With the main indexes mildly rallying into the close - but closing 'mixed', the VIX slipped in the closing hour, climbing a mere 2.4%, to rest @ 15.50

VIX'60min

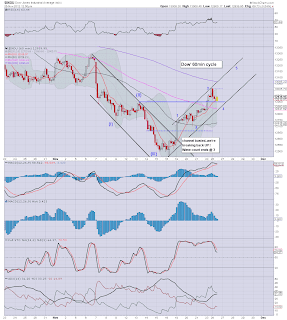

VIX' daily

Summary

There isn't much to be said on the VIX. It

remains at a bizarrely low level - and is vulnerable at any time, to a

giant gap higher, if there is any surprise 'comment', rumour, or

whatever, that the fiscal cliff will not be largely delayed.

So,

near term volatility remains cheap, but yes...further out, its actually

kinda expensive - as some good articles have highlighted

More later..on the indexes.