nonsense, I'm still seeking a rollover on the indexes.

*I hold heavy short into tomorrow

--

2.20pm..market STILL looks like its due to rollover into the close and early Wednesday.

Bears need to break the rising channel..which at the Wed' close will be around 1570.

So....a Wed' close <1570..and bears have a chance of seeing the market fall ALL the way into the weekend.

2.31pm..market starting to slide again..back in the 1573s. A close in the 1560s would be 'useful', with VIX 14s.

Looking at the hourly VIX chart...its suggesting market to drop kinda hard tomorrow., there is major downside potencial.

sub'wave'1 of the minor'3 ? Hmm....won't be long to wait.

sp'60min

vix'60min

Summary

Well, I'm still reeling from that flash-drop.

--

Regardless of that nonsense, I'm still seeking a rollover on the indexes.

*I hold heavy short into tomorrow

--

2.20pm..market STILL looks like its due to rollover into the close and early Wednesday.

Bears need to break the rising channel..which at the Wed' close will be around 1570.

So....a Wed' close <1570..and bears have a chance of seeing the market fall ALL the way into the weekend.

2.31pm..market starting to slide again..back in the 1573s. A close in the 1560s would be 'useful', with VIX 14s.

Looking at the hourly VIX chart...its suggesting market to drop kinda hard tomorrow., there is major downside potencial.

sub'wave'1 of the minor'3 ? Hmm....won't be long to wait.

1pm update - waiting for a provisional rollover

Market appears stuck a touch under sp'1580, and both the 15/60min cycles are due to rollover this afternoon. Arguably, the only issue is how low can we go on the next 'small' cycle into early Wednesday. Bears should be seeking a Tuesday VIX close back in the low 14s.

sp'15min

vix'60min

Summary

Obviously, the last line in the sand for the bears is 1597. Personally, I can't see that being broken over, not least since the weekly charts are STILL warning of trouble, as they have been for the last 2-3 weeks.

Nothing has changed, and indeed..today's gains were largely expected.

-

Now..its just a case of waiting for a rollover, and seeing how far we can fall...and how fast.

*I will hold heavy short into Wednesday...and more likely into late Friday.

-

1.10pm WTF ? wahhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

Holy moly....'raise the shields'...its flashy crashy action....

Urghh

1.16pm...seems the AP news was HACKED, a false report about Obama and the Whitehouse sent the algo-bots into freakout mode..and market dropped 1% in seconds.

CNBC confirming the AP twitter feed was HACKED.

--

Man alive, that was crazy.

*interesting that the algo-bots are literallly reacting second by second to the twitter feeds.

Regardless of that nonsense, I am STILL looking for a rollover..just not that fast.

sp'15min

vix'60min

Summary

Obviously, the last line in the sand for the bears is 1597. Personally, I can't see that being broken over, not least since the weekly charts are STILL warning of trouble, as they have been for the last 2-3 weeks.

Nothing has changed, and indeed..today's gains were largely expected.

-

Now..its just a case of waiting for a rollover, and seeing how far we can fall...and how fast.

*I will hold heavy short into Wednesday...and more likely into late Friday.

-

1.10pm WTF ? wahhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

Holy moly....'raise the shields'...its flashy crashy action....

Urghh

1.16pm...seems the AP news was HACKED, a false report about Obama and the Whitehouse sent the algo-bots into freakout mode..and market dropped 1% in seconds.

CNBC confirming the AP twitter feed was HACKED.

--

Man alive, that was crazy.

*interesting that the algo-bots are literallly reacting second by second to the twitter feeds.

Regardless of that nonsense, I am STILL looking for a rollover..just not that fast.

12pm update - bears need to keep a lid on things

Market is surpassing the upside expectations of most again, and we're on the border of the 1580s. VIX is holding the opening lows (at least so far), with the precious metals the standout weakest aspect of today. Oil is still lower, but well above the earlier lows.

sp'15min

vix'60min

Summary

Is this the capitulation squeeze higher?

What is important is a daily close back in the low 1570s...preferably the 1560s. A VIX back in the low 14s would similarly be useful.

time for lunch.

*I resolutely hold a heavy short index position, seeking an exit 'somewhat lower' by the Friday close.

--

VIX update from Mr T.

stay tuned

12.10pm...at the current rate, the 15min index cycles will go negative MACD no later than 1pm.

Anyway..long afternoon ahead, I'm kinda interested in how we close the day, not least since I'm heavy short now. No risk......no gain.

sp'15min

vix'60min

Summary

Is this the capitulation squeeze higher?

What is important is a daily close back in the low 1570s...preferably the 1560s. A VIX back in the low 14s would similarly be useful.

time for lunch.

*I resolutely hold a heavy short index position, seeking an exit 'somewhat lower' by the Friday close.

--

VIX update from Mr T.

stay tuned

12.10pm...at the current rate, the 15min index cycles will go negative MACD no later than 1pm.

Anyway..long afternoon ahead, I'm kinda interested in how we close the day, not least since I'm heavy short now. No risk......no gain.

11am update - was that the RS top?

The market has seen some reasonable gains this morning, most indexes up around 1%, with the VIX slipping 5% into the mid 13s. However, all things considered, there is a very significant possibility that this was a RS top. Bears now need a daily close back in the low 1560s.

sp'60min

vix'60min

Summary

Well, I've made my move, and I'm actually pretty content with how things have gone. Yes, we've seen a spike to 1576, but that's tolerable.

Bears should hope we can get a close in the low 1560s today or tomorrow. That will easily allow for an attempt to take out last Thursday afternoons low of 1536 - by this Friday.

*I am heavy short from sp'1572. seeking an initial exit in the low 1540s or so, but will adjust as the week continues.

--

Precious metals are weak..Silver is sitting on the edge of the cliff, not that I'm inclined to short it here.

A new low would open up the 17s...rather fast.

-

UPDATE 11.22am.. sp'1577s...although the VIX is holding above the earlier lows.

I was looking at the Transports & R2K, those hourly cycles should 'in theory' be levelling out across the next few hours, and then first signs of a turn lower near the close.

-

11.37am, well the next obvious soft resistance is the 1580 level..barely 1% from the all time highs.

Bears sure don't want to see a close in the 1580s..no matter how 'generally' bearish the weekly charts still are.

-

sp'60min

vix'60min

Summary

Well, I've made my move, and I'm actually pretty content with how things have gone. Yes, we've seen a spike to 1576, but that's tolerable.

Bears should hope we can get a close in the low 1560s today or tomorrow. That will easily allow for an attempt to take out last Thursday afternoons low of 1536 - by this Friday.

*I am heavy short from sp'1572. seeking an initial exit in the low 1540s or so, but will adjust as the week continues.

--

Precious metals are weak..Silver is sitting on the edge of the cliff, not that I'm inclined to short it here.

A new low would open up the 17s...rather fast.

-

UPDATE 11.22am.. sp'1577s...although the VIX is holding above the earlier lows.

I was looking at the Transports & R2K, those hourly cycles should 'in theory' be levelling out across the next few hours, and then first signs of a turn lower near the close.

-

11.37am, well the next obvious soft resistance is the 1580 level..barely 1% from the all time highs.

Bears sure don't want to see a close in the 1580s..no matter how 'generally' bearish the weekly charts still are.

-

10am update - in the target zone

Mr Market opens moderately higher, and we're back in the low sp'1570s. VIX is back in the 13s, and currently showing no sign of levelling out. USD is holding moderate gains, and is probably putting some downside pressure on commodities.

sp'60min

vix'60min

Summary

Standing by for a major re-short. Eyes on the 5/15min sp and VIX cycles.

Kinda exciting huh?

--

10am...I'm now SHORT the indexes @ 1572.

10.08am....so, I'm short, seeking first exit target at the lower bollinger - hourly chart..currently 1536, but that will probably rise to the 1545/50 area by Thur/Friday.

Bears should be seeking a green VIX close, that'd be a very good sign.

VIX'15min

Arguably close to a floor. Certainly...NO turn yet...but its right in the target zone of the mid 13s.

Those looking to buy TVIX, well, now is about the time, with good stops, not least at the sp'1597 level, if bulls are going to magically achieve that..which I can't imagine.

10.25am.. VIX holding the low, but the indexes spike to 1576. Hmm..

Bears should be able to tolerate a spike higher, but clearly, a daily close >1575 would be an issue.

All things considered, I'm content with my re-short from 1572, its a hell of a lot better than those who been holding since 1540/30s.

10.32am sp'1576/75...its about as high as most bears should be tolerating this morning.

10.37am.. VIX looks like its floored, in whichcase indexes should be follow soon enough.

sp'60min

vix'60min

Summary

Standing by for a major re-short. Eyes on the 5/15min sp and VIX cycles.

Kinda exciting huh?

--

10am...I'm now SHORT the indexes @ 1572.

10.08am....so, I'm short, seeking first exit target at the lower bollinger - hourly chart..currently 1536, but that will probably rise to the 1545/50 area by Thur/Friday.

Bears should be seeking a green VIX close, that'd be a very good sign.

VIX'15min

Arguably close to a floor. Certainly...NO turn yet...but its right in the target zone of the mid 13s.

Those looking to buy TVIX, well, now is about the time, with good stops, not least at the sp'1597 level, if bulls are going to magically achieve that..which I can't imagine.

10.25am.. VIX holding the low, but the indexes spike to 1576. Hmm..

Bears should be able to tolerate a spike higher, but clearly, a daily close >1575 would be an issue.

All things considered, I'm content with my re-short from 1572, its a hell of a lot better than those who been holding since 1540/30s.

10.32am sp'1576/75...its about as high as most bears should be tolerating this morning.

10.37am.. VIX looks like its floored, in whichcase indexes should be follow soon enough.

Pre-Market Brief

Good morning. Futures have swung back moderately higher, sp +5pts, we're set to open around 1568. USD is higher, and might be why the precious metals and Oil are both lower - although too dramatic. Primary target remains the low sp'1570s, with VIX in the 13s...briefly.

sp'60min

sp'daily5

Summary

So, it looks like we're going to open a little higher. Its certainly not over key resistance in the 1572/74 though.

We do have some econ-data at 10am to be mindful of, and Mr Market could use it as an excuse to move into those 1570s.

--

*I will be on standby to launch a major re-short across the day.

I think 10.30/11am would be a very reasonable time to see the market max out.

--

UPDATE 8.52am . metals are on the slide. Silver -60 cents @ $22. a mere 5 cents from taking out the recent crash low.

If SLV closes <21.96, it bodes badly for the days ahead. SLV 17 is viable 'at any time' on an overnight snap. I am not meddling in it..yet.

UPDATE 9.19am...sp +7pts..we're now set to open on the 1570 border.

If the 10am econ-data comes in at least 'reasonable', then we'll see just how much power the bulls have. Anything >1575 would be a problem to the bears.

9.35am...well, we're in the low 1570s...the target zone.

Those bears holding to the H/S theory should be seeking a re-short across the next few hours...with very obvious stops @ 1575 tight..or 1597 loose.

Its actually a rather straight forward trading situation.

--

9.41am sp'1573s...we're NOW on the threshold. I suppose we could spike over, and its not an issue. VIX is -5%...as expected.

9.50am sp'1574s...still no levelling on the 5/15min charts...VIX still falling.

sp'60min

sp'daily5

Summary

So, it looks like we're going to open a little higher. Its certainly not over key resistance in the 1572/74 though.

We do have some econ-data at 10am to be mindful of, and Mr Market could use it as an excuse to move into those 1570s.

--

*I will be on standby to launch a major re-short across the day.

I think 10.30/11am would be a very reasonable time to see the market max out.

--

UPDATE 8.52am . metals are on the slide. Silver -60 cents @ $22. a mere 5 cents from taking out the recent crash low.

If SLV closes <21.96, it bodes badly for the days ahead. SLV 17 is viable 'at any time' on an overnight snap. I am not meddling in it..yet.

UPDATE 9.19am...sp +7pts..we're now set to open on the 1570 border.

If the 10am econ-data comes in at least 'reasonable', then we'll see just how much power the bulls have. Anything >1575 would be a problem to the bears.

9.35am...well, we're in the low 1570s...the target zone.

Those bears holding to the H/S theory should be seeking a re-short across the next few hours...with very obvious stops @ 1575 tight..or 1597 loose.

Its actually a rather straight forward trading situation.

--

9.41am sp'1573s...we're NOW on the threshold. I suppose we could spike over, and its not an issue. VIX is -5%...as expected.

9.50am sp'1574s...still no levelling on the 5/15min charts...VIX still falling.

Seeking a fail in the low sp'1570s

The main indexes closed higher for a second day, with the VIX back in the low 14s. Many are starting to get bullish again, yet is this just a small wave'2 bounce, before a much sharper wave'3 decline? Primary downside target zone is the sp'1490/80s, with VIX 20+.

sp'daily5b - best guess

sp'daily3 - fib levels

sp'weekly3 - bollinger and keltner bands

Summary

So.....the market opens higher - although for anyone watching, pre-market price action was weakening into the open. The opening gains then quickly failed, and the market broke into the 1540s again.

No doubt, a fair few bears were chasing that open lower...and got burnt, especially those running without trading stops. The latter day recovery was certainly expected, and the algo-bots (in melt mode), were given free reign during what became a very quiet afternoon session.

The bands of constraint

As ever, I think its important to note the current weekly Bollinger - and sometimes, Keltner.bands The lower weekly bol' band is now up to 1408, and that is going to keep rising in the weeks ahead - even if the indexes decline.

Quite frankly, it seems near impossible for the market to be trading anywhere under the 1450/40 zone in the current down cycle. Its possible we could break much lower levels, but only on a secondary down cycle - see May-August 2011 for a good example.

Holding to the 'best guess'.

Nothing has changed in my view, and so I'm holding to what I stated last week. Bears should be seeking a market fail/rollover in the sp'1570s...and then a swift move lower. Perhaps the 1500 level will hold on first attempt, before the FOMC give the market a wave'4 bounce higher..only to eventually hit the primary target of 1485 - the old February low.

Looking ahead

Its hard to call how the market will open tomorrow. Regardless of the open, I'd be looking to wait until I see the sp'1570s, before I start hitting buttons. Another 8-12pts on the sp'500 certainly look viable by tomorrow afternoon.

We have a very long week ahead!

Goodnight from London

sp'daily5b - best guess

sp'daily3 - fib levels

sp'weekly3 - bollinger and keltner bands

Summary

So.....the market opens higher - although for anyone watching, pre-market price action was weakening into the open. The opening gains then quickly failed, and the market broke into the 1540s again.

No doubt, a fair few bears were chasing that open lower...and got burnt, especially those running without trading stops. The latter day recovery was certainly expected, and the algo-bots (in melt mode), were given free reign during what became a very quiet afternoon session.

The bands of constraint

As ever, I think its important to note the current weekly Bollinger - and sometimes, Keltner.bands The lower weekly bol' band is now up to 1408, and that is going to keep rising in the weeks ahead - even if the indexes decline.

Quite frankly, it seems near impossible for the market to be trading anywhere under the 1450/40 zone in the current down cycle. Its possible we could break much lower levels, but only on a secondary down cycle - see May-August 2011 for a good example.

Holding to the 'best guess'.

Nothing has changed in my view, and so I'm holding to what I stated last week. Bears should be seeking a market fail/rollover in the sp'1570s...and then a swift move lower. Perhaps the 1500 level will hold on first attempt, before the FOMC give the market a wave'4 bounce higher..only to eventually hit the primary target of 1485 - the old February low.

Looking ahead

Its hard to call how the market will open tomorrow. Regardless of the open, I'd be looking to wait until I see the sp'1570s, before I start hitting buttons. Another 8-12pts on the sp'500 certainly look viable by tomorrow afternoon.

We have a very long week ahead!

Goodnight from London

Daily Index Cycle update

The main indexes saw some moderate swings in the early morning, but closed moderately higher. The sp' close of 1562 is barely 10pts away from a target right shoulder, of what might be a mini H/S formation, within a (possible) much larger H/S. Bears need to keep market <1575.

sp'daily5

Summary

Today was broadly as expected, with continued upside from the Thursday afternoon low of sp'1536. A move into the low 1570s looks relatively easy, the only issue is whether we are setting up a mini H/S formation.

Bears really need to keep prices <1575. Any daily close in the upper 1570s..or higher, would mean the above scenario needs to be thrown out.

Considering the bigger picture, I would say there is at least a 60/70% probability of the sp' failing in the 1570s, with a rather 'swift and fierce' move to the 1490/80s - within 5-7 trading days.

Worse case for the bears, would be a choppy 1-2 weeks, but putting in a lower high, <1597. What I can't envision - after the recent strong downside action, are new index highs. That now seems extremely unlikely.

a little more later...

sp'daily5

Summary

Today was broadly as expected, with continued upside from the Thursday afternoon low of sp'1536. A move into the low 1570s looks relatively easy, the only issue is whether we are setting up a mini H/S formation.

Bears really need to keep prices <1575. Any daily close in the upper 1570s..or higher, would mean the above scenario needs to be thrown out.

Considering the bigger picture, I would say there is at least a 60/70% probability of the sp' failing in the 1570s, with a rather 'swift and fierce' move to the 1490/80s - within 5-7 trading days.

Worse case for the bears, would be a choppy 1-2 weeks, but putting in a lower high, <1597. What I can't envision - after the recent strong downside action, are new index highs. That now seems extremely unlikely.

a little more later...

Subscribe to:

Posts (Atom)